Assignment Of Trust

Description

Form popularity

FAQ

Choosing whether to gift a house or place it in a trust depends on your financial and personal circumstances. Gifting a house may simplify the transfer process, but it can have tax implications. Conversely, putting it in a trust provides better control over how the property is managed and distributed, which is essential for an effective assignment of trust. Evaluating your long-term goals can help you make the best decision.

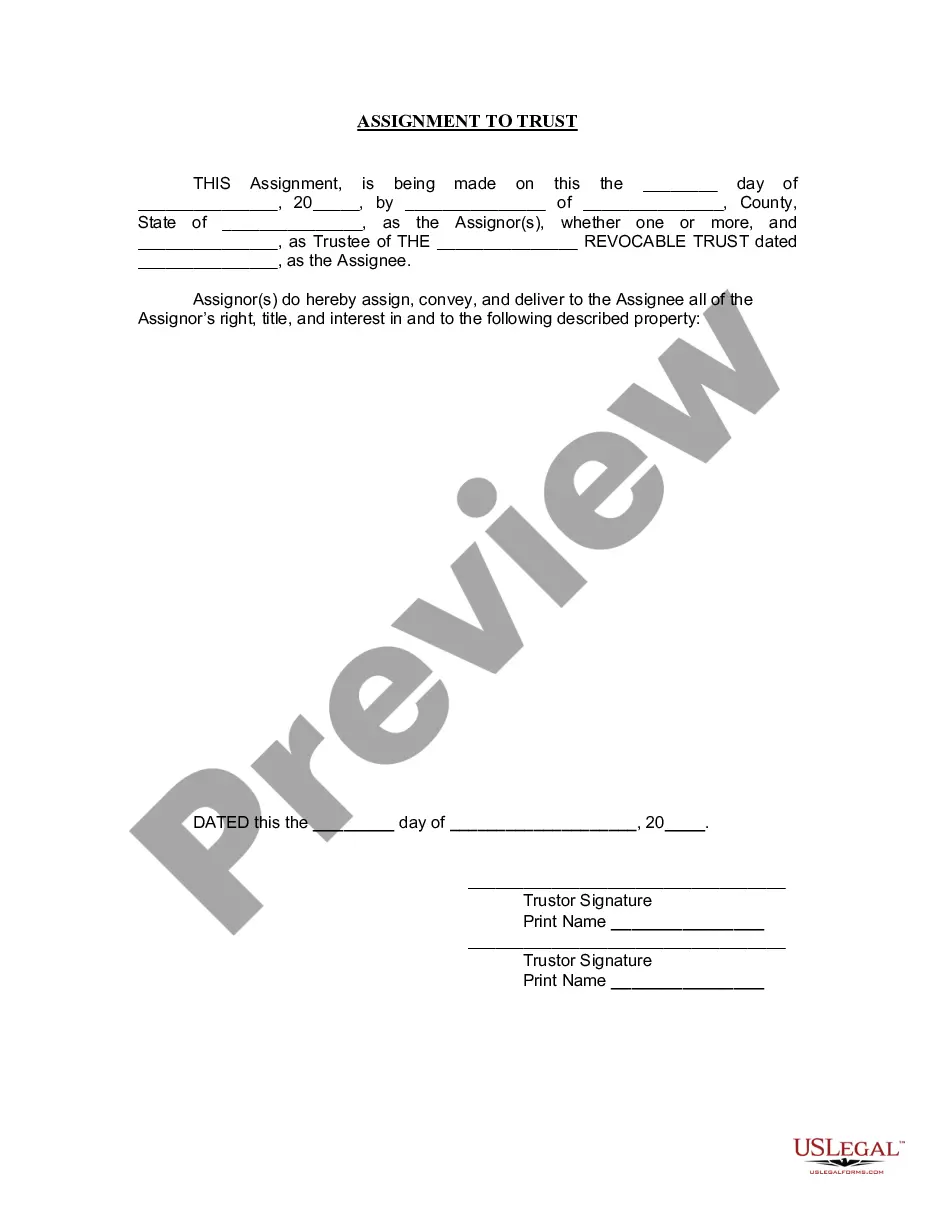

Typically, the assignment of deed of trust is signed by the trustee or the party that holds the legal title of the property. Each signer must have the authority to do so according to the trust’s terms. Additionally, it is a good idea to have a notary public witness the signing, as this adds an extra layer of authenticity to the assignment of trust.

Preparing a deed of trust can take anywhere from a few days to several weeks, depending on the complexity of the trust and the specific requirements of your state. It's crucial to ensure all details, such as the parties involved and property descriptions, are accurate and complete. When you use a reliable platform like US Legal Forms, you can streamline this process and make the assignment of trust more efficient.

To obtain a certificate of trust, you need to prepare a trust document that details the terms and conditions of the trust. After creating this document, you should have it signed by the trustee. Your next step is to file this document with the relevant court or local authority. This certificate plays a vital role in the assignment of trust, ensuring clear governance for beneficiaries.

Assets are typically added to a trust through a formal process of assignment of trust. You must fill out the appropriate legal documents for each asset, which may include transferring titles for real estate or designating bank accounts. Ensuring all documents are correctly completed is crucial for keeping your estate plan organized and effective, and platforms like uslegalforms can simplify this process significantly.

Moving items into a trust involves creating a clear plan for asset allocation. Begin by identifying what you want to include in the trust, and then complete an assignment of trust for each item. If you need assistance, the uslegalforms platform provides templates and resources that can guide you through the documentation needed to ensure the transition is seamless and legally binding.

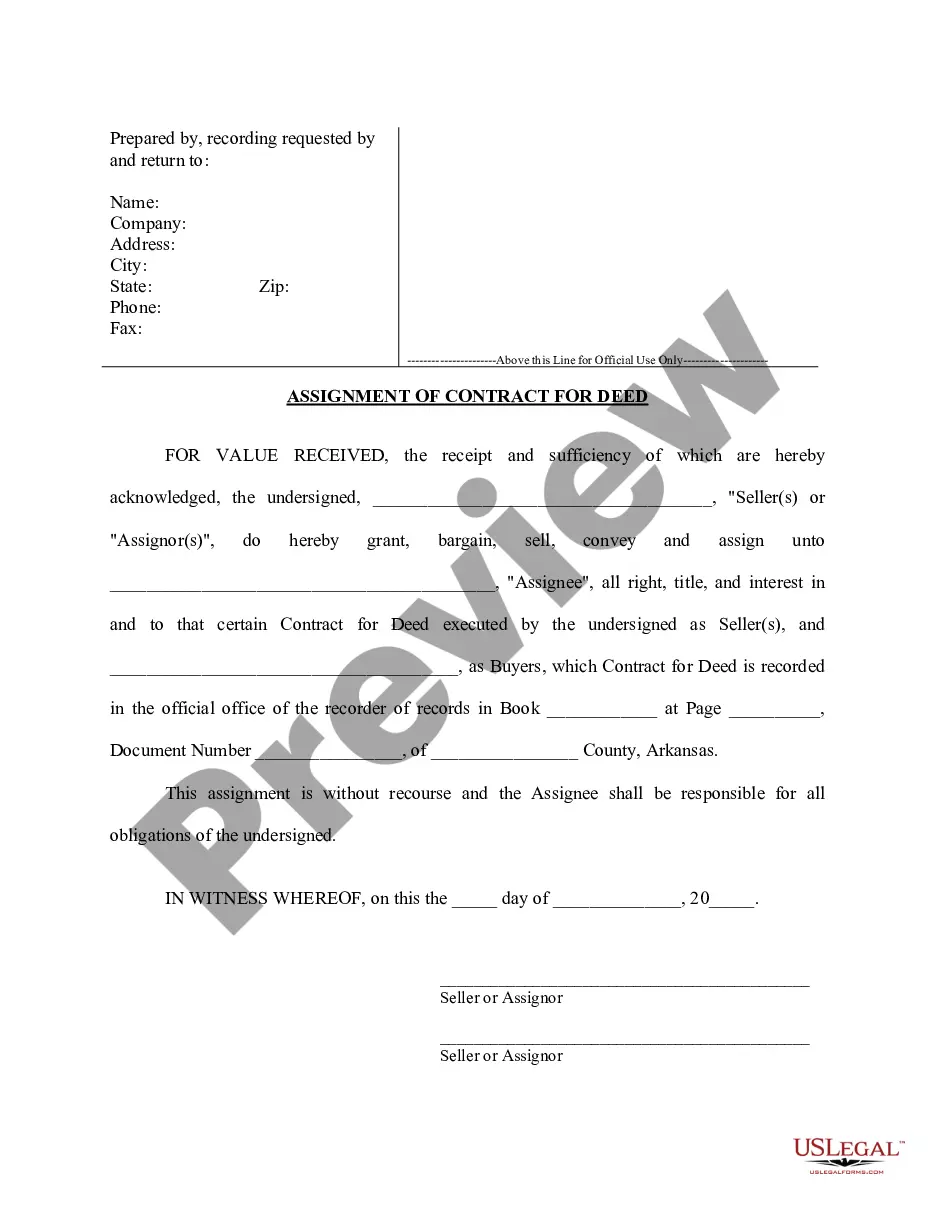

An assignment of deed of trust serves to officially transfer the ownership rights of a property from one party to another, like a lender to a new lender. This legal document plays a vital role in real estate transactions, ensuring that the new party holds all the rights associated with the trust. Understanding this assignment is essential for maintaining clear property ownership and avoiding disputes.

Transferring assets into a trust is a straightforward process. You'll typically start by identifying the assets you want to place in the trust, such as real estate, bank accounts, or investments. Then, you will need to complete an assignment of trust document, which formally transfers ownership from you to the trust. It’s crucial to ensure the titles of the assets are updated to reflect this change.

The purpose of an Assignment of a mortgage is to transfer the lender's rights to another party. This transfer can enhance the lender's ability to sell the mortgage investment or adjust to changing financial circumstances. Understanding the Assignment of trust within this context can help borrowers and investors make informed decisions regarding their financial arrangements.

To assign a trust, you typically need to follow legal procedures defined by both the trust document and state laws. This process often involves drafting an assignment agreement, notifying beneficiaries, and possibly obtaining court approval. For those unfamiliar with these steps, using platforms like USLegalForms can streamline the process and ensure compliance with relevant regulations.