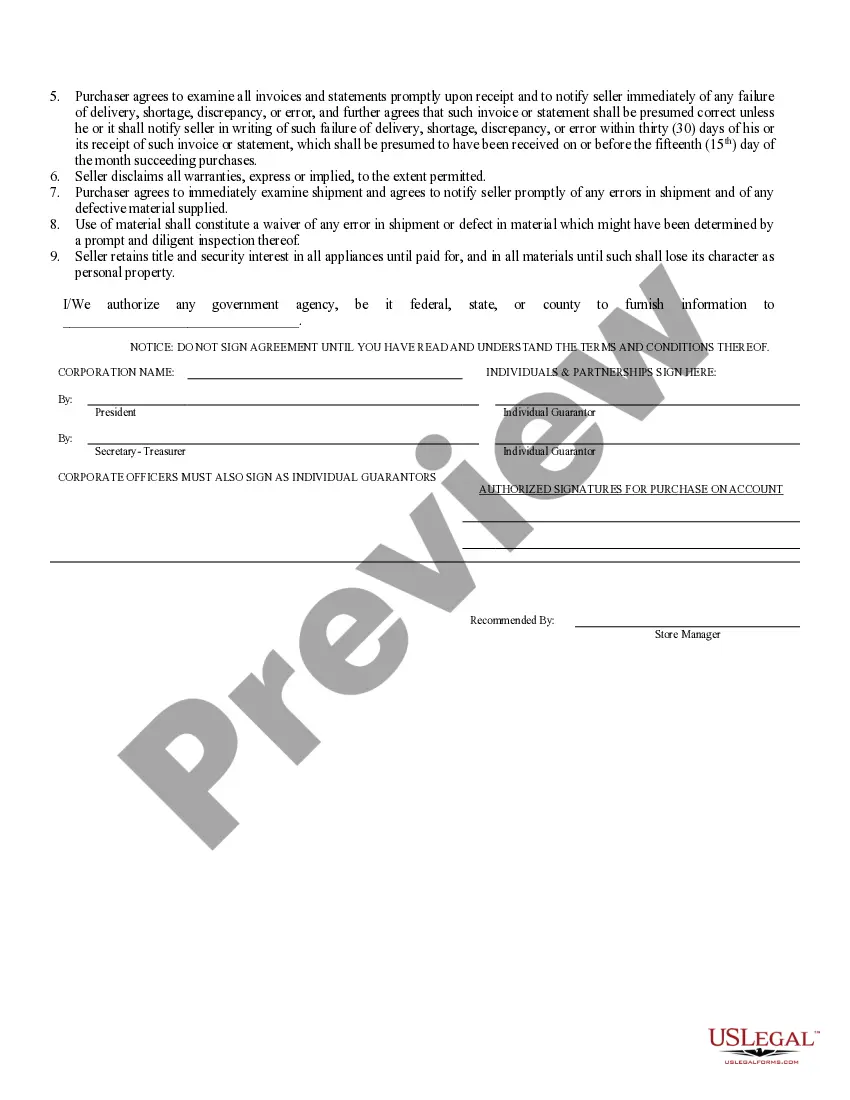

Credit Application Form For Car Dealership

Description

How to fill out Credit Application Form For Car Dealership?

Administrative procedures necessitate exactness and thoroughness.

If you don't engage in completing documents like the Credit Application Form For Car Dealership on a regular basis, it may lead to some misunderstanding.

Selecting the correct template from the outset will guarantee that your document submission proceeds seamlessly and avert any inconveniences associated with resubmitting a file or repeating the same task from the beginning.

Acquiring the correct and updated templates for your documentation takes just a few minutes with an account at US Legal Forms. Eliminate the administrative uncertainties and simplify your paperwork tasks.

- Locate the template by utilizing the search function.

- Confirm that the Credit Application Form For Car Dealership you’ve discovered is suitable for your state or region.

- View the preview or examine the description detailing the specifics on utilizing the template.

- When the results align with your search, click the Buy Now option.

- Choose the appropriate option from the suggested pricing plans.

- Log Into your account or create a new one.

- Finalize the purchase using a credit card or PayPal account.

- Receive the form in the format of your preference.

Form popularity

FAQ

Lenders can choose which credit score they want to use when evaluating your auto loan application. Different lenders might use different scores, and even the same lender might test several credit scores. As a result, you likely won't know exactly which credit score the lender will see when you apply for an auto loan.

The only time you are required to fill out a credit application is if you are seeking financing from the dealership. If it's really worth it for them to walk away from a deal, so be it. Another dealer will surely sell you a car with a 50% down payment and a check from a lender in hand.

A lot of dealerships require a credit application to prove your identity so that they don't get caught up in a check fraud scheme. If you don't want to fill out a credit application to buy a new car, you could try somewhere else or maybe ask them to call you to pick up the car when the check clears.

But even some car dealers favor preapproval. I always suggest that you apply for financing with your bank or credit union before you go car shopping, says Michael Bradley, fleet internet sales manager at Selman Chevrolet in Orange, California. Then let the dealer try to get you a better rate than you already have.

Key Takeaways. A credit application is a request for a loan or line of credit. The information included in a credit report helps the lender determine whether the borrower is a good candidate for a loan. You can usually fill out a credit application either online or in person.