North Carolina Bylaws With Secretary Of State

Description

How to fill out North Carolina Bylaws For Corporation?

Dealing with legal paperwork and procedures might be a time-consuming addition to your entire day. North Carolina Bylaws With Secretary Of State and forms like it typically require you to search for them and understand the way to complete them correctly. For that reason, if you are taking care of financial, legal, or individual matters, having a extensive and hassle-free web library of forms when you need it will go a long way.

US Legal Forms is the best web platform of legal templates, boasting over 85,000 state-specific forms and numerous resources to help you complete your paperwork easily. Discover the library of appropriate documents open to you with just one click.

US Legal Forms provides you with state- and county-specific forms offered by any moment for downloading. Protect your papers management processes by using a high quality service that lets you prepare any form within a few minutes with no extra or hidden cost. Just log in to your account, locate North Carolina Bylaws With Secretary Of State and acquire it straight away in the My Forms tab. You can also access formerly downloaded forms.

Is it the first time utilizing US Legal Forms? Register and set up an account in a few minutes and you’ll have access to the form library and North Carolina Bylaws With Secretary Of State. Then, stick to the steps below to complete your form:

- Ensure you have the correct form by using the Review option and reading the form description.

- Select Buy Now once all set, and select the monthly subscription plan that is right for you.

- Press Download then complete, sign, and print the form.

US Legal Forms has twenty five years of experience assisting users manage their legal paperwork. Get the form you require today and enhance any process without having to break a sweat.

Form popularity

FAQ

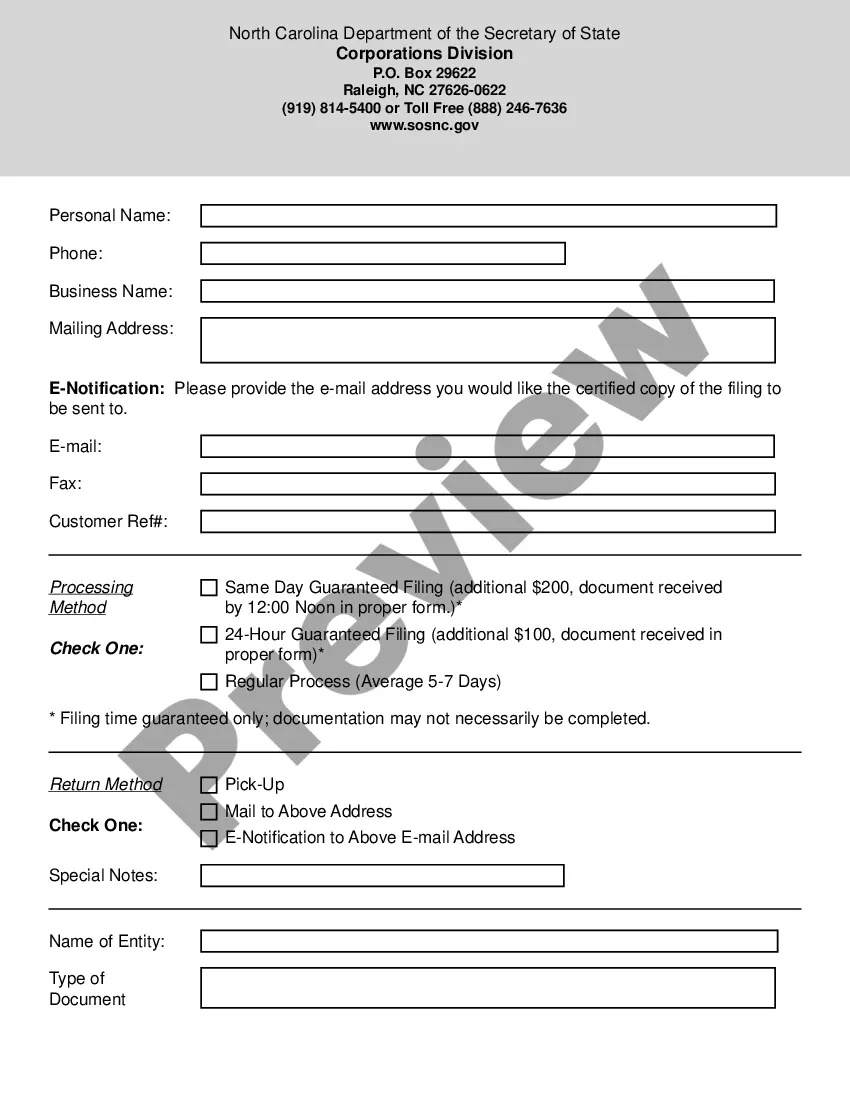

The Articles of Incorporation signed by the incorporator(s) must be submitted to the N.C. Department of the Secretary of State by mail or in person, along with a check, money order, or cash for the $125 filing fee required by law.

There are three ways you can submit your document. Online through our PDF Upload Portal. Mail. Type of Document. ... You may deliver your documents directly to us in person between a.m. and p.m. Monday through Friday excluding weekends and State holidays. ... *Make checks payable to "NC Secretary of State".

Corporate bylaws are guidelines for the way you'll structure and run your corporation. Bylaws are required in most states. Even when they're not required, bylaws are useful because they avoid uncertainty and ensure you're complying with legal formalities.

Mailing Documents Type of DocumentMailing AddressAnnual ReportPO Box 29525, Raleigh, NC 27626-0525Any other type of documentPO Box 29622, Raleigh, NC 27626-0622

Corporate bylaws are legally required in North Carolina. North Carolina law requires the incorporators or board of directors of a corporation to adopt initial bylaws?per NC Gen. Stat. § 55-2-06.