Revocation of Statutory General Power of Attorney

Power of Attorney and Health Care - General - Minnesota

Section 257B.01: The definitions in this section apply to this chapter.

"Alternate" means a person with all the rights, responsibilities, and qualifications of a standby custodian who shall become a standby custodian if the currently designated standby custodian is unable or unwilling to fulfill the obligations of custodian.

"Attending physician" means a physician who has primary responsibility for the treatment and care of the designator. If physicians share responsibility, another physician is acting on the attending physician's behalf, or no physician has primary responsibility, any physician who is familiar with the designator's medical condition may act as an attending physician under this chapter.

"Co-custodian" means a standby custodian who is acting as custodian along with the parents and shares physical or legal custody of the children, or both, due to the occurrence of a triggering event.

"Consent" means a written authorization signed by the designator in the presence of two witnesses who also sign the writing. The witnesses must be 18 years of age or older and not named in the designation.

"Debilitation" means a person's chronic and substantial inability, as a result of a physically incapacitating disease or injury, to care for the children.

"Designation" means a written document naming a standby or temporary custodian. A parent may designate an alternate standby custodian in the same writing. A parent may not designate an alternate temporary custodian.

"Designator" means a parent or legal custodian who appoints a standby or temporary custodian.

"Determination of debilitation" means a written finding made by an attending physician which states that the designator suffers from a physically incapacitating disease or injury. No identification of the illness in question is required.

"Determination of incapacity" means a written finding made by an attending physician which states the nature, extent, and probable duration of the designator's mental or organic incapacity.

"Incapacity" means a chronic and substantial inability, resulting from a mental or organic impairment, to understand the nature and consequences of decisions concerning the care of the designator's dependent children and a consequent inability to care for the children.

"Standby custodian" means a person named by a designator to assume the duties of co-custodian or custodian of a child and whose authority becomes effective upon the incapacity, debilitation and consent, or death of the child's parent.

"Temporary custodian" means a person named by a designator to assume the duties of legal and physical custodian of a child for a specific time up to 24 months.

"Triggering event" means a specified occurrence stated in the designation that empowers a standby or temporary custodian to assume the powers, duties, and responsibilities of custodian or co-custodian.

Section 257B.02: Chapters 257 and 518 and sections 525.539 to 525.705 apply to standby custodians, temporary custodians, co-custodians, custodians, and alternates unless otherwise specified in this chapter.

Nothing in this chapter may be construed to deprive a parent of any parental rights or responsibilities. A designator does not lose any custodial rights by the appointment of a standby or temporary custodian.

Nothing in this chapter may be construed to relieve any parent of a duty to support the parent's children. A preexisting child support order is not suspended or terminated during the time a child is cared for by a standby or temporary custodian, unless otherwise provided by court order. A standby custodian or temporary custodian has a cause of action for child support against an absent parent under section 256.87,subdivision 5.257B.03 Designator.

(a) A parent with legal and physical custody or a legal custodian may designate a standby or temporary custodian by means of a written designation unless the child has another legal parent:

(1) whose parental rights have not been terminated;

(2) whose whereabouts are known; and

(3) who is willing and able to make and carry out the daily custodial care and make decisions concerning the child.

(b) Notwithstanding paragraph (a), a parent or legal custodian may designate a standby or temporary custodian with the consent of the other parent, or as provided by section 257B.05, subdivision 6.

(c) A legal custodian pursuant to a designation of temporary custodianship may not designate a different temporary custodian.

Section 257B.04: A designation of a standby or temporary custodian must identify the designator making the designation; the children; the other parent, if any; the standby or temporary custodian; and the triggering event or events upon which a standby or temporary custodian becomes a co-custodian or custodian. Different standby custodians may be designated for different triggering events. The designation must include the signed consent of the standby or temporary custodian and the signed consent of the other parent or a statement why the other parent's consent is not required.

The designation must be signed by the designator in the presence of two witnesses who are 18 years of age or older and not otherwise named in the designation. The witnesses must also sign the declaration.

If the designator is physically unable to sign the designation, the designator may direct another person not named in the designation to sign on the designator's behalf in the presence of the designator and both witnesses.

A designator may, but need not, designate an alternate standby custodian in the designation. No alternate temporary custodian may be named.

Section 257B.05: A petition for approval of a designation under this chapter may be made at any time by filing with the court a copy of the designation.

No filing fee is required to initiate the proceeding. A court may, however, determine the ability to pay fees in the event of a hearing on the petition.

Only the designator may file a petition for confirmation of a temporary custodian. If the triggering event has not occurred on or before the time of filing, only the designator may file the petition for confirmation of a standby custodian.

If the triggering event has occurred on or before the time of filing, the standby custodian named in the designation may file a petition containing one of the following:

(1) a determination of the designator's incapacity;

(2) a determination of the designator's debilitation and the designator's signed and dated consent; or

(3) a copy of the designator's death record.

(a) The petitioner must serve any person named in the designation and any other current caregiver of the children with a copy of the petition and designation and notice of any hearing within ten days of the filing of the petition.

(b) If the petition alleges that a nondesignating parent cannot be located, that parent must be notified in accordance with section 518.11.

No notice is required to a parent whose parental rights have been terminated by a court order.

For purposes of determining jurisdiction under this chapter, the provisions of chapter 518D apply.

In a proceeding for judicial confirmation of a standby custodian or temporary custodian, a designation constitutes a presumption that the designated custodian is capable of serving as co-custodian or custodian. If the designator is the sole surviving parent, the parental rights of the other parent have been terminated, or both parents consent to the designation, there is a presumption that entry of an order confirming the designation of the standby or temporary custodian is in the best interest of the children.

Approval of the designation without a hearing is permitted if the designator is the sole surviving parent, the parental rights of the other parent have been terminated, or both parents consent to confirmation of the standby or temporary custodian.

A hearing is required if there is a parent other than the designator whose parental rights have not been terminated and who has not consented to the designation. The court shall apply the factors in section 518.17 and make specific findings in determining whether to confirm the designation of the standby or temporary custodian, to appoint a different custodian, or to grant custody to the other parent. A court that finds the appointment of the standby or temporary custodian to be in the best interest of the child shall enter an order confirming the designation.

A designator who is medically unable to appear in court need not appear.

A standby or temporary custodian may act as co-custodian or custodian upon the occurrence of the triggering event. The commencement of the standby or temporary custodian's authority to act as co-custodian pursuant to a determination of incapacity, a determination of debilitation and consent, or the receipt of consent alone does not itself divest the designator of any parental rights but confers on the standby or temporary custodian concurrent or shared custody of the child.

The commencement of the standby custodian's authority to act as custodian because of the death of the designator does not confer upon the standby custodian more than legal and physical custody of the child as defined in chapter 518. On the death of the designator, the standby custodian shall be appointed a guardian pursuant to section 525.551. No separate petition is required. No bond or accounting is required except as specified in this chapter.

A co-custodian shall assure frequent and continuing contact with and physical access by the designator with the child and shall assure the involvement of the parents, to the greatest extent possible, in decision making on behalf of the child.

The designator may file a petition for approval of a designation with the court at any time. If the petition is approved by the court before the occurrence of the triggering event, the standby or temporary custodian's authority commences automatically upon the occurrence of the triggering event. No further petition or confirmation is required. If a designation has been made but the petition for approval of the designation has not been filed and a triggering event has occurred, the standby custodian has temporary legal authority to act as a co-custodian or custodian of the child(ren) without the direction of the court for a period of 60 days. The standby custodian must, within that period, file a petition for approval in accordance with this chapter. If no petition is filed within 60 days, the standby custodian loses all authority to act as co-custodian or custodian. If a petition is filed but the court does not act upon it within the 60-day period, the temporary legal authority to act as co-custodian or custodian continues until the court orders otherwise.

The commencement of a co-custodian's or custodian's authority under this chapter does not, by itself, divest a parent or legal custodian of any parental or custodial rights.

Once a court has confirmed the designation of a standby custodian, the appointment may be modified only under section 518.18, except that the designator may revoke the designation under section 257B.07.

If a licensed physician determines that the designator has regained capacity, the co-custodian's authority that commenced on the occurrence of a triggering event becomes inactive. Failure of a co-custodian to immediately return the child(ren) to the designator's care entitles the designator to an emergency hearing within five days of a request for a hearing.

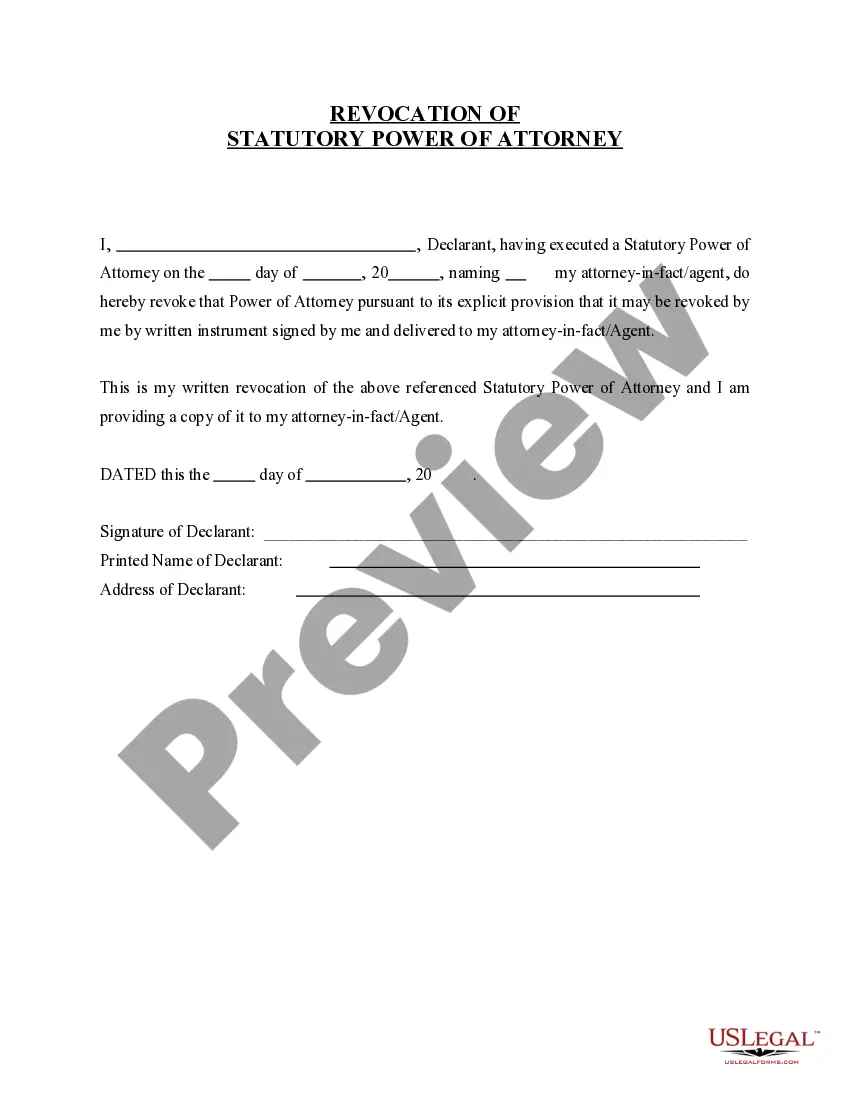

Section 257B.07: Prior to a petition being filed under this chapter, the designator may revoke the appointment of a standby or temporary custodian by destruction of the designation and notification of the revocation to the standby or temporary custodian.

After a petition has been filed, the designator may revoke the designation of standby or temporary custodian by:

(1) executing a written revocation;

(2) filing the revocation with the court; and

(3) notifying the persons named in the designation of the revocation in writing.

An unwritten revocation of the designation may be considered by the court if it can be proven by clear and convincing evidence.

Section 257B.08: If a parent has appointed a testamentary guardian of the person or estate of children by will under chapter 529 and there is a conflict between the designation in the will and a duly executed standby custodian designation, the document latest in date of execution prevails.

Section 257B.09: A standby or temporary custodian must not be required to post bond prior to the occurrence of the triggering event. The court may require a bond if the standby or temporary custodian is designated the co-custodian or custodian of the estate of the children but may not require a bond for the co-custodianship of the person of the children.

Section 257B.10: If a designated caregiver agreement entered under chapter 257A before April 15, 2000, would have become operative but for the operation of Laws 2000, chapter 404, sections 1 to 13, the parent who executed the agreement, or if the parent is unable to act, the designated caregiver under the agreement may file a petition under section 257B.05 to request that the designated caregiver agreement be approved by the court as a standby custodian.