Missouri Lien Waiver Form Statute

Description

Form popularity

FAQ

To obtain a lien release in Missouri, you need to ensure you have received full payment for the services or materials provided. Once payment is confirmed, use the Missouri lien waiver form statute to create a formal lien release document. This document should clearly state that the debt has been settled and should be signed by the lienholder. If you prefer an easy solution, consider using US Legal Forms to access templates and filing instructions tailored to Missouri's laws.

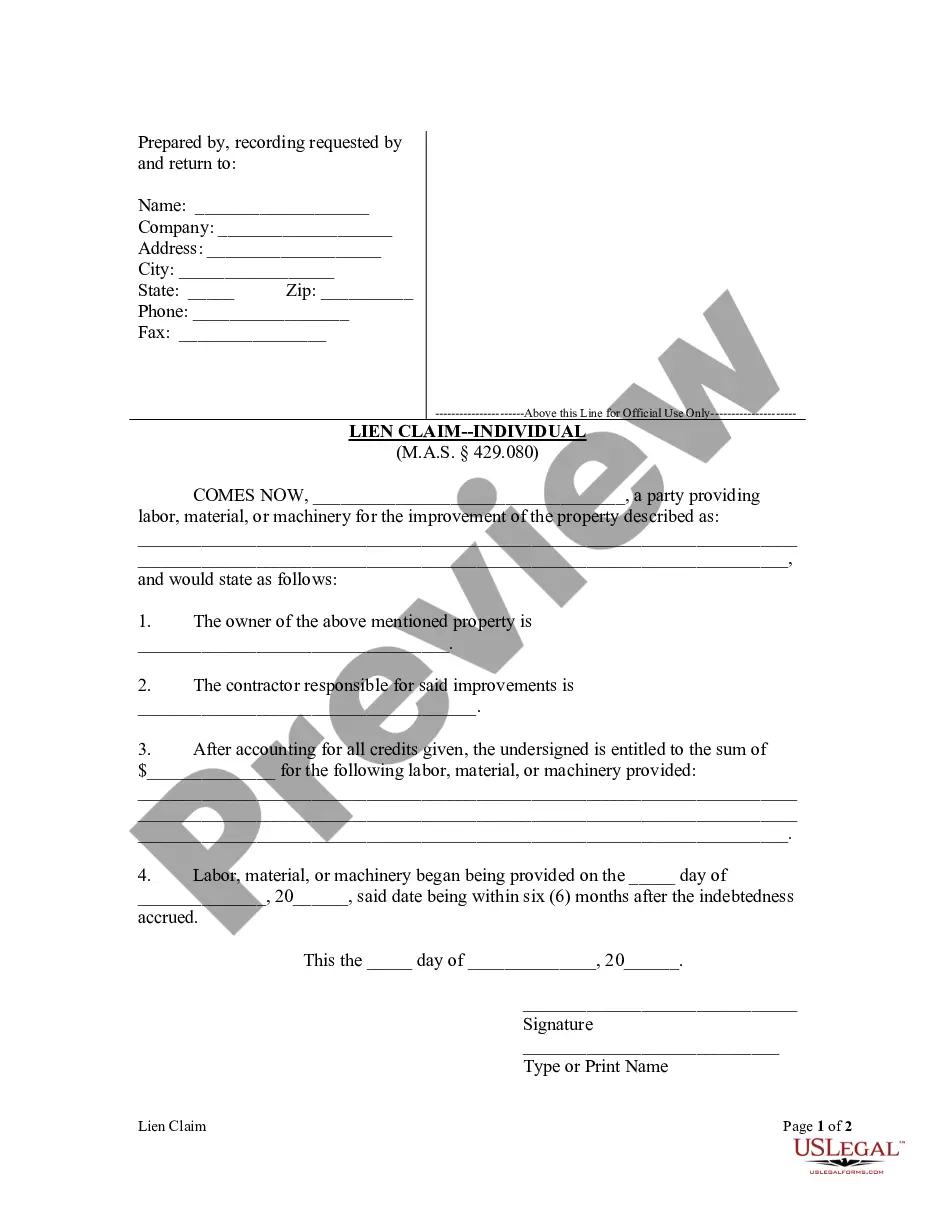

In Missouri, you typically have six months to file a lien after providing labor or materials for a property. If you miss this window, you may lose your right to place a lien on the property. It’s vital to act promptly, and the Missouri lien waiver form statute can guide you through the filing process. Using our platform can simplify your understanding and execution of lien waivers.

Liens in Missouri serve as legal claims against property, allowing creditors to secure payments. When a lien is placed, it prevents the property owner from selling or refinancing the property without settling the debt. It is crucial for property owners to understand how liens function within the context of the Missouri lien waiver form statute. This knowledge can help in managing relations with creditors and ensuring proper legal compliance.

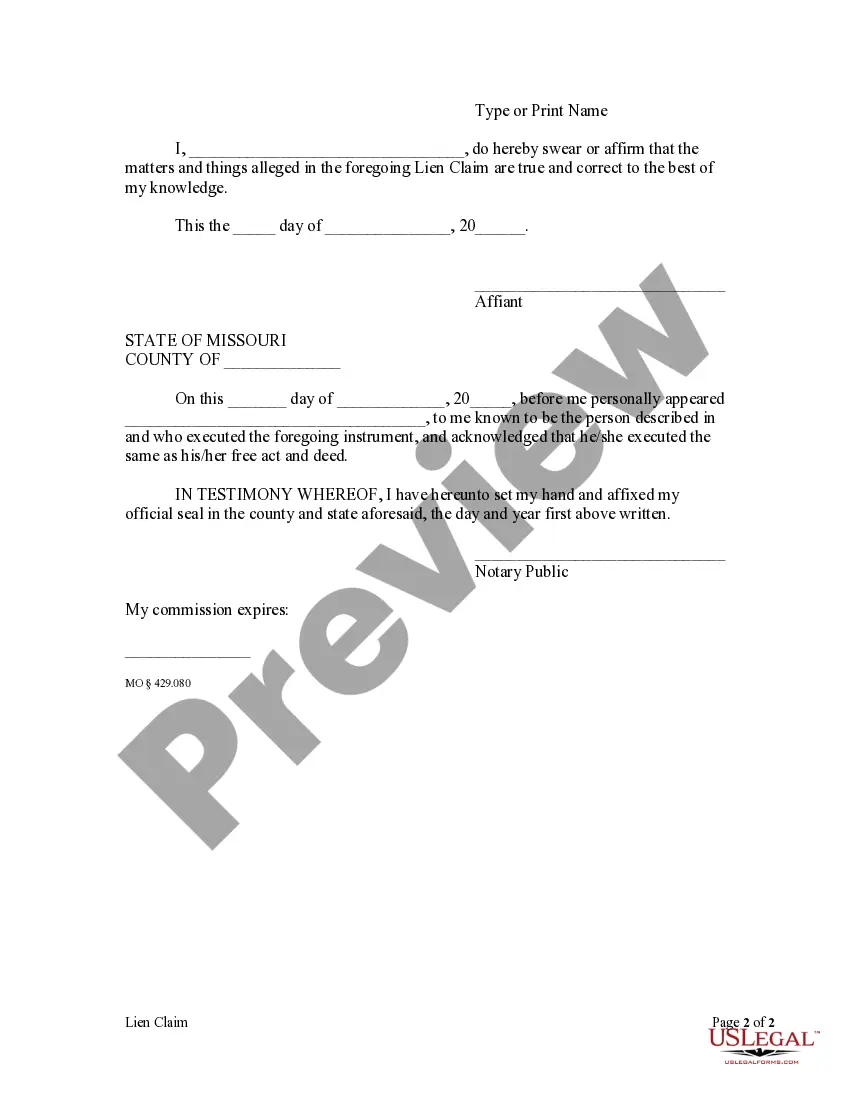

Yes, lien releases must be notarized in Missouri. This requirement ensures that the signatures on the document are verified and legitimate. A notarized lien release provides protection for all parties involved, confirming that the debt has been satisfied. You can refer to the Missouri lien waiver form statute for proper procedures and guidelines.

In Missouri, the statute of limitations for most debts is typically five years. This means that creditors have five years to initiate legal action to collect a debt. It is important to understand this timeframe to protect your rights. If you need assistance with lien documents, consider the Missouri lien waiver form statute, which can clarify your obligations and rights.

The process of releasing a lien is generally called the 'release of lien.' This action removes the claim against a property and informs the public that the lien is no longer valid. According to the Missouri lien waiver form statute, completing this form accurately is crucial to ensure that all legal provisions are satisfied. If you are unsure about any step, USLegalForms offers straightforward templates and support for a smooth process.

Yes, Missouri does have statutory lien waivers which are designed to protect parties involved in construction and other contracts. These waivers follow specific guidelines outlined in the Missouri lien waiver form statute, providing assurance to parties that their payments are secure. It is important to use the correct forms and understand how these waivers work to avoid potential issues. For comprehensive resources, consider visiting USLegalForms for the appropriate templates.

To release a lien in Missouri, you must file a Release of Lien form with the appropriate county office. This typically involves completing the form, obtaining the signature of the lien holder, and submitting it along with any required fees. Ensuring compliance with the Missouri lien waiver form statute helps prevent future disputes. If you need assistance, platforms like USLegalForms can guide you through this process.

Statute 429.016 in Missouri pertains to mechanics' liens, specifically addressing the requirements for perfecting such liens. This statute outlines procedures for contractors and suppliers to secure their rights when owed for work completed on a property. Familiarity with statute 429.016 is important for anyone dealing with the Missouri lien waiver form statute, as it impacts how liens are enforced.

The statute of limitations on a lien in Missouri is generally five years from the time the lien is filed. After this period, you may lose your ability to enforce the lien unless legal action is taken beforehand. Being aware of this timeline is crucial to effectively manage your claims under the Missouri lien waiver form statute.