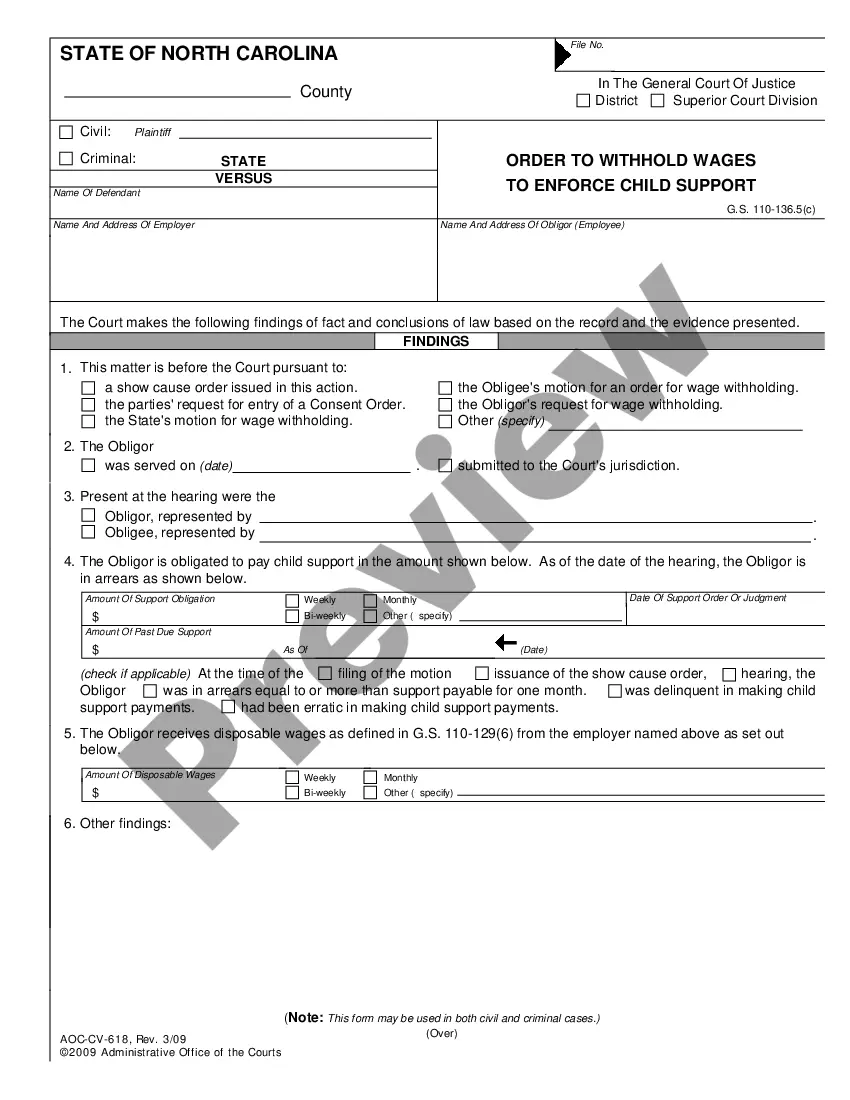

Order to Withhold from Income Other than Wages to Enforce Child Support Order: This is an official form from the North Carolina Administration of the Courts (AOC), which complies with all applicable laws and statutes. USLF amends and updates the forms as is required by North Carolina statutes and law.

Child Support Income Withholding

Description

How to fill out North Carolina Order To Withhold From Income Other Than Wages To Enforce Child Support Order?

Well-constructed official documentation is one of the vital assurances for preventing issues and lawsuits, but obtaining it without the assistance of an attorney may require time.

Whether you need to swiftly locate a current Child Support Income Withholding or any other forms for employment, family, or business purposes, US Legal Forms is always available to assist.

The procedure is even simpler for existing users of the US Legal Forms library. If your subscription is active, you just need to Log In to your account and click the Download button adjacent to the chosen document. Additionally, you can access the Child Support Income Withholding at any time, as all paperwork ever obtained on the platform is stored within the My documents section of your profile. Save time and money on arranging formal documentation. Try US Legal Forms today!

- Verify that the document is appropriate for your situation and area by reviewing the description and preview.

- Look for an alternative template (if necessary) using the Search bar in the header of the page.

- Select Buy Now once you find the correct template.

- Pick the payment plan, sign into your account or create a new one.

- Choose your preferred payment method to acquire the subscription plan (via credit card or PayPal).

- Select PDF or DOCX file format for your Child Support Income Withholding.

- Click Download, then print the template to complete it or upload it to an online editor.

Form popularity

FAQ

On your tax return, you do not report child support payments as income. Since child support is not taxable income, you will not find a specific spot to enter it. However, being aware of child support income withholding can help you manage your financial responsibilities more effectively.

You do not put child support on your W4. This form focuses on your income and tax situation for withholding purposes. Remember that child support income withholding is a separate obligation, and it should be handled accordingly.

No, paying child support does not count as a dependent on your tax return. A dependent typically refers to a child you support, not the obligations you have towards them. Therefore, child support income withholding is a responsibility, but it does not afford you any dependent tax credits.

Yes, you can claim your child on your W4 if you qualify as their custodial parent. This helps reduce your taxable income and adjusts your tax withholding accordingly. Claiming your child ensures that you receive the financial benefits you deserve while managing child support income withholding.

No, you do not claim child support on your W4 form. The W4 is used to determine your withholding tax allowances, and child support income withholding is not counted as taxable income. It is essential to understand that child support payments are not reported as income for tax purposes.

Despite frustrations over unpaid child support, withholding a child from their parent can have legal repercussions. Child support income withholding is designed to ensure timely payments, but it does not legally justify preventing visitation. It's crucial to discuss these issues with a legal professional who can guide you through your options while ensuring compliance with the law. Resources from uslegalforms can assist in navigating these complexities.

Yes, Florida law mandates that employers must comply with child support income withholding orders. This requirement ensures that support payments are deducted directly from an employee's paycheck, streamlining the payment process. Employers should familiarize themselves with their responsibilities under the law to avoid penalties. If you have questions about enforcement, consider exploring the resources available on platforms like uslegalforms.

If an employer fails to comply with the child support income withholding order, it can lead to significant consequences. The employer may face legal penalties, including fines and mandatory compliance orders. Additionally, the parent owed support may experience delays in receiving necessary funds. It’s important for employers to understand their legal obligations and for parents to seek assistance if issues arise.

The process for income tax refunds being redirected to child support can vary. Typically, it may take several weeks to receive the funds adjusted for child support income withholding. Keep in mind that the timelines depend on the specific circumstances of the case and the efficiency of the child support enforcement agency. Monitoring your case with the agency can provide more accurate updates.

Yes, employers can face legal repercussions if they fail to comply with child support income withholding orders. If an employer does not deduct the agreed amount from an employee’s paycheck, they may be held liable for the unpaid child support. It's important for employers to understand their responsibilities in these situations to avoid complications.