North Carolina Deed In Lieu Of Foreclosure

Description

How to fill out North Carolina Deed In Lieu Of Foreclosure?

Regardless of whether you handle documentation frequently or occasionally need to send a legal file, it's vital to have a reliable resource that offers all the relevant and current samples.

The first step with a North Carolina Deed In Lieu Of Foreclosure is to confirm that you have the latest version, as this determines its eligibility for submission.

For a streamlined search of the most recent document templates, look for them on US Legal Forms.

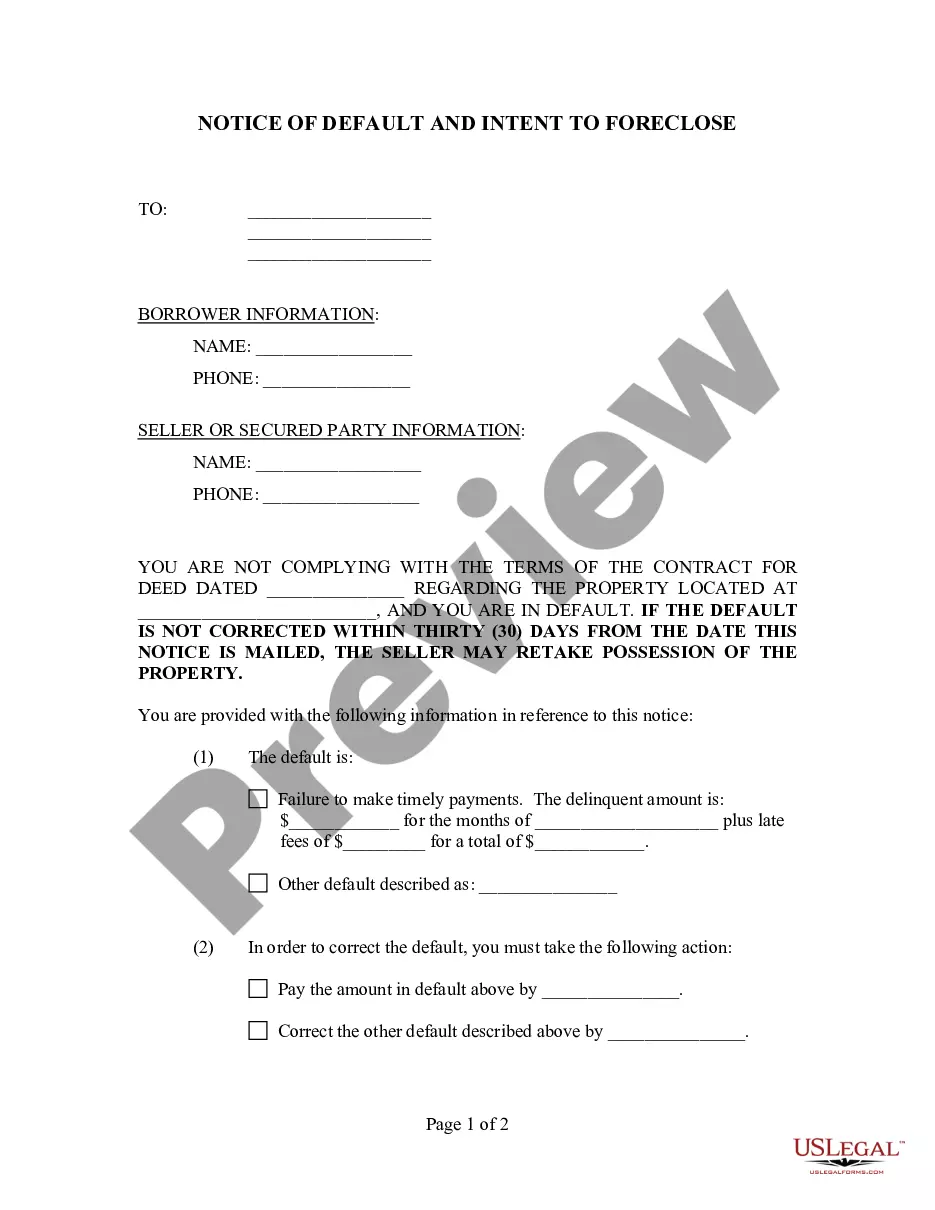

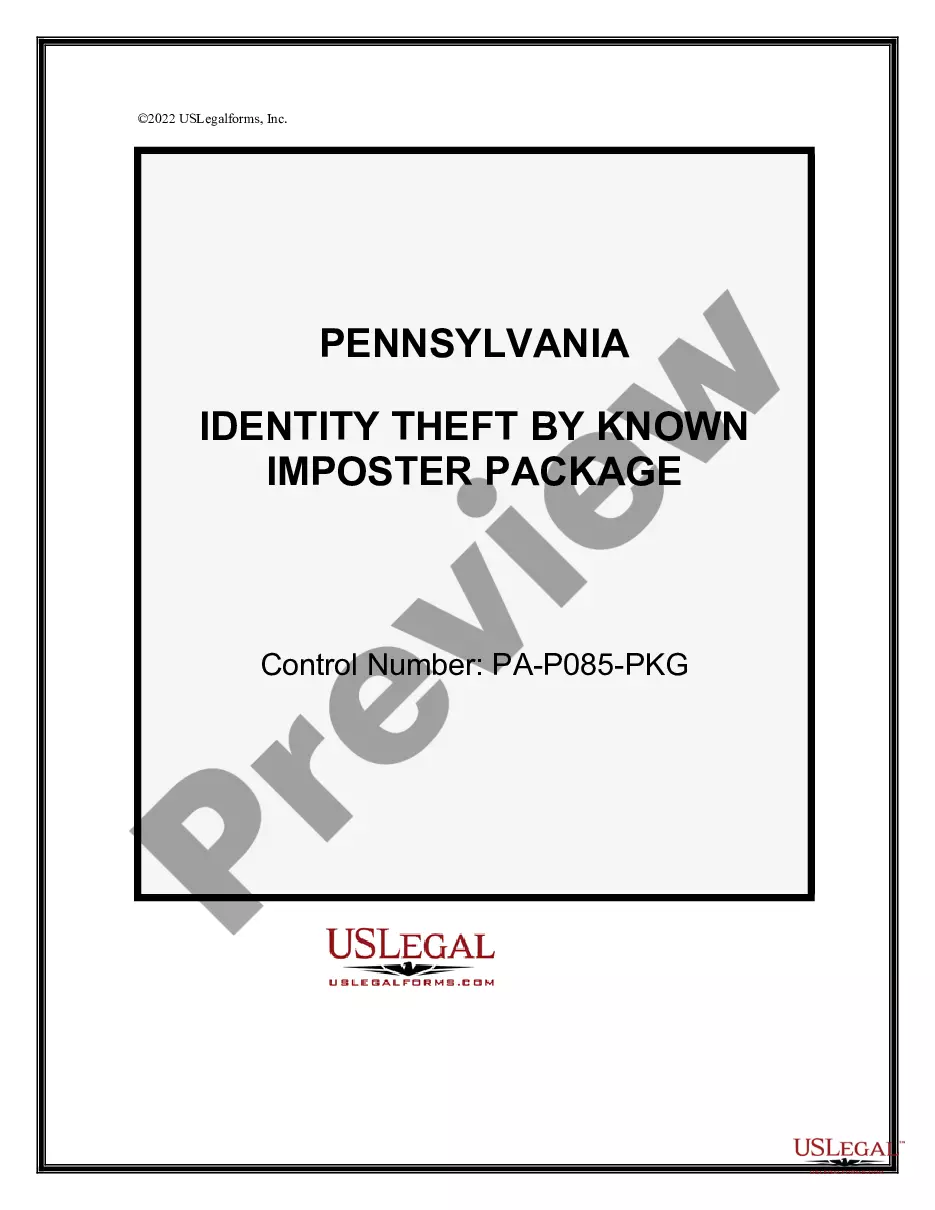

To obtain a form without an account, follow these steps: Use the search menu to locate the form you need. Review the North Carolina Deed In Lieu Of Foreclosure preview and description to confirm it is the exact document you are looking for. After verifying the form, click Buy Now. Choose a subscription plan that suits you. Create a new account or Log Into your existing one. Complete the purchase using your credit card information or PayPal account. Select the download file format and confirm it. Say goodbye to the confusion of managing legal documents. Once you have an account at US Legal Forms, all your templates will be organized and verified.

- US Legal Forms is a comprehensive collection of legal documents featuring nearly every type of sample you may require.

- Search for the templates you need, assess their appropriateness immediately, and learn more about their applications.

- With US Legal Forms, you can access over 85,000 templates across various sectors.

- Retrieve the North Carolina Deed In Lieu Of Foreclosure samples within a few clicks and save them at any time in your account.

- A US Legal Forms account grants you convenient access to all the templates you need, reducing effort and complications.

- Simply click Log In in the header of the website and navigate to the My documents section to find all the necessary forms, eliminating the need to spend time searching for the correct template or verifying its authenticity.

Form popularity

FAQ

There are several disadvantages to a North Carolina deed in lieu of foreclosure. First, homeowners may struggle with the stigma attached to the deed and the potential for credit score impacts. Additionally, once you transfer the deed, you lose all ownership rights and may not be eligible for further financial assistance from the lender. Understanding these potential drawbacks is essential, and resources like US Legal Forms can help clarify your rights and options.

A North Carolina deed in lieu of foreclosure can be seen as a less damaging option compared to traditional foreclosure methods. While it does impact your credit score, it typically results in a smoother process and less emotional distress than a protracted foreclosure. It is important to remember that while it alleviates some immediate financial burdens, it still carries consequences, such as being recorded on your credit report.

The most likely disadvantage for a lender accepting a North Carolina deed in lieu of foreclosure is the risk of unencumbered or unknown issues with the property. This can include hidden repair costs or the potential for existing liens that could complicate the process. These unexpected challenges can lead to financial losses for the lender, as they may need to invest more than initially anticipated to make the property marketable.

A North Carolina deed in lieu of foreclosure can negatively impact your credit score, but typically not as much as a foreclosure. Generally speaking, a deed in lieu can drop your score by around 85 to 150 points, depending on your overall financial profile. The impact may be more significant for someone with a higher credit score initially. However, with responsible financial behavior after the deed in lieu, you can begin to rebuild your credit over time.

Lenders often prefer a North Carolina deed in lieu of foreclosure because it typically takes less time and effort than a full foreclosure process. The deed in lieu allows the lender to avoid lengthy court proceedings and associated costs. Moreover, accepting a deed in lieu often results in a quicker possession of the property, enabling the lender to start the resale process sooner, and ultimately reducing losses.

The North Carolina deed in lieu of foreclosure can have some disadvantages for homeowners. First, it may negatively impact your credit score, similar to a foreclosure. Second, it may continue to leave you responsible for any remaining debt on your mortgage if the property's sale does not cover it. Lastly, you may lose any opportunity to reclaim your home through the foreclosure process.

In North Carolina, while it is not strictly required for an attorney to prepare a deed, it is highly recommended. An attorney can ensure that the deed complies with state laws and contains all necessary information. If you're considering a North Carolina deed in lieu of foreclosure, consulting an attorney can help safeguard your rights and facilitate the process.

One notable disadvantage of a deed in lieu of foreclosure is that it may negatively impact your credit score. While it avoids the lengthy foreclosure process, the deed in lieu still shows up on your credit report, which may affect future borrowing ability. It's essential to weigh this against your options should you consider a North Carolina deed in lieu of foreclosure.

The timeline to finalize a deed in lieu of foreclosure can vary, often taking several weeks to complete. This period usually includes negotiations with the lender and the processing of the necessary paperwork. It's advisable to stay in communication with your lender and seek guidance on the North Carolina deed in lieu of foreclosure process for a smoother experience.

Writing a deed in lieu of foreclosure letter involves clearly stating your intention to surrender the property to the lender. Include details like your name, the property's address, and a statement of your financial difficulties. Be sure to mention the North Carolina deed in lieu of foreclosure to make your intent clear, or consider templates available on platforms like US Legal Forms for assistance.