North Carolina Articles Of Incorporation With Secretary Of State

Description

Form popularity

FAQ

To find North Carolina articles of incorporation, you can visit the North Carolina Secretary of State's official website. The website provides a searchable database where you can locate documents related to business entities. Additionally, platforms like US Legal Forms can assist you in obtaining these legal documents easily and quickly. Being informed helps you stay compliant and organized with your business filings.

Yes, North Carolina has a Secretary of State who oversees various functions related to business filings. This includes managing the filing of North Carolina articles of incorporation with the Secretary of State. Their office helps entrepreneurs and business owners ensure compliance with state laws. You can reach out to them for assistance and guidance on starting your business in North Carolina.

In North Carolina, specific businesses may require a state business license, depending on their industry. It’s essential to research your particular business type to ensure compliance with state regulations. Some businesses might also need local permits. Always verify the requirements with the North Carolina Secretary of State to avoid potential legal issues.

In North Carolina, you do not need to formally register a sole proprietorship unless you choose to operate under a different business name. In that case, you must file for a Certificate of Assumed Name. This step is crucial for compliance and helps protect your brand in the marketplace.

The main disadvantage of being a sole proprietor is the exposure to personal liability. This means that your personal assets could be at risk in the event of business debts or legal issues. Unlike an LLC, a sole proprietorship does not provide a clear separation between personal and business finances. Therefore, many consider forming an LLC for better protection.

In North Carolina, a sole proprietor typically does not need to register with the Secretary of State if they operate under their own name. However, if you choose to use a business name that differs from your personal name, you must file for a Certificate of Assumed Name. This requirement helps maintain transparency and ensures your business operates legally.

You can contact the North Carolina Secretary of State's office through their official website, where you’ll find various contact methods. They offer a phone number and an email address for inquiries. Additionally, you can visit their office in person if you need direct assistance. This ensures you get the information you need regarding North Carolina articles of incorporation with Secretary of State.

The primary difference between a sole proprietorship and an LLC in North Carolina lies in liability protection and taxation. A sole proprietorship does not provide personal liability protection, meaning your personal assets are at risk. In contrast, an LLC separates your personal and business liabilities, protecting your personal assets while offering flexibility in taxation.

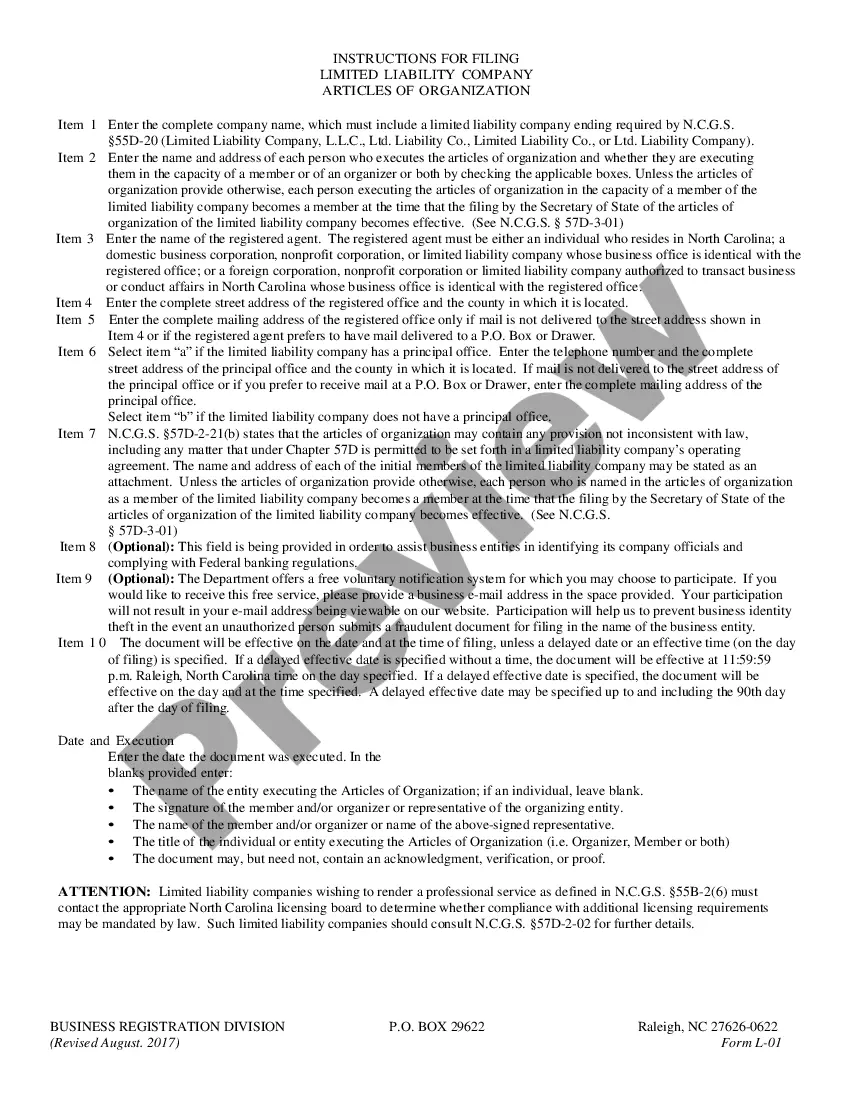

To obtain a copy of your articles of organization in North Carolina, visit the North Carolina Secretary of State's website. You can request a copy online or by mail. Typically, you will need to provide your business name and details to complete the request. This process ensures you have the necessary documentation to manage your business efficiently.

While North Carolina does not legally require an operating agreement for an LLC, it is highly recommended. An operating agreement outlines the management structure and operating procedures of your LLC, providing clarity for members. Having this document can also help when filing North Carolina articles of incorporation with the secretary of state, as it showcases the professionalism and preparedness of your business. Consider using uslegalforms to easily create an operating agreement that meets your needs.