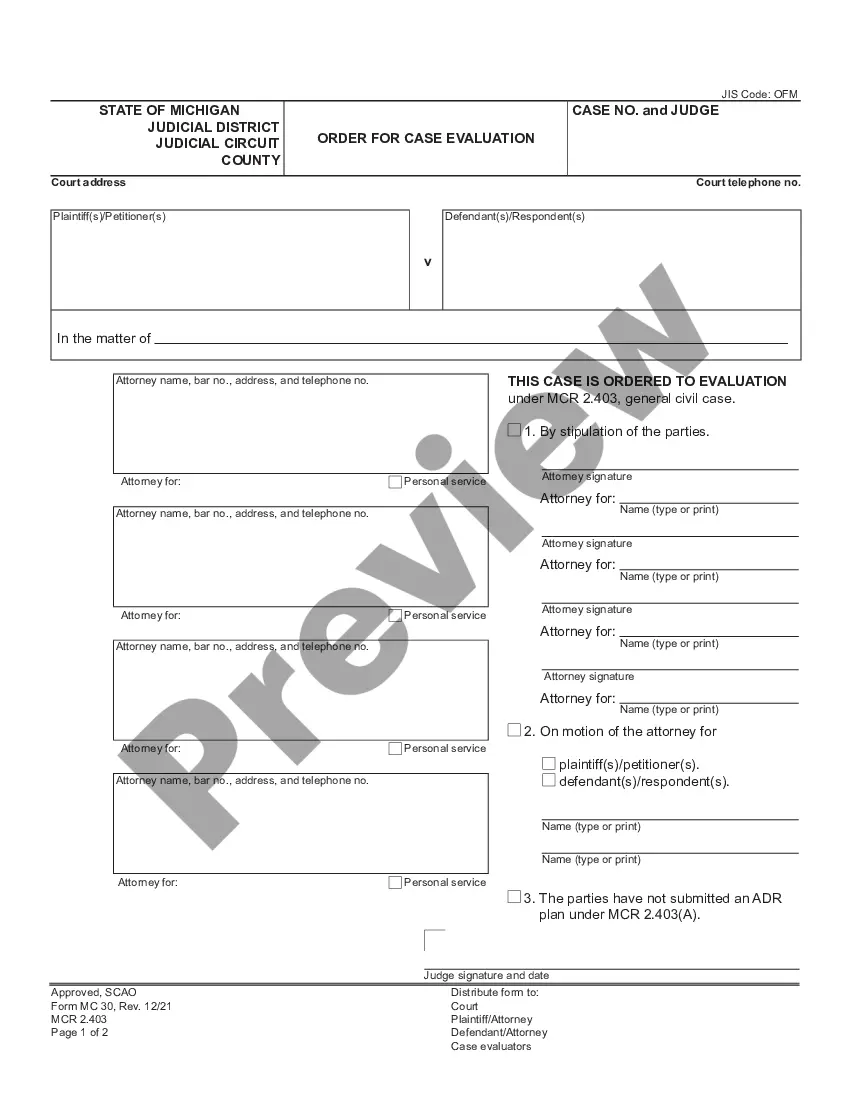

Example Of Alta Settlement Statement

Description

How to fill out North Carolina Closing Statement?

Working with legal papers and procedures could be a time-consuming addition to the day. Example Of Alta Settlement Statement and forms like it often require you to search for them and understand how to complete them appropriately. As a result, if you are taking care of financial, legal, or individual matters, having a extensive and hassle-free web library of forms when you need it will greatly assist.

US Legal Forms is the number one web platform of legal templates, offering more than 85,000 state-specific forms and a number of tools that will help you complete your papers easily. Check out the library of appropriate documents available with just one click.

US Legal Forms provides you with state- and county-specific forms offered at any moment for downloading. Safeguard your papers administration processes having a high quality service that allows you to make any form in minutes with no extra or hidden cost. Simply log in to the profile, find Example Of Alta Settlement Statement and acquire it straight away in the My Forms tab. You may also gain access to previously downloaded forms.

Would it be the first time using US Legal Forms? Sign up and set up your account in a few minutes and you’ll have access to the form library and Example Of Alta Settlement Statement. Then, stick to the steps below to complete your form:

- Be sure you have discovered the right form by using the Preview option and looking at the form description.

- Pick Buy Now when all set, and choose the subscription plan that fits your needs.

- Choose Download then complete, eSign, and print the form.

US Legal Forms has twenty five years of expertise assisting users manage their legal papers. Get the form you require today and improve any process without breaking a sweat.

Form popularity

FAQ

Mortgage loan settlement statements, used in real estate transactions, are often referred to as closing statements.

The ALTA settlement statement is an itemized list of all of the fees or charges that the buyer and seller will pay during the settlement portion of a real estate transaction. Everything from the sale price, loan amounts, school taxes, and other pertinent information is contained in this document.

ALTA statements are comprehensive and used in commercial transactions, while HUD statements are regulated by federal law and used in residential transactions. Understanding these differences is crucial for buyers, sellers, and real estate professionals lenders to ensure smooth and compliant real estate transactions.

What's the ALTA Settlement Statement? A Breakdown for Buyers Typically, the first number you see will be in the debit column, and that is the sale price of your property. Next will be a credit in the form of your earnest money you agreed to put down in the contract. Prorations are next. ... Loan/Lender fees will be next.

ALTA Settlement Statement Cash ? This is the version used for cash transactions for property purchases. Settlement Statement ? This is the version used specifically for the buyers in the real estate purchase and contains only information pertinent to the buyer's side of the transaction.