Missouri Foreign Llc Registration With Itin Number

Description

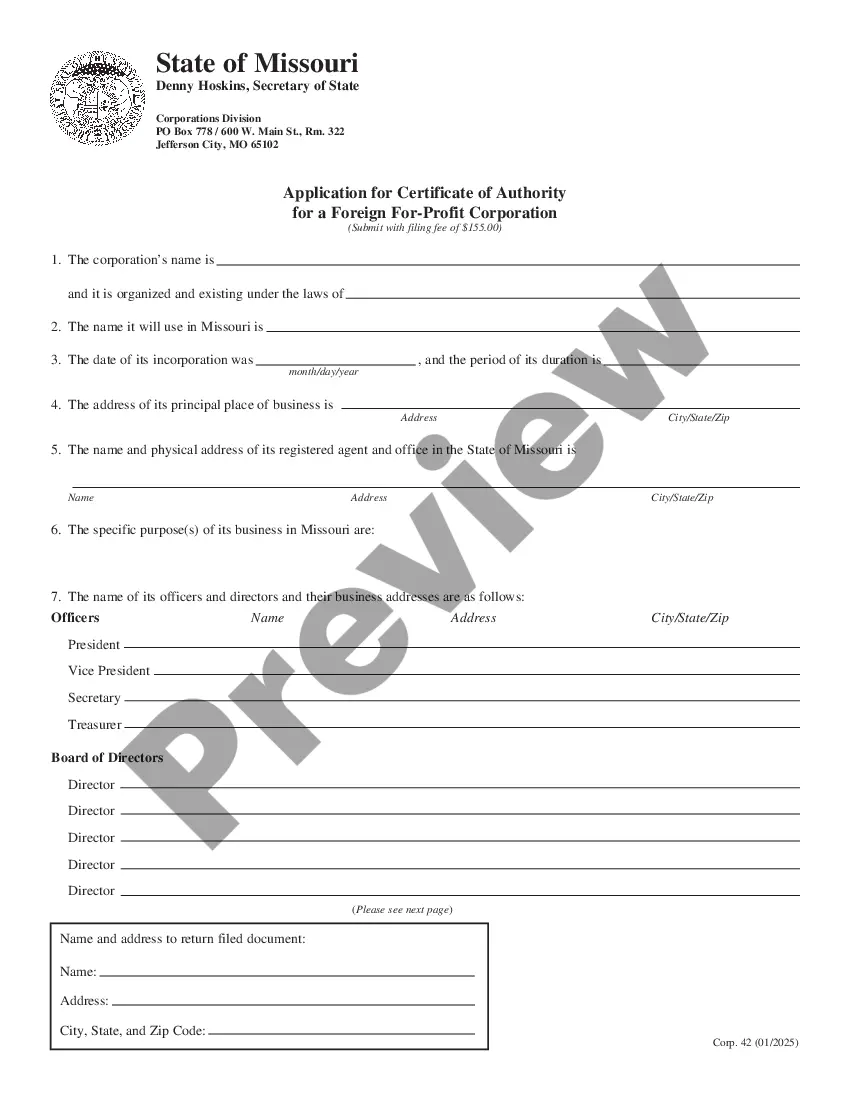

How to fill out Missouri Registration Of Foreign Corporation?

Regardless of whether it’s for commercial reasons or personal affairs, everyone must confront legal issues at some stage in their life.

Completing legal paperwork requires meticulous focus, starting with choosing the correct form template. For instance, if you choose an incorrect version of a Missouri Foreign Llc Registration With Itin Number, it will be rejected upon submission. Thus, it is vital to obtain a reliable source for legal documents like US Legal Forms.

With an extensive US Legal Forms library available, you won't have to waste time searching for the right template online. Take advantage of the library’s straightforward navigation to find the suitable template for any occasion.

- Search for the template you require by using the search box or browsing the catalog.

- Review the details of the form to ensure it corresponds with your situation, state, and county.

- Click on the form’s preview to inspect it.

- If it is not the right document, return to the search function to locate the Missouri Foreign Llc Registration With Itin Number sample you seek.

- Acquire the file if it fulfills your requirements.

- If you already possess a US Legal Forms account, click Log in to access previously saved templates in My documents.

- If you do not yet have an account, you may purchase the form by clicking Buy now.

- Choose the appropriate pricing option.

- Fill out the profile registration form.

- Select your payment method: use a credit card or PayPal account.

- Choose the file format you desire and download the Missouri Foreign Llc Registration With Itin Number.

- Once downloaded, you can fill out the form using editing software or print it and complete it by hand.

Form popularity

FAQ

If you sell goods, provide a service, pay employees, or own a corporation, you must register your business with the Missouri Department of Revenue. (Almost all businesses in Missouri must register with the Department of Revenue.) More specifically, obtaining a tax ID is required for paying: Retail Sales Tax.

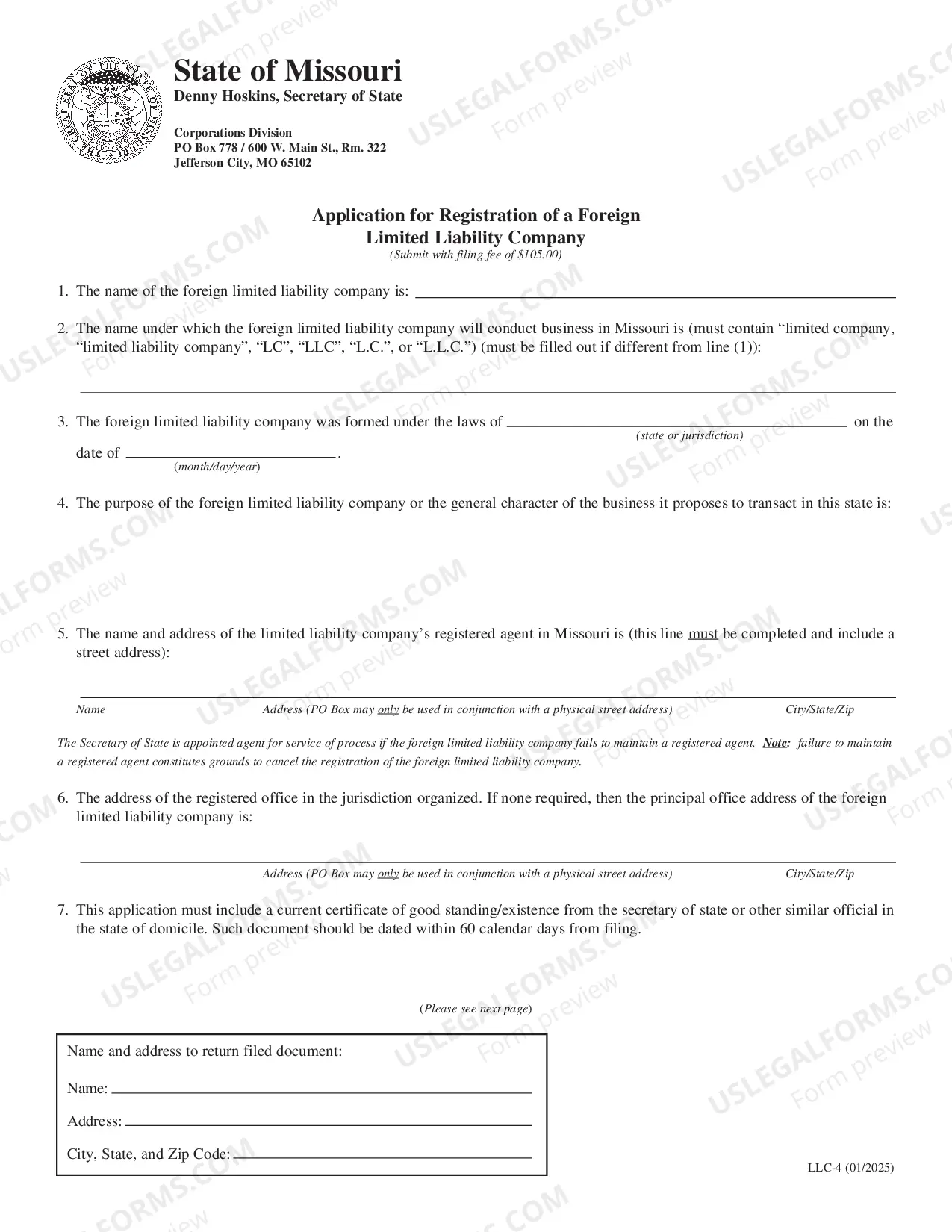

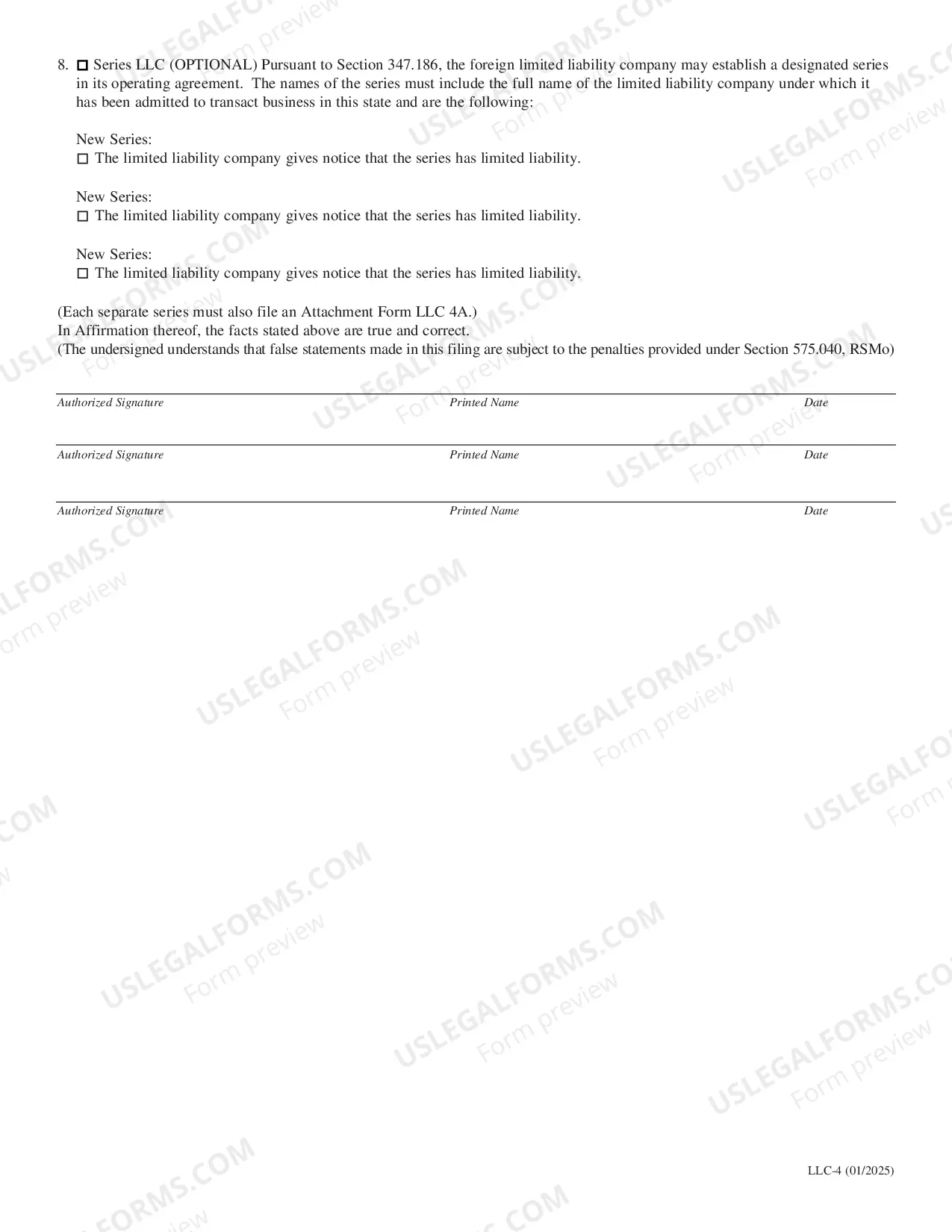

To do business as a foreign LLC in Missouri, you'll need to appoint a local registered agent, file an Application for Registration of a Foreign Limited Liability Company with the Missouri Secretary of State, and pay the state filing fee of $105 (plus a 2.15% added fee if paying by credit card).

Employer Withholding Tax - Every employer maintaining an office or transacting any business within the state of Missouri and making payment of wages to a resident or nonresident individual must obtain a Missouri Employer Tax Identification Number.

Missouri's statutes don't explicitly define what the state considers to count as doing business, but in general, your LLC will need to register as a foreign LLC in Missouri if it applies for state or county business or occupational licenses, sells or provides retail or other services, has a physical address, storefront ...

Starting an LLC in Missouri will include the following steps: #1: Draft a Business Plan. #2: Research Your Business Structure Options. #3: Register a Business Name. #4: Appoint a Registered Agent. #5: File Articles of Organization. #6: Obtain an Employer Identification Number (EIN) #7: Draft an Operating Agreement.