Trust Fund With Lawyer

Description

How to fill out Missouri Living Trust For Husband And Wife With Minor And Or Adult Children?

Managing legal documentation can be daunting, even for the most experienced experts.

If you are looking for a Trust Fund With Lawyer and lack the time to dedicate to finding the correct and current version, the process can be challenging.

US Legal Forms caters to all your needs, from personal to business documentation, all in one place.

Leverage advanced tools to manage your Trust Fund With Lawyer effectively.

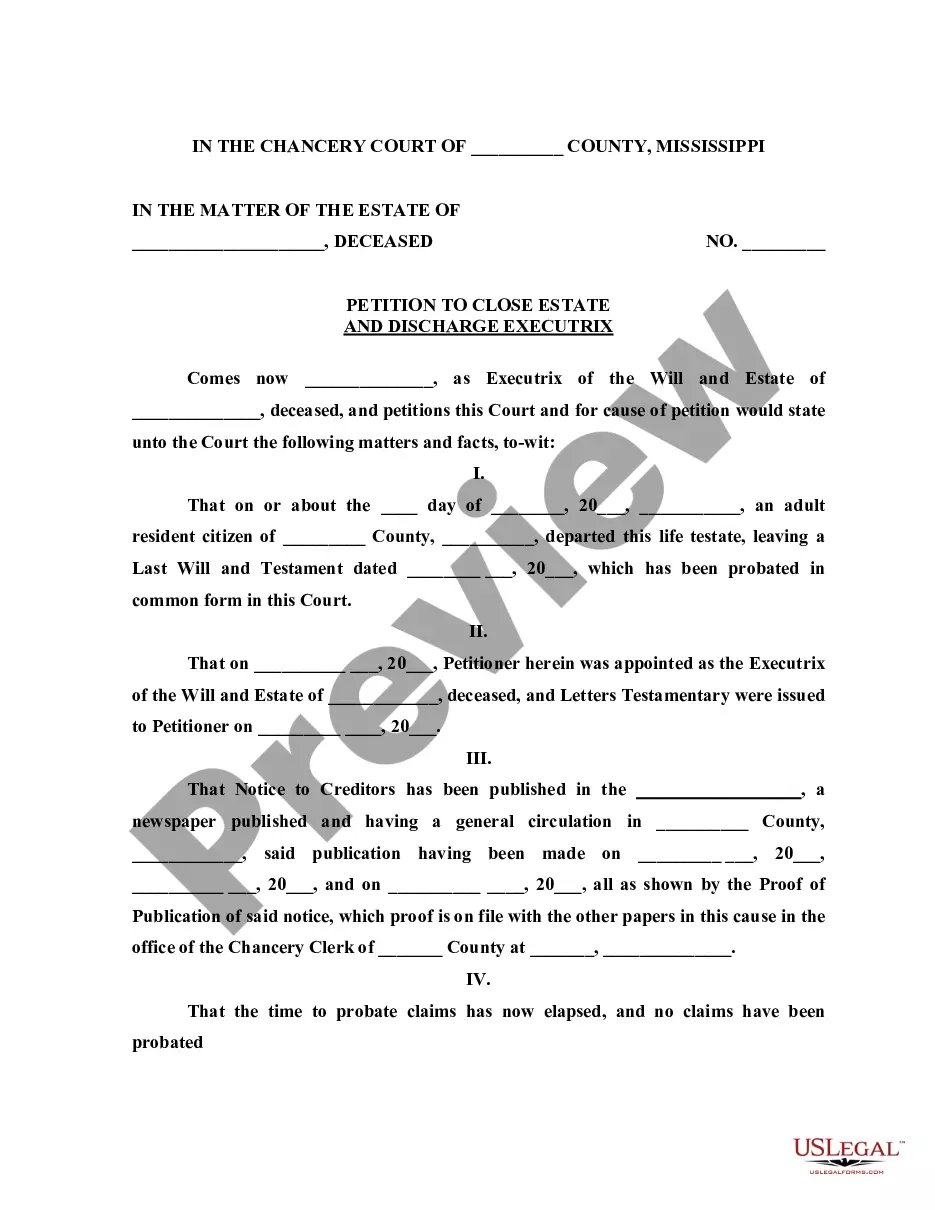

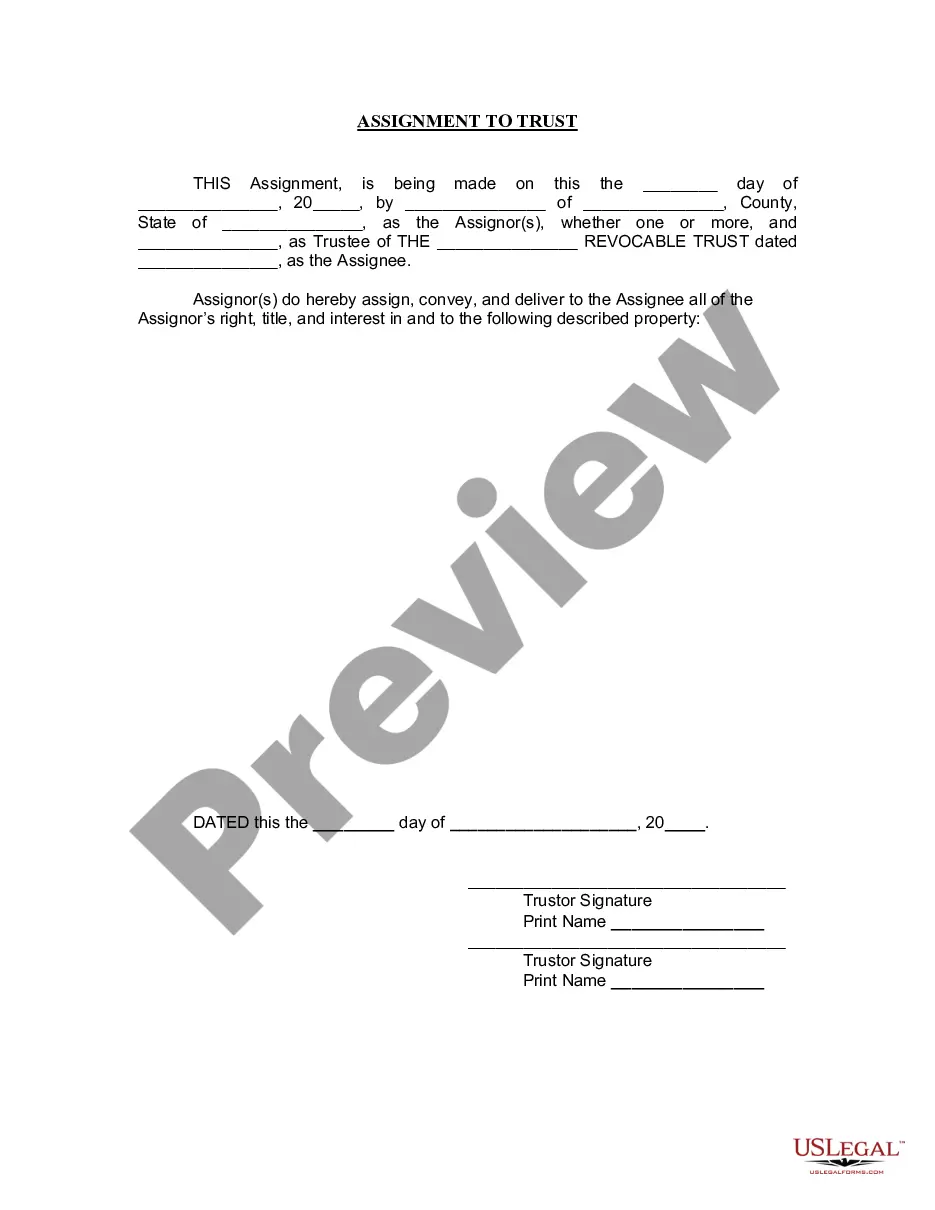

Here are the steps to follow after locating the form you need: Verify it is the correct form by previewing it and reviewing its details. Confirm that the template is recognized in your state or county. Click Buy Now when ready. Choose a subscription option. Locate the desired format, and Download, fill out, eSign, print, and submit your documents. Take advantage of the US Legal Forms online library, supported by 25 years of experience and trustworthiness. Streamline your everyday document management into a seamless and user-friendly process today.

- Access a valuable collection of articles, manuals, and resources pertinent to your situation and needs.

- Save time and energy searching for the required documents, and utilize US Legal Forms’ sophisticated search and Preview feature to find Trust Fund With Lawyer and obtain it.

- If you hold a membership, Log In to your US Legal Forms account, search for the form, and download it.

- Check the My documents section to review the documents you have previously acquired and manage your folders as desired.

- If this is your first time using US Legal Forms, create a complimentary account to gain unlimited access to all platform benefits.

- An extensive online form library can significantly enhance the experience for anyone aiming to handle these matters efficiently.

- US Legal Forms stands as a leader in the realm of online legal documents, offering over 85,000 state-specific forms available at your convenience.

- With US Legal Forms, you can access legal and business forms that are specific to your state or county.

Form popularity

FAQ

A trust balance with a lawyer refers to the funds held in a trust account managed by a legal professional on your behalf. This arrangement ensures that your assets are safeguarded and distributed according to your wishes. When you establish a trust fund with a lawyer, you gain peace of mind knowing that your financial matters are in capable hands. Trust balances can be utilized for various purposes, including estate planning, managing inheritances, and ensuring compliance with legal obligations.

One of the biggest mistakes parents make when setting up a trust fund with lawyer is failing to clearly specify their wishes. Ambiguities can lead to disputes among beneficiaries and may undermine the intended purpose of the trust. Additionally, not reviewing or updating the trust regularly can result in outdated provisions that do not reflect current circumstances. Consulting a legal expert helps ensure your trust aligns with your intentions and adapts to life changes.

While you can fill out your own trust, working with a trust fund with lawyer can ensure that all legal requirements are met. A lawyer can help you navigate complex laws and tailor the trust to fit your unique needs. This approach can save you time and potentially prevent costly mistakes. It's beneficial to consider professional assistance for peace of mind.

SCR .15(f) requires trust account checks to be pre-printed and pre-numbered. The rule further specifies that the name and address of the lawyer or law firm and the name of the account must be printed in the upper left corner of the check.

Less than 2 percent of the U.S. population receives a trust fund, usually as a means of inheriting large sums of money from wealthy parents, ing to the Survey of Consumer Finances. The median amount is about $285,000 (the average was $4,062,918) ? enough to make a major, lasting impact.

Any assets which are transferred into the trust belong to the beneficiaries and must be managed on their behalf. Just as it would be inappropriate for an attorney to use a client's checking account to pay for office supplies, it would be inappropriate for them to use beneficiaries' funds on themselves.

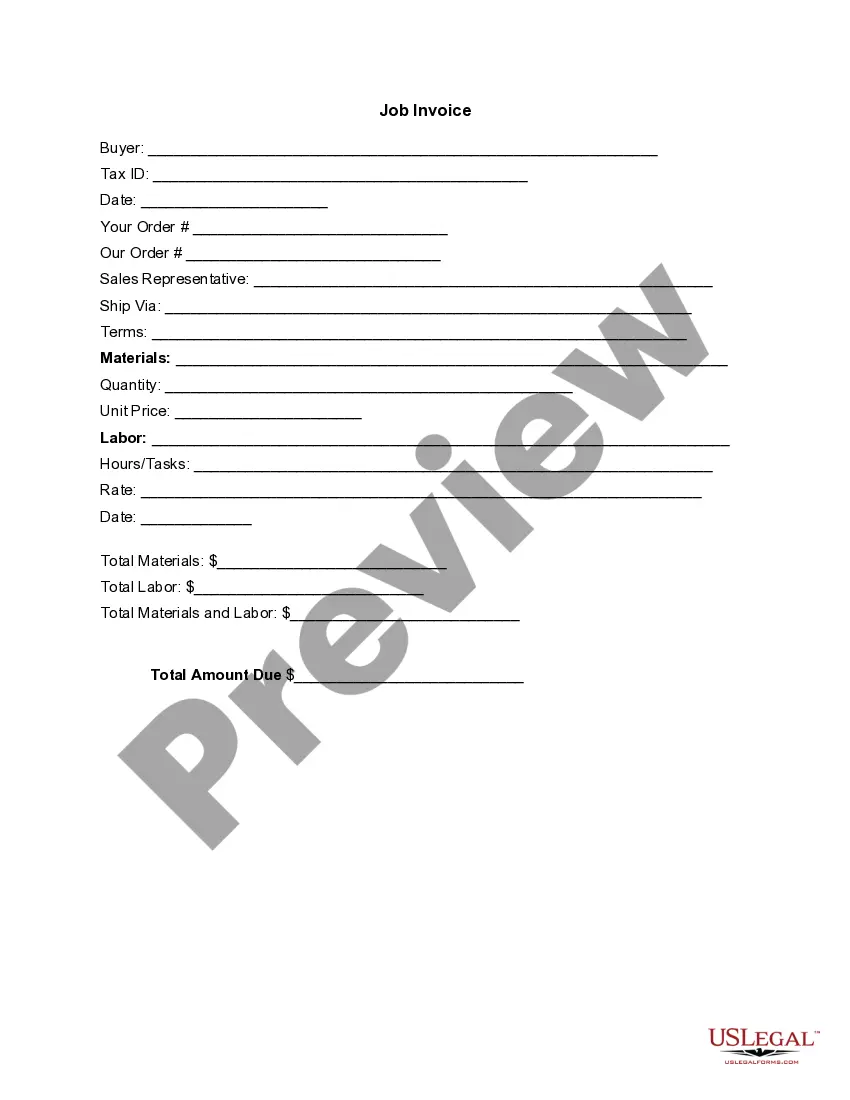

How to Fund a Trust: Bank Accounts and Other Financial Accounts Contact your bank to see what's required to transfer your accounts to the Trust. Your bank will provide any necessary forms. Complete, sign and return forms to your bank. ... Have the bank change the title to the Trustee of the Trust.

For trust accounts, the check can be payable to the custodian, the trustee, or the name of the trust account ? but it must appear exactly as it's registered on the account. Any deviation will cause the check to be returned.