Clerical Error In Auditing

Description

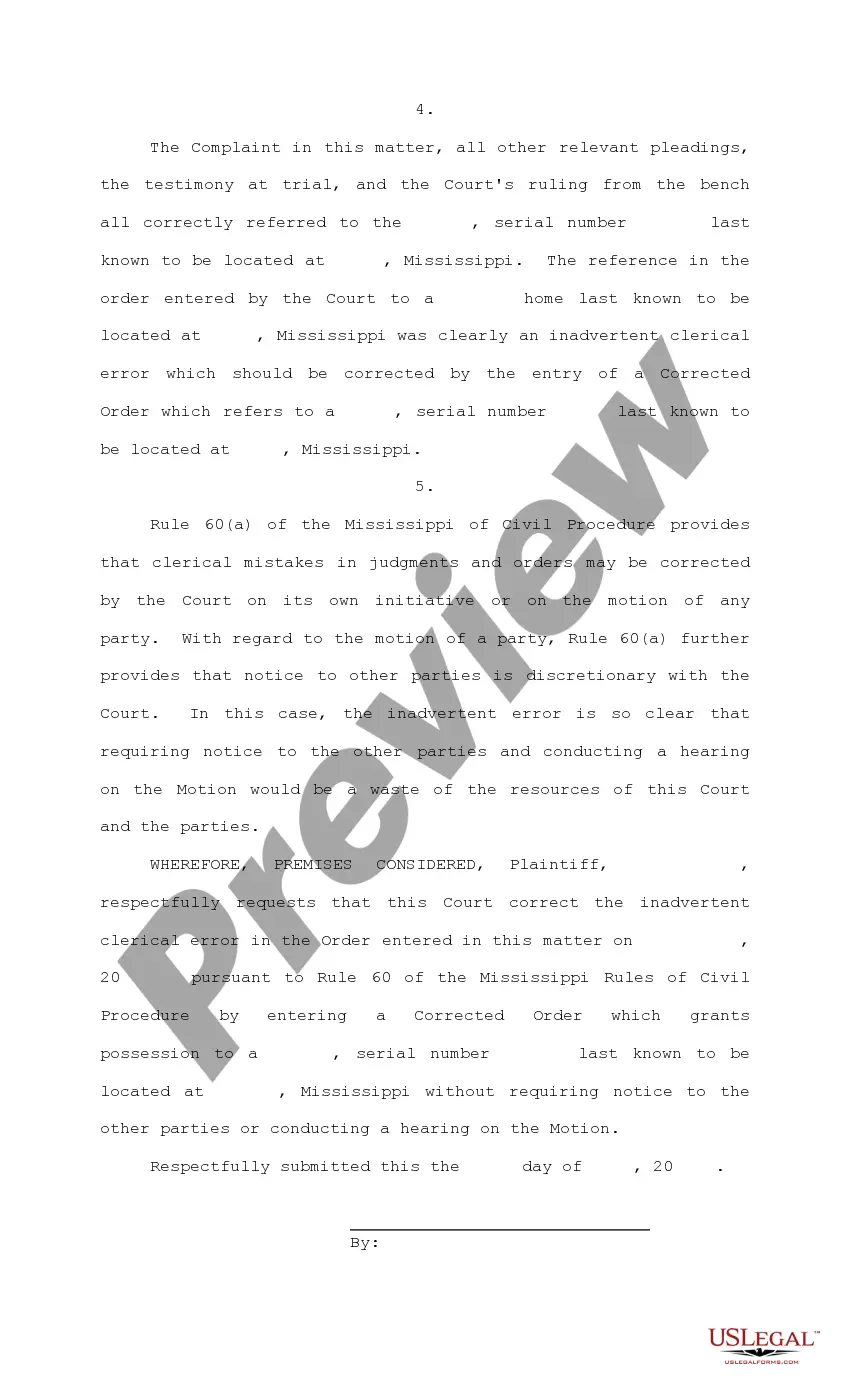

How to fill out Mississippi Motion To Correct A Clerical Error Pursuant To Rule 60a?

The Administrative Mistake In Auditing you observe on this page is a versatile official template created by expert attorneys in accordance with federal and local laws.

For over 25 years, US Legal Forms has offered individuals, organizations, and legal practitioners more than 85,000 authenticated, state-specific documents for any business and personal needs. It’s the fastest, simplest, and most dependable method to acquire the paperwork you require, as the service ensures bank-level data protection and anti-malware safeguards.

Choose the format you desire for your Administrative Mistake In Auditing (PDF, DOCX, RTF) and download the sample onto your device.

- Search for the document you require and review it.

- Browse through the file you searched and preview it or check the form description to confirm it meets your requirements. If it doesn’t, use the search feature to find the suitable one. Click Buy Now when you have discovered the template you need.

- Register and Log In.

- Select the pricing plan that fits you and create an account. Use PayPal or a credit card to make a quick payment. If you already possess an account, Log In and verify your subscription to continue.

- Obtain the editable template.

Form popularity

FAQ

Hear this out loud PauseA clerical error is a mistake found in a court order. You can correct a clerical error by filing a document with the court called a motion for judgment nunc pro tunc.

Hear this out loud PauseIn an earlier post, we covered the classes of clerical errors: error of omission, error of commission, compensating error, error of duplication, and error of principle.

Hear this out loud PauseFollowing are the examples of such errors; Omission of purchase or sale from the purchase day book or the sale day book respectively. Omission of outstanding or unpaid expenses.

Hear this out loud PauseClerical errors include errors of omission, errors of commission and compensating. 1) Error of omission is when a transaction is being missed out from being recorded by the person maintaining accounts. 2) errors of commission is recording wrong account, wrong amount, wrong totalling etc,.

Types of Errors: Clerical Errors: Such an error arises on account of wrong posting. Errors of Commission : When amount of transaction or entry is incorrectly recorded in accounting books/ledger. Errors of Omission : When the transactions are not recorded in the books of original entry or posted to the ledger.