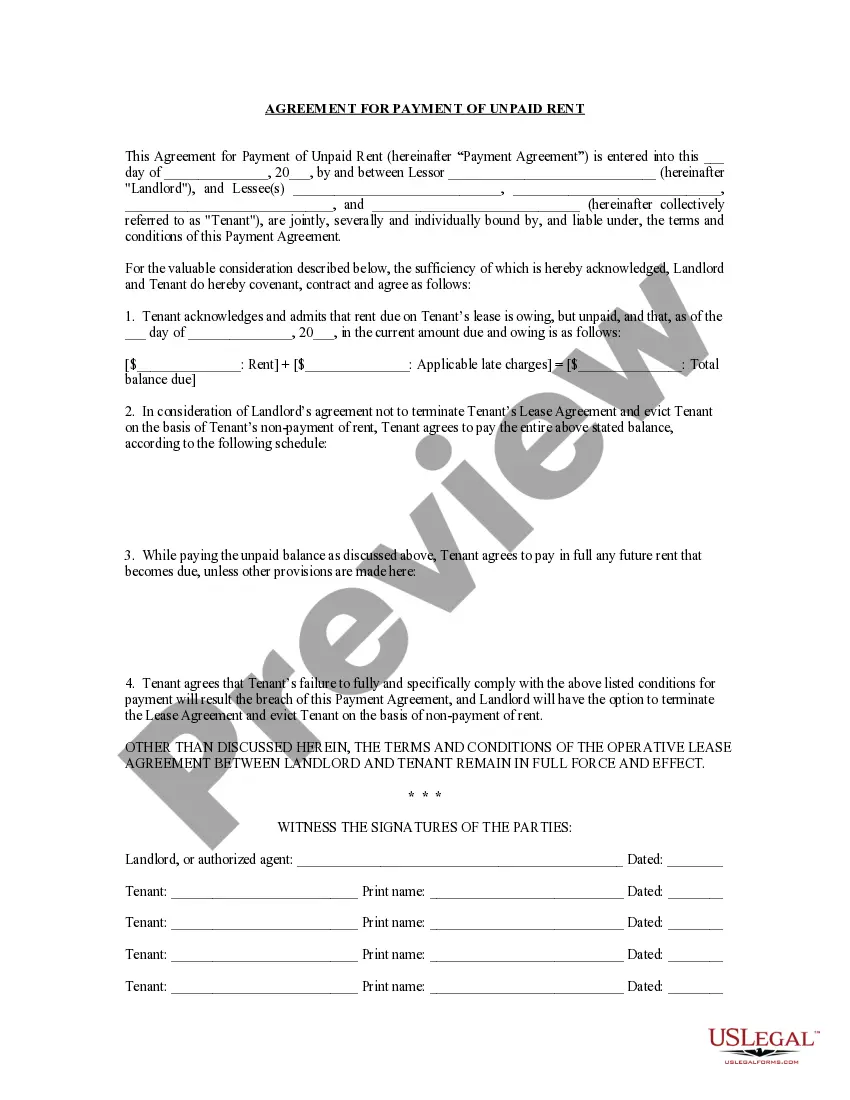

This Agreement for Payment of Unpaid Rent is an agreement between a landlord and tenant. An Agreement for Payment of Unpaid Rent provides for the structuring and deadlines for a tenant's payment of overdue rent in return for landlord agreeing not to have tenant evicted. This form meets all state law specifications.

Unpaid Rent In Income Statement

Description

Form popularity

FAQ

To account for unpaid rent, you should track it through your accounts receivable. Record the unpaid rent by crediting your rental income and debiting the accounts receivable. This practice ensures that your income statement displays all income expected, enhancing the precision of your financial representation. Software solutions like those offered by US Legal Forms can assist you in managing these entries effectively.

When you have rent not received, it is essential to record it as an accounts receivable in your financial records. You will log this by crediting the rental income account and debiting accounts receivable, indicating that you expect the payment. This accounting method allows your income statement to reflect income that you anticipate receiving, despite it being unpaid at the moment. Utilizing tools from US Legal Forms can simplify this process for you.

Rent received is recorded as rental income on the income statement. This entry increases your revenue, contributing positively to your financial performance. It is important to differentiate between received rent and unpaid rent in your accounting records, as this affects your net income. You want to ensure clarity in your financial statements to avoid misinterpretation.

To record unpaid rent, you typically create a journal entry that reflects the income you expect but have not yet received. This involves debiting the accounts receivable and crediting the rental income account. By doing this, you ensure that your income statement accurately represents the expected earnings, even when you have unpaid rent included. Using a platform like US Legal Forms can help streamline this process by providing templates and resources for accurate accounting.

To report unpaid rent on your credit report, you typically need to document the unpaid balance and notify credit reporting agencies. This action will ensure that potential creditors are aware of your financial obligations. Remember that unpaid rent in the income statement can reflect poorly, so addressing it early is advisable. Platforms like US Legal Forms can assist in properly documenting overdue rent.

Leases usually appear under operating expenses in the income statement. They represent contractual obligations that you must cover, impacting your overall profitability. Recording unpaid rent in the income statement offers a comprehensive view of your financial responsibilities. Keeping track of these items helps you manage your accounts effectively.

Rent typically falls under the 'expenses' or 'operating expenses' accounts in financial reports. This classification helps clarify how much a business spends on rented properties or facilities. When you are reporting unpaid rent in the income statement, it’s essential to keep it distinguished for clear financial analysis. This classification aids you in tracking costs and making informed decisions.

To claim unpaid rent on your taxes, you can recognize it as income when it is due, even if you have not yet collected it. You should record this in your income statement, but ensure you provide documentation to support your claim. Using resources like US Legal Forms can help guide you through the process of accurately reporting this unpaid rent to remain compliant with tax laws.

In an income statement, rent typically falls under the revenue section as part of your total income. It is important to categorize it correctly to reflect the amount received and any unpaid rent effectively. This proper classification helps stakeholders understand your financial performance and can influence investment decisions.

Not reporting rental income can lead to serious consequences, including fines and penalties from the IRS. Failing to disclose this information might trigger an audit, which can result in back taxes or legal troubles. It's important to report all income, including any unpaid rent in your income statement, to avoid complications and ensure compliance with tax laws.