North Carolina Bylaws Withholding Registration

Description

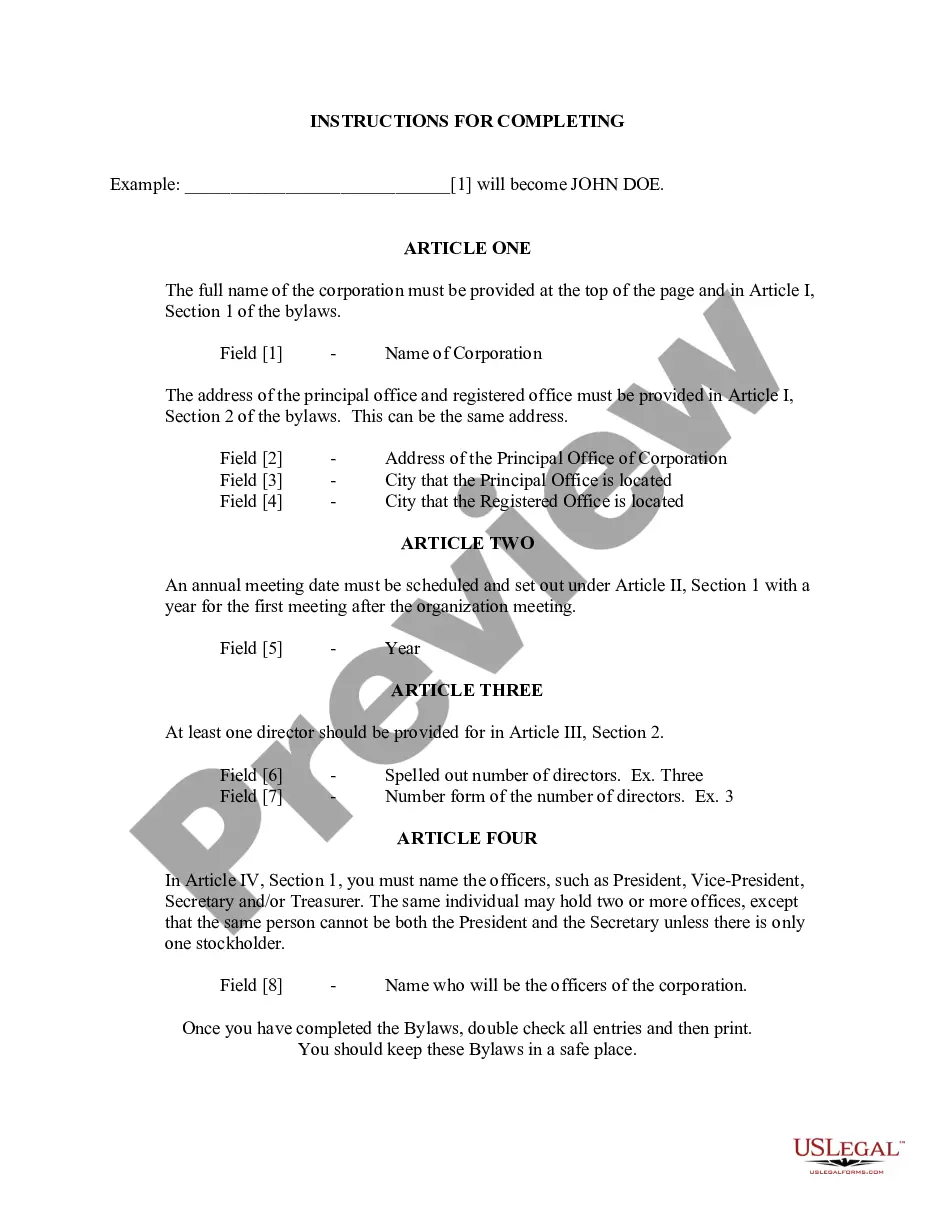

How to fill out North Carolina Bylaws For Corporation?

It’s no secret that you can’t become a legal professional immediately, nor can you learn how to quickly draft North Carolina Bylaws Withholding Registration without the need of a specialized background. Creating legal forms is a long venture requiring a specific education and skills. So why not leave the preparation of the North Carolina Bylaws Withholding Registration to the specialists?

With US Legal Forms, one of the most extensive legal template libraries, you can find anything from court papers to templates for in-office communication. We know how important compliance and adherence to federal and local laws are. That’s why, on our platform, all templates are location specific and up to date.

Here’s how you can get started with our platform and get the form you need in mere minutes:

- Find the document you need with the search bar at the top of the page.

- Preview it (if this option provided) and read the supporting description to figure out whether North Carolina Bylaws Withholding Registration is what you’re searching for.

- Start your search over if you need a different form.

- Register for a free account and select a subscription plan to buy the template.

- Choose Buy now. As soon as the transaction is through, you can download the North Carolina Bylaws Withholding Registration, fill it out, print it, and send or mail it to the necessary people or entities.

You can re-access your documents from the My Forms tab at any time. If you’re an existing client, you can simply log in, and find and download the template from the same tab.

No matter the purpose of your paperwork-whether it’s financial and legal, or personal-our platform has you covered. Try US Legal Forms now!

Form popularity

FAQ

North Carolina Median Household Income Every taxpayer in North Carolina will pay 4.99% of their taxable income for state taxes.

You can submit Form NC-BR electronically or you can mail it to: NC Department of Revenue, Post Office Box 25000, Raleigh, NC 27640. After your application is processed, your NC withholding tax account number will be mailed to you.

If your withholding allowances decrease, you must file a new NC-4 with your employer within 10 days after the change occurs. Exception: When an individual ceases to be head of household after maintaining the household for the major portion of the year, a new NC-4 is not required until the next year.

FORM NC-4 EZ - You may use Form NC4-EZ if you plan to claim either the N.C. Standard Deduction or the N.C. Child Deduction Amount (but no other N.C. deductions), and you do not plan to claim any N.C. tax credits. FORM NC-4 NRA - If you are a nonresident alien you must use Form NC-4 NRA.

Complete a new Form W-4, Employee's Withholding Allowance Certificate, and submit it to your employer. Complete a new Form W-4P, Withholding Certificate for Pension or Annuity Payments, and submit it to your payer. Make an additional or estimated tax payment to the IRS before the end of the year.