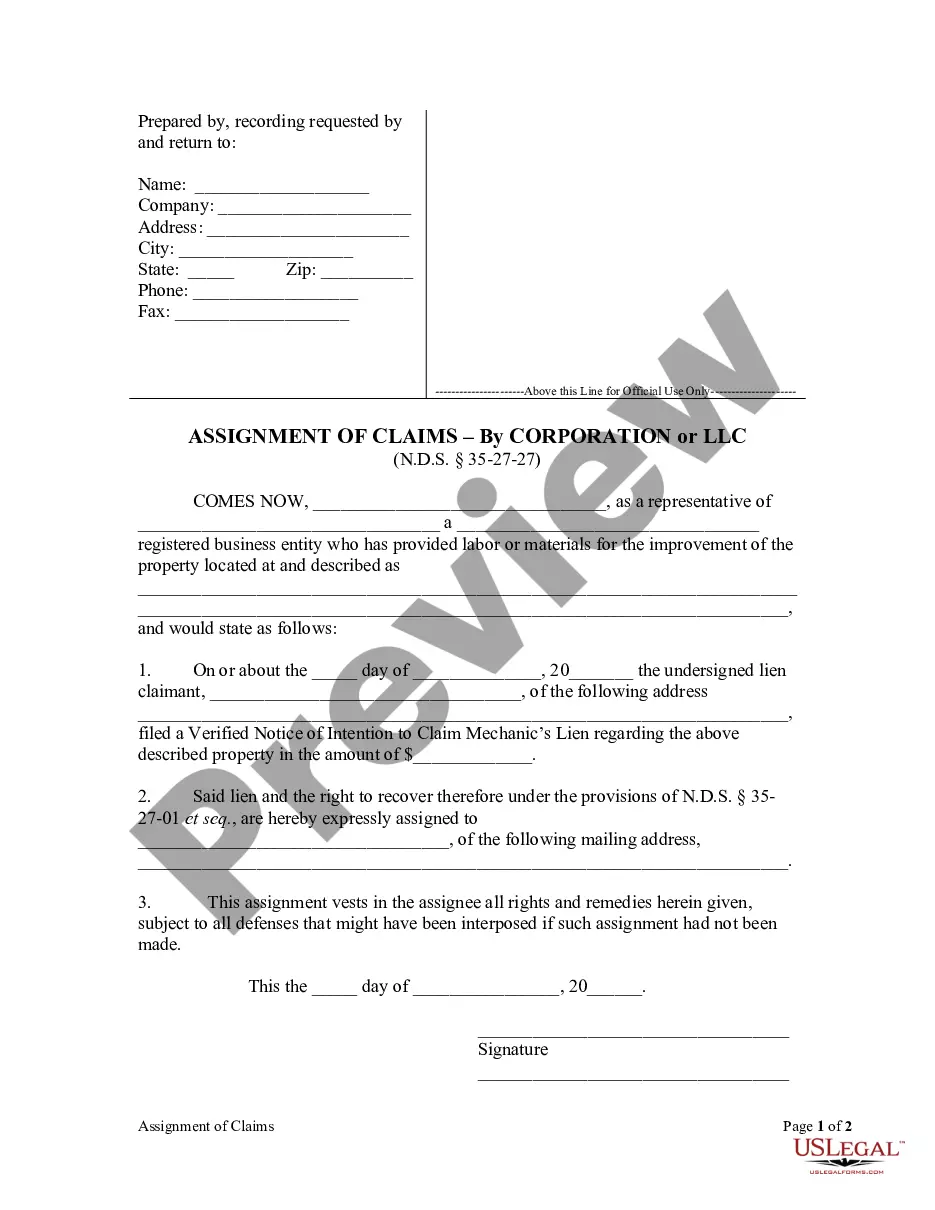

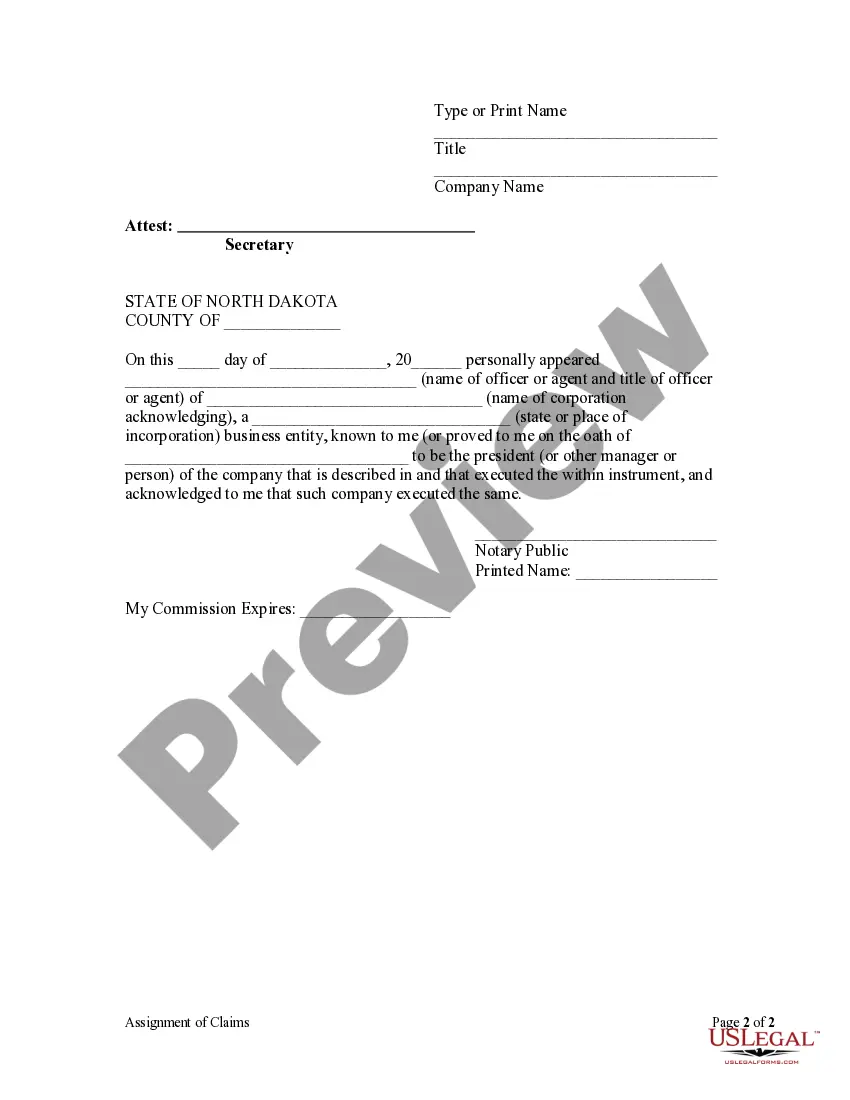

This Assignment of Claims form is for use by a corporation that has provided labor or materials for the improvement of real property to assign the corporation's lien for the same who will have all the rights and remedies of the lien claimant, subject to all defenses that might have been interposed if such assignment had not been made.

North Dakota Assignment Withholding Guide

Description

How to fill out North Dakota Assignment Withholding Guide?

How to obtain expert legal documents that adhere to your state laws and create the North Dakota Assignment Withholding Guide without hiring an attorney.

Numerous online services offer templates to address different legal matters and formal procedures. However, it may require time to determine which of the provided samples meet both your needs and legal standards.

US Legal Forms is a trusted resource that assists you in finding formal documents drafted according to the latest state law revisions and helps you save on legal fees.

If you do not have a US Legal Forms account, follow the steps below: Review the webpage you have accessed to verify if the form suits your requirements. To do this, utilize the form description and preview options if available. Look for another template in the header displaying your state if necessary. Click the Buy Now button once you locate the appropriate document. Choose the most suitable pricing plan, then Log In or create a new account. Select your preferred payment method (by credit card or PayPal). Alter the file format for your North Dakota Assignment Withholding Guide and click Download. The acquired documents remain yours: you can always access them in the My documents tab of your account. Join our library and draft legal documents independently like a seasoned legal expert!

- US Legal Forms is not an ordinary online directory.

- It is a compilation of over 85,000 verified templates for numerous business and personal scenarios.

- All documents are categorized by field and state for faster and more efficient searches.

- It also integrates with powerful tools for PDF editing and electronic signatures, enabling users with a Premium subscription to effortlessly complete their documents online.

- Obtaining the required paperwork requires minimal effort and time.

- If you already possess an account, Log In and ensure your subscription is active.

- Download the North Dakota Assignment Withholding Guide using the corresponding button next to the file name.

Form popularity

FAQ

By placing a 0 on line 5, you are indicating that you want the most amount of tax taken out of your pay each pay period. If you wish to claim 1 for yourself instead, then less tax is taken out of your pay each pay period.

Withholding is the portion of an employee's wages that is not included in their paycheck but is instead remitted directly to the federal, state, or local tax authorities. Withholding reduces the amount of tax employees must pay when they submit their annual tax returns.

Form 307 North Dakota Transmittal of Wage and Tax Statement needs to be submitted by anyone who has an open withholding account with the Office of State Tax Commissioner and does not file electronically, even if you did not have employees for the filing period.

Use the Tax Withholding Estimator on IRS.gov. The Tax Withholding Estimator works for most employees by helping them determine whether they need to give their employer a new Form W-4. They can use their results from the estimator to help fill out the form and adjust their income tax withholding.

Here's a step-by-step look at how to complete the form.Step 1: Provide Your Information. Provide your name, address, filing status, and Social Security number.Step 2: Indicate Multiple Jobs or a Working Spouse.Step 3: Add Dependents.Step 4: Add Other Adjustments.Step 5: Sign and Date Form W-4.