Notice Beneficiaries Form With Decimals

Description

How to fill out Notice Beneficiaries Form With Decimals?

Properly written official documents are crucial for preventing issues and legal disputes, but obtaining them without the assistance of an attorney may require time.

Whether you're in search of an updated Notice Beneficiaries Form With Decimals or other templates for work, family, or business situations, US Legal Forms is always available to assist.

The process is even more straightforward for current subscribers of the US Legal Forms library. If your subscription is active, you simply need to Log In to your account and click the Download button next to the desired document. Additionally, you can access the Notice Beneficiaries Form With Decimals at any time in the future, as all documents previously obtained on the platform are available in the My documents section of your profile. Save time and money on official document preparation. Try US Legal Forms today!

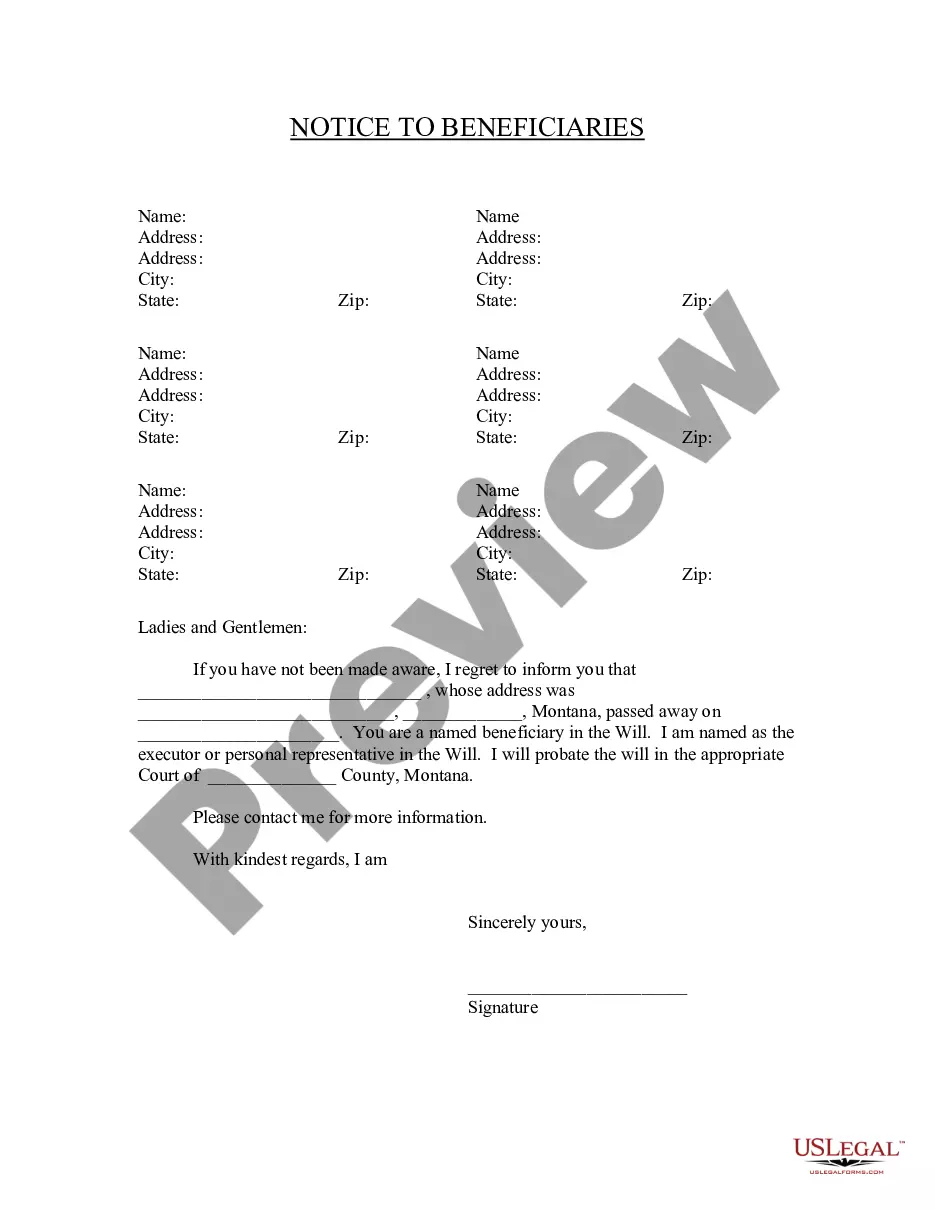

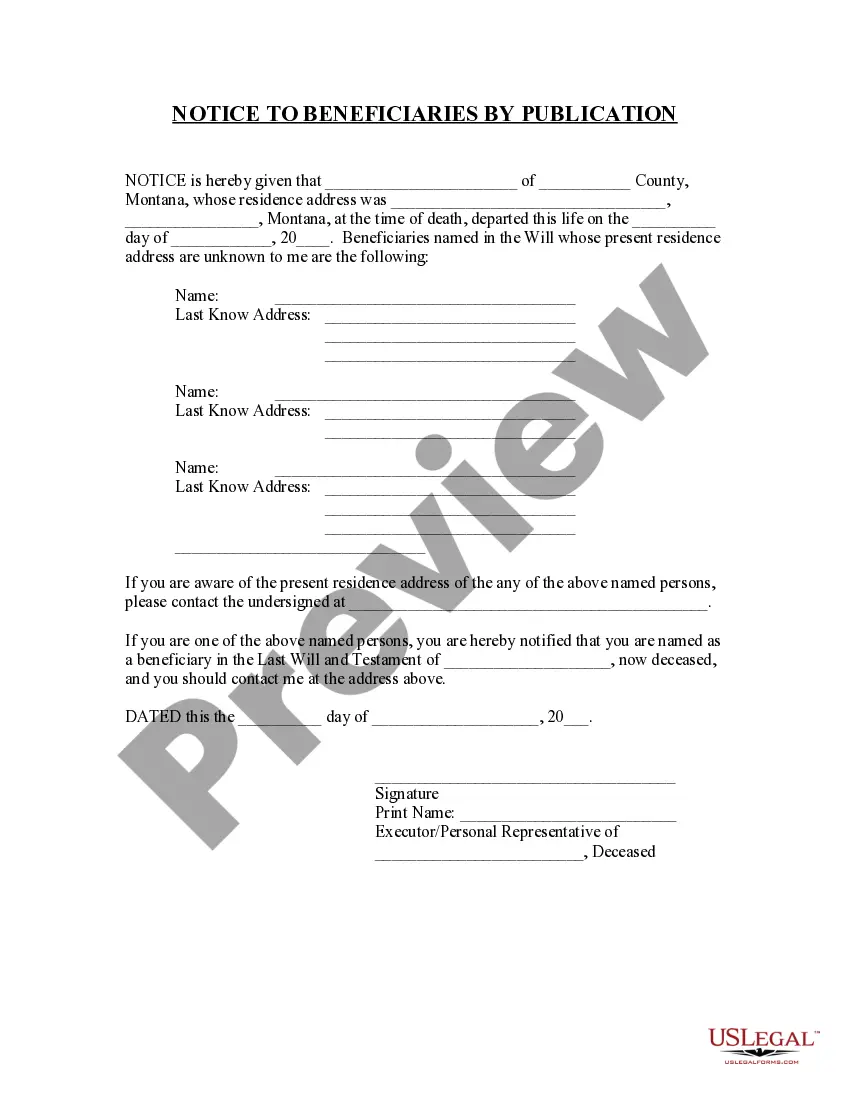

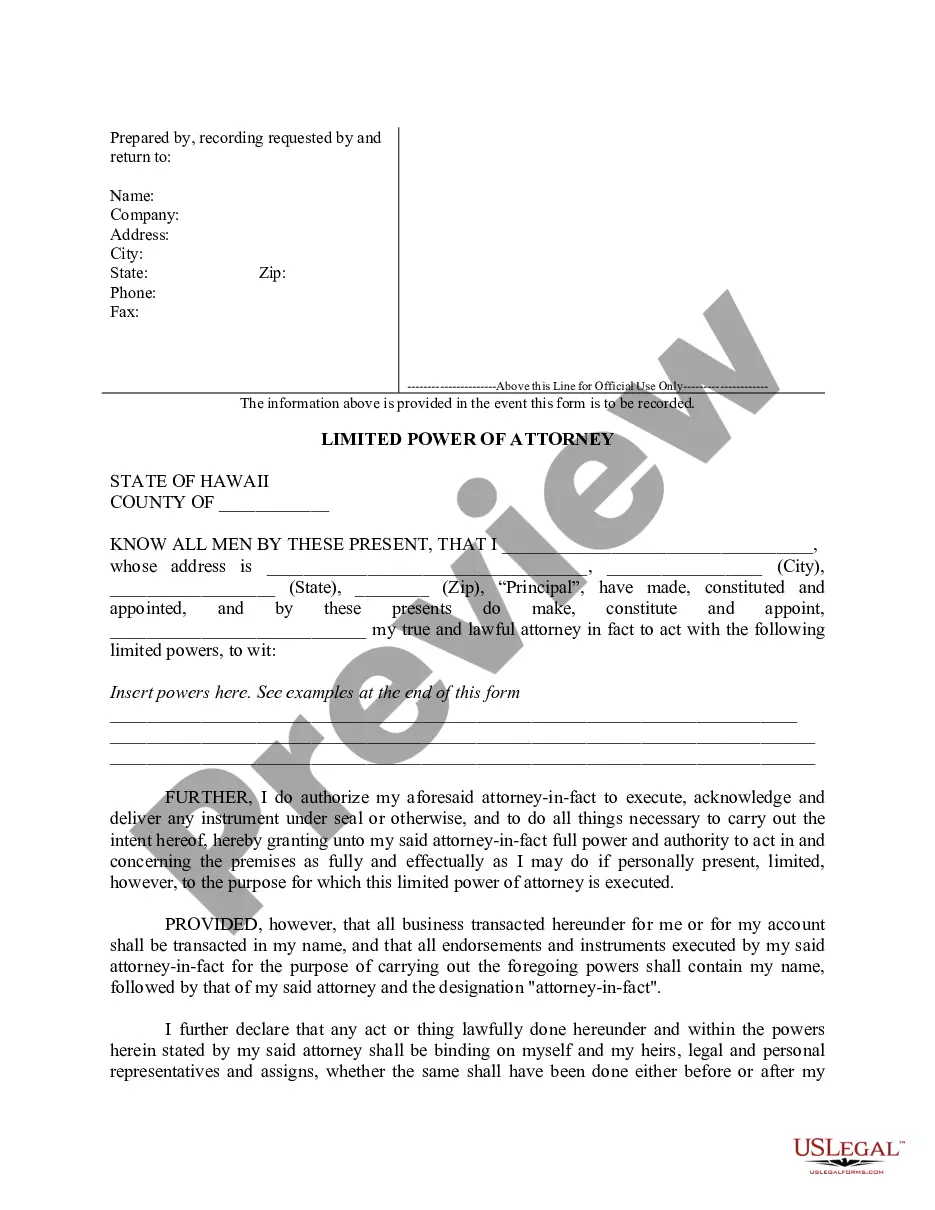

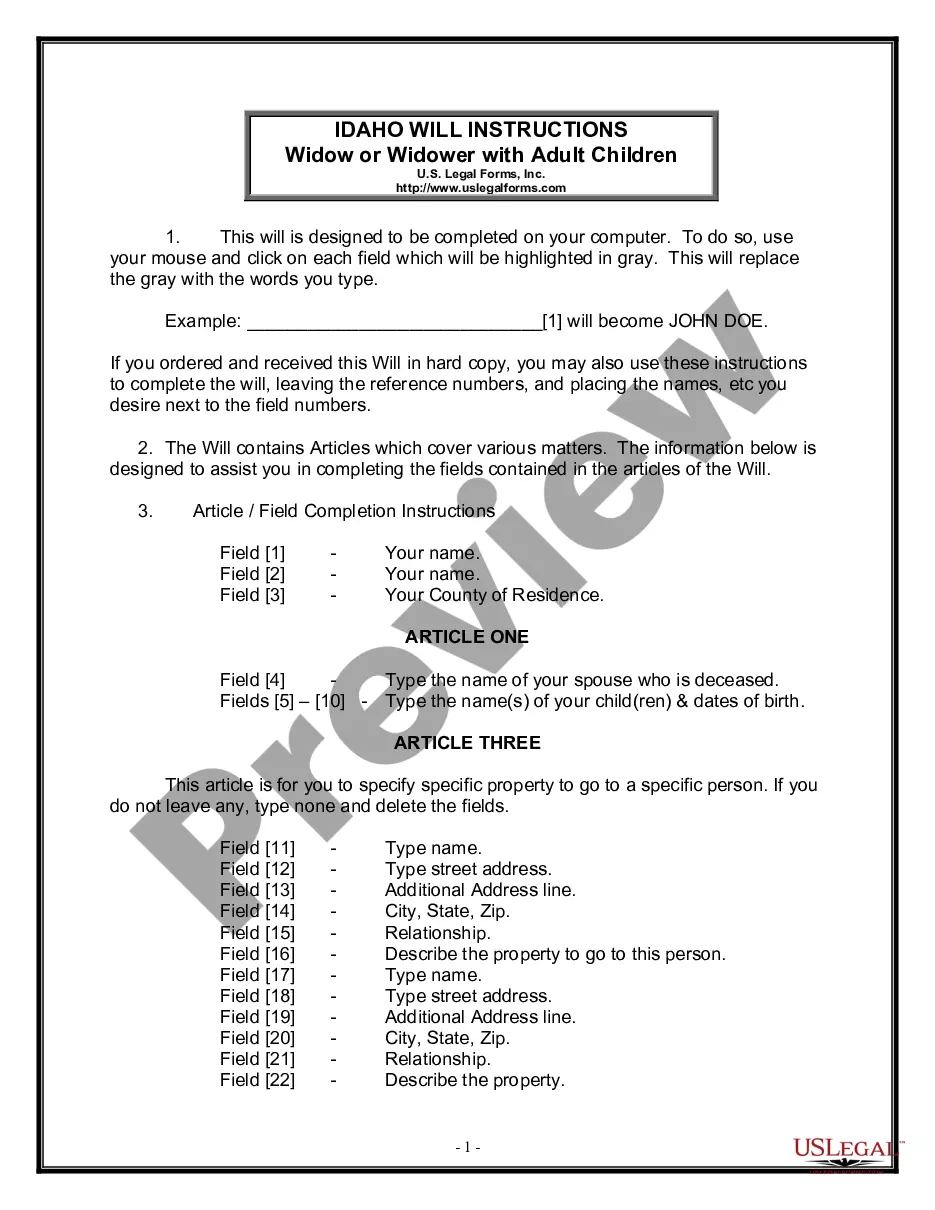

- Ensure that the document is appropriate for your situation and locale by reviewing the description and preview.

- If needed, search for another example using the Search bar in the page header.

- Once you find the appropriate template, click on Buy Now.

- Select a pricing plan, Log Into your account, or create a new one.

- Choose your preferred payment method to purchase the subscription plan (via credit card or PayPal).

- Select PDF or DOCX format for your Notice Beneficiaries Form With Decimals.

- Click Download, then print the form to complete it or upload it to an online editor.

Form popularity

FAQ

To complete beneficiary paperwork correctly, start by obtaining the Notice beneficiaries form with decimals, which provides clarity in designating percentages. Carefully enter the required details, including your information and each beneficiary's name and percentages. After filling it out, review everything for accuracy. If necessary, consider using resources from uslegalforms to ensure you are meeting all legal obligations.

While considering your beneficiaries, avoid naming individuals who may financially depend on you or those who have unresolved legal issues. Naming someone like a minor or someone in a contentious relationship may lead to complications. Always think ahead, and it's wise to consult with a financial advisor or attorney to ensure your choices support your overall estate planning goals.

Filling out a beneficiary form requires you to provide personal information about each beneficiary and to use the Notice beneficiaries form with decimals for exact allocations. Start by entering your details and listing each beneficiary’s name, along with the percentage you wish to assign to them. Make sure to double-check the information for accuracy, as any errors can affect the distribution of your assets.

To allocate percentages for beneficiaries effectively, use the Notice beneficiaries form with decimals. This form allows you to specify exact percentages for each beneficiary, enabling clear distribution of your assets. For example, you can designate one beneficiary to receive 50.5% and another 49.5%. This level of detail helps avoid confusion and ensures that your wishes are honored.

The new rules for Thrift Savings Plan (TSP) beneficiaries emphasize the need for clarity when naming beneficiaries. Commonly, individuals can now use the Notice beneficiaries form with decimals to allocate specific percentages among multiple beneficiaries. This approach ensures that distributions are precisely managed, eliminating potential disputes among heirs. It's essential to stay updated, as these rules can impact your future financial decisions.

Trusts face distinct tax brackets that can escalate rapidly, with the highest rate applying to income above a certain threshold. For 2023, trusts reach the top tax rate at just over $13,000 of taxable income. Awareness of these tax brackets is imperative, particularly when preparing the Notice beneficiaries form with decimals because distributions can impact the overall tax burden. Working with a tax expert can provide clarity on navigating these brackets effectively.

Income generated by a trust is typically taxed either at the trust level or passed through to its beneficiaries. When income is distributed to beneficiaries, they are responsible for reporting it on their individual tax returns. This process relates closely to the Notice beneficiaries form with decimals, which outlines how distributions occur. Understanding this taxation can aid in strategic planning to minimize tax liabilities effectively.

The 5 percent rule allows trustees to make distributions that do not exceed 5 percent of the net asset value of the trust in a given year. This rule is significant for managing the trust's growth while providing for beneficiaries. When managing distributions, it's crucial to reference the Notice beneficiaries form with decimals to ensure accurate calculations. Adhering to this rule can help maintain the trust's integrity and benefit all parties involved.

An estate tax ID number, or Employer Identification Number (EIN), follows a standard nine-digit format that looks like this: 12-3456789. This number is essential for any estate or trust when filing taxes or regarding the Notice beneficiaries form with decimals. Having the correct EIN is necessary for smooth processing of tax-related responsibilities and the distribution of estate assets. Ensure this is completed promptly to avoid potential issues.

Trusts are subject to different capital gains tax brackets which can reach the maximum rate more quickly than individual taxpayers. For 2023, trust income above a specified threshold is taxed at a rate of 20%. Understanding these brackets can influence how income is distributed to beneficiaries, making the Notice beneficiaries form with decimals a crucial document for effective tax planning. Consulting a tax advisor can provide further insights into managing these taxes.