North Carolina Corporation With The Most Employees

Description

How to fill out North Carolina Business Incorporation Package To Incorporate Corporation?

Creating legal documents from the ground up can occasionally be rather daunting.

Certain situations may require extensive research and significant financial investment.

If you’re seeking a simpler and more economical method of generating North Carolina Corporation With The Most Employees or any other paperwork without undergoing unnecessary complications, US Legal Forms is consistently accessible for you.

Our online resource of over 85,000 current legal documents encompasses nearly every facet of your financial, legal, and personal matters.

However, before you proceed to download the North Carolina Corporation With The Most Employees, consider these suggestions: Check the form preview and descriptions to confirm that you are on the document you need. Ensure the template you select meets the criteria of your state and county. Opt for the appropriate subscription plan to purchase the North Carolina Corporation With The Most Employees. Download the form, then complete, sign, and print it out. US Legal Forms prides itself on a flawless reputation and over 25 years of experience. Join us today and simplify your form completion process!

- With just a few clicks, you can swiftly acquire state- and county-specific templates meticulously crafted for you by our legal experts.

- Utilize our website whenever you require trusted and dependable services to effortlessly locate and download the North Carolina Corporation With The Most Employees.

- If you’re familiar with our services and have previously registered an account with us, simply Log In to your account, select the form and download it instantly or retrieve it at any later time in the My documents section.

- Not registered yet? No worries. Setting it up and exploring the library requires minimal time.

Form popularity

FAQ

FORM NC-4 EZ - You may use Form NC4-EZ if you plan to claim either the N.C. Standard Deduction or the N.C. Child Deduction Amount (but no other N.C. deductions), and you do not plan to claim any N.C. tax credits. FORM NC-4 NRA - If you are a nonresident alien you must use Form NC-4 NRA.

Yes. The amount you withhold is deemed by law to be held in trust by you for the State of North Carolina. If you fail to withhold the proper amount of income taxes or pay the amount withheld to the Secretary you are liable for the amount of tax not withheld or not paid.

What is the difference between the NC-4EZ and the NC-4? A2. The NC-4EZ is a new, simplified form which should suffice for most taxpayers. The NC-4 is the complete form which may result in a more accurate withholding amount, but requires historical tax information and will involve estimates.

An individual can claim two allowances if they are single and have more than one job, or are married and are filing taxes separately. Usually, those who are married and have either one child or more claim three allowances.

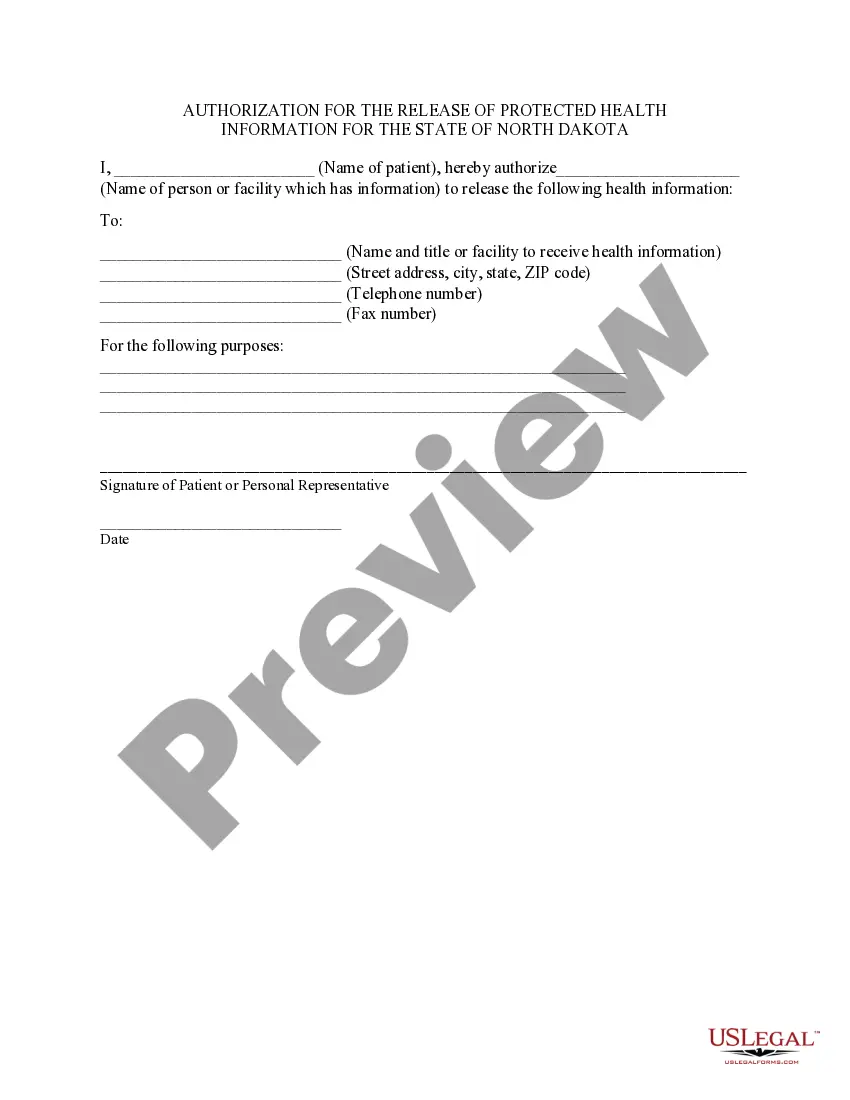

Forming an S corporation is straightforward. First, you start a business as a corporation by filing articles of incorporation with the Corporations Division of the North Carolina Secretary of State's Office. Next, to elect S corporation status, all shareholders in your company must sign and file Form 2553 with the IRS.