Living Trust Form Sample For A Family

Description

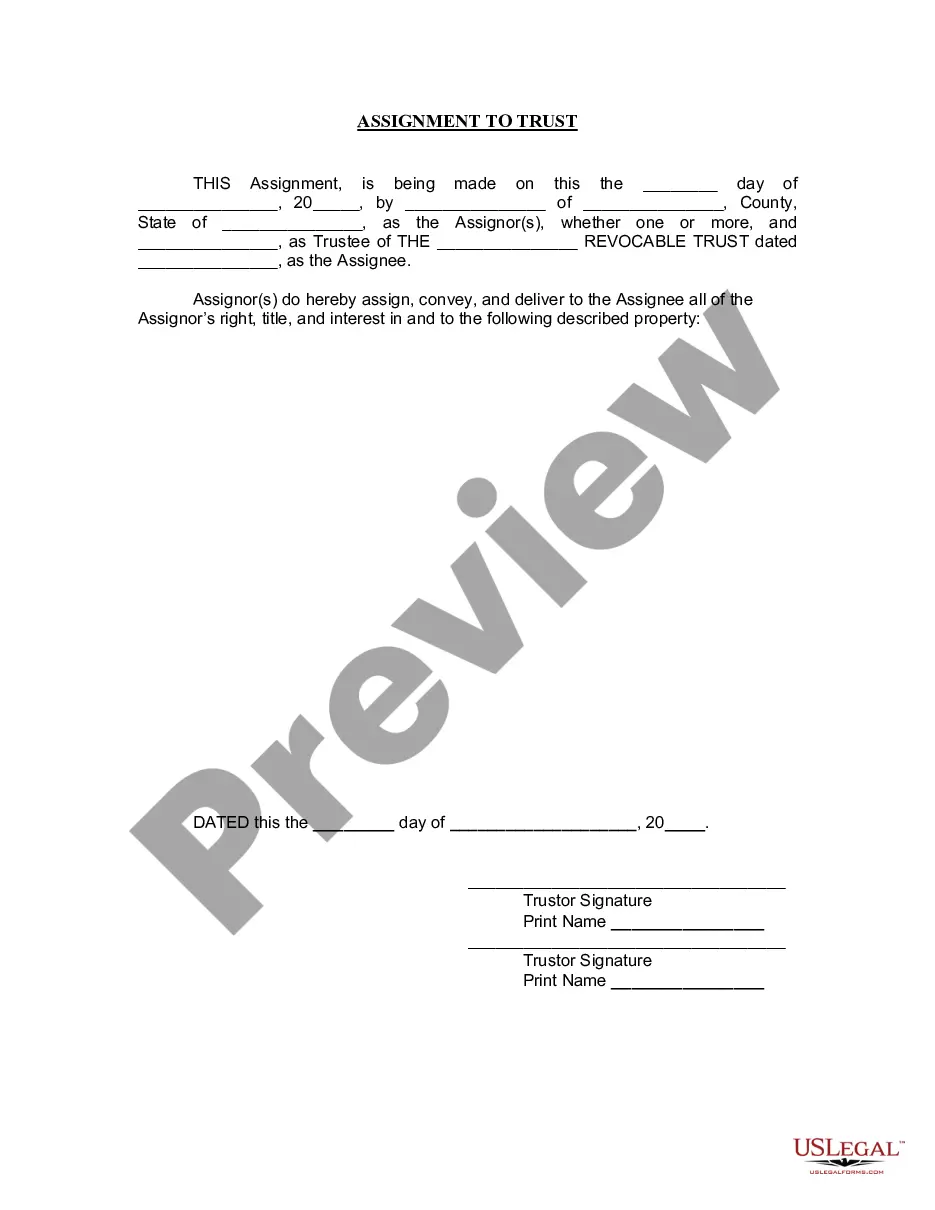

How to fill out Missouri Assignment To Living Trust?

- Log in to your US Legal Forms account if you're a returning user, and verify that your subscription remains active.

- For first-time users, begin by browsing the Preview mode and reviewing the form description to confirm it meets your family’s specific requirements.

- If you need a different template, utilize the Search bar to find the appropriate form that aligns with your local jurisdiction's criteria.

- When you identify the correct document, select the Buy Now button to choose your preferred subscription plan and create an account.

- Complete the payment process by entering your credit card details or using PayPal to finalize your subscription.

- Once your purchase is confirmed, download the living trust form and save it to your device. You can also access it anytime via the My Forms section in your profile.

In conclusion, US Legal Forms provides families with a robust library of over 85,000 fillable legal documents, ensuring quick and easy access to necessary forms. Their services empower you with the tools needed for precise estate planning.

Start your experience today by visiting US Legal Forms to secure your living trust form sample and ensure your family's future is protected.

Form popularity

FAQ

Filing taxes for a family trust typically involves completing IRS Form 1041, which is the U.S. Income Tax Return for Estates and Trusts. You should gather all necessary financial documents related to the trust, including income and expenses. If you're unsure how to proceed, a living trust form sample for a family can provide guidance on structuring your trust correctly, helping you better understand your tax obligations. It's always wise to consult a tax professional for personalized advice tailored to your unique situation.

To create a living trust template, start by outlining your assets and beneficiaries. Then, research various living trust form samples for a family to find a format that aligns with your needs. Finally, customize the template to fit your unique situation, making sure to include all necessary legal stipulations.

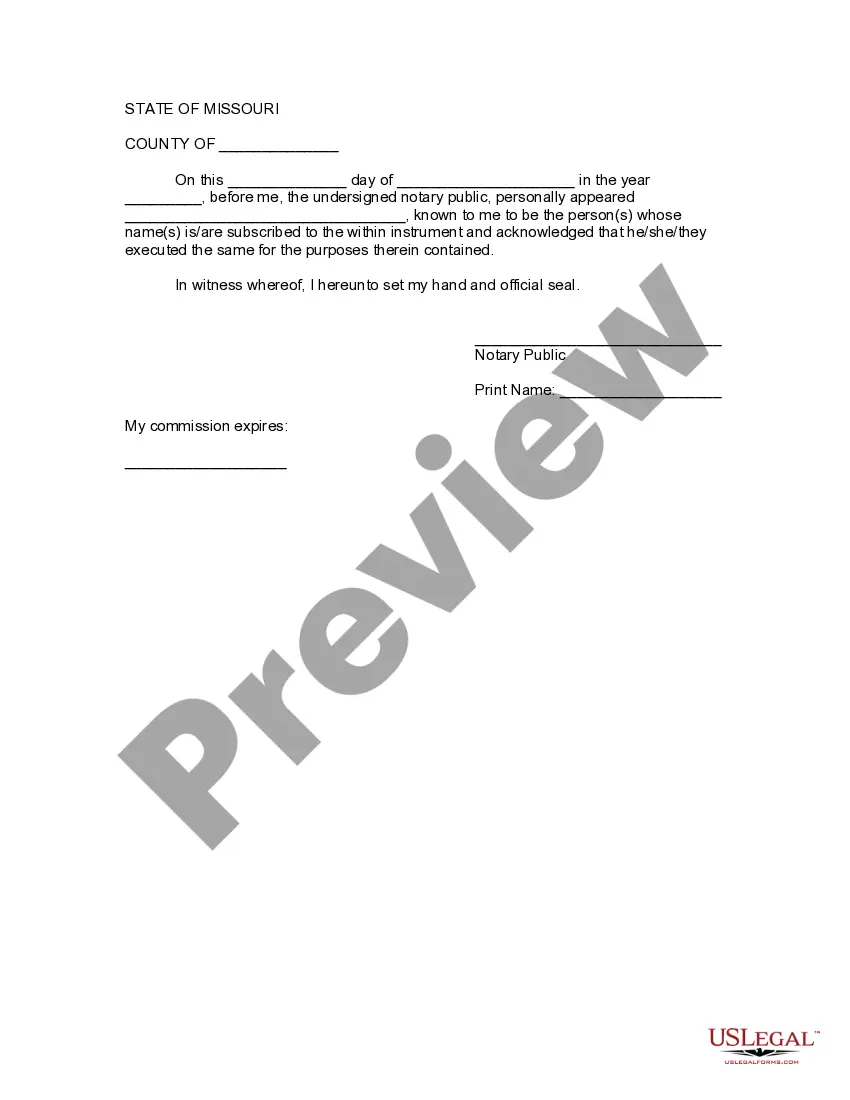

Certain legal agreements may require notarization, including wills, property deeds, and some business contracts. Notarization helps verify the identities of those involved and prevents future disputes. When using a living trust form sample for a family, consider notarizing it for added legal security.

Yes, you can create your own certificate of trust, which outlines essential details of your trust without disclosing its entire terms. Be sure to include key information such as the trust's name and its principal assets. A living trust form sample for a family can help you structure your certificate correctly.

Notarization of a family trust is not always required, but it can enhance the document's validity. Each state has different requirements, and notarization provides solid proof of authenticity. Using a well-prepared living trust form sample for a family can help you decide the best approach for your situation.

A trust document becomes legal when it is executed according to the laws of your state. This typically involves clear signatures from the trustor and, depending on the state, witnesses or notarization. Ensure your living trust form sample for a family contains the required information and complies with local regulations for legal standing.

In Texas, a trust is valid if it has a definite beneficiary and lawful purpose. The document must be signed by the trustor and, ideally, notarized for proof. Using a living trust form sample for a family ensures you include the necessary elements to establish a valid trust according to Texas law.

A trust may still be valid without notarization, but it's essential to check your state's laws. Some states allow trusts to be valid with the signatures of witnesses. However, having a notarized living trust form sample for a family can provide additional legal protection and avoid future disputes.

Creating a living trust by yourself starts with gathering important documents, like property deeds and financial information. Next, choose a living trust form sample for a family that suits your needs. Fill it out, ensuring all beneficiaries and assets are clearly defined. Finally, sign the document in front of witnesses, if required by your state laws.

A major downfall of having a trust can be the complexity involved in managing it over time. Families may encounter challenges if they do not keep the living trust form sample for a family up to date or fully funded, leading to potential issues in asset distribution later. Therefore, staying organized and regularly reviewing the trust can help mitigate these concerns.