Irrevocable Trust Trustor With Trust

Description

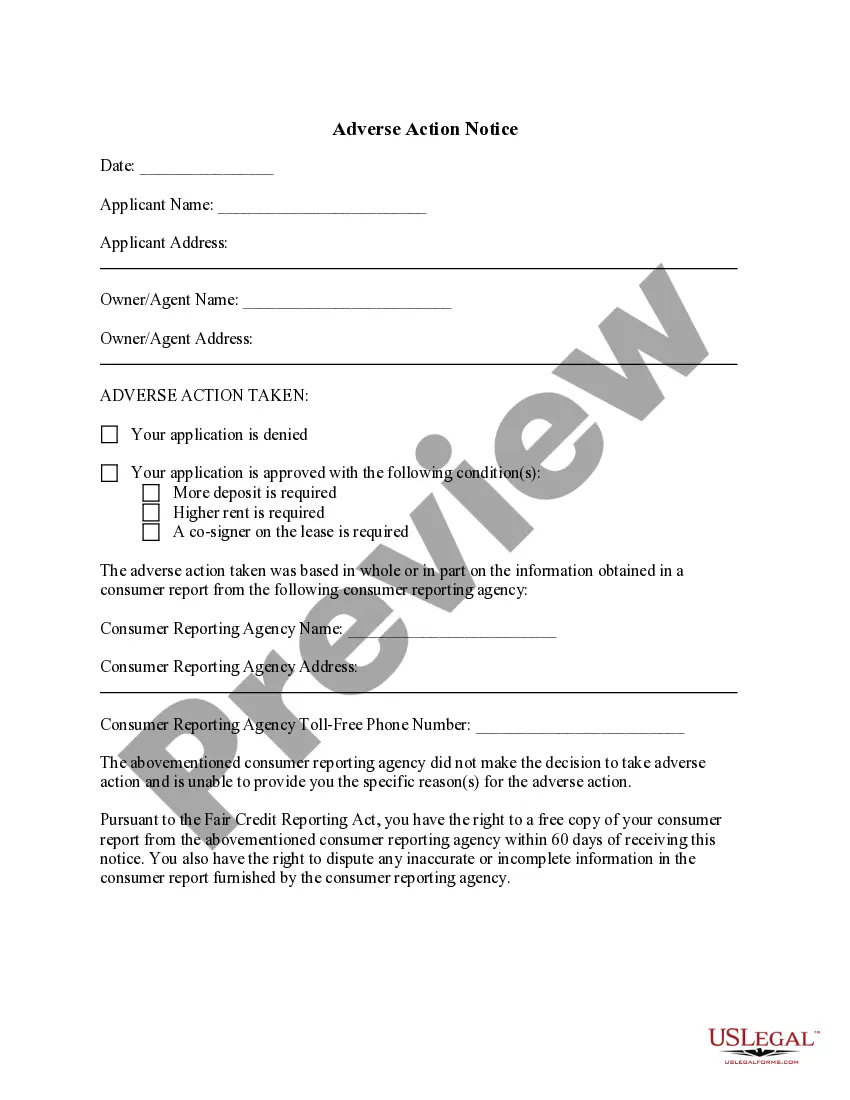

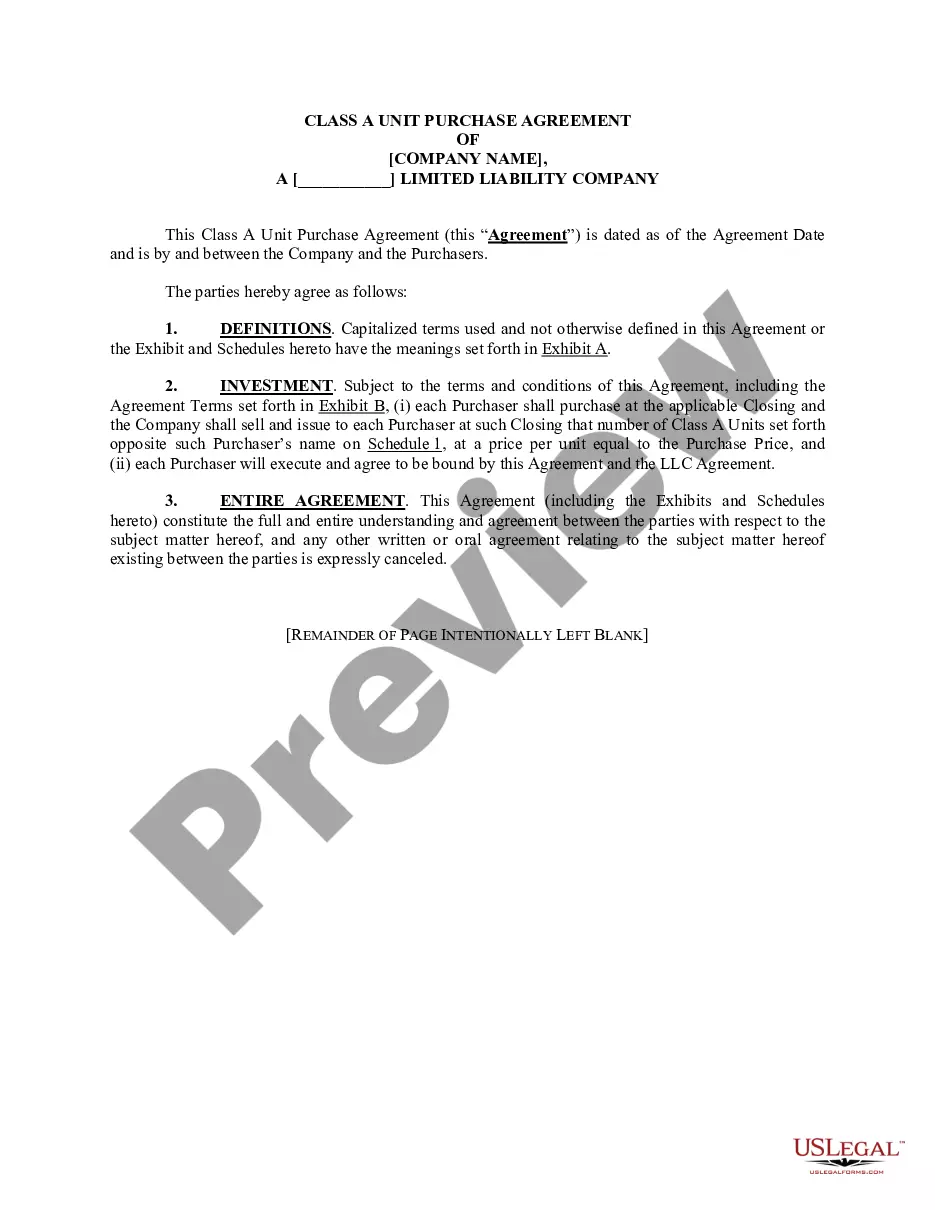

How to fill out Missouri Self-Settled Irrevocable Trust For Lifetime Benefit Of Trustor With Power Of Invasion In Trustor?

- If you're a returning user, log into your account. Ensure your subscription is active before downloading your trust form from your account's dashboard.

- For first-time users, start by exploring the Preview mode of the chosen form to confirm its suitability for your jurisdiction and needs.

- If you need a different form, utilize the Search feature to find a template that complies with your requirements.

- Purchase the desired document by clicking the Buy Now button. Select the subscription plan that best suits you and create an account to gain access.

- Enter your payment details, either by credit card or PayPal, to confirm your subscription.

- Once your purchase is complete, download the form to your device. You can also access it anytime via the My Forms section of your profile.

US Legal Forms provides an extensive library of over 85,000 legal templates that are fillable and editable, giving you the advantage of choice and customization. Their premium expert assistance ensures that your documents are not only accessible but also legally sound.

Take charge of your estate planning today. Visit US Legal Forms to explore your options and secure your irrevocable trust document effectively!

Form popularity

FAQ

When creating an irrevocable trust, avoid putting assets that you may need to access in the future. Additionally, highly volatile investments or assets that require close management are not ideal choices. Remember, once assets are transferred to the trust, you cannot reclaim them. It's advisable to consult with professionals like uslegalforms to ensure you make informed decisions.

The concept of ownership in an irrevocable trust is different from traditional ownership. The trustee acts as the legal owner while the beneficiaries receive the benefits of the trust. As the trustor, you create the trust but do not retain ownership of the assets placed in it. Understanding this distinction is essential for effective estate planning and asset protection.

An irrevocable trust does not have an owner in the conventional sense; rather, the trustee manages the assets for the beneficiaries. The trustor, who establishes the trust, relinquishes ownership and control over the assets. This separation is fundamental in preserving the trust's integrity. Thus, your role as a trustor shifts to that of a facilitator of the terms laid out in the trust document.

The title of the owner of a trust typically refers to the trustee, who holds legal title to the assets. However, it's important to note that the beneficiaries hold the equitable title, meaning they benefit from the trust’s assets. As a trustor, clear documentation will outline the roles and responsibilities of both the trustee and beneficiaries. This clarity is vital for avoiding misunderstandings in the trust's operation.

Generally, you cannot be the trustee of your own irrevocable trust if you want to maintain certain tax benefits and legal protections. Assigning a separate trustee allows the trust to be independent of the trustor. It's essential to choose a reliable individual or institution that can properly manage the trust's assets. This step ensures that the interests of the beneficiaries are prioritized.

In irrevocable trusts, the beneficiaries are considered the beneficial owners. They receive the benefits from the trust and have rights to the assets as defined by the trust agreement. Importantly, as a trustor, once you establish an irrevocable trust, you relinquish control over those assets. This can provide protection from creditors and estate taxes.

In a unit trust, the legal ownership of assets belongs to the trustee. The trustee manages the assets in the best interest of the beneficiaries. As the trustor, you can define how the trust operates and who receives the benefits from it. It's crucial to have a clear agreement to ensure that the trust's objectives are met.

Yes, you can designate yourself as the trustee of an irrevocable trust under certain conditions. However, as the irrevocable trust trustor with trust, doing so may complicate the purpose and intent of the trust. It's wise to evaluate your circumstances and consider having an independent trustee, which can help maintain the trust’s integrity and ensure proper management.

Recent regulations may affect how irrevocable trusts are treated for tax purposes and asset protection. It's essential to stay updated on any changes relevant to the irrevocable trust trustor with trust, as these could impact your financial planning. Engaging with resources from platforms like US Legal Forms can help you navigate these updates and keep your trust compliant.

For an irrevocable trust to be valid, it must meet certain legal requirements, including clear intention from the irrevocable trust trustor with trust to establish the trust. Additionally, the trust must have a defined beneficiary and a competent trustee. Proper drafting by a qualified professional ensures that all requirements are fulfilled, helping you avoid potential challenges in the future.