Owner Corporation Paper With Ein Number

Description

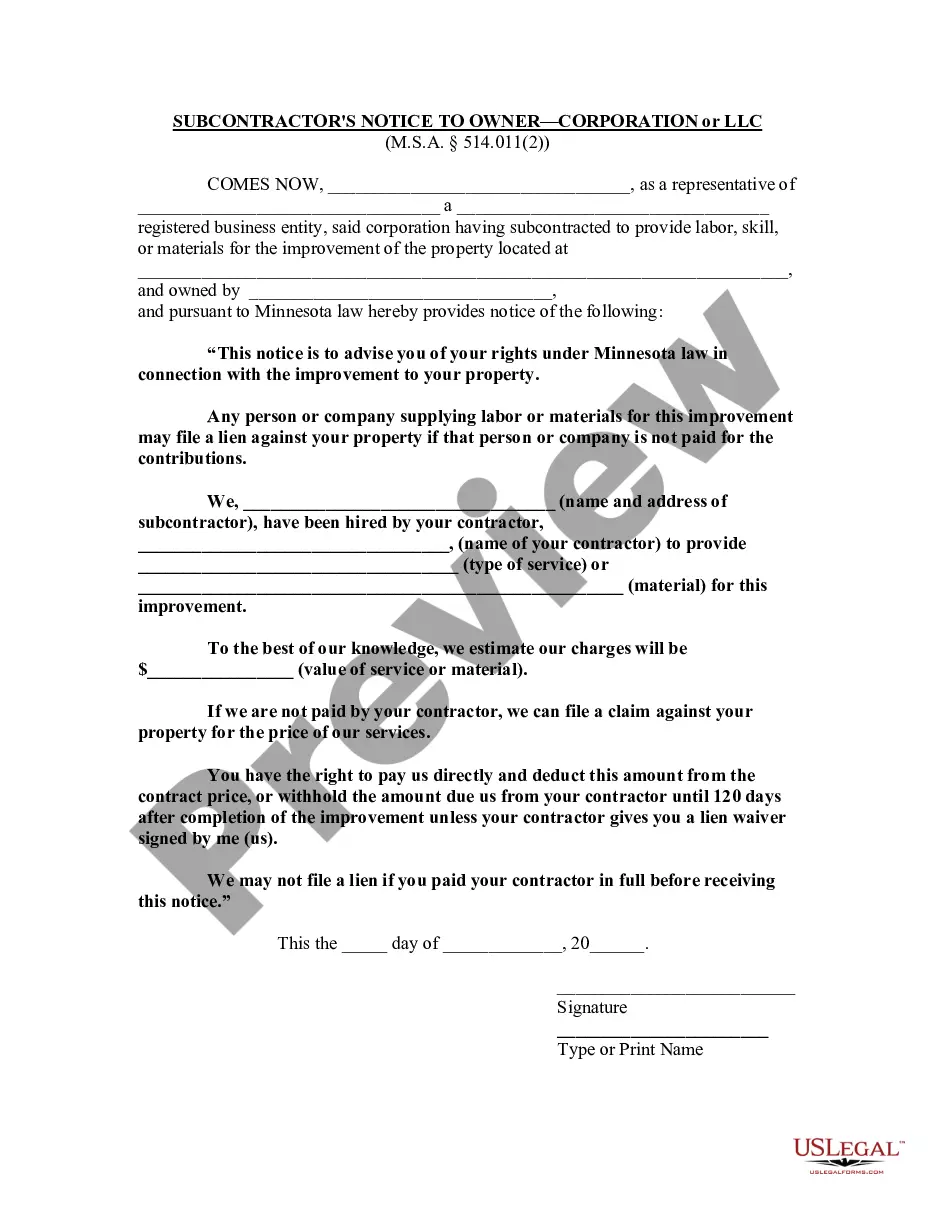

How to fill out Minnesota Contractor's Notice To Owner - Corporation Or LLC?

- If you are an existing user, log in to your account and download the necessary form template by clicking the Download button. Ensure your subscription is active; renew if required.

- For new users, start by checking the Preview mode and form description to confirm you selected the right template that adheres to your jurisdiction's requirements.

- If you need a different template, utilize the Search tab to find a suitable one and proceed once you have found your match.

- To purchase the document, click the Buy Now button and select your preferred subscription plan. Registration is necessary to access the library resources.

- Complete your purchase by entering your credit card information or using your PayPal account for payment.

- Finally, download your form to your device, allowing you to complete it anytime. You can access it later in the My Forms section.

US Legal Forms stands out with its extensive collection of over 85,000 legal forms, providing more options than competitors at a comparable cost.

With the added benefit of accessing premium experts for assistance, you can ensure that your documents are both precise and legally compliant. Get started today for a hassle-free legal process!

Form popularity

FAQ

To get a copy of your EIN paper, refer to your initial EIN confirmation letter that the IRS provided. If you no longer have this document, you can contact the IRS directly to request a copy. Alternatively, if you have online access to your tax records or business filings, you may find your EIN listed there. For additional assistance, consider services from platforms like uslegalforms to efficiently handle your requests.

You can use your EIN confirmation letter from the IRS as proof of your EIN. Other acceptable forms of evidence include your business tax returns and bank statements that list your EIN. Having these documents readily available is helpful for many business activities, including applying for loans or establishing business credit. Always ensure that these documents are secure and easily accessible.

The paper application for an EIN number is Form SS-4, which you can fill out and send to the IRS. This form collects essential information about your business, allowing the IRS to assign your unique EIN. Filling out this form accurately is crucial for obtaining your EIN, and using a resource like uslegalforms can help streamline this process. Once processed, you will receive your EIN notification via mail.

Unfortunately, you cannot look up the owner of an EIN directly through public databases. The IRS keeps this information confidential for privacy protection. However, if you have a valid reason, such as legal queries or business verification, you may be able to access this information through official channels. Consider using platforms like uslegalforms to navigate these requirements more easily.

EIN paper typically refers to the physical documentation that includes your Employer Identification Number. This paper can be the IRS confirmation letter or any other formal document that displays this number. It is essential for businesses, especially those that are owner corporations, as it legitimizes your company and is often required for opening business accounts or hiring employees.

An EIN document refers to any official paperwork that contains your Employer Identification Number. This includes your EIN confirmation letter from the IRS and any tax filings that display your EIN. Essentially, it provides identification for your business, similar to a social security number for individuals. Having this document simplifies various aspects of managing your corporation, including tax reporting.

To obtain proof of your EIN number, you can refer to the EIN confirmation letter that the IRS sends after your application approval. This letter serves as your official documentation. If you have lost it, you can call the IRS and request a replacement. Additionally, documents from your business that display your EIN, like tax returns or bank statements, can serve as proof.

You can obtain documents containing your EIN number by accessing your IRS account online, or by requesting copies via mail. It is important to keep these documents organized, as they relate closely to your owner corporation paper with EIN number. Consider using USLegalForms for an efficient solution to gather and manage your essential business documents.

To get a copy of your SS-4 letter, you can contact the IRS directly by phone or send a written request for a duplicate. The SS-4 form is important for your business documentation, especially when referencing your owner corporation paper with EIN number. Remember to provide sufficient details to help expedite your request.

Yes, you can look up your EIN online, but access typically depends on your active IRS account. If you don't have access, you may need to retrieve documents such as your owner corporation paper with EIN number. As a result, it’s wise to keep these documents organized and stored in an easily accessible location.