Form A Limited Liability Company With The Ability To Establish Series

Description

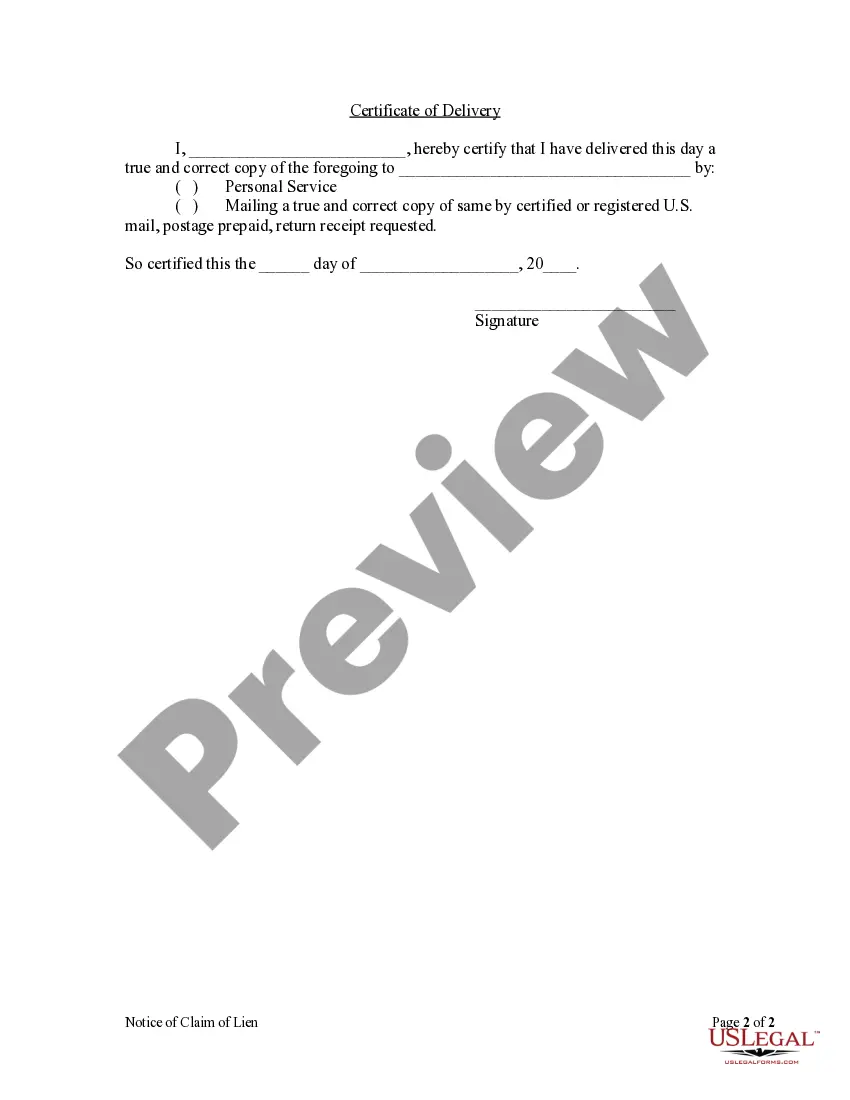

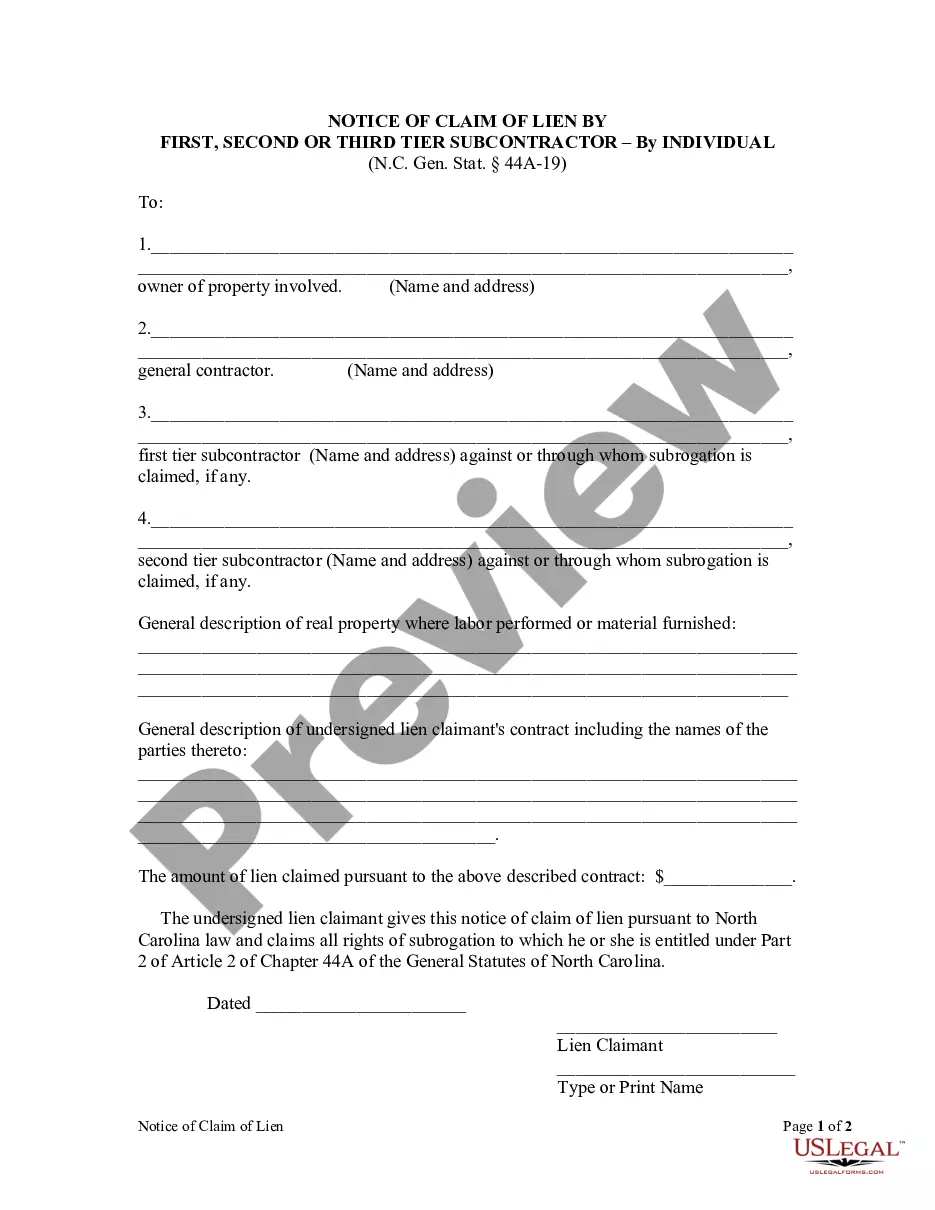

How to fill out North Carolina Notice Of Claim - More Remote Than 3rd Tier - Corporation?

- If you're an existing user, log in to your account and download the required form by clicking the Download button. Ensure your subscription is active; renew it if necessary.

- For first-time users, begin by looking at the Preview mode and detailed form description to confirm that it meets your local requirements.

- Should you find any discrepancies, utilize the Search feature above to find an appropriate template. Ensure it aligns with your needs before proceeding.

- Purchase the document by selecting the Buy Now button and opting for a subscription plan that suits you. You'll need to create an account to tap into the entire resource library.

- Complete your transaction by entering your credit card details or opting for PayPal for secure payment.

- Finally, download your form and save it on your device. Access it anytime through the My Forms section in your profile.

In conclusion, forming a limited liability company has never been more straightforward. The robust selection and expert support from US Legal Forms make it an invaluable resource for both new and seasoned entrepreneurs. Ready to take the next step?

Start your journey with US Legal Forms today!

Form popularity

FAQ

An LLC must file taxes regardless of its income level unless it qualifies for specific exemptions. If you form a limited liability company with the ability to establish series, you will need to file taxes for each series if it generates income. Clear record-keeping is crucial to ensure compliance and optimal tax strategy.

Multiple member LLCs typically file taxes as partnerships, unless they choose another tax status. Each member reports their share of the LLC's income and expenses on their personal tax returns. When you form a limited liability company with the ability to establish series, you can also opt to have each series taxed differently, adding further flexibility to your tax filings.

While a Series LLC offers numerous benefits, it also has downsides. One significant concern is the complexity of compliance, as each series must adhere to state regulations. Additionally, some states do not recognize series LLCs, which can limit your business operations if you operate in multiple jurisdictions after you form a limited liability company with the ability to establish series.

Absolutely, an LLC can establish a series. When you form a limited liability company with the ability to establish series, it allows you to create distinct divisions within the LLC, each with its own assets and liabilities. This structure not only offers liability protection but also provides operational flexibility, making it an attractive option for business owners.

Filing taxes for a Series LLC requires careful consideration of each series as a separate entity. Each series can have its own income and expenses, so it's vital to maintain accurate records. When you form a limited liability company with the ability to establish series, you can choose how each series will be taxed, whether as a disregarded entity or a partnership, which can optimize your taxation strategy.

Yes, you can change your LLC to a series LLC, but the process involves specific steps. First, you need to ensure that your state allows the formation of series LLCs. After forming a limited liability company with the ability to establish series, you can create series within it, offering personal liability protection and flexibility in operations.

You typically do not file LLC and personal taxes together. When you form a limited liability company with the ability to establish series, the LLC is treated as a separate entity for tax purposes. You will report income from the LLC on your personal tax return, but it remains distinct from your personal income. Therefore, understanding how to manage these filings is crucial for compliance.

Forming a limited liability company with the ability to establish series allows business owners to protect their assets more effectively. Each series can hold its own assets and liabilities, which means that risks associated with one series do not impact the others. This structure provides flexibility to manage different types of investments or business activities under one umbrella entity. Ultimately, it simplifies administration while enhancing liability protection, making it a valuable option for entrepreneurs.

An LLC with the ability to establish series, commonly referred to as a Series LLC, allows business owners to create multiple 'series' or subdivisions under a single LLC umbrella. Each series can have its own assets, liabilities, and members, which provides significant flexibility. This structure is beneficial for businesses that wish to separate different lines of business while still retaining the protections of a single LLC. Consider using platforms like US Legal Forms to simplify the formation process.

Yes, each series in a Series LLC typically requires its own Employer Identification Number (EIN) if it operates as a separate entity. This is crucial for managing finances, filing taxes, and ensuring proper compliance. When you form a limited liability company with the ability to establish series, each series can have individual financial and tax responsibilities. Always check with the IRS for the latest requirements regarding EINs for each series.