Trust Account For Real Estate

Description

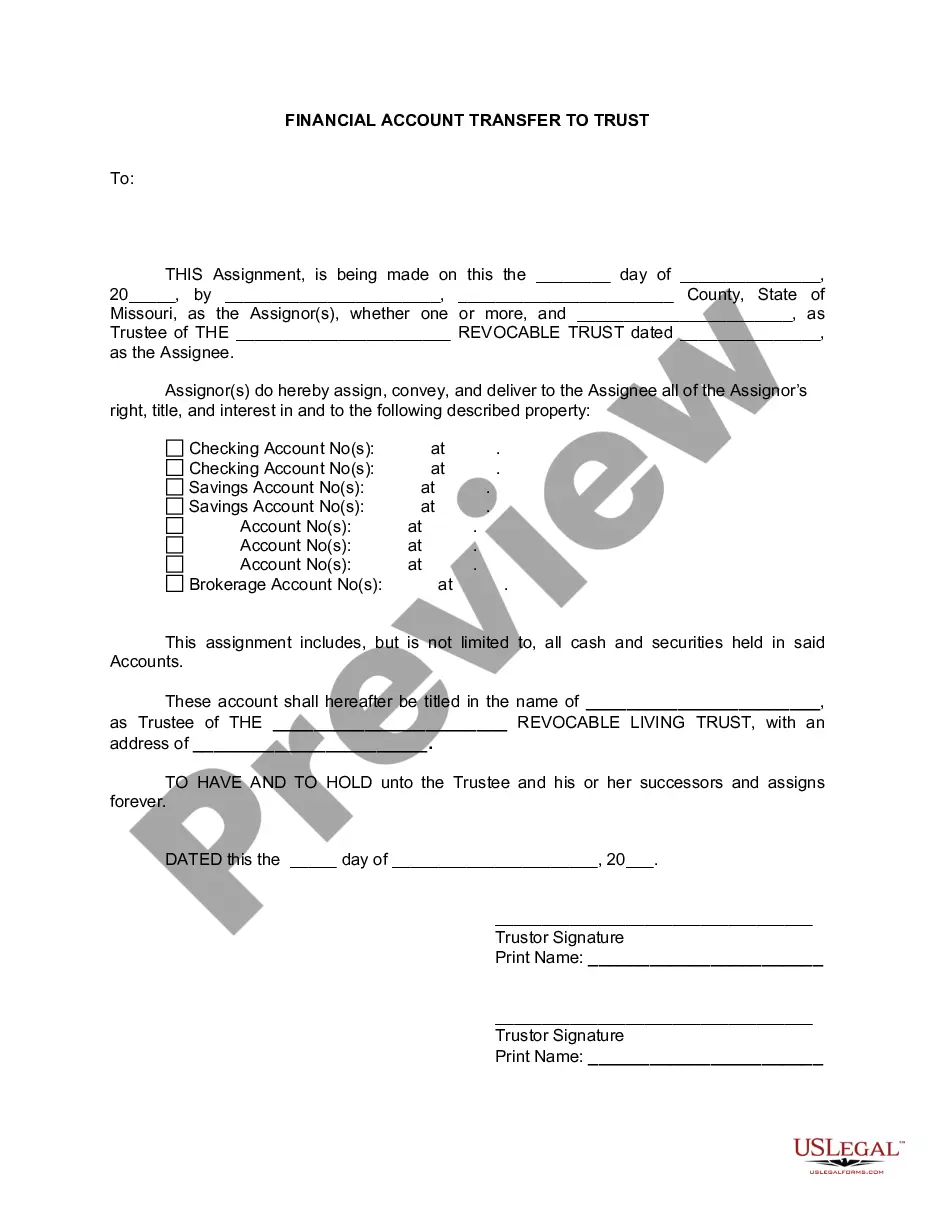

How to fill out Missouri Financial Account Transfer To Living Trust?

- First, log into your account on the US Legal Forms website. If you're a new user, register to create your account.

- Navigate to the form library and search for the 'trust account for real estate' template. Use the Preview mode to confirm it meets your requirements.

- If the template is not suitable, utilize the search feature to find another form that aligns with your local jurisdiction's regulations.

- Once finished with your search, click the 'Buy Now' button next to the desired template and select your subscription plan.

- Proceed to checkout by entering your payment information, either through credit card or PayPal, to complete your purchase.

- After purchase, download the form to your device and access it at any time through your profile under 'My Forms.'

By following these straightforward steps, you can efficiently obtain necessary legal forms for your trust account, ensuring compliance and accuracy in all transactions.

Remember, US Legal Forms provides an extensive collection of over 85,000 templates and access to premium experts to assist you. Get started today and secure your trust account for real estate!

Form popularity

FAQ

Choosing the best bank for a trust account for real estate depends on your specific needs. Look for banks that offer competitive fees, strong online banking features, and excellent customer support. It's also wise to consider banks with a history of managing trust accounts effectively. Researching and comparing your options will help you find the right financial partner for your real estate investments.

To open a trust account for real estate, start by gathering your necessary documents, such as your identification and property details. Then, contact a bank that offers trust accounts, and they will guide you through their specific application process. Many banks may require you to fill out forms and submit verification documents. Remember, a well-set-up trust account for real estate can help you manage funds securely and streamline transactions.

The biggest mistake parents often make is failing to regularly update their trust fund as circumstances change. As your family evolves, so do your financial needs and goals. A well-managed trust account for real estate should be revisited periodically to ensure it still reflects your current wishes and assets.

One disadvantage of an estate trust is the potential for higher administrative costs and legal fees. Managing a trust account for real estate may involve ongoing expenses that can accumulate over time. Additionally, certain tax implications can arise, making it essential to plan carefully.

Whether to file your trust as an estate depends on its specific structure and the assets involved. In many cases, a trust account for real estate may not require you to file as an estate until the individual passes away. It's advisable to consult with a tax professional to understand the implications specific to your situation.

To set up a trust account for an estate, first, decide on the type of trust that meets your needs. Then, you will typically need to gather relevant documents and choose a trustee. Consulting a legal expert can simplify this process and ensure all steps are properly executed for your real estate.

The best bank for opening a trust account for real estate often depends on your specific needs. Look for a bank with experience in trust accounts, favorable fees, and good customer service. Doing thorough research and reading reviews can guide you to the right choice for your assets.

A trust generally manages assets during a person's lifetime, while an estate trust typically comes into play after someone's passing. When you set up a trust account for real estate, you can control how your assets are distributed both during your life and afterwards. Knowing the difference helps you better plan your estate.

An irrevocable trust often stands out as the best trust for avoiding estate taxes. When you transfer assets into this trust, they are no longer considered part of your estate, effectively reducing your taxable estate value. However, managing an irrevocable trust requires careful planning and understanding of your financial situation. Utilizing a trust account for real estate can play a key role in your overall tax strategy.

A revocable living trust typically serves as the best trust for property. This trust allows you to keep control over your assets during your lifetime while providing a straightforward transfer to beneficiaries after death. It effectively simplifies the management of your properties and is flexible enough to adapt to changes in your situation. Your trust account for real estate will benefit from this streamlined process.