Limited Liabili

Description

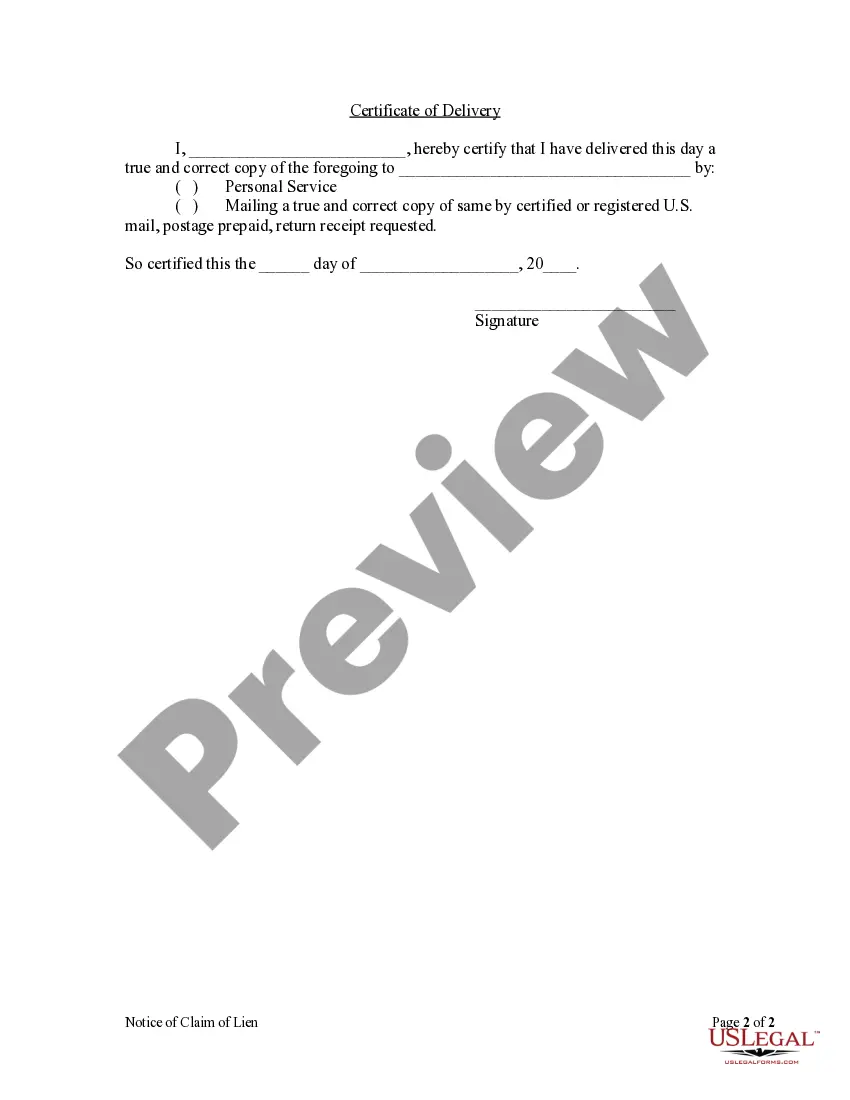

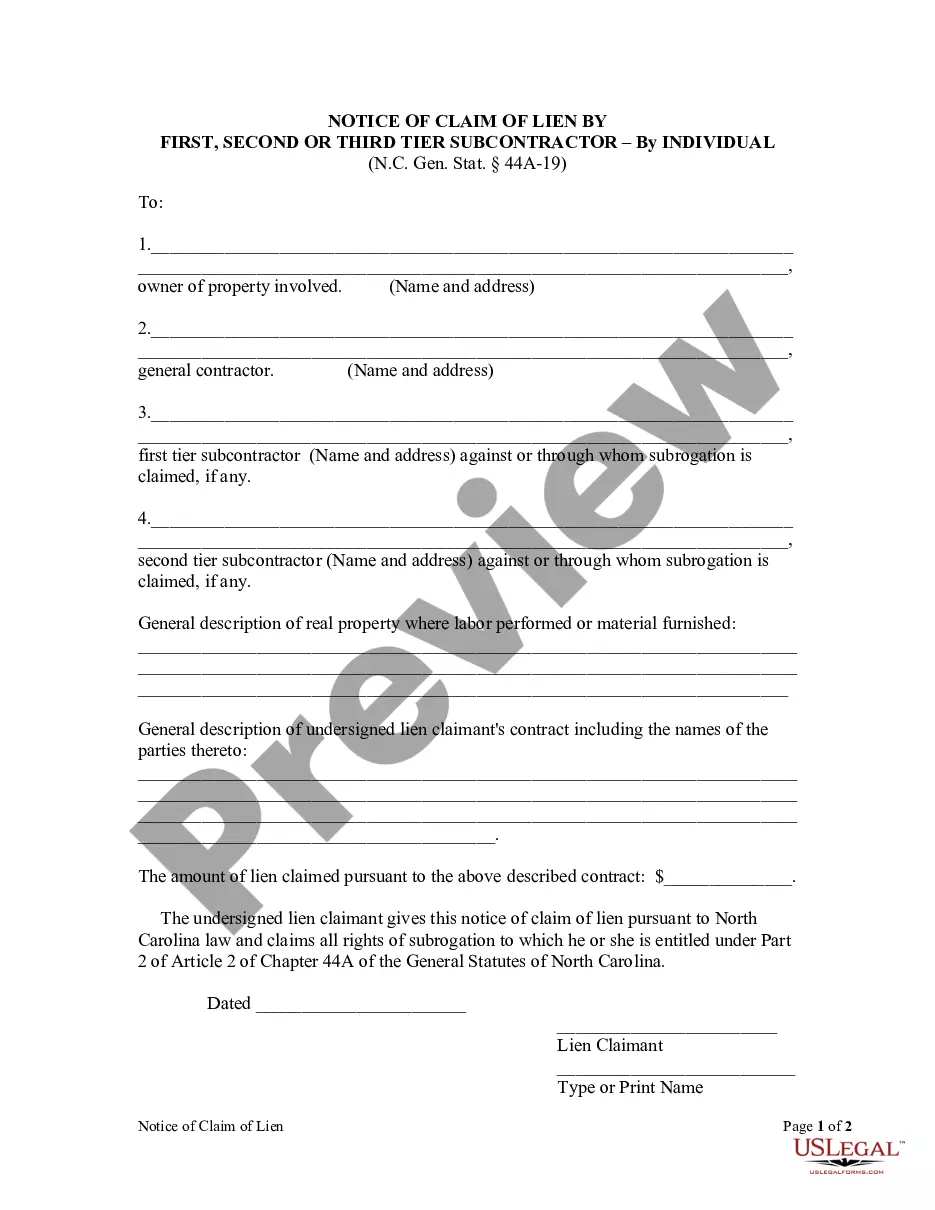

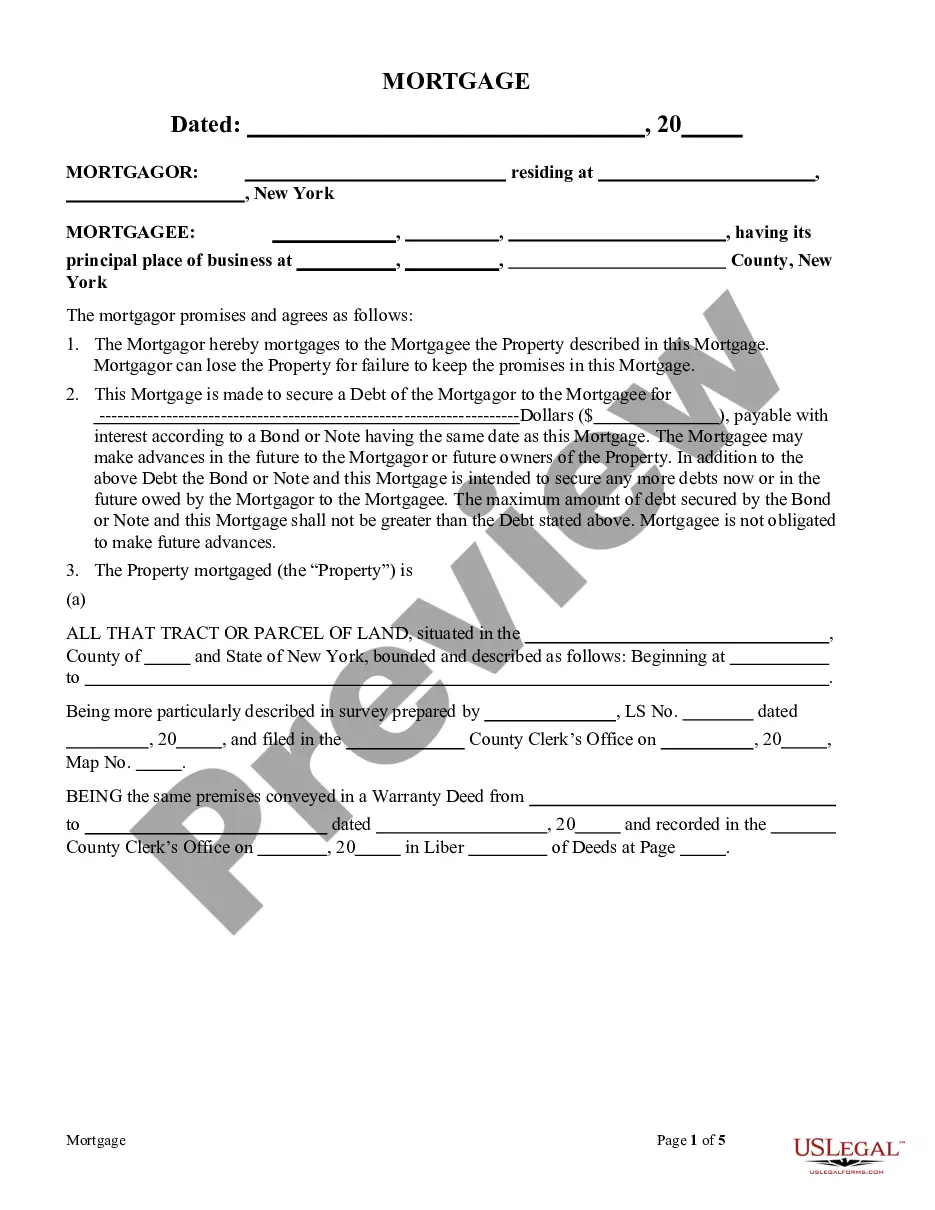

How to fill out North Carolina Notice Of Claim - More Remote Than 3rd Tier - Corporation?

- If you're a returning user, log in to your account and check your subscription status before proceeding to download the desired form.

- For new users, begin by browsing the extensive form library. Use the preview mode to verify the form's relevance to your needs.

- If necessary, utilize the Search feature to find alternate forms that might be more suitable.

- Once you locate the correct document, click the 'Buy Now' button to choose your preferred subscription plan and create an account.

- Next, complete your purchase by entering payment information through a credit card or your PayPal account.

- Finally, download the form to your device and access it anytime from the My Forms section of your profile.

By following these straightforward steps, you can not only access essential legal documents but also tap into premium expert assistance for form completion.

Start using US Legal Forms today to ensure your limited liabili documents are accurate and legally compliant!

Form popularity

FAQ

Starting a Limited Liability Corporation involves various costs, primarily the filing fees, which can range significantly by state. Additional expenses may include registration of your business name, obtaining licenses or permits, and possibly legal fees for consultations. You should also consider costs for annual maintenance, like filing yearly reports. Using services like UsLegalForms can help you anticipate these costs and manage your budget effectively.

To establish a Limited Liability Corporation, you need to select a catchy name and then file the Articles of Organization with your state's Secretary of State office. It’s essential to comply with specific naming regulations and provide key information about your business. After that step, you can draft an operating agreement to clarify ownership and management roles. Platforms like UsLegalForms can streamline this process and guide you through the necessary paperwork efficiently.

The limited liabilities of an LLC protect members' personal assets from business debts and liabilities. This means that if your LLC faces legal issues, creditors typically cannot claim personal property of the members. Furthermore, members enjoy flexibility in management and distribution of profits. Understanding these benefits is crucial, and US Legal Forms can provide resources to help you navigate the protections of limited liability.

Filling out an LLC requires you to complete the articles of organization and include essential details about your business. You should provide your business name, address, and the names of all members involved. Be sure to double-check for accuracy and completeness to avoid delays in processing. Utilizing US Legal Forms can streamline this process, providing templates and guidance tailored for your needs.

Creating a limited liability company, or LLC, involves drafting articles of organization that outline your business structure. You must include information such as your business name, address, and the names of the members. It is also essential to comply with your state’s specific requirements, which you can often find on your state’s government website. For assistance in this process, consider using US Legal Forms to ensure accuracy and adherence to regulations.

Yes, you can file your limited liabili business separately from your personal taxes if your LLC is structured appropriately. If your LLC has opted for corporate taxation, you will file a corporate tax return. To navigate these requirements smoothly, uslegalforms can assist you in understanding the best options for your specific situation.

member limited liabili company typically files taxes as a sole proprietorship, reflecting that you're the sole owner. You'll report your LLC's income or loss on your personal tax return, often using Schedule C. This process simplifies your tax reporting, ensuring you meet obligations while enjoying the protections of your LLC.

While a limited liabili company offers many benefits, it does have some drawbacks. One downside is the ongoing costs and administrative responsibilities associated with maintaining the LLC. Additionally, some states impose additional fees or taxes on LLCs that could affect your overall profit.

Failing to file taxes for your limited liabili business can result in serious consequences. The IRS may impose penalties, interest, and even legal action if you consistently neglect your filing requirements. Maintaining compliance is essential to enjoy the benefits of your LLC and avoid issues with tax authorities.

owner limited liabili company typically files taxes as a sole proprietorship. This means you report your business income and expenses on your personal tax return. You'll use IRS Schedule C for this purpose, simplifying the reporting process while ensuring you meet your tax obligations.