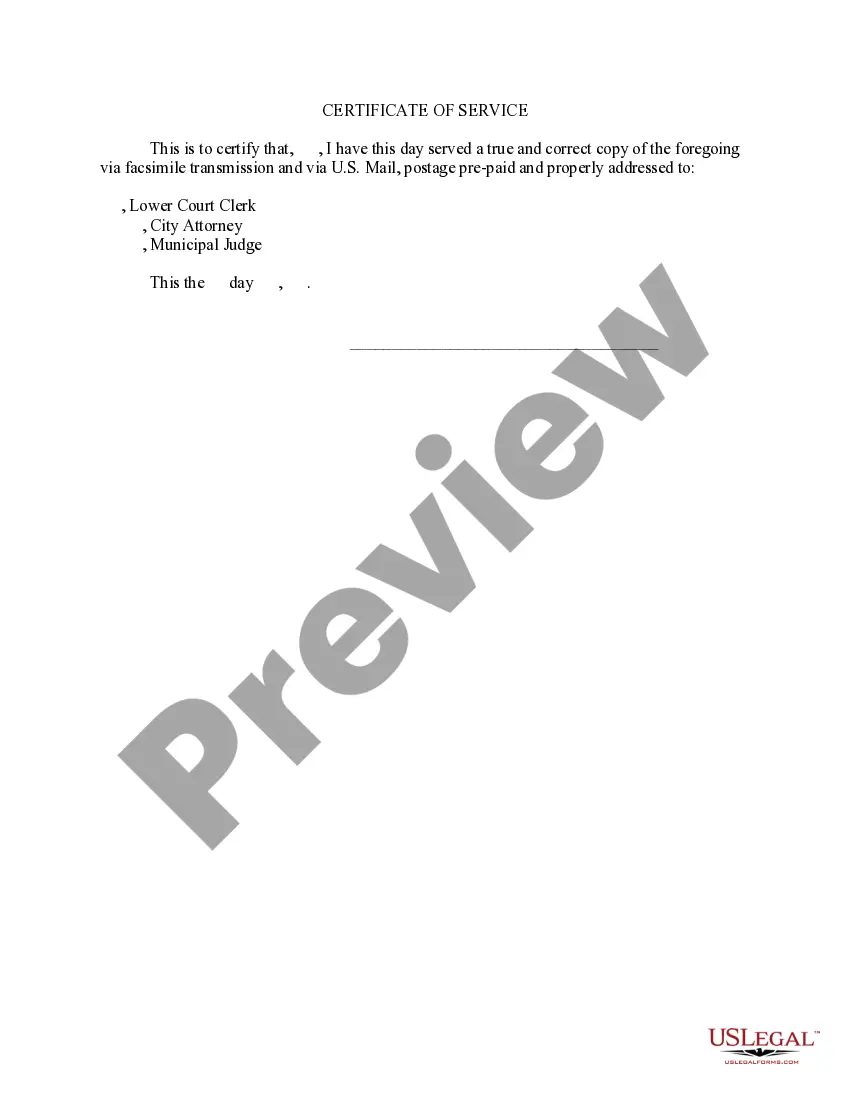

Appeal For Court Decision

Description

How to fill out Mississippi Notice Of Appeal From Municipal Court To County Court?

The Request For Judicial Ruling you observe on this site is a versatile legal document crafted by expert attorneys in accordance with national and local regulations.

For over 25 years, US Legal Forms has supplied individuals, businesses, and legal experts with more than 85,000 authenticated, state-tailored forms for any commercial and personal situation. It's the quickest, simplest, and most reliable method to acquire the documents you require, as the service assures bank-grade data protection and anti-malware safeguards.

Select the format you prefer for your Request For Judicial Ruling (PDF, Word, RTF) and save the document on your device. Complete and sign the document. Print the template to fill it out manually. Alternatively, make use of an online multifunctional PDF editor to swiftly and accurately complete and sign your form with a legally-binding electronic signature. Download your documents again. Use the same document again whenever necessary. Access the My documents tab in your profile to redownload any previously saved forms. Register for US Legal Forms to have verified legal documents for all of life's situations at your fingertips.

- Search for the document you require and evaluate it.

- Browse through the sample you searched and view it or review the form description to confirm it matches your needs. If it doesn't, utilize the search bar to discover the correct one. Click Buy Now once you have found the document you need.

- Register and Log In.

- Choose the pricing option that fits your needs and create an account. Utilize PayPal or a credit card to make an immediate payment. If you already possess an account, Log In and check your subscription to continue.

- Obtain the editable template.

Form popularity

FAQ

We recommend applying for an EIN online if you have a SSN (Social Security Number) or ITIN (Individual Taxpayer Identification Number). This is the easiest filing method and it has the fastest approval time. Your EIN Number will be issued at the end of the online application, which takes about 15 minutes to complete.

How to start a sole proprietorship: 7 steps to take Choose a business name. ... Register your business name. ... Purchase a website domain name. ... Obtain a business license and other permits. ... File for an employer identification number (EIN) ... Open a business bank account. ... Get insurance coverage.

Though no action is required to legally create a sole proprietorship, you should follow four simple steps to start your business: Choose a business name. File an Assumed Business Name Certificate with your city or town. Apply for licenses, permits, and zoning clearance. Obtain an employer identification number (EIN).

All forms supplied by the Division of Taxation are in Adobe Acrobat (PDF) format. Most forms are provided in a format allowing you to fill in the form and save it. To have forms mailed to you, please call 401.574. 8970 or email Tax.Forms@tax.ri.gov.

The Division has transitioned from the RI-7004 to the Form BUS-EXT. Details are contained in ADV 2022-38. For Tax Year 2022, if an extension is being filed for the RI- 1065, RI-1120S, RI-1120C, RI-PTE or RI-1120POL, the extension must be filed using the Form BUS-EXT.

In Rhode Island, there is no paperwork required to become a sole proprietor and no associated fee. If you want to operate under a name other than your own, you can file a Fictitious Business Name application and pay a $10 fee, but this is not required. You can start a sole proprietorship today with no formalities.

To file taxes on your sole proprietorship income, you must keep track of a few IRS forms like Form 1040, Schedule C, Form 940, Form 941, Form 944, etc. Let's have a look at the forms. Plus, any self-employment tax deductions need to be factored in and recorded.

And, as is the case with other types of business entities, sole proprietors are also subject to self-employment taxes. As a sole proprietor, instead of filing a separate tax return for your business, you report your business income on IRS Form 1040, using Schedule C to report your business profit or loss.