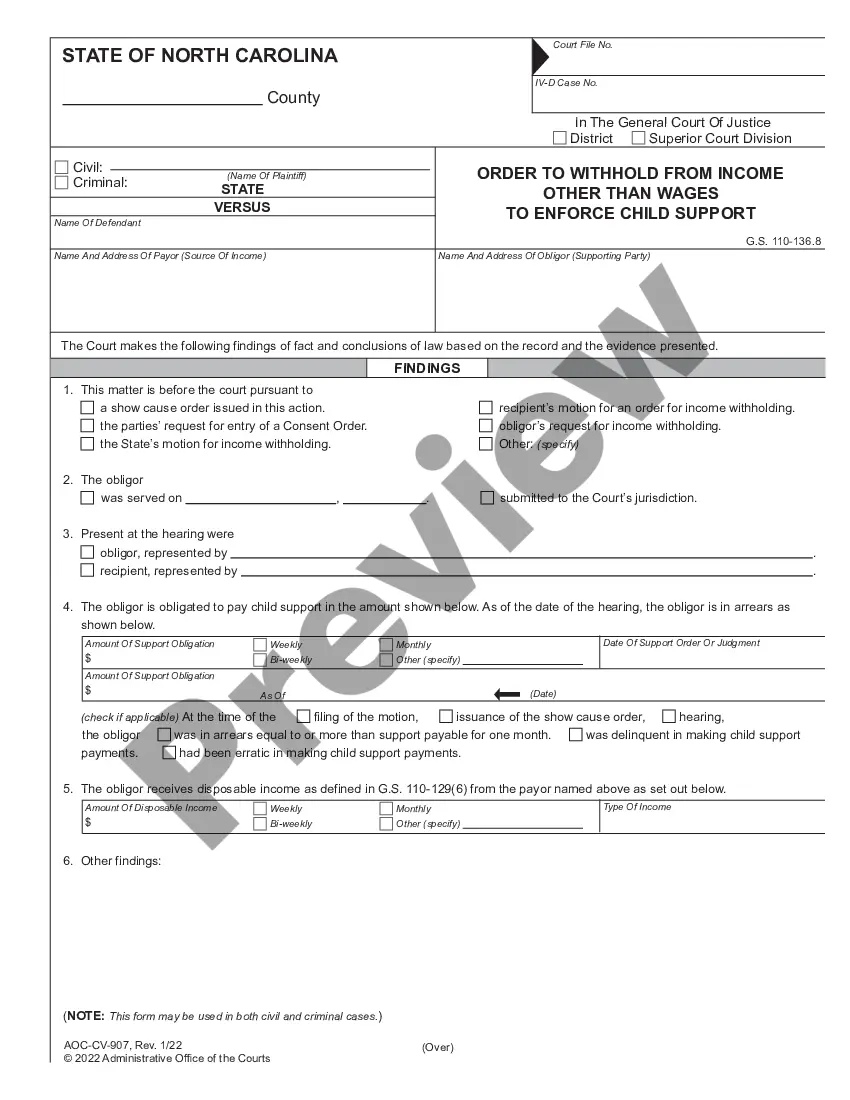

Order to Withhold Wages to Enforce Child Support: This is an official form from the North Carolina Administration of the Courts - AOC, which complies with all applicable laws and statutes. USLF amends and updates the forms as is required by North Carolina statutes and law.

Enforce Child Support Withholding Limits

Description

How to fill out North Carolina Order To Withhold Wages To Enforce Child Support?

What is the most reliable service to obtain the Enforce Child Support Withholding Limits and other current versions of legal documents? US Legal Forms is the answer!

It holds the largest assortment of legal forms for any purpose. Each template is expertly crafted and validated for adherence to federal and local regulations. They are categorized by domain and state of application, making it easy to find what you require.

US Legal Forms is a fantastic solution for anyone needing to manage legal documents. Premium users can enjoy even more benefits, as they can fill out and sign previously saved documents electronically at any time within the incorporated PDF editing tool. Explore it now!

- Experienced users of the platform only need to Log In to the system, confirm if their subscription is active, and click the Download button next to the Enforce Child Support Withholding Limits to acquire it.

- Once downloaded, the template remains accessible for future reference within the My documents section of your account.

- If you do not yet have an account with our database, here are the steps you should follow to create one.

- Form compliance assessment. Before acquiring any template, ensure that it meets your usage requirements and adheres to your state or county's regulations. Review the form description and utilize the Preview feature if available.

Form popularity

FAQ

In Pennsylvania, if an employer does not withhold child support, the employer may face significant penalties, including fines and potential legal action. The employee may experience financial difficulties due to unpaid support, which can strain family relationships. It is crucial for employers to understand and enforce child support withholding limits to avoid such issues. The US Legal Forms platform provides resources to help employers navigate these complex requirements and manage their obligations effectively.

If an employer fails to take out child support, it can lead to serious consequences for both the employee and the employer. The employee may face penalties for not making their child support payments, which could result in wage garnishment or even legal action. Additionally, the employer may also face legal repercussions for not enforcing child support withholding limits as mandated by law. Using the US Legal Forms platform can help employers understand their responsibilities and ensure they consistently enforce child support withholding limits.

The maximum rate of child support is determined by state law, typically falling within a percentage of the non-custodial parent's income. Most states set a cap around 20-25% of the parent’s income for one child, which can increase with additional children. Enforcing child support withholding limits allows for fair financial obligations, preventing any undue burden on the paying parent. For reliable information and forms, explore US Legal Forms, which can streamline this process for you.

The maximum child support amount is not universally defined, as it largely depends on the state’s guidelines, the parents’ incomes, and the needs of the child. Each state evaluates these factors to calculate what is fair and just for both parties involved. Understanding how to enforce child support withholding limits can help you adhere to state guidelines without sacrificing essential needs. It's advisable to consult resources like US Legal Forms to tailor your approach to your specific situation.

The maximum amount that can be deducted for child support varies by state, but generally, the limit is 50-65% of a non-custodial parent's disposable earnings. Various factors, such as additional obligations, can also influence this percentage. Enforcing child support withholding limits ensures that these deductions remain fair and manageable. To navigate these complexities, consider using platforms like US Legal Forms for accurate guidance.

In Minnesota, the law specifies that a maximum of 50% to 55% of disposable earnings can be withheld for child support, depending on the arrangement. This guideline is in place to protect the earning potential of non-custodial parents while providing support for children. Employers should enforce these child support withholding limits to ensure compliance and avoid legal issues.

Kansas law mandates that child support orders include specific withholding limits, which typically allow for up to 50% of an employee's disposable earnings to be withheld. Understanding these laws helps ensure that employers comply and support children effectively. Utilizing resources like USLegalForms can streamline this process and provide clarity on enforcement.

The maximum amount that can be withheld for child support varies by state, but generally, it ranges from 50% to 65% of disposable income. This is contingent upon factors such as additional court-ordered obligations. It's important to be aware of these limits to ensure proper enforcement and compliance with withholding orders.

Yes, employers in Florida are legally required to withhold child support from employee wages if they receive a court order. This process ensures that the necessary child support payments are made directly to the custodial parent. Enforcing child support withholding limits is crucial for maintaining compliance and supporting children in need.

In Texas, the maximum amount that can be withheld for child support is typically 50% of the employee's disposable earnings. However, this limit may vary depending on the individual circumstances of the case, such as additional family obligations. Understanding and enforcing these child support withholding limits can help both employers and employees navigate their responsibilities.