Norcom Mortgage

Description

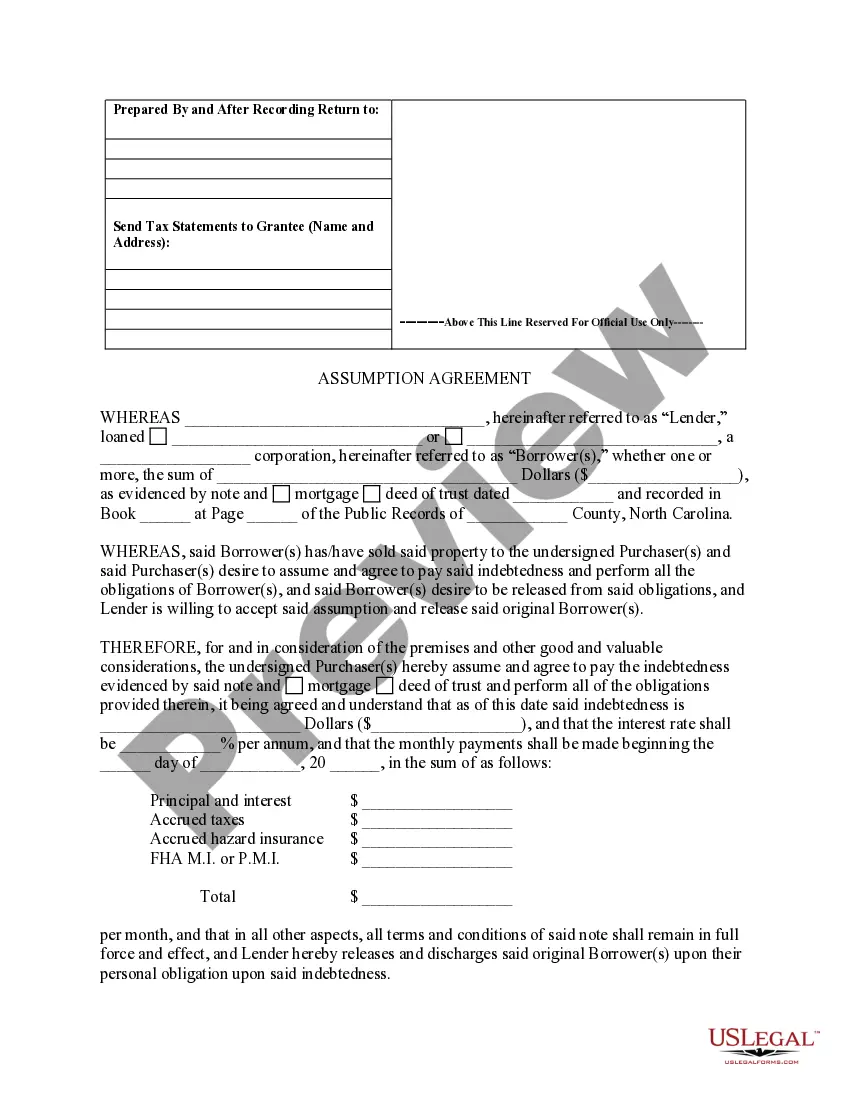

How to fill out North Carolina Assumption Agreement Of Deed Of Trust And Release Of Original Mortgagors?

- Log in to your existing US Legal Forms account by following this link to access your needed form templates. Ensure your subscription is active; if it’s not, renew as per your plan.

- Preview the form description to verify you have selected the correct document that aligns with your needs and local jurisdiction requirements.

- If any discrepancies arise, utilize the Search function at the top of the page to find alternative templates that may better suit your needs.

- Select and click on the Buy Now button for your chosen document and choose a subscription plan that fits your requirements. You will need to register an account to unlock the full library.

- Complete your purchase by entering your payment details, using either a credit card or PayPal, according to your selected subscription option.

- Download the completed form to your device. You can easily revisit it anytime in the My Forms section of your account.

In summary, US Legal Forms streamlines the often complex process of obtaining legal forms for your Norcom mortgage. Their extensive library and user-friendly interface ensure you have access to the legal documents needed for a smooth experience.

Take the first step towards simplifying your mortgage documentation today by visiting US Legal Forms!

Form popularity

FAQ

When speaking with a mortgage lender, it's important to avoid uncertain or negative statements about your finances. Do not downplay your credit issues or question your ability to make payments, as this may create doubts about your reliability. Instead, focus on presenting a strong case for your qualifications, enabling lenders to see you as a valuable candidate for a Norcom mortgage.

Filling out a mortgage form includes providing detailed information about your financial situation, employment, and property details. Make sure to include your income, debts, and assets comprehensively, as this information will help lenders assess your eligibility for a Norcom mortgage. Taking the time to fill out the form accurately can streamline the application process and improve your chances for approval.

Before it rebranded to Rocket Mortgage, the company was originally known as Quicken Loans. This change aimed to create a more streamlined and efficient mortgage process, similar to what Norcom Mortgage provides. Understanding this history helps you appreciate the evolution of mortgage services and the emergence of personalized offerings.

As of now, Norcom Mortgage has maintained its identity and has not been bought out. This independence allows them to focus on customer satisfaction and innovate within the mortgage market continually. If you are considering a mortgage solution, Norcom Mortgage remains a strong contender.

USA Mortgage operates as a lending institution but is not classified as a traditional bank. Instead, it provides various mortgage products similar to those offered by Norcom Mortgage. This includes home purchases, refinancing, and first-time homebuyer options, giving you flexibility in your mortgage choices.

Yes, Gateway Mortgage did undergo a transition by being acquired by a larger financial institution. This acquisition aimed to enhance the services offered to clients, which includes improving processes for securing a Norcom mortgage. If you are looking for updated information on mortgage options, keep an eye on lenders like Norcom Mortgage and how they fit into the new landscape.

Getting a mortgage as an independent contractor can be challenging due to the nature of fluctuating incomes. To improve your chances, maintain thorough records of your earnings and be prepared to provide two years of tax returns. Norcom Mortgage understands these unique situations and can assist you in finding solutions to fit your specific circumstances.

To obtain a blanket mortgage, you usually need to present a solid investment strategy involving multiple properties. Lenders will assess your financial situation and the potential value of your properties. Norcom Mortgage specializes in this area and can provide tailored options to simplify the process.

To easily qualify for a mortgage, start by checking your credit score and addressing any issues. Keeping your debt-to-income ratio low and saving for a larger down payment can also enhance your chances. Norcom Mortgage provides tools and resources to simplify this process, ensuring you’re well-prepared.

The easiest mortgage to qualify for often includes government-backed loans such as FHA or VA loans. These options typically have lower credit score requirements and offer flexibility in terms of down payment. At Norcom Mortgage, we can help you explore these options to find a solution that fits your needs.