Power Of Attorney Revocation Form With Irs Verification

Description

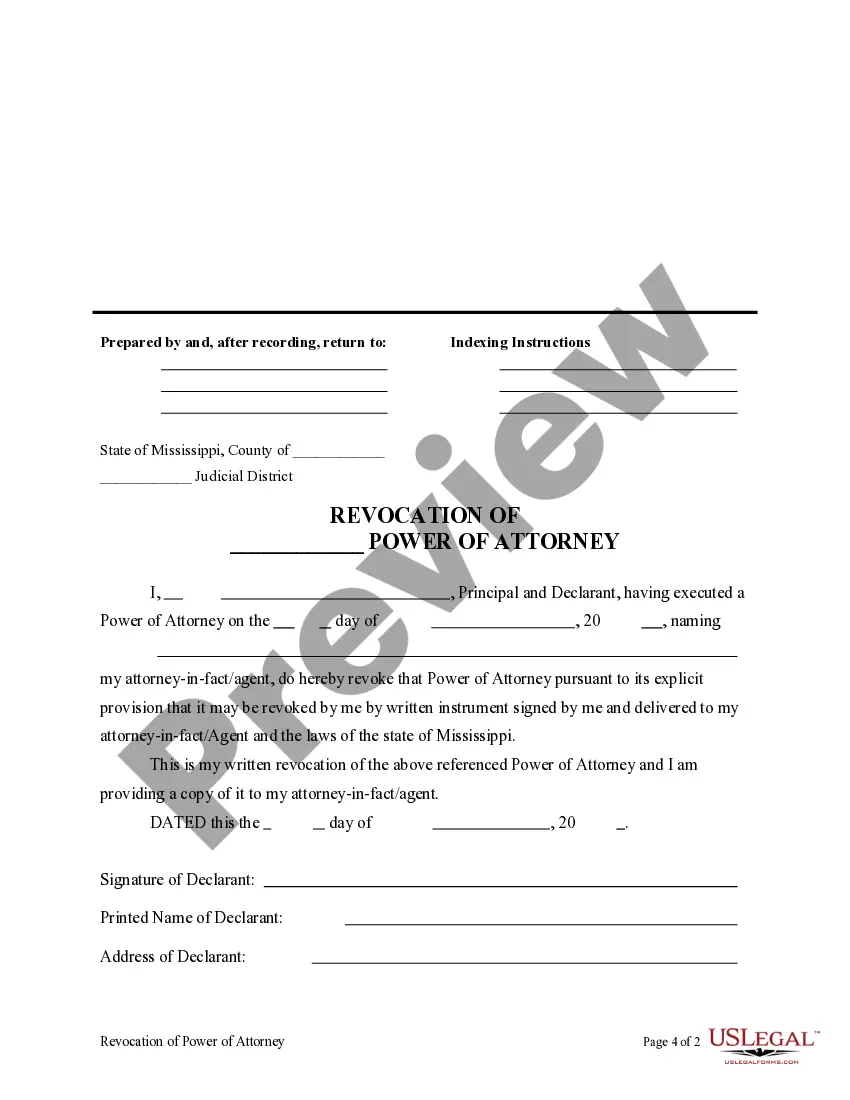

How to fill out Mississippi Revocation Of General Durable Power Of Attorney?

Precisely crafted official documents are one of the crucial assurances for steering clear of issues and disputes, yet obtaining them without the assistance of an attorney may require time.

Whether you need to swiftly locate a current Power Of Attorney Revocation Form With Irs Verification or any other templates for employment, family, or business situations, US Legal Forms is consistently here to assist.

The procedure is even more straightforward for current users of the US Legal Forms library. If your subscription is active, you simply need to Log In to your account and click the Download button adjacent to the selected file. Moreover, you can access the Power Of Attorney Revocation Form With Irs Verification at any future time, as all documents ever acquired on the platform remain accessible within the My documents tab of your account. Conserve time and resources on preparing official documents. Experience US Legal Forms today!

- Verify that the form aligns with your situation and location by reviewing the description and preview.

- Search for an alternative template (if necessary) using the Search bar in the page header.

- Select Buy Now once you find the appropriate template.

- Choose your pricing plan, Log In to your account or set up a new one.

- Select your preferred payment method to purchase the subscription plan (via credit card or PayPal).

- Pick either PDF or DOCX file format for your Power Of Attorney Revocation Form With Irs Verification.

- Click Download, then print the document to complete it or upload it to an online editor.

Form popularity

FAQ

Form 8821 is a taxpayer's written authorization designating a third party to receive and view the taxpayer's information. The taxpayer and the tax professional must sign Form 2848. If the tax professional uses the new online option, the signatures on the forms can be handwritten or electronic.

You can use Form 2848, Power of Attorney and Declaration of Representative for this purpose. Your signature on the Form 2848 allows the individual or individuals named to represent you before the IRS and to receive your tax information for the matter(s) and tax year(s)/period(s) specified on the Form 2848.

Form 8821 is a taxpayer's written authorization designating a third party to receive and view the taxpayer's information. The taxpayer and the tax professional must sign Form 2848. If the tax professional uses the new online option, the signatures on the forms can be handwritten or electronic.

Form 8821 authorizes the IRS to disclose your confidential tax information to the person you designate. This form is provided for your convenience and its use is voluntary. The information is used by the IRS to determine what confidential tax information your designee can inspect and/or receive.

The Taxpayer First Act (TFA) of 2019 requires the IRS to provide digital signature options for Form 2848, Power of Attorney, and Form 8821, Tax Information Authorization. These improvements will help individual taxpayers, business taxpayers, and the tax professionals who serve them.