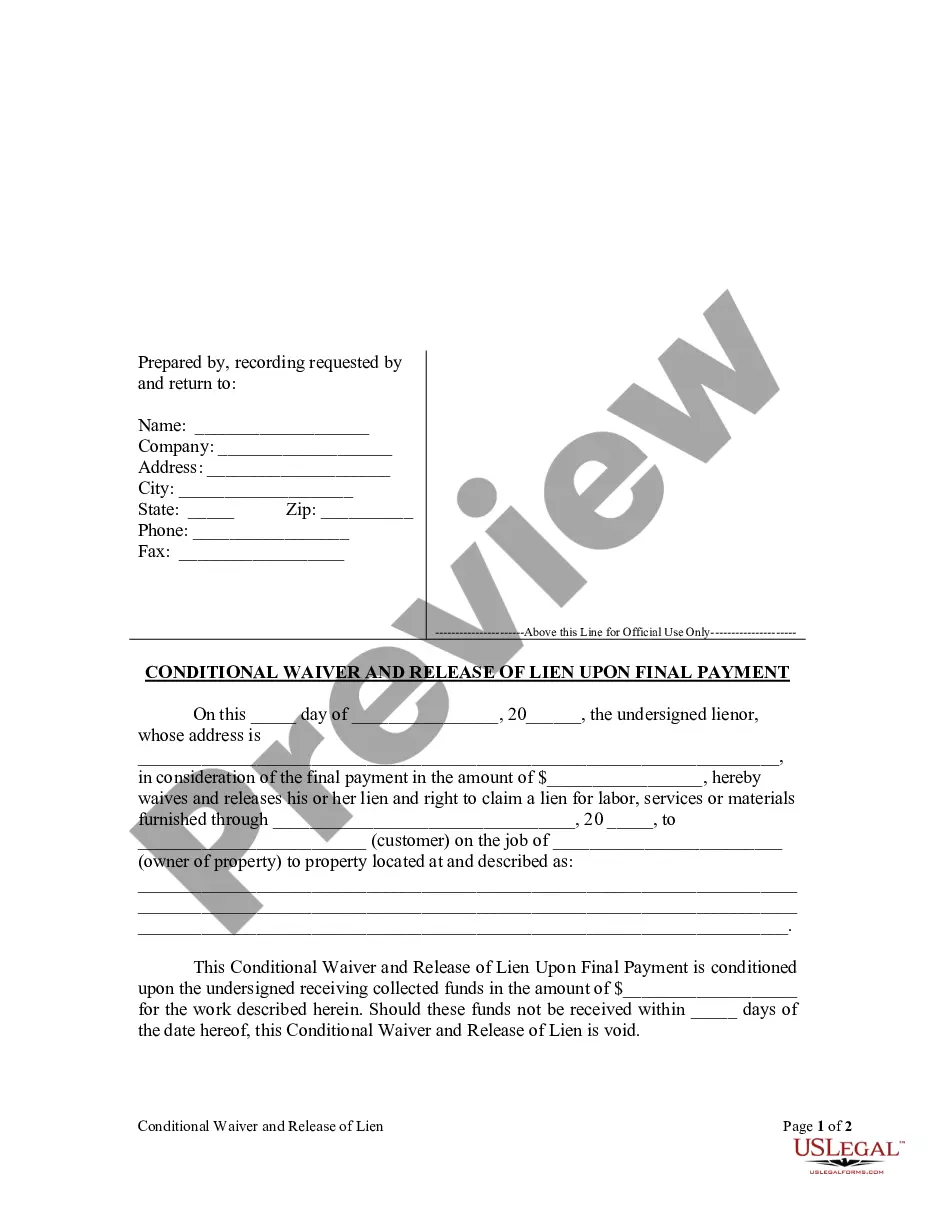

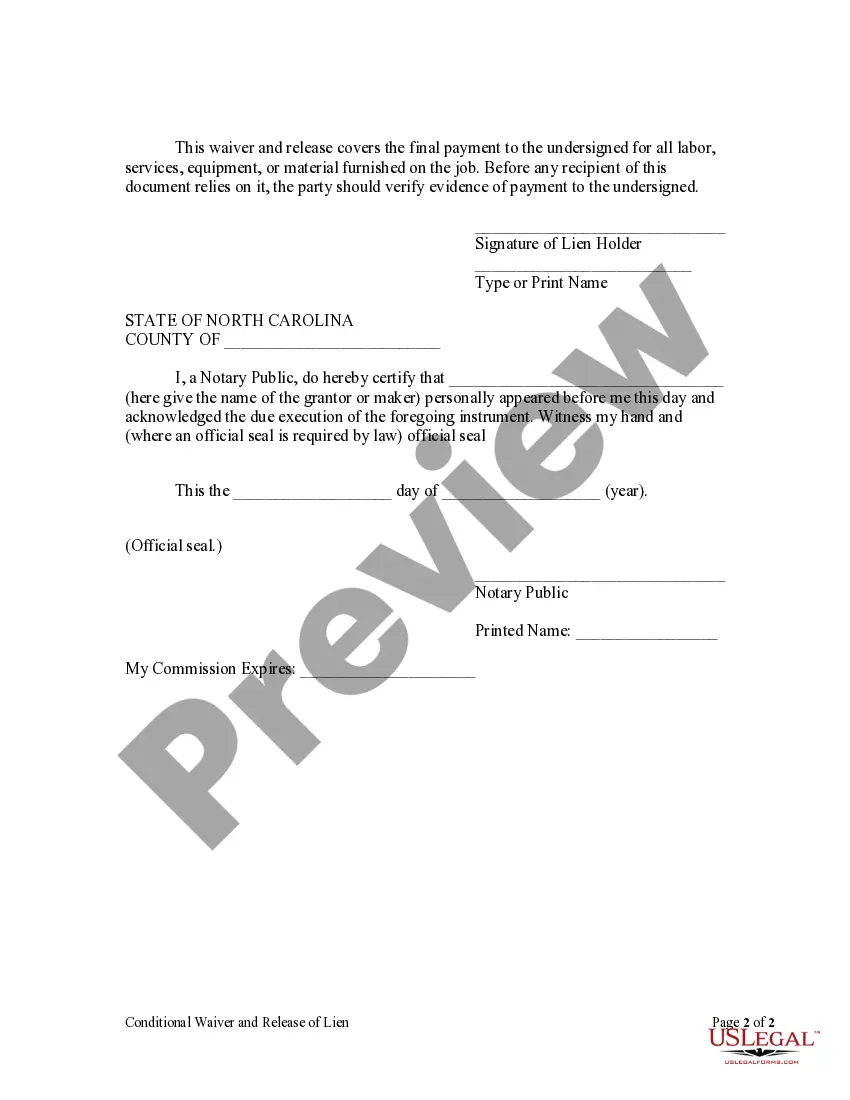

Waiver And Release Of Lien Upon Final Payment Withholding Tax

Description

How to fill out North Carolina Conditional Waiver And Release Of Lien Upon Final Payment?

When it is necessary to complete the Waiver And Release Of Lien Upon Final Payment Withholding Tax in accordance with your local state's statutes and regulations, there can be numerous alternatives to select from.

There is no requirement to scrutinize each document to ensure it fulfills all the legal standards if you are a US Legal Forms member.

It is a trustworthy service that can assist you in obtaining a reusable and contemporary template on any topic.

Utilizing US Legal Forms makes obtaining expertly crafted formal documents hassle-free. Additionally, Premium users gain access to powerful integrated tools for online PDF editing and signing. Try it today!

- US Legal Forms represents the largest online repository with a compilation of over 85,000 ready-to-use documents for business and personal legal matters.

- All templates are verified to comply with each state's regulations.

- Consequently, when you download the Waiver And Release Of Lien Upon Final Payment Withholding Tax from our platform, you can have confidence that you possess a valid and up-to-date document.

- Acquiring the required sample from our platform is straightforward.

- If you already have an account, simply Log In to the system, verify that your subscription is active, and save the selected file.

- In the future, you can access the My documents section in your profile and maintain access to the Waiver And Release Of Lien Upon Final Payment Withholding Tax whenever needed.

- If this is your first experience with our library, please follow the instructions listed below.

- Review the indicated page and confirm it aligns with your needs.

Form popularity

FAQ

Placing a Player on Unconditional Release Waivers Removes Him from All Rosters. On the date of the waiver request, the club must notify the player that the club intends to release the player. When the Commissioner's Office receives the waiver request, the player is immediately removed from all player limits.

Lien Release: After a lien has been filed, the California claimant can release or cancel the lien by filing a Mechanics Lien Release form with the county recorder's office where the lien was originally recorded.

How to complete the Conditional Waiver and Release on Progress Payment formName of Claimant. The claimant is the party receiving the payment in other words, the one waiving their lien rights.Name of Customer.Job Location.Owner.Through Date.Maker of the Check.Amount of the Check.Check Payable To.More items...?

Components of a waiverGet help. Writing a waiver should not be complicated.Use the correct structure. Waivers should be written in a certain structure.Proper formatting.Include a subject line.Include a caution!Talk about the activity risks.Do not forget an assumption of risk.Hold harmless.More items...?

How to complete the Conditional Waiver and Release on Progress Payment formName of Claimant. The claimant is the party receiving the payment in other words, the one waiving their lien rights.Name of Customer.Job Location.Owner.Through Date.Maker of the Check.Amount of the Check.Check Payable To.More items...?