Notice To Creditors Forms Montana Withholding

Description

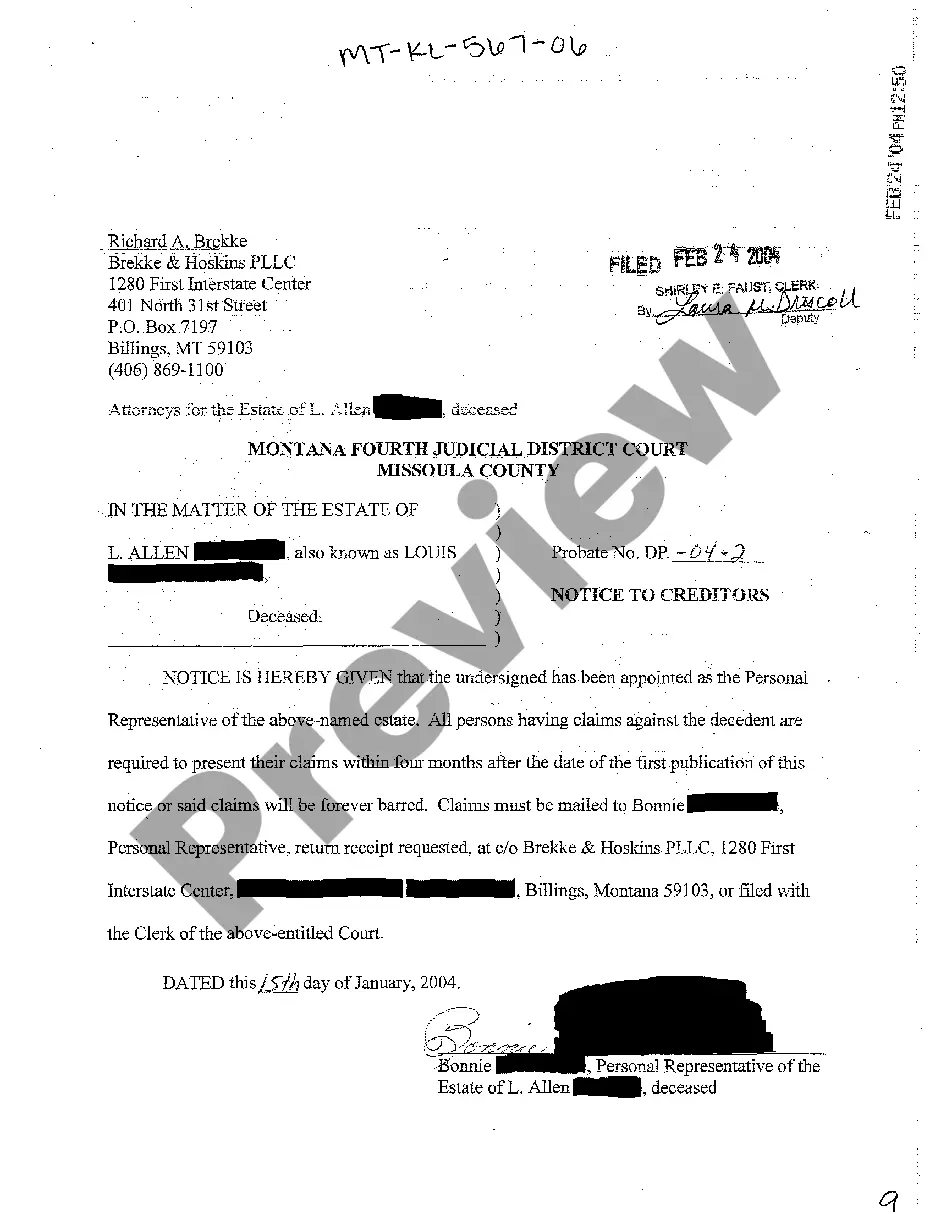

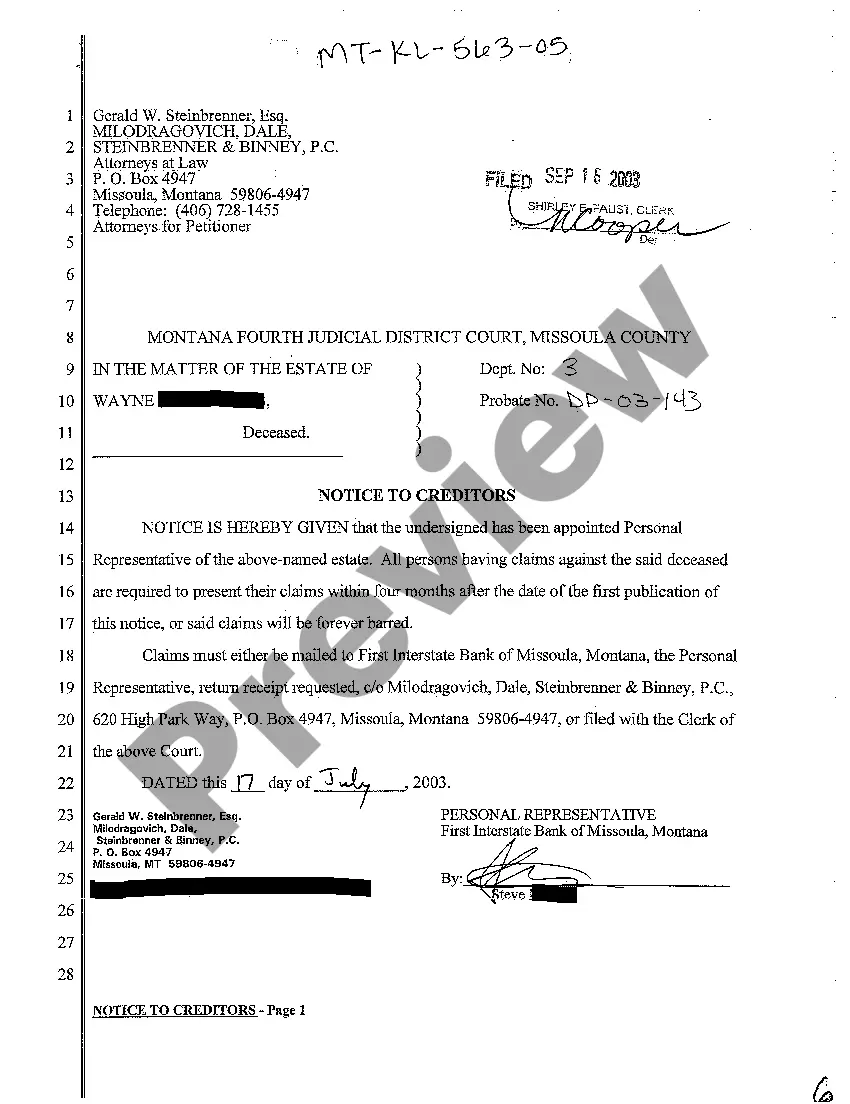

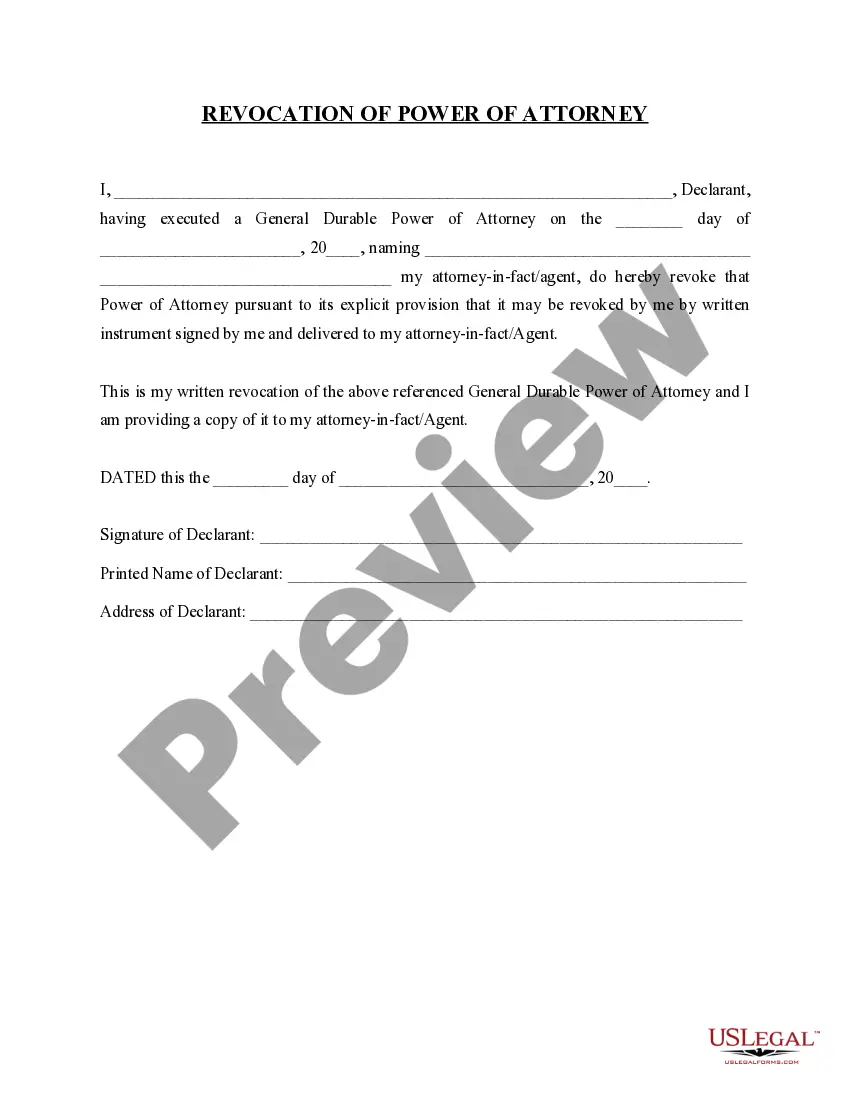

How to fill out Montana Notice To Creditors?

What is the most reliable platform to obtain the Notice To Creditors Forms Montana Withholding and other current iterations of legal documents.

US Legal Forms is the solution! It offers the most comprehensive collection of legal templates for any circumstance.

If you do not yet have an account with our library, here’s how to get started: Form compliance verification. Before obtaining any template, ensure that it meets your specific use case requirements and complies with your state or county regulations. Review the form description and utilize the Preview if available.

- Each template is professionally crafted and confirmed for adherence to federal and local legislation.

- They are categorized by region and state of application, making it straightforward to find the one you need.

- Experienced users of the site simply need to Log In, verify their subscription status, and click the Download button next to the Notice To Creditors Forms Montana Withholding to retrieve it.

- Once downloaded, the template is accessible for further use in the My documents section of your account.

Form popularity

FAQ

Yes, Montana has several state tax forms that residents need to complete for tax purposes. These forms facilitate the reporting of income, deductions, and credits applicable in the state. Using the appropriate forms is essential, particularly when you want to ensure compliance with processes linked to Notice to creditors forms montana withholding.

To inquire about state withholding in Montana, you can call the Montana Department of Revenue. Their phone number is available on their official website, allowing you to get direct answers to your questions about withholding, especially in context with Notice to creditors forms montana withholding.

The Montana MW4 form is a state withholding certificate. Employees use this form to indicate their correct tax withholding status to their employer. By filling out the MW4, individuals can better manage their tax withholdings, which is crucial when dealing with matters related to Notice to creditors forms montana withholding.

Yes, Montana does have state withholding. Employers in Montana are responsible for withholding state income tax from their employees' paychecks. This process helps ensure that residents meet their tax obligations, including any responsibilities related to Notice to creditors forms montana withholding.

Setting up payroll in Montana involves several key steps, starting with registering your business and obtaining a withholding account number. You’ll then establish a payroll system to calculate wages, taxes, and withholdings accurately. It’s advisable to consult resources like uslegalforms to navigate compliance requirements, especially when dealing with Notice to creditors forms montana withholding.

Acquiring a Montana withholding account number is streamlined through the Montana Department of Revenue. You can register your business online, providing essential information about your entity and employees. This number is vital considering its relevance in submitting Notice to creditors forms montana withholding correctly and on time.

In 2024, Montana will implement adjustments to withholding rates and thresholds. These changes aim to align state tax policies with federal regulations, ensuring efficiency in tax collection. Stay informed through official resources or trusted platforms like uslegalforms for necessary updates, particularly relating to Notice to creditors forms montana withholding.

To get a Montana withholding account number, visit the Montana Department of Revenue website, where you can complete an online application. This account number is crucial for businesses to comply with state tax requirements, especially when handling Notice to creditors forms montana withholding.

To obtain a Montana Employer Identification Number (EIN), you need to fill out Form SS-4, which you can get from the IRS website or a tax professional. Once completed, you may submit it online, by mail, or by fax. Acquiring your EIN is important for tax reporting and to ensure proper handling of Notice to creditors forms montana withholding.

An executor should wait at least six months after filing for probate before distributing assets to beneficiaries. This waiting period allows time for creditors to present their claims and ensures all financial obligations are met. By using Notice to creditors forms Montana withholding, executors can effectively manage claims and adhere to timelines, promoting a smoother distribution process.