North Carolina Deed Of Trust Statute

Description

How to fill out North Carolina Deed Of Trust Statute?

Maneuvering through the red tape of official paperwork and templates can be challenging, particularly when one is not engaged in that field professionally.

Even locating the appropriate template for a North Carolina Deed Of Trust Statute will be labor-intensive, as it needs to be accurate and valid down to the last detail.

However, you will require significantly less time selecting a suitable template from a trusted resource.

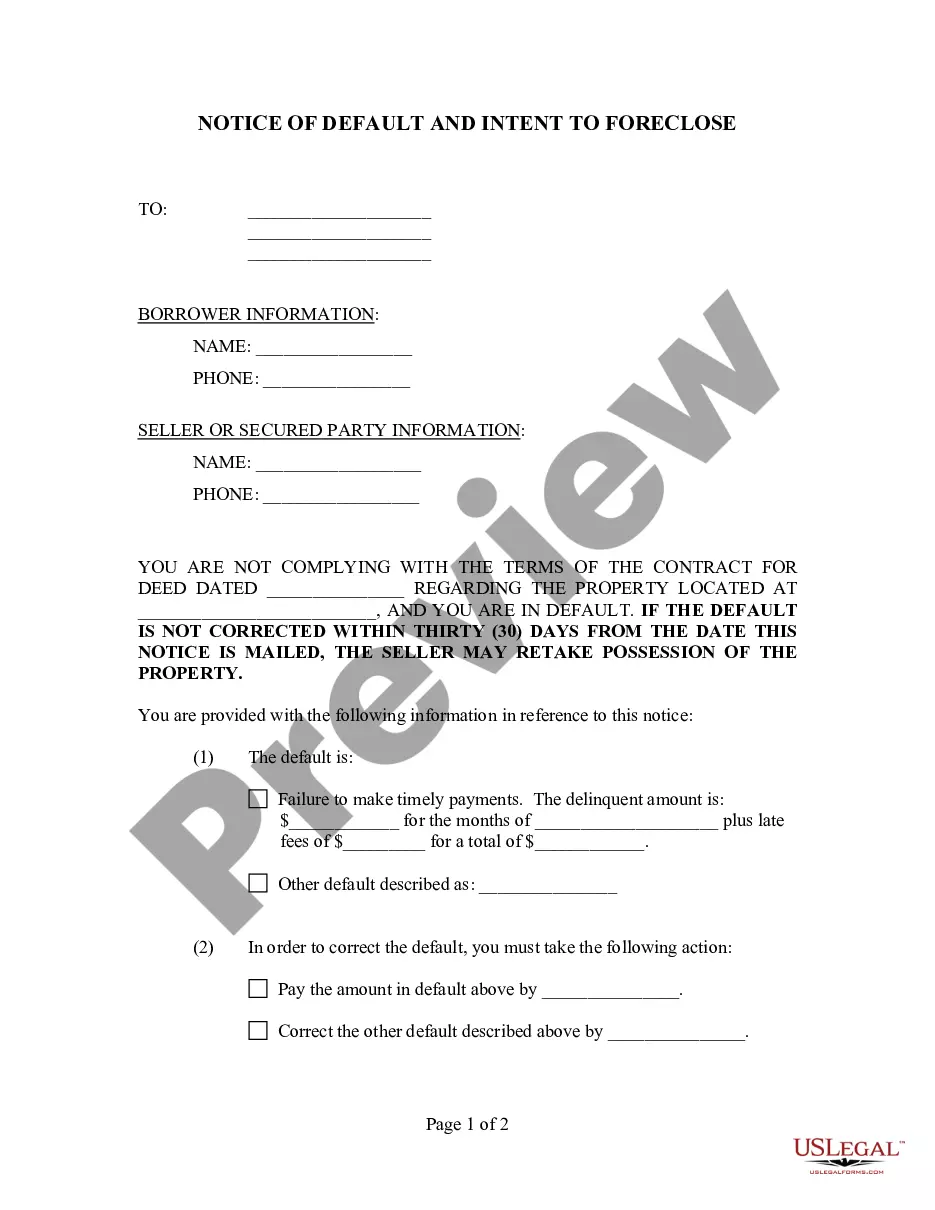

Obtain the right form in a few simple steps: Enter the title of the document in the search bar; Find the correct North Carolina Deed Of Trust Statute from the results; Review the sample's description or view its preview; Once the template aligns with your needs, click Buy Now; Proceed to select your subscription plan; Use your email and set a security password to register an account at US Legal Forms; Choose either a credit card or PayPal payment method; Save the template file on your device in your preferred format. US Legal Forms can save you a significant amount of time verifying whether the form you discovered online is appropriate for your requirements. Create an account and gain unlimited access to all the templates you need.

- US Legal Forms is a platform that streamlines the process of locating the right forms online.

- US Legal Forms serves as a singular destination for obtaining the latest document samples, understanding their uses, and downloading these files for completion.

- It is a repository containing over 85K forms applicable across various industries.

- When searching for a North Carolina Deed Of Trust Statute, you will not have to doubt its authenticity because all forms are verified.

- Creating an account at US Legal Forms ensures you have all essential samples within your reach.

- You can keep them in your history or add them to the My documents collection.

- Your saved forms can be accessed from any device by selecting Log In on the library’s website.

- If you do not possess an account yet, you can always start a new search for the template you require.

Form popularity

FAQ

In North Carolina, a deed does not have to be recorded to be valid between the parties involved. However, according to the North Carolina deed of trust statute, failing to record the deed may affect its enforceability against third parties. Recording provides public notice of ownership and protects your rights. Therefore, it is advisable to record your deed promptly for enhanced security.

To record a deed in North Carolina, you must first prepare the necessary documents as outlined in the North Carolina deed of trust statute. Next, you will need to submit the deed to your local Register of Deeds, along with any applicable fees and potential tax declarations. It's crucial to ensure that your deed complies with all legal requirements to avoid delays. For a smoother process, consider using resources from US Legal Forms.

Recording a deed in North Carolina typically takes a few days, but it can vary depending on the county. The North Carolina deed of trust statute requires timely recording to ensure the validity of the deed against third parties. Once submitted, your local Register of Deeds will process the deed, which can generally be expedited with proper documentation. If you need assistance, platforms like US Legal Forms can guide you through recording efficiently.

Yes, North Carolina does use a deed of trust as a common method for securing loans on real estate. In fact, the North Carolina deed of trust statute outlines the specific terms and conditions regarding these agreements. This tool allows lenders to secure their interests in properties, while borrowers can access essential financing. Understanding this statute is key to navigating property transactions in NC.

In North Carolina, the statute of limitations on a deed of trust generally allows a lender to enforce the deed within ten years after the last payment due date. After this period, the lender may lose the right to seek repayment through foreclosure. It's important to familiarize yourself with the North Carolina deed of trust statute to ensure you understand your rights and obligations.

In North Carolina, a title refers to the legal right to own or use a property, while a deed is the document that transfers that ownership. The deed records the change in ownership and provides a legal description of the property. Both terms are crucial in understanding the North Carolina deed of trust statute, which governs property transactions.

Yes, North Carolina is a deed state, meaning the use of deeds, particularly deeds of trust, is standard in property transactions. This structure provides an effective mechanism for securing loans and clarifying ownership. Understanding the North Carolina deed of trust statute is essential for anyone looking to buy property in the state.

In North Carolina, a deed can be prepared by a licensed attorney or an individual with knowledge of real estate transactions. However, professional assistance is often recommended to ensure clarity and compliance with the North Carolina deed of trust statute. Using a reputable platform like USLegalForms can also guide you in preparing legal documents correctly.

The Register of Deeds in North Carolina is a county office responsible for recording and maintaining property records, including deeds, mortgages, and other legal documents. This office ensures that property transactions are documented according to the North Carolina deed of trust statute. By visiting your local Register of Deeds, you can gain valuable insights into property ownership.

You can look up property deeds in North Carolina by accessing the local Register of Deeds office either in person or online. Many counties offer digital databases that you can search using the property owner's details or the property address. Familiarity with the North Carolina deed of trust statute will also help you understand the implications of the deeds you find.