Payment Rent Property For Sale

Description

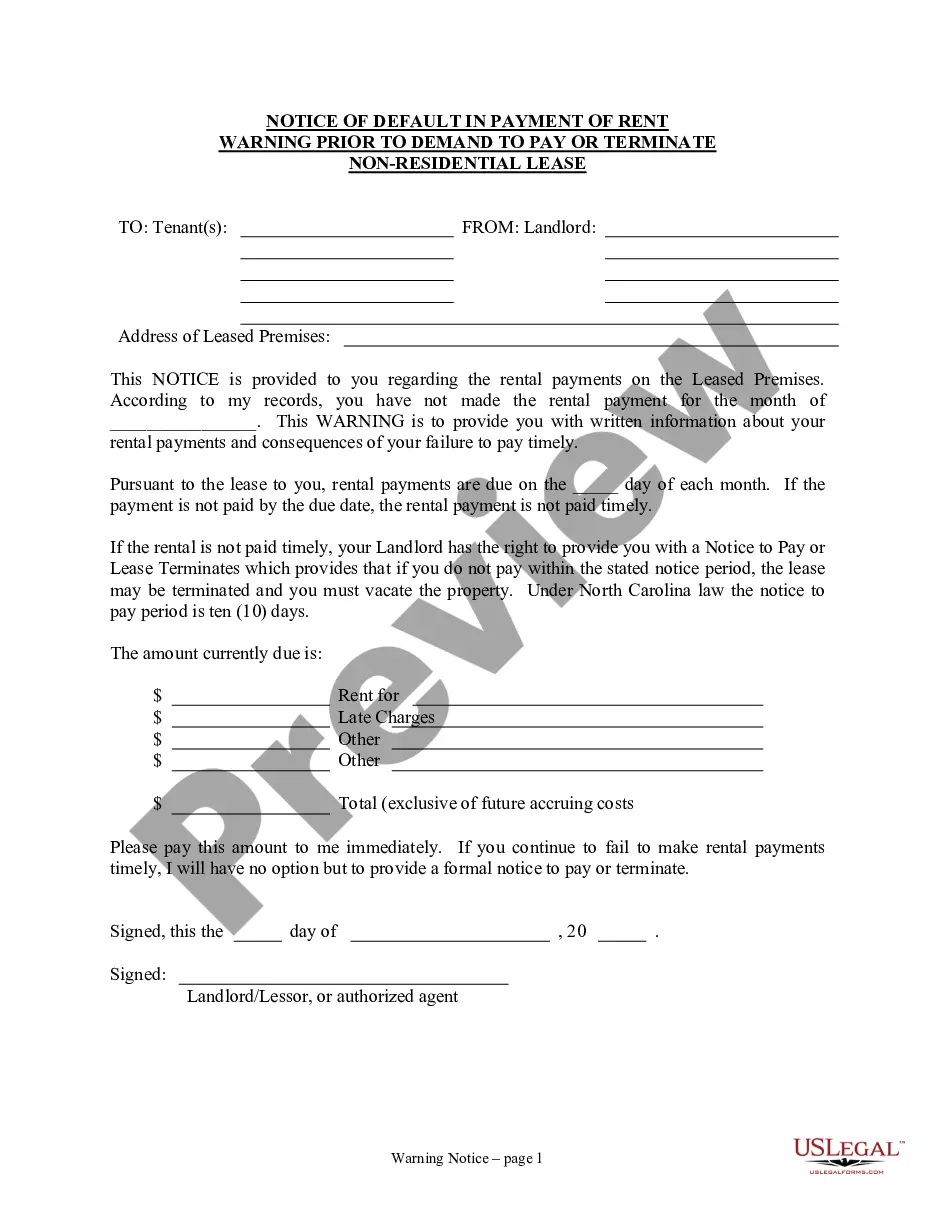

How to fill out North Carolina Notice Of Default In Payment Of Rent As Warning Prior To Demand To Pay Or Terminate For Nonresidential Or Commercial Property?

Handling legal documents and operations can be a time-consuming addition to the day. Payment Rent Property For Sale and forms like it usually need you to look for them and navigate the best way to complete them effectively. Consequently, whether you are taking care of financial, legal, or individual matters, using a comprehensive and practical online catalogue of forms at your fingertips will significantly help.

US Legal Forms is the top online platform of legal templates, offering more than 85,000 state-specific forms and numerous tools that will help you complete your documents effortlessly. Discover the catalogue of pertinent papers open to you with just one click.

US Legal Forms gives you state- and county-specific forms offered by any moment for downloading. Safeguard your document administration operations with a top-notch service that allows you to prepare any form within minutes without extra or hidden fees. Just log in to the account, find Payment Rent Property For Sale and acquire it right away within the My Forms tab. You can also access formerly saved forms.

Could it be the first time utilizing US Legal Forms? Register and set up up your account in a few minutes and you will get access to the form catalogue and Payment Rent Property For Sale. Then, stick to the steps below to complete your form:

- Be sure you have found the right form by using the Preview feature and looking at the form description.

- Select Buy Now when all set, and choose the monthly subscription plan that fits your needs.

- Choose Download then complete, eSign, and print the form.

US Legal Forms has 25 years of expertise assisting users control their legal documents. Find the form you require today and streamline any process without breaking a sweat.

Form popularity

FAQ

To complete a Rent Receipt, ensure it contains the following information: The payment method (e.g., cash, electronic funds transfer, money order, personal check, etc.) The payment date. The payment amount. The remaining balance, if the tenant makes a partial payment.

Include the date, the amount paid, the rental address, what month the payment represents, your name, and unit. To make the process easier, you can also use an online rental receipt form. As a tenant, you may also want a receipt if you work at home and want to claim a tax deduction for business use.

Tax Considerations You will use the gain or loss from the sale of your property assets, any recaptured depreciation, and selling expenses to calculate any capital gains taxes owed. The sale of rental property is typically reported on IRS Form 4707 or Form 8949 in conjunction with the Schedule D.

What form(s) do we need to fill out to report the sale of rental property? Report the gain or loss on the sale of rental property on Form 4797, Sales of Business Property or on Form 8949, Sales and Other Dispositions of Capital Assets depending on the purpose of the rental activity.

What form(s) do we need to fill out to report the sale of rental property? Report the gain or loss on the sale of rental property on Form 4797, Sales of Business Property or on Form 8949, Sales and Other Dispositions of Capital Assets depending on the purpose of the rental activity.