Stock Purchase Agreement For S Corporation

Description

How to fill out Mississippi Stock Sale And Purchase Agreement?

What is the most dependable service to acquire the Stock Purchase Agreement For S Corporation and other updated versions of legal documents? US Legal Forms is the solution! It boasts the largest collection of legal forms for any purpose.

Each template is expertly crafted and verified for adherence to federal and regional laws. They are categorized by industry and jurisdiction, making it easy to find what you need.

US Legal Forms is an ideal choice for anyone needing to handle legal documents. Premium members additionally have the benefit of completing and signing previously saved documents electronically at any time using the built-in PDF editor. Check it out now!

- Experienced users of the platform simply need to Log In to the system, verify their subscription status, and click the Download button next to the Stock Purchase Agreement For S Corporation to obtain it.

- Once saved, the document is accessible for future reference within the My documents section of your account.

- If you do not possess an account yet, follow these steps to create one.

- Form compliance evaluation. Prior to obtaining any template, ensure it aligns with your use case requirements and the laws of your state or county. Review the form description and utilize the Preview feature if applicable.

Form popularity

FAQ

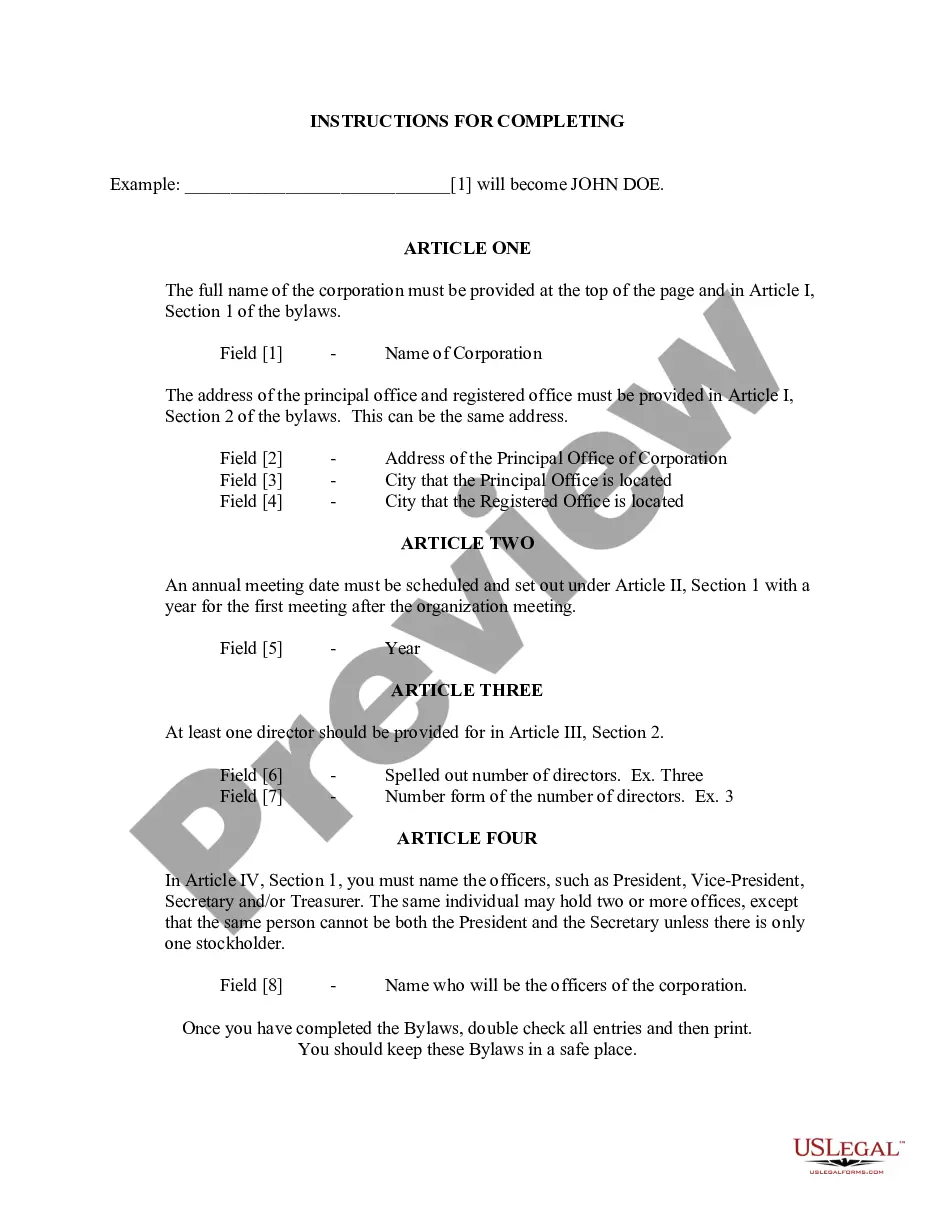

How to WriteStep 1 Download The Stock (Shares) Purchase Agreement.Step 2 Set This Agreement To A Specific Date.Step 3 Produce The Purchaser's Identity.Step 4 Attach The Seller's Information.Step 5 Define The Entity Behind The Shares The Purchaser Shall Buy.Step 6 Provide A Discussion On The Concerned Shares.More items...

Your company's status as an S corporation with the Internal Revenue Service won't affect the buyout transaction between you and your partner. Under state law, ownership of a corporation is vested in shares of stock. One stockholder can buy out another stockholder simply by purchasing his shares.

A shareholder buyout involves a corporation buying all of its stock back from a single or group of shareholders at an agreed upon price. The corporation will negotiate a price, and then exchange cash for the shareholder's stock. An S Corporation may buy out a shareholder for a few reasons.

The S corp shareholder agreement is a contract between the shareholders of an S corporation. The contents of the shareholder agreement differ from one S corporation to another. The shareholders are also able to decide what goes into the shareholder agreement, which is also referred to as the stockholder agreement.

Your company's status as an S corporation with the Internal Revenue Service won't affect the buyout transaction between you and your partner. Under state law, ownership of a corporation is vested in shares of stock. One stockholder can buy out another stockholder simply by purchasing his shares.