Credit Application Form For Business Template

Description

How to fill out North Carolina Business Credit Application?

What is the most dependable service to obtain the Credit Application Form For Business Template and other updated versions of legal documents? US Legal Forms is the solution! It's the largest repository of legal forms for any situation.

Each template is expertly crafted and verified for adherence to federal and local laws. They are organized by region and state of use, ensuring that locating the document you require is effortless.

US Legal Forms is an excellent resource for anyone needing to handle legal documentation. Premium users enjoy additional benefits, as they can complete and authorize previously saved documents electronically at any time using the integrated PDF editing tool. Give it a try today!

- Experienced users of the platform simply need to Log In to the system, verify if their subscription is active, and click the Download button adjacent to the Credit Application Form For Business Template to acquire it.

- Once saved, the template stays accessible for future usage within the My documents section of your account.

- If you do not yet have an account with us, here are the steps you need to follow to create one.

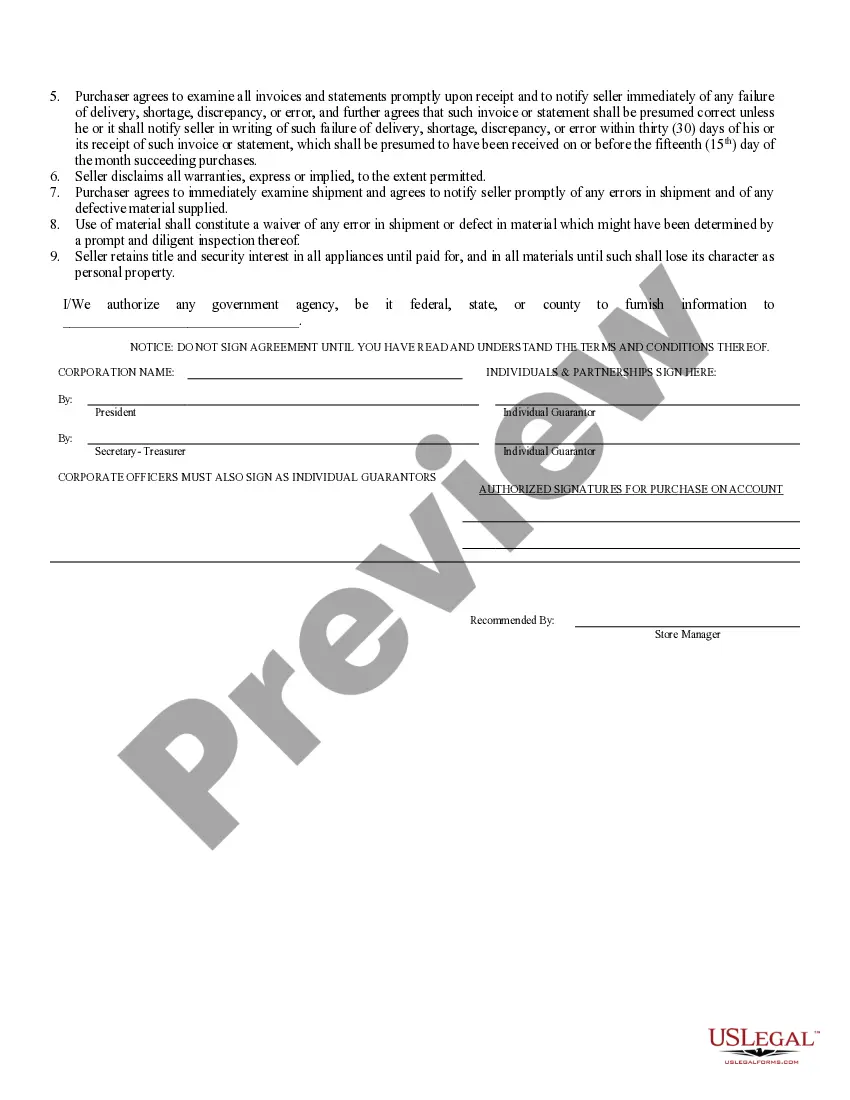

- Form compliance evaluation. Before you procure any template, you need to verify if it complies with your use case requirements and your state or county's regulations. Review the form description and utilize the Preview if available.

Form popularity

FAQ

Creating a business credit file is essential for your LLC's financial health. Start by registering your business with a credit reporting agency to get on their radar. Then, use a credit application form for business template to secure credit from suppliers and financial institutions. By establishing trade lines and consistently making timely payments, you will build a strong business credit file.

Building credit for your LLC involves a few straightforward steps. First, ensure that your business is registered and has its own EIN, or Employer Identification Number. Next, open a business bank account and keep your personal and business finances separate. Finally, consider using a credit application form for business template to apply for business credit, ensuring you establish a solid payment history with vendors that report to credit bureaus.

Yes, you can use your Employer Identification Number (EIN) to build business credit. Your EIN serves as your business's unique identifier and is necessary when filling out a credit application form for business template. By applying for credit accounts and using your EIN consistently, you can develop a strong business credit profile. This credibility is vital for accessing financial opportunities and establishing your business's financial identity.

Creating a credit application form for business template is straightforward. Start by identifying the essential information you need, such as business details, financial history, and ownership information. You can use online resources or platforms like US Legal Forms that offer ready-made templates to simplify the process. This allows you to customize your form to better suit your business needs while ensuring compliance with industry standards.

When filling out the credit application form for business template, include the official name of your business as it appears in your registration documents. This ensures clarity and accuracy, helping lenders verify your business identity. If your business operates under a different name, you should also mention the 'Doing Business As' (DBA) name. Providing complete and correct information on the credit application form for business template can expedite the approval process.

A credit application for a business is a formal request for credit submitted to suppliers or lenders, aimed at assessing the business’s ability to repay debts. This document usually includes financial statistics, personal guarantees, and business history. By utilizing a credit application form for business template, businesses can present a complete profile, facilitating a smoother credit evaluation process.

A credit application typically includes any official request for credit or financing, capturing relevant financial information about the requester. This can involve various forms, such as those from banks, credit card companies, or suppliers. Implementing a credit application form for business template helps ensure that you collect all necessary details consistently.

A credit application from a vendor is a request made by a business to establish credit terms for purchasing goods or services. Vendors rely on this application to assess the financial viability and credit risks of a business. By using a credit application form for business template, vendors can standardize their process, making it easier to evaluate potential clients.

To create a business credit application form, first outline the required information, such as ownership details, financial statements, and references. Then, design the form using a credit application form for business template to ensure all key elements are included. This organized approach simplifies the application process for both you and your applicants.

Creating a business credit file involves collecting and maintaining accurate financial information about your company. Begin by obtaining your Employer Identification Number (EIN), setting up trade lines, and monitoring credit reporting agencies. Utilizing a credit application form for business template can help you gather and organize the necessary data for your credit file.