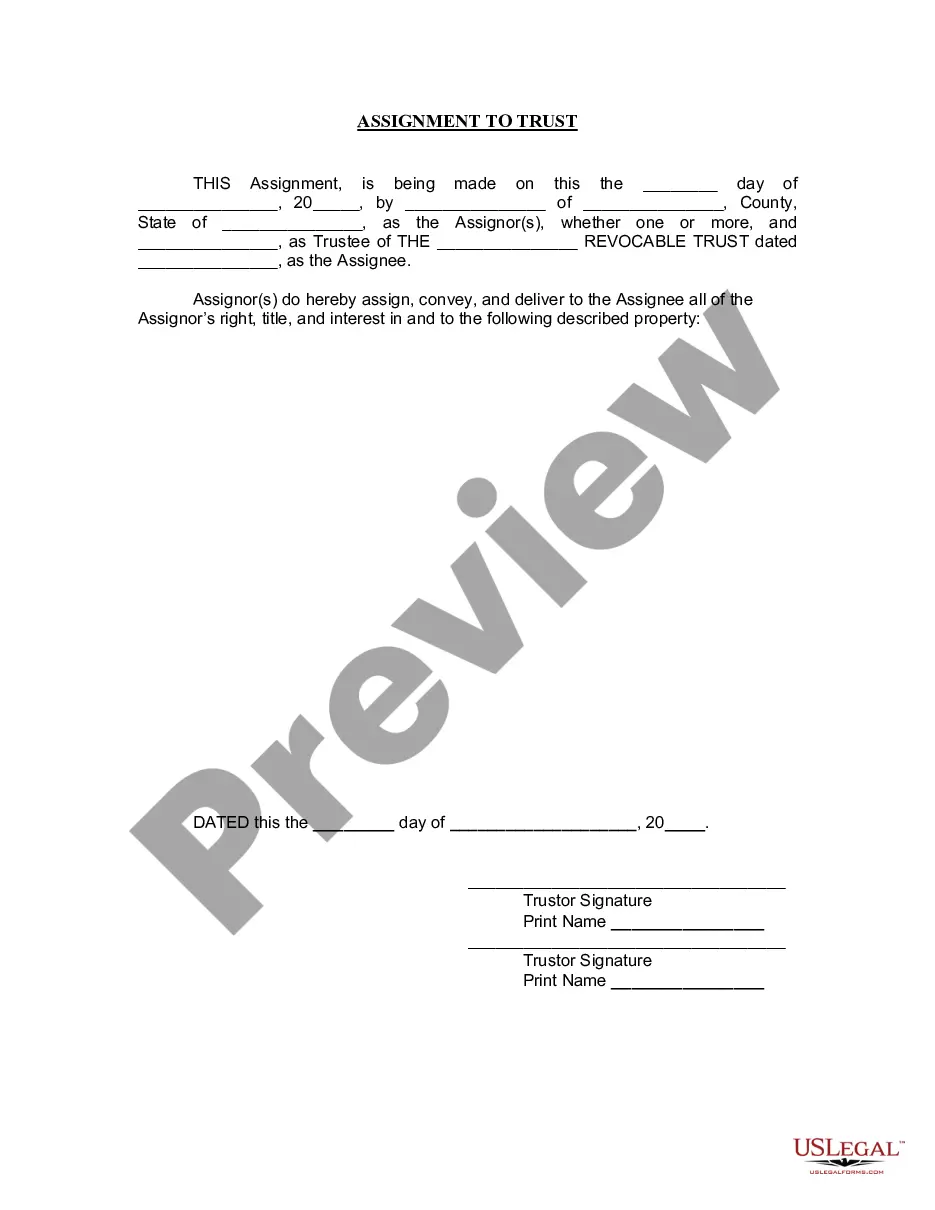

This Assignment to Trust form is used to assign all right, title and interest in specific property to a Living Trust. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. This form must be signed by the Assignor before a notary public.

Missouri Assignment to Living Trust

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Missouri Assignment To Living Trust?

Obtain any version from 85,000 lawful documents like Missouri Assignment to Living Trust online with US Legal Forms. Each template is crafted and refreshed by state-certified attorneys.

If you possess a membership, Log In. After reaching the form’s page, click the Download button and navigate to My documents to retrieve it.

If you have not yet subscribed, follow the instructions outlined below.

With US Legal Forms, you’ll consistently have instant access to the appropriate downloadable sample. The platform provides access to documents and categorizes them to simplify your search. Utilize US Legal Forms to acquire your Missouri Assignment to Living Trust swiftly and effortlessly.

- Verify the state-specific prerequisites for the Missouri Assignment to Living Trust you wish to utilize.

- Examine the description and view the sample.

- When you’re confident the template meets your needs, click Buy Now.

- Choose a subscription plan that fits your financial situation.

- Establish a personal account.

- Make payment in one of two convenient methods: by credit card or through PayPal.

- Select a format to download the document in; two options are available (PDF or Word).

- Save the document to the My documents section.

- Once your reusable template is downloaded, print it out or save it on your device.

Form popularity

FAQ

Setting up a living trust in Missouri involves several steps, starting with defining your goals and determining which assets to include in the trust. Next, you will need to draft the trust document, specifying the trust's terms and appointing a trustee. After that, you can transfer your assets to the trust, completing the Missouri Assignment to Living Trust process. Utilizing US Legal Forms can streamline this journey by providing the necessary templates and expert guidance to ensure your trust is established correctly.

Creating an addendum to a living trust involves drafting a document that outlines the changes you wish to make, such as adding or removing beneficiaries or modifying asset allocations. This addendum should clearly reference the original trust and specify the modifications, ensuring that it aligns with Missouri Assignment to Living Trust regulations. It is wise to have this document signed and notarized to confirm its validity. US Legal Forms offers resources to help you create an effective addendum that meets legal requirements.

To assign assets to a living trust, you first need to identify the assets you want to transfer, such as real estate, bank accounts, or investments. Then, you must complete a Missouri Assignment to Living Trust document for each asset, which legally transfers ownership from you to the trust. It is important to update titles or deeds accordingly, ensuring that the trust is named as the new owner. Using platforms like US Legal Forms can simplify this process, providing you with the necessary templates and guidance.

The average cost for an attorney to create your trust ranges from $1,000 to $1,500 for an individual and $1,200 to $1,500 for a couple. Legal fees vary by location, so your costs could be much higher or slightly lower.

Choose whether to make an individual or shared trust. Decide what property to include in the trust. Choose a successor trustee. Decide who will be the trust's beneficiaries who will get the trust property. Create the trust document.

No, you don't need a lawyer to set up a trust, but it might be a good idea to seek legal advice to ensure the trust is set up correctly and that you have considered all long-term financial and estate planning aspects of the trust.Some living trusts are revocable, which means the trust can be changed at any time.

You can change your living trust, usually without incurring lawyer bills.Because you and your spouse made the trust together, you should both sign the amendment, and when you sign it, get your signatures notarized, just like the original. Another way to go is to create a "restatement" of your trust.

The process of funding your living trust by transferring your assets to the trustee is an important part of what helps your loved ones avoid probate court in the event of your death or incapacity. Qualified retirement accounts such as 401(k)s, 403(b)s, IRAs, and annuities, should not be put in a living trust.

Choose whether to make an individual or shared trust. Decide what property to include in the trust. Choose a successor trustee. Decide who will be the trust's beneficiaries who will get the trust property. Create the trust document.

Funding a Trust Is Expensive... This is the major drawback to using a revocable living trust for many people, but it's not worth the time, money, and effort to create one if the trust isn't fully funded.