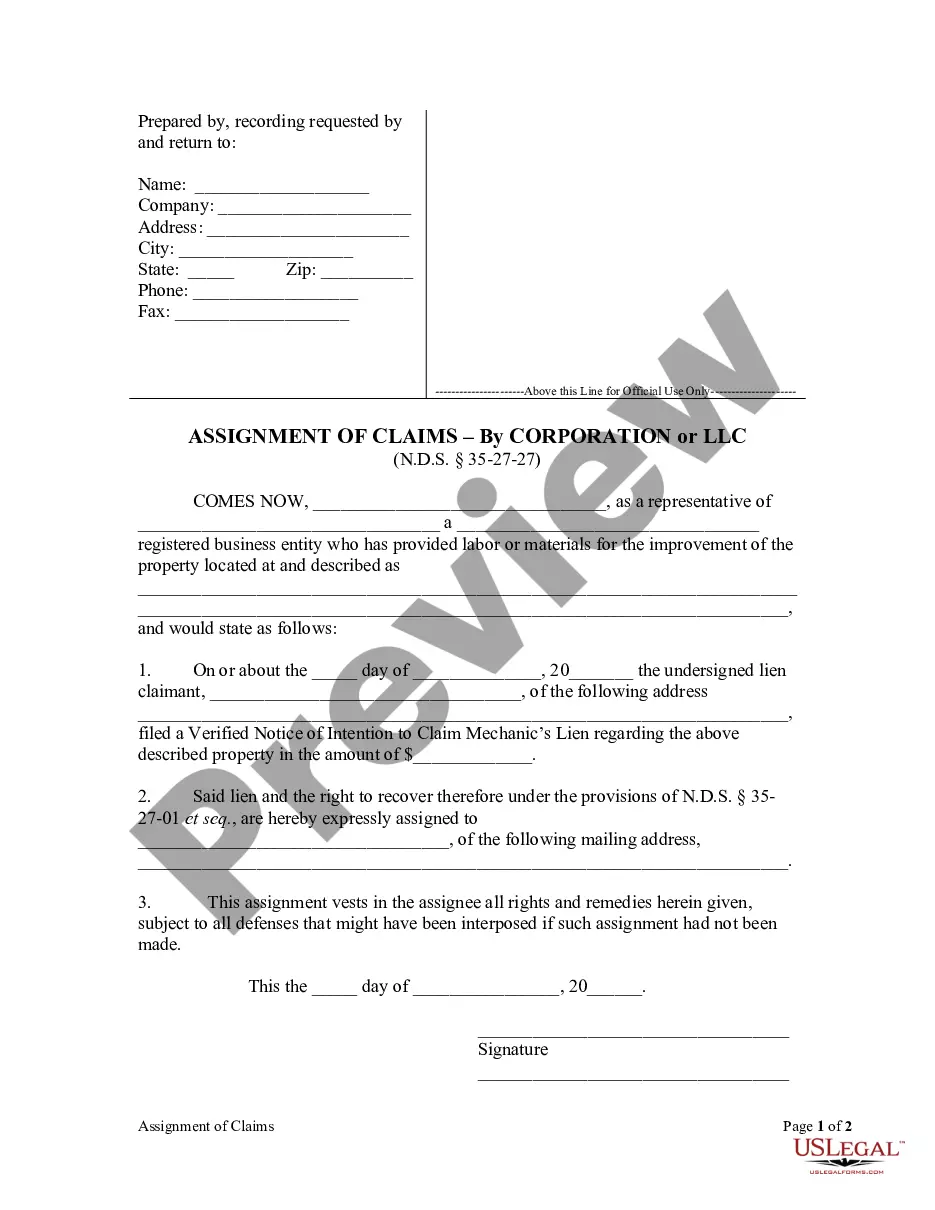

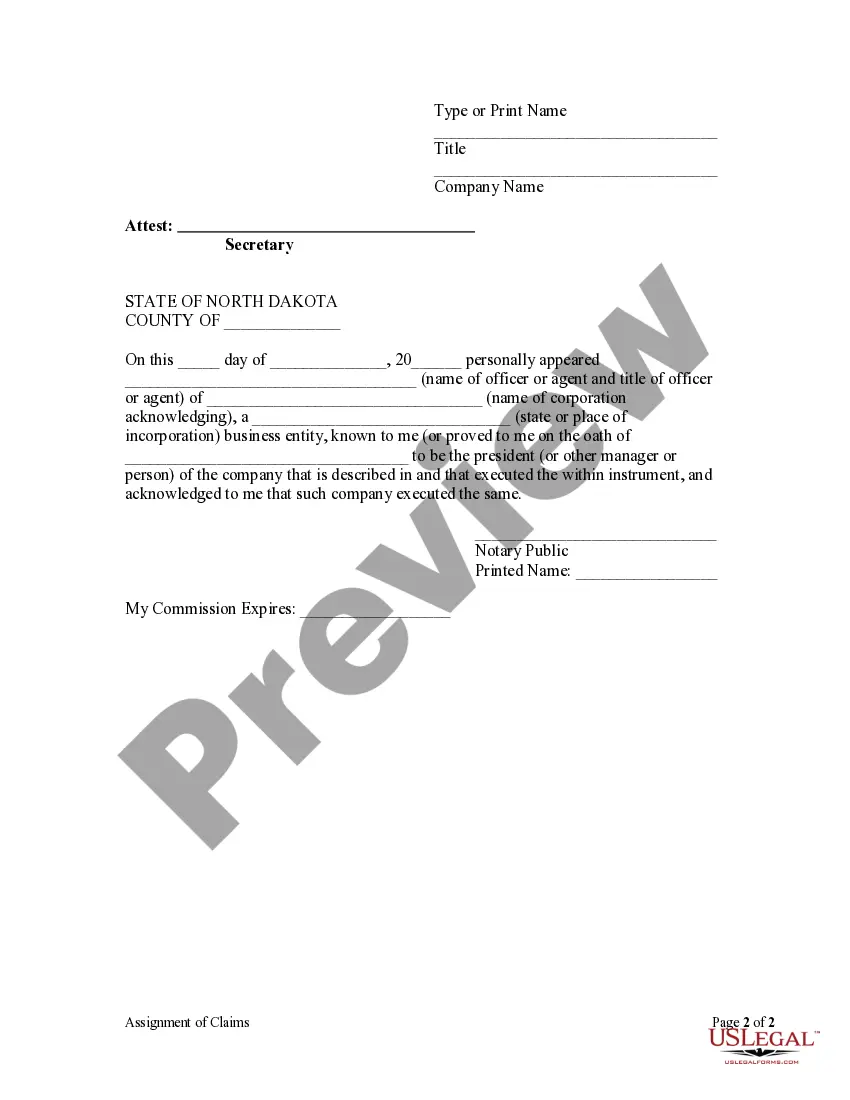

This Assignment of Claims form is for use by a corporation that has provided labor or materials for the improvement of real property to assign the corporation's lien for the same who will have all the rights and remedies of the lien claimant, subject to all defenses that might have been interposed if such assignment had not been made.

North Dakota Assignment Form 40 Instructions 2020

Description

How to fill out North Dakota Assignment Form 40 Instructions 2020?

There is no longer a necessity to dedicate time searching for legal documents to fulfill your local state regulations. US Legal Forms has gathered all of them in a single location and simplified their availability.

Our platform provides over 85,000 templates for any business and individual legal matters categorized by state and type of use. All forms are expertly prepared and verified for accuracy, granting you confidence in acquiring an up-to-date North Dakota Assignment Form 40 Instructions 2020.

If you are acquainted with our platform and already possess an account, you must verify that your subscription is active before accessing any templates. Log In to your account, select the document, and click Download. You can also revisit all stored documents at any time by accessing the My documents tab in your profile.

You can print your form to complete it manually or upload the sample if you prefer to fill it out using an online editor. Preparing official documentation under federal and state regulations is quick and straightforward with our library. Experience US Legal Forms today to maintain your paperwork organized!

- If you have not previously utilized our platform, the procedure will involve additional steps to finalize.

- Here's how new users can find the North Dakota Assignment Form 40 Instructions 2020 in our collection.

- Examine the page content attentively to ensure it contains the template you need.

- To achieve this, make use of the form description and preview options if available.

- Utilize the Search field above to find another example if the previous one did not meet your requirements.

- Click Buy Now adjacent to the template title once you discover the correct one.

- Select the most appropriate pricing plan and register for an account or Log In.

- Complete the payment for your subscription using a credit card or through PayPal to proceed.

- Choose the file format for your North Dakota Assignment Form 40 Instructions 2020 and download it onto your device.

Form popularity

FAQ

Yes, North Dakota does have a state withholding form that you need to complete. This form helps ensure that the correct amount of state income tax is withheld from your paycheck. To navigate the requirements of state tax withholding, consider reviewing the North Dakota assignment form 40 instructions 2020 for detailed guidelines. Using resources like the uslegalforms platform can simplify the process by providing clear templates and instructions.

Yes, North Dakota accepts federal extensions for corporate tax filings. This allows corporations additional time to prepare their state tax returns, as long as they adhere to the federal guidelines. For clarity on how to file extensions correctly, including guidance on the North Dakota Assignment Form 40 instructions 2020, USLegalForms provides essential tools and information.

No, North Dakota is not a tax-exempt state; it levies income tax along with sales tax on various transactions. However, there are specific exemptions and deductions available that residents can utilize. To fully understand the tax landscape in North Dakota, including relevant forms and the North Dakota Assignment Form 40 instructions 2020, you can rely on USLegalForms for comprehensive assistance.

To amend your North Dakota tax return, you need to file a Form ND-1 or ND-1NR, indicating the changes clearly. The process involves providing necessary documentation supporting your amendments. For the specific steps and guidance, including the North Dakota Assignment Form 40 instructions 2020, USLegalForms offers tailored resources that simplify the amendment process.

Individuals who earn income from North Dakota sources but reside in another state must file a North Dakota nonresident tax return. This includes income from wages, rental properties, or business activities within the state. For assistance with the filing process and access to the North Dakota Assignment Form 40 instructions 2020, check out USLegalForms for effective solutions.

South Dakota is the state that does not impose a state income tax. This makes it a popular choice for individuals and businesses looking to minimize their tax burden. For those in North Dakota, however, understanding the state’s tax obligations, including the North Dakota Assignment Form 40 instructions 2020, is critical to compliance.

Yes, North Dakota has a state income tax form that residents need to file annually. The form is essential for reporting your income and calculating your tax liability. For detailed guidance on how to complete this form, including the North Dakota Assignment Form 40 instructions 2020, visit USLegalForms to ensure you have all the necessary resources.

Generally, you can carry forward business losses indefinitely until they are fully utilized, subject to applicable state regulations. This means you have the flexibility to offset future profits against past losses for as long as necessary. For the most effective approach, reference the North Dakota assignment form 40 instructions 2020 to ensure compliance with state law.

In some cases, net operating losses can be transferred through ownership changes in certain types of businesses, subject to specific rules. This can provide relief for businesses looking to mitigate tax burdens. When considering these options, review the North Dakota assignment form 40 instructions 2020 for precise guidelines.

Business income tax rates in North Dakota vary based on your business's income levels. Generally, businesses must file a corporate income tax return using form 40, among others. To navigate the intricacies of taxation effectively, the North Dakota assignment form 40 instructions 2020 will be essential to understand your obligations.