Enhanced Life Estate Deed Example

Description

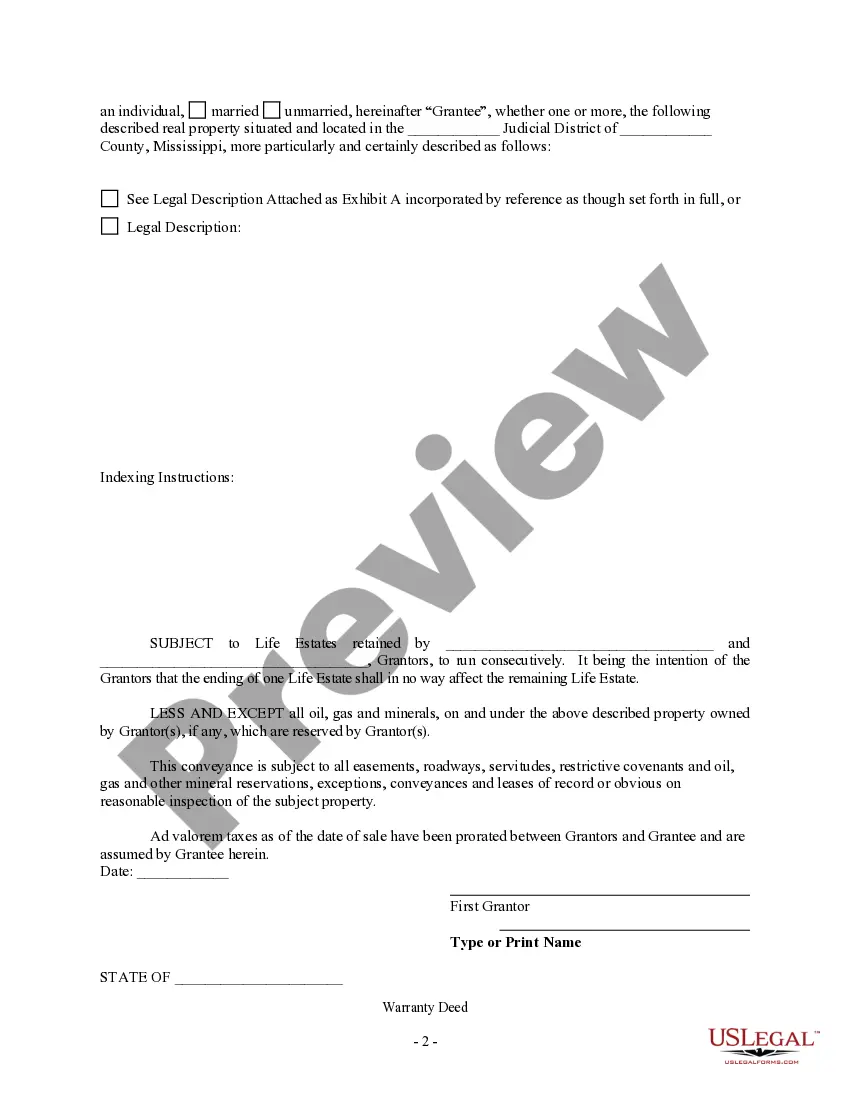

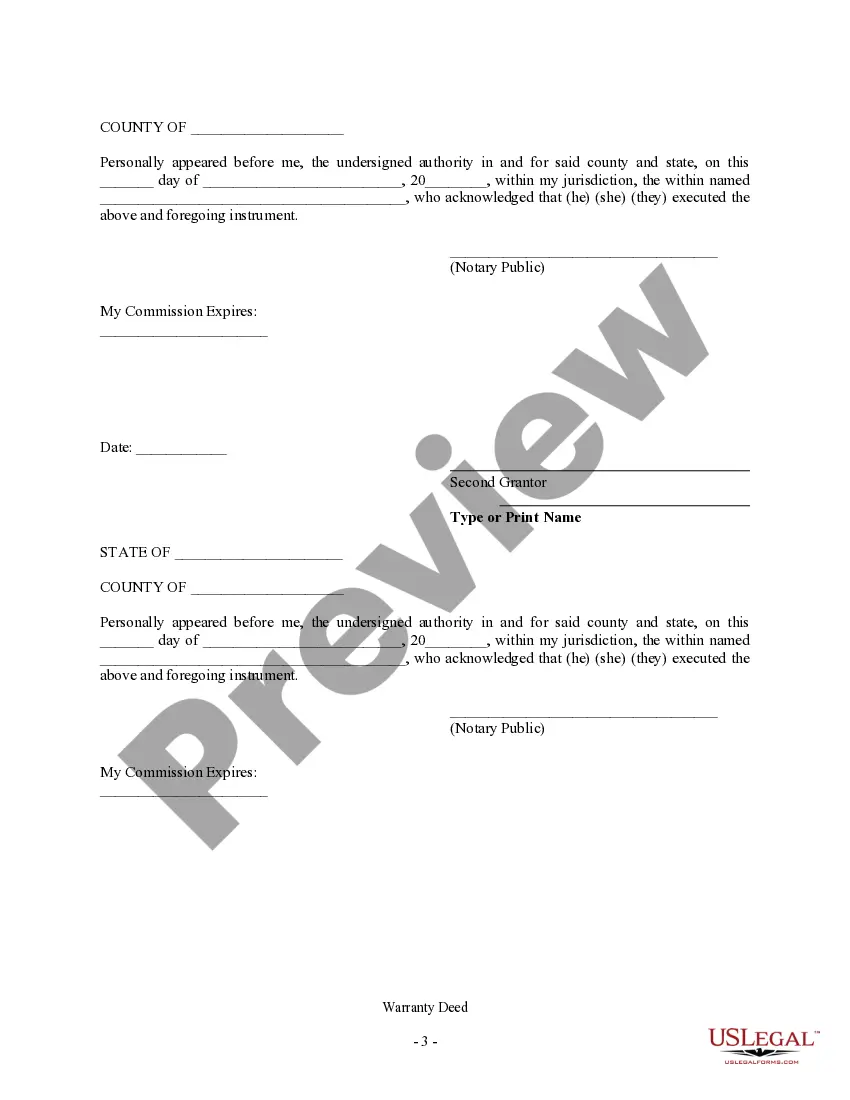

How to fill out Mississippi Warranty Deed To Child Reserving A Life Estate In The Parents?

It’s clear that you cannot transform into a legal expert instantly, nor can you easily learn how to swiftly prepare an Enhanced Life Estate Deed Example without a particular set of competencies.

Drafting legal documents is a protracted procedure that necessitates specialized education and expertise.

So why not entrust the creation of the Enhanced Life Estate Deed Example to the professionals.

You can regain access to your files from the My documents tab whenever necessary. If you are an existing client, you can simply Log In and locate and download the template from the same section.

Regardless of the purpose of your forms—whether they relate to finance, law, or personal matters—our platform has you covered. Experience US Legal Forms today!

- Find the document you require using the search bar located at the top of the webpage.

- View it (if this option is available) and review the accompanying description to ascertain if the Enhanced Life Estate Deed Example meets your needs.

- Begin your search anew if you need an alternative form.

- Create a complimentary account and select a subscription plan to acquire the document.

- Select Buy now. Once the transaction is complete, you can obtain the Enhanced Life Estate Deed Example, complete it, print it, and deliver it to the relevant individuals or organizations.

Form popularity

FAQ

The ELE deed is designed to enable a grantor to retain title to real property for the duration of the grantor's lifetime and transfer the real property to a named beneficiary upon the grantor's death without the need to go through probate.

As of now, South Carolina law does not permit the use of TOD deeds to transfer ownership of real estate. Instead, other estate planning tools, such as joint tenancy or a living trust, can be used to avoid probate for real estate.

The Florida Enhanced Life Estate Deed Unlike standard-life-estate-deed beneficiaries, the beneficiaries named in an enhanced life estate deed do not get the property immediately upon the deed's execution. Instead, the property is transferred upon the death of the deed's creator.

For starters, lady bird deeds are not recognized in South Carolina. This means that our clients in South Carolina are not able to take advantage of this loophole whereas clients in North Carolina can. ingly, in South Carolina individuals are more likely to have a traditional life estate deed recommended to them.

A grantor of a lady bird deed retains part of the ownership as an enhanced life estate in the property during their lifetime. In other words, a lady bird deed functions as a quit claim deed that only becomes effective after death under Florida law.