Articles Of Incorporation For Nc

Description

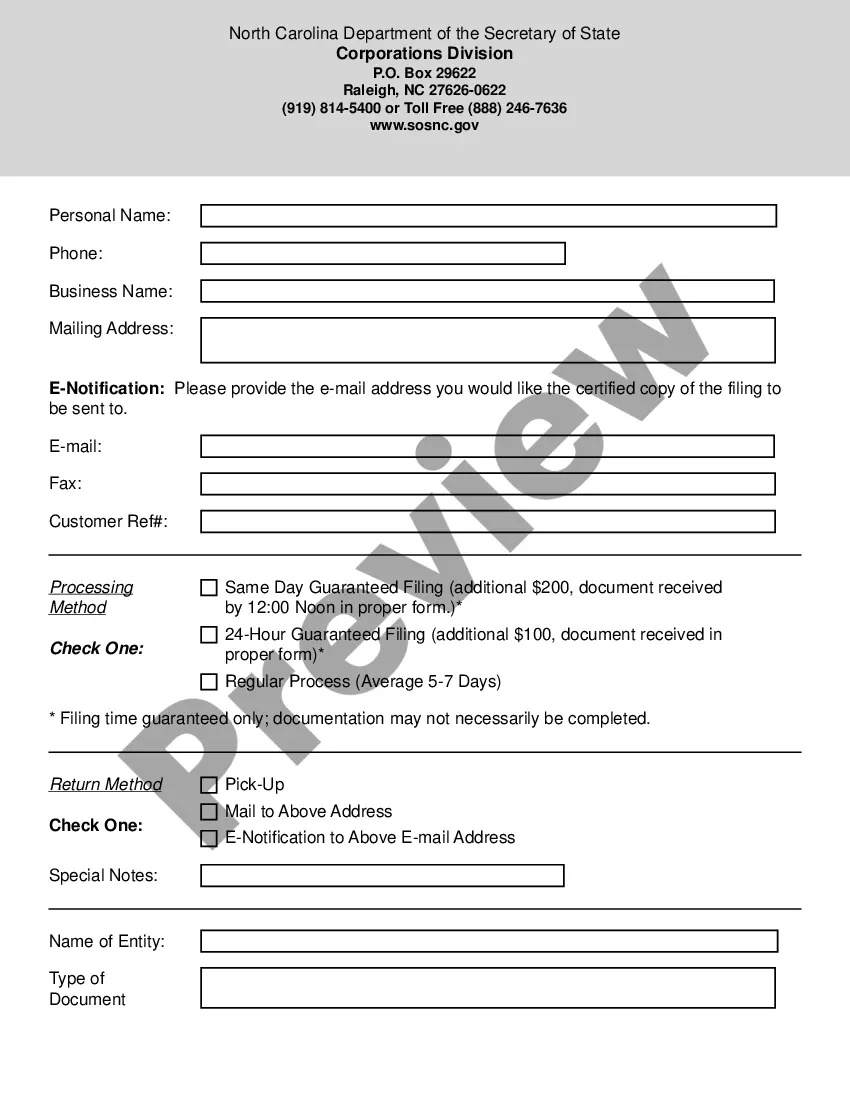

How to fill out North Carolina Articles Of Incorporation For Domestic For-Profit Corporation?

Whether for commercial reasons or for personal matters, everyone eventually needs to handle legal issues at some point in their life.

Filling out legal documents demands meticulous care, starting with selecting the right form template.

After downloading, you can fill out the form using editing software or print it to complete it by hand. With an extensive US Legal Forms catalog available, you will never need to waste time searching for the correct template online. Take advantage of the library’s straightforward navigation to find the right template for any occasion.

- Obtain the template you require by using the search box or browsing the catalog.

- Review the form’s details to ensure it aligns with your situation, state, and county.

- Click on the form’s preview to examine it.

- If it is not the correct form, return to the search tool to find the Articles Of Incorporation For Nc template you need.

- Download the document if it satisfies your criteria.

- If you possess a US Legal Forms account, simply click Log in to access files you have saved in My documents.

- If you have not yet created an account, you can download the form by clicking Buy now.

- Select the appropriate pricing option.

- Complete the registration form for your profile.

- Choose your payment method: you can use a credit card or PayPal.

- Select the desired file format and download the Articles Of Incorporation For Nc.

Form popularity

FAQ

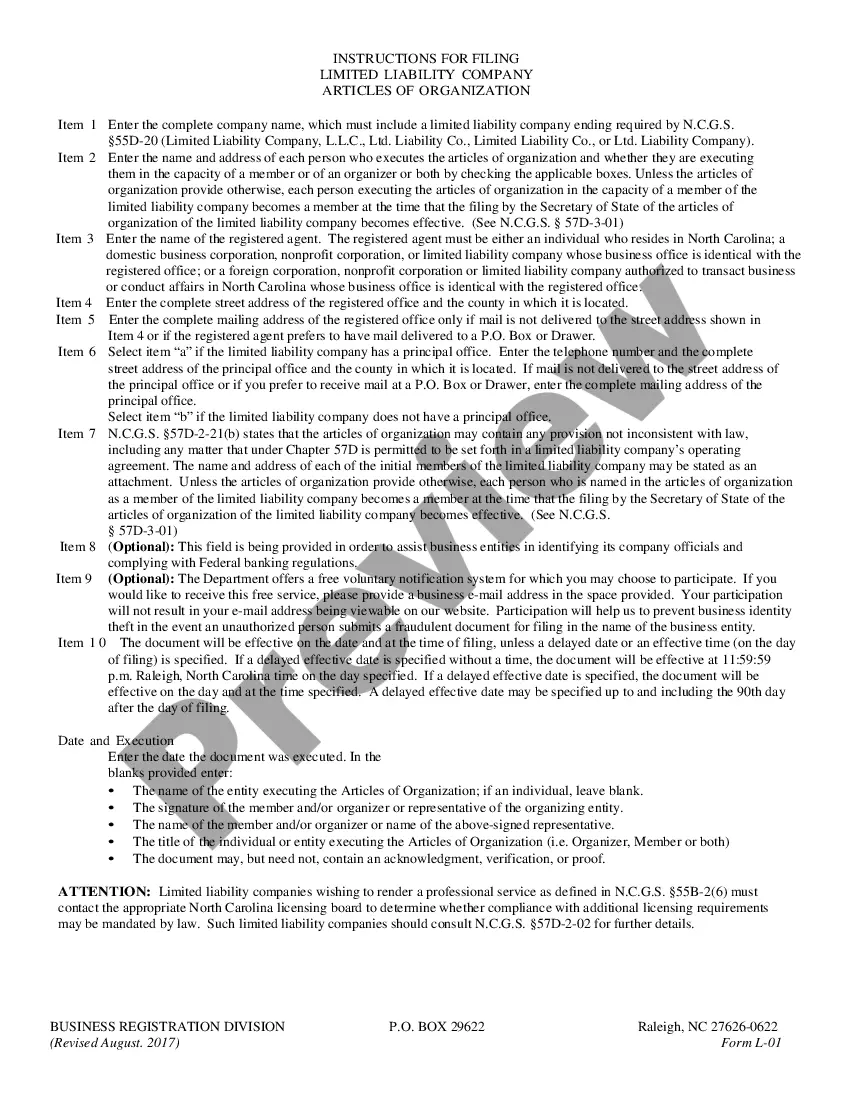

To find your NC Articles of Incorporation, visit the North Carolina Secretary of State's website and navigate to the business entity search tool. By entering your business name or ID, you can access a copy of your filed Articles of Incorporation for NC. This helps confirm your business's legal status and ensures all information is up to date. US Legal Forms can assist you in retrieving or verifying your documents.

You must electronically file this Appearance and Answer using EDMS at unless you obtain from the court an exemption from electronic filing requirements.

The veteran must own and occupy the property as a homestead on July 1 of each year, declare residency in Iowa for income tax purposes and occupy the property for at least six months each year. Persons in the military or nursing homes who do not occupy the home are also eligible.

Iowa DVA State Benefits Injured Veterans Grant. ... Homeownership Assistance. ... Property Tax Exemption. ... Disabled Veteran's Homestead Tax Credit. ... Iowa Military Retirement Tax Exemption. ... Iowa Drivers Licenses and IDs - Veterans Designation. ... Lifetime Hunting and Fishing License. ... License Plates.

In Iowa, you have to file an action against the other party to seek enforcement of the existing court decree order. The enforcement action is formally known as an Application for Rule to Show Cause, commonly referred to as a contempt filing. This filing brings the opposing party's bad acts to the court's attention.

Iowa Disabled Veteran's Homestead Tax Credit:Iowa offers a 100% property tax credit for homesteads owned by eligible Veterans and the Surviving Spouse of an eligible Veteran.

Iowa State Taxes on U.S. Department of Veterans Affairs Disability Dependency and Indemnity Compensation: Dependency and Indemnity Compensation (DIC) is a tax-free monetary benefit paid to eligible survivors of military service members who died in the line of duty or eligible survivors of Veterans whose death resulted ...

Iowans age 65 or older are eligible for a property tax exemption worth $3,250 for the assessment year beginning Jan. 1, 2023. In subsequent years, the exemption doubles to $6,500. Exemptions are a reduction in the taxable value of the property, not a direct reduction of how much property taxes a homeowner pays.

Iowa Disabled Veteran's Homestead Tax Credit:Iowa offers a 100% property tax credit for homesteads owned by eligible Veterans and the Surviving Spouse of an eligible Veteran.