Missouri Lien Claim - Individual

Overview of this form

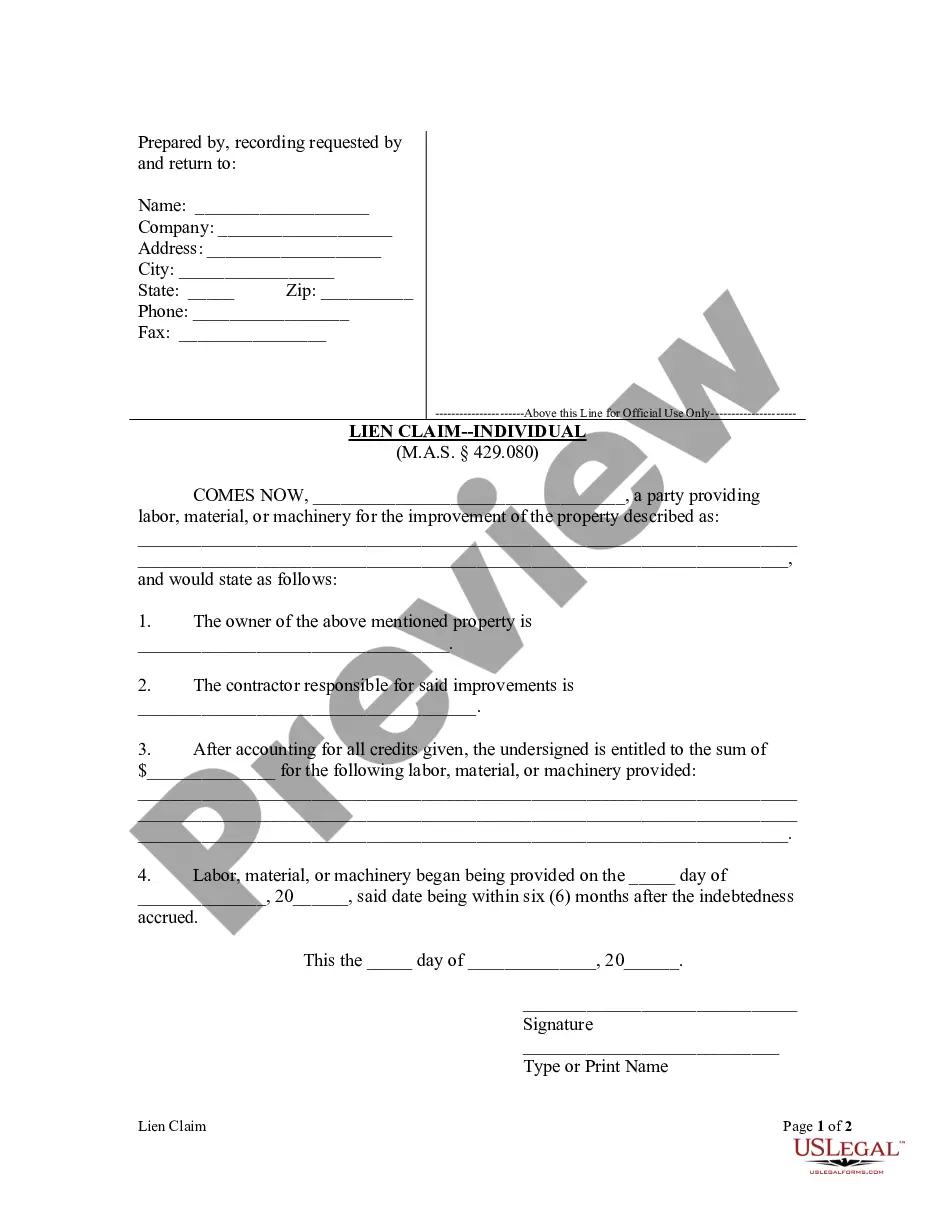

The Lien Claim - Individual form is a legal document used to assert a claim for payment against a property owner for labor, materials, or machinery provided during property improvement. This form is specific to individual claimants and serves to establish a contractor's right to collect payment. It differs from other lien forms by being tailored for individual service providers rather than companies or corporations.

Key components of this form

- Identification of the lien claimant's name and contact details.

- Details about the property where improvements were made.

- Identification of the property owner and contractor.

- Specific amount owed after accounting for any credits.

- Dates when work commenced and the filing date of the claim.

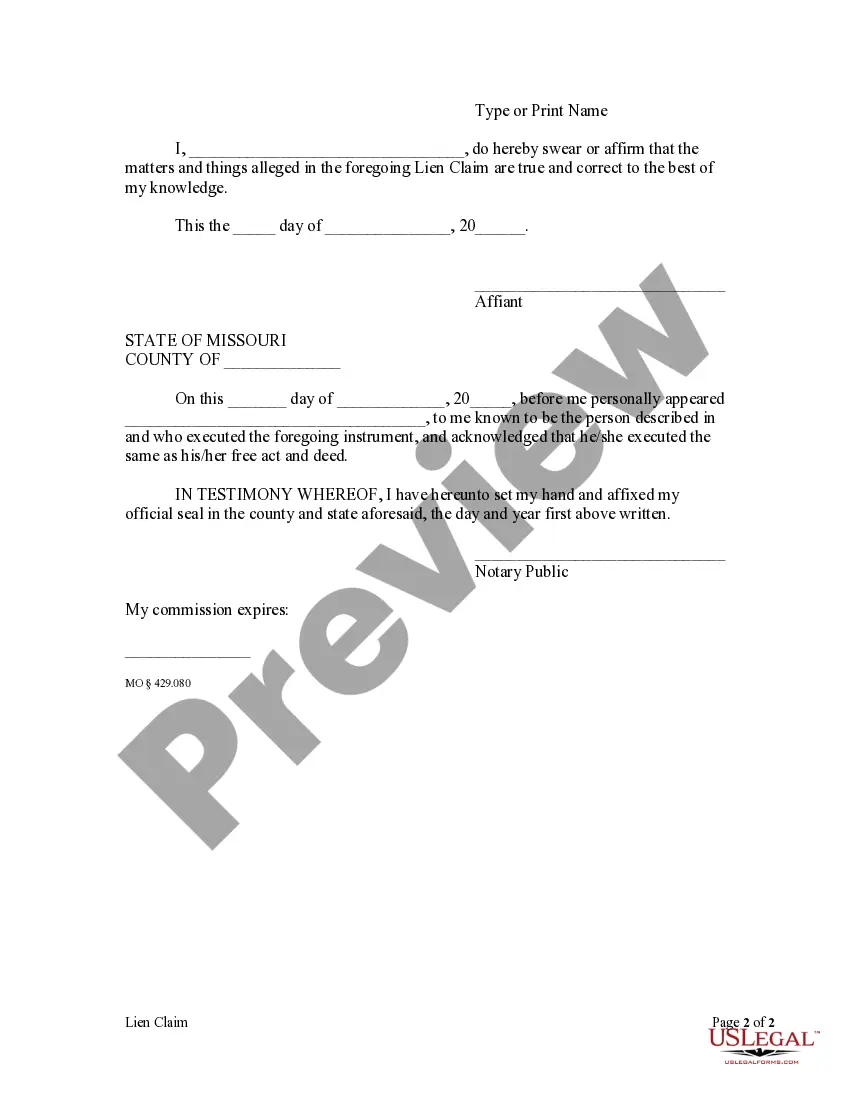

- A sworn affirmation that the details provided are accurate.

Common use cases

This form should be used when an individual contractor has provided labor, materials, or machinery for the improvement of a property and has not been paid. It's essential to file the Lien Claim within six months of the debt accruing, making this form vital for protecting the contractor's right to payment through a legal claim against the property.

Intended users of this form

- Individual contractors who have provided services or materials for a property improvement.

- Subcontractors working independently from the primary contractor.

- Material suppliers who have not received full payment for provided goods.

- Anyone entitled to file a lien under Missouri's statutes as an individual claimant.

Steps to complete this form

- Identify and enter your name, company, and contact information at the top of the form.

- Provide a description of the property where the work was done, including its address.

- Fill in the owner's name and the contractor responsible for the work.

- State the total amount due after all credits and outline the services or materials provided.

- Include the start date of when the work commenced and the date of filing.

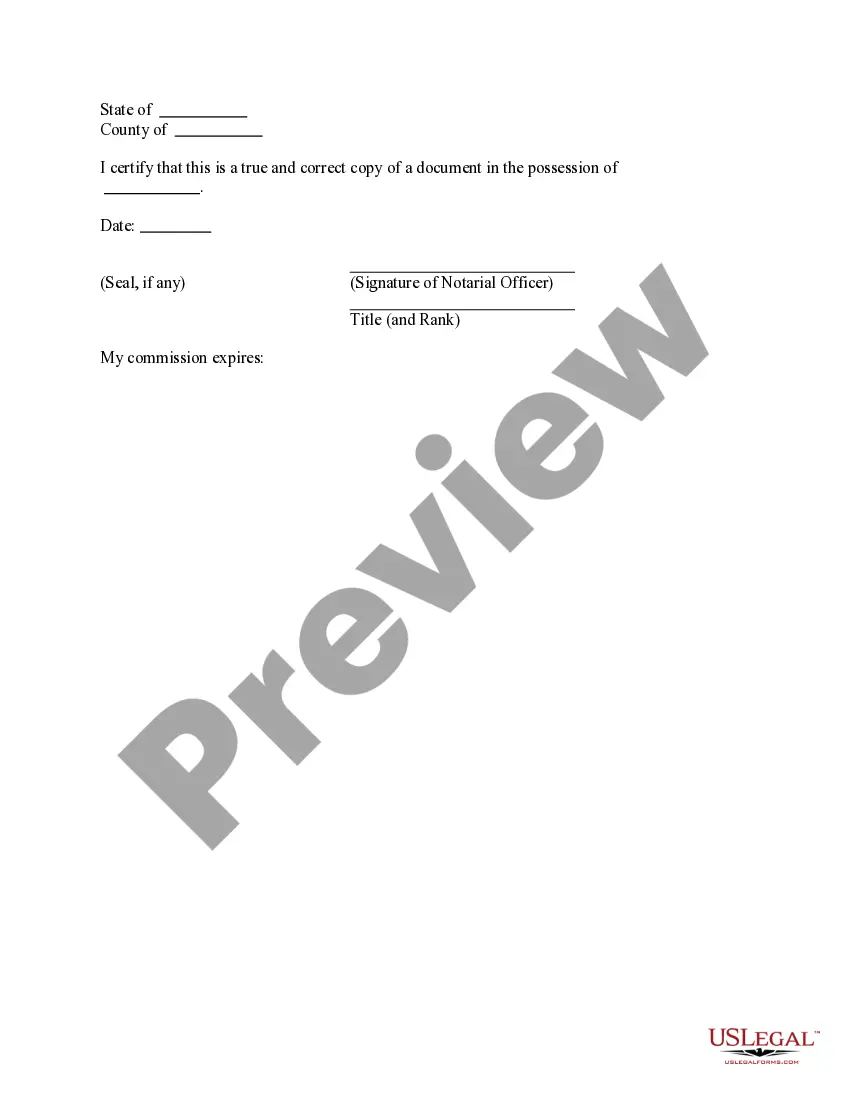

- Sign the document in the presence of a notary public who will witness your signature.

Notarization requirements for this form

This form needs to be notarized to ensure legal validity. US Legal Forms provides secure online notarization powered by Notarize, allowing you to complete the process through a verified video call, available anytime.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Mistakes to watch out for

- Failing to file the lien within the six-month deadline.

- Not providing complete and accurate information about the property or debt.

- Overlooking the requirement for notarization.

- Forgetting to include the description of labor or materials provided.

Advantages of online completion

- The form is easily downloadable, allowing quick access and immediate use.

- Editable fields provide convenience to customize the form as needed.

- Completely reliable as it's based on legal standards set by licensed attorneys.

Looking for another form?

Form popularity

FAQ

Yes, an individual can place a lien on a car in Missouri by filing a Missouri Lien Claim - Individual. This process involves submitting the necessary forms to the state and providing proof of the debt related to the vehicle. Ensuring you follow the correct procedures is key to making the lien enforceable.

To obtain a lien release in Missouri, you must provide evidence that the debt has been satisfied. This may include payment receipts or a settlement agreement. Once you have this documentation, you can file a release form with the county office where the lien was initially recorded.

Yes, it is possible for someone to file a Missouri Lien Claim - Individual against your property without your immediate knowledge. However, the law requires that you be notified of the lien once it is filed. It is essential to regularly check public records to stay informed about any claims against your property.

To place a lien in Missouri, you need detailed information about the debt, the debtor, and the property. You must complete the appropriate lien form and submit it to the relevant county office. Moreover, retaining proof of the debt and any communication with the debtor will strengthen your claim.

Filing a Missouri Lien Claim - Individual can typically be done in a matter of days, depending on how quickly you gather the necessary documentation. Once filed, the lien becomes effective immediately, but processing times may vary based on the county’s workload. It’s advisable to check with the local office for specific timelines.

To establish a Missouri Lien Claim - Individual, you need to provide specific details about the debt and the property involved. You must file the lien with the appropriate county office, including documents that outline the nature of the debt. Additionally, you must ensure that you comply with Missouri's legal requirements for notice and timing.

Can a lien be placed on your property without you knowing? Yes, it happens. Sometimes a court decision or settlement results in a lien being placed on a property, and for some reason the owner doesn't know about it initially.

Voluntary and Involuntary Liens. Creditors, such as a mortgage or car lender, can ask borrowers to put up the purchased property as collateral as part of the condition of the loan. Creditors With Involuntary Liens. Judgment Liens. Other Types of Involuntary Liens.

The simplest way to prevent liens and ensure that subcontractors and suppliers are paid is to pay with joint checks. This is when both parties endorse the check. Compare the contractor's materials or labor bill to the schedule of payments in your contract and the Preliminary Notices.

How do property liens work? Property liens are legal claims against property granted by a court to a creditor when a debtor doesn't pay their debts. Liens are filed with the county office and sent to the property owner advising them of repossession of the asset(s).