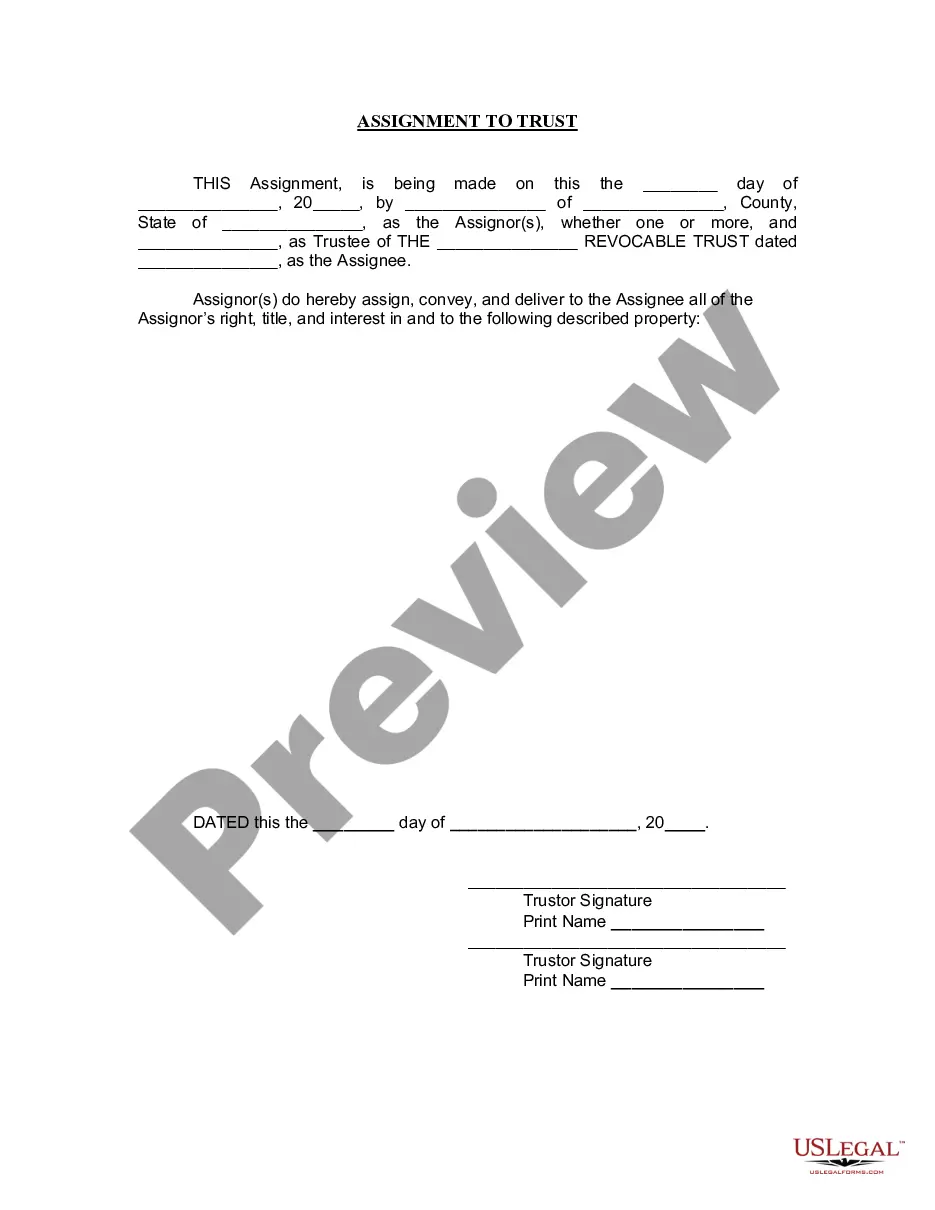

Living Trust Form Sample For A Property

Description

How to fill out Missouri Assignment To Living Trust?

- If you have an existing US Legal Forms account, log in and download your desired form template by clicking the Download button. Ensure your subscription is current or renew if necessary.

- For first-time users, start by checking the Preview mode and description of your chosen form to confirm it meets your requirements and adheres to local laws.

- If adjustments are needed, use the Search tab to find additional templates that fit your criteria.

- Purchase your selected document by clicking the Buy Now button, then select your preferred subscription plan and create an account to access the document library.

- Complete your purchase by entering your credit card information or logging into your PayPal account for payment.

- Download the living trust form and save it on your device. You can find it in the My Forms section of your profile for future access.

In conclusion, US Legal Forms offers an extensive range of legal documents, making the process of creating a living trust straightforward and efficient. Their robust library and access to expert assistance provide confidence that your documents will be accurate and legally binding.

Start your journey towards a well-structured estate plan by accessing your living trust form sample today on US Legal Forms!

Form popularity

FAQ

Yes, you can set up a trust fund by yourself using a living trust form sample for a property. Many people choose to create their trusts without legal assistance by following templates or guides available online. However, it's important to consider that DIY options may lack legal rigor, and minor errors can lead to complications. If you want peace of mind, consider professional guidance to ensure your trust is valid and meets all legal requirements.

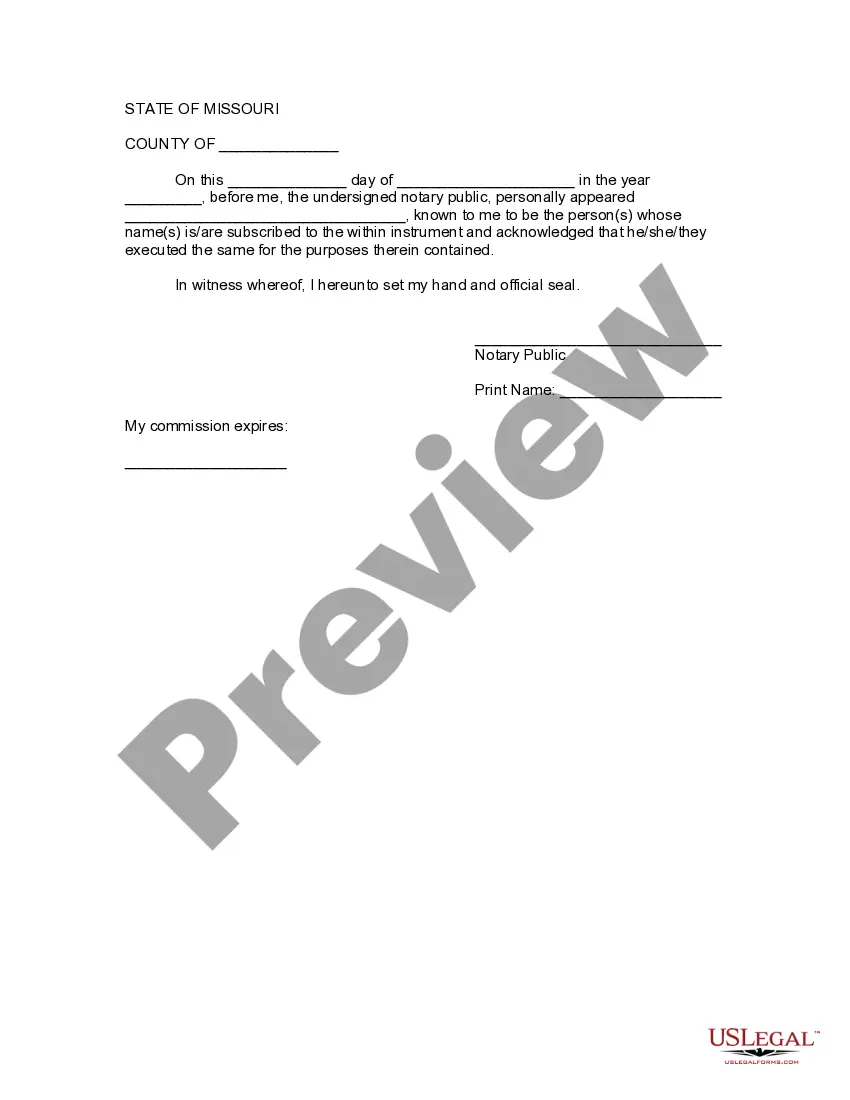

You can create a living trust by yourself by following a step-by-step approach. Begin with a living trust form sample for a property that fits your needs, and fill it out with the required information about your assets and beneficiaries. Once complete, sign the trust in front of a notary to give it legal standing, and consider transferring your property titles to the trust for effective management.

Creating a living trust template involves outlining your estate and designating your beneficiaries. Utilizing a living trust form sample for a property can provide you with a structured template to streamline this process. Ensure that you include detailed sections about asset management and distribution preferences, and remember to sign the document in the presence of a notary to finalize it.

To set up a trust template, start by gathering necessary information about your assets and your beneficiaries. You might want to use a living trust form sample for a property as a guide to ensure you create a comprehensive document. Make sure to specify how you want your assets managed during your lifetime and after, and consider consulting an attorney or using a reliable online service for clarity and legal compliance.

When considering a living trust form sample for a property, it’s essential to understand which assets may not be suitable for inclusion. Assets that typically should not go into a trust include retirement accounts, health savings accounts, and assets with named beneficiaries because these accounts may bypass the probate process. Additionally, personal items with significant sentimental value, such as family heirlooms and pets, should remain outside a trust, as they may require separate arrangements.

One downside of putting assets in a trust is the potential loss of control during one's lifetime, depending on the type of trust created. Moreover, the initial setup and maintenance can require time and financial investment. However, a living trust form sample for a property can simplify this process and clarify how different assets can be integrated. Weighing these factors alongside benefits is crucial.

A common mistake parents make when setting up a trust fund is not properly funding it with their desired assets. Without transferring property into the trust, it won't operate as intended. Utilizing a living trust form sample for a property can help parents understand which assets to include, ensuring that their trust functions effectively. Additionally, failing to update the trust as circumstances change can also lead to complications.

If your parents are considering a trust, it can offer benefits like avoiding probate and providing clear instructions for asset distribution. A living trust form sample for a property can illustrate how to structure the trust effectively. However, it's essential to evaluate their specific situation and financial goals before deciding. Consulting with a legal expert can ensure they make an informed choice.

One disadvantage of a family trust is that it may require ongoing management and legal maintenance, unlike a will that is effective immediately upon death. Additionally, the costs associated with creating and maintaining a trust can be significant. Using a living trust form sample for a property can help you understand your obligations better and prepare you for potential pitfalls. It is beneficial to weigh the pros and cons before making a decision.

To fill a living trust, start by gathering necessary information about your assets and beneficiaries. You will then need to use a living trust form sample for a property, which guides you through naming the trust, selecting a trustee, and detailing the assets included. Once completed, ensure you sign the document and have it notarized to make it legally binding. This process can simplify managing your estate and help ensure your wishes are fulfilled.