Owner Residents

Description

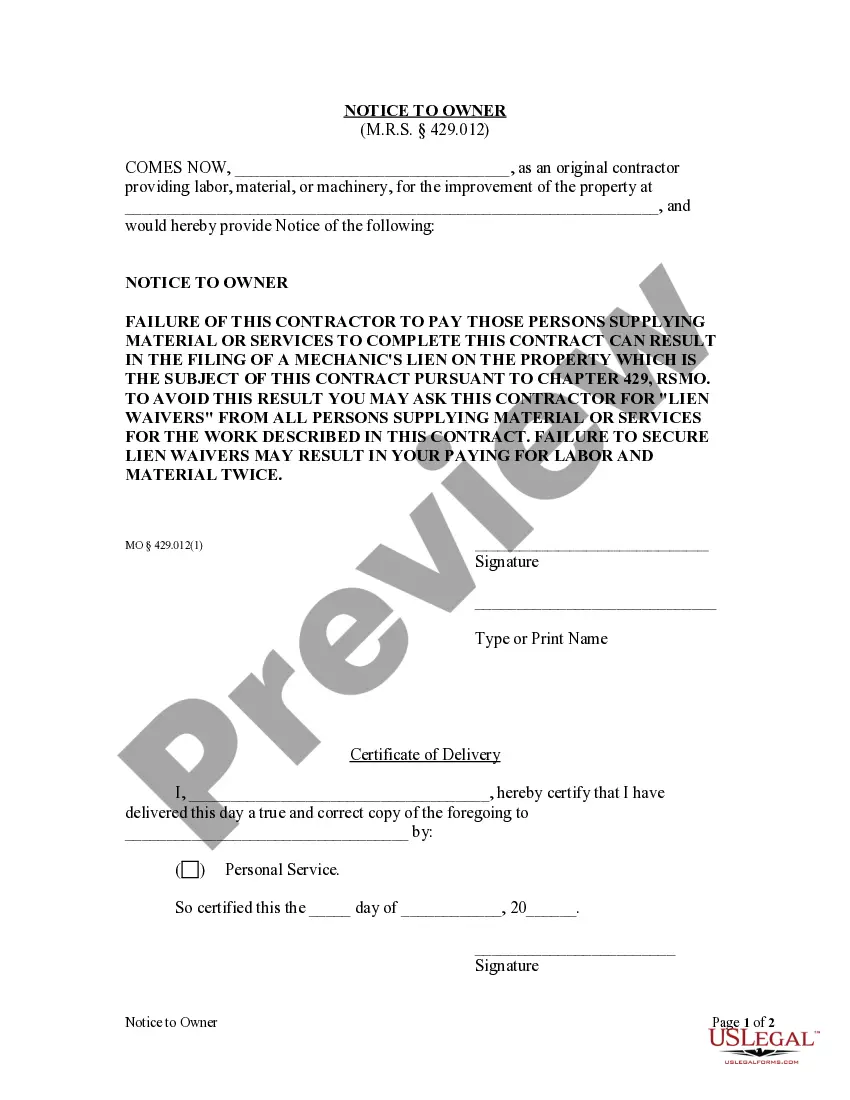

How to fill out Missouri Consent Of Owner - Residential - Individual?

- If you’re a returning user, log in to your account to access your needed form template directly. Ensure your subscription is active; if not, renew it based on your chosen payment plan.

- For first-time users, begin by exploring the Preview mode and the form description. Confirm that you've selected a template that aligns with your specific requirements and local jurisdiction.

- If necessary, search for additional templates using the Search tab to find one that fits your need perfectly.

- To proceed, click the Buy Now button to select your preferred subscription plan. Account registration is required to access the library's resources.

- Complete your purchase by entering your payment details through credit card or PayPal. This grants you immediate access to the selected documents.

- Finally, download the form to your device. You can easily find it later in the My Forms section of your profile.

Using US Legal Forms not only saves time but also guarantees that owner residents can navigate legal processes smoothly and effectively.

Start your journey to precise legal documentation today with US Legal Forms!

Form popularity

FAQ

To make a property your primary residence, begin by moving your address on personal documents like your driver’s license, voter registration, and bank statements. You also should update your insurance and potentially file for a homestead exemption with the local tax office. This process helps you establish your status as an owner resident effectively.

For tax purposes, you cannot designate two properties as your primary residence simultaneously. Typically, tax benefits available for owner residents apply to only one primary home at a time. However, if you move frequently or have specific circumstances, consulting with a tax professional may offer guidance on the best approach.

The IRS determines your primary residence based on various factors, including where you spend the most time, where your family lives, and the address you use for voter registration and tax returns. Owner residents should ensure that all relevant documentation reflects this designation to avoid any confusion. Keeping organized records strengthens your case if questioned.

To avoid paying capital gains tax on property, you may qualify for certain exclusions, particularly if the property has been your primary residence for at least two of the last five years. Owner residents, when selling, can often exclude up to $250,000 of gain from taxes, or $500,000 if married. Using legal resources, such as USLegalForms, can help you understand and apply these exclusions effectively.

To declare your property as your primary residence, you need to ensure that it is the home where you spend the majority of your time. Typically, you can do this by filing a homestead exemption application with your local tax office. This not only declares your intention but may also provide tax benefits for owner residents, helping to lower your property taxes.

Generally speaking, owners do have more rights than renters. Owners can make decisions about their property, such as renovations or modifications, while renters must adhere to lease agreements that limit their authority. For owner residents, knowing their enhanced rights can be empowering when managing their property. Understanding these distinctions can also help maintain a positive relationship with tenants.

Yes, a resident who owns their home is referred to as a homeowner. This status grants them specific rights and responsibilities compared to those who rent. For owner residents, understanding their rights as a homeowner is vital for protecting their interests. Utilizing resources from platforms like uslegalforms can help clarify any legal obligations associated with homeownership.

A resident owner is someone who lives in a property that they legally own. This individual holds full rights and responsibilities associated with property ownership, including maintenance and compliance with local laws. For owner residents, understanding the nuances of their status can greatly impact their rights. Resources available through platforms like uslegalforms can guide them through property ownership complexities.

The key difference between a tenant and an owner lies in property rights. An owner has legal title and complete control over the property, while a tenant has permission to occupy the space under specific terms set forth in a lease. Understanding this difference is essential not just for owner residents but also for tenants. Recognizing their rights allows both parties to maintain better relationships and clear communication.

A residential owner is an individual or entity that owns a property intended for living purposes, such as a house or apartment. This person enjoys full legal rights to the property, including the authority to modify it, rent it out, or sell it. For owner residents, understanding their role and rights can enhance their living experience. Legal platforms like uslegalforms can provide valuable resources to assist these individuals in managing their responsibilities.