Transfer Death Individual With Deceased Spouse

Description

How to fill out Minnesota Transfer On Death Deed - Individual To Individual?

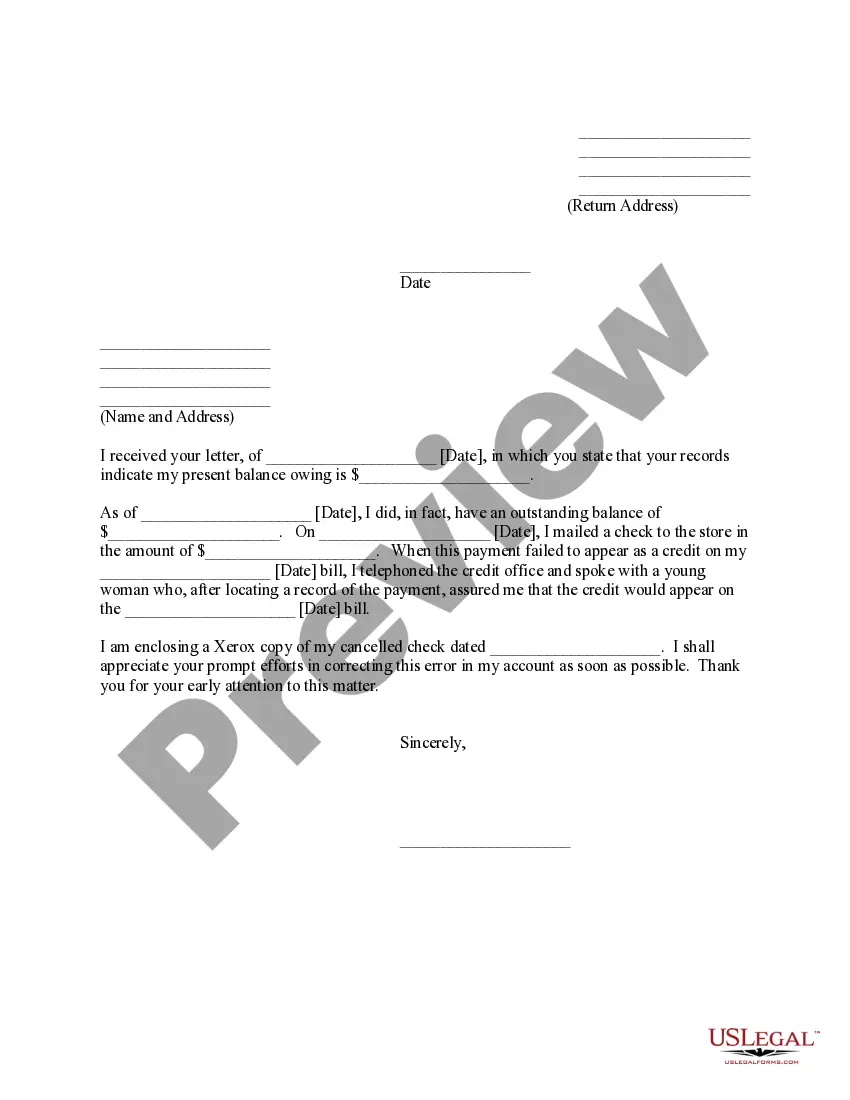

- If you're an existing user, log into your account, check your subscription status, and grab the necessary form template by clicking the Download button.

- For new users, start by browsing the extensive library to preview and read the form descriptions. Make sure the document aligns with your specific legal needs and local jurisdiction requirements.

- In case you can’t find the right template, use the Search tab to explore other options that fit your situation.

- Once you've found your document, click the Buy Now button and select your preferred subscription plan. You'll need to create an account to gain full access.

- Complete your purchase by entering your payment details using a credit card or PayPal.

- After the transaction, download your form to your device. You can easily access it again later in the My Forms section of your profile.

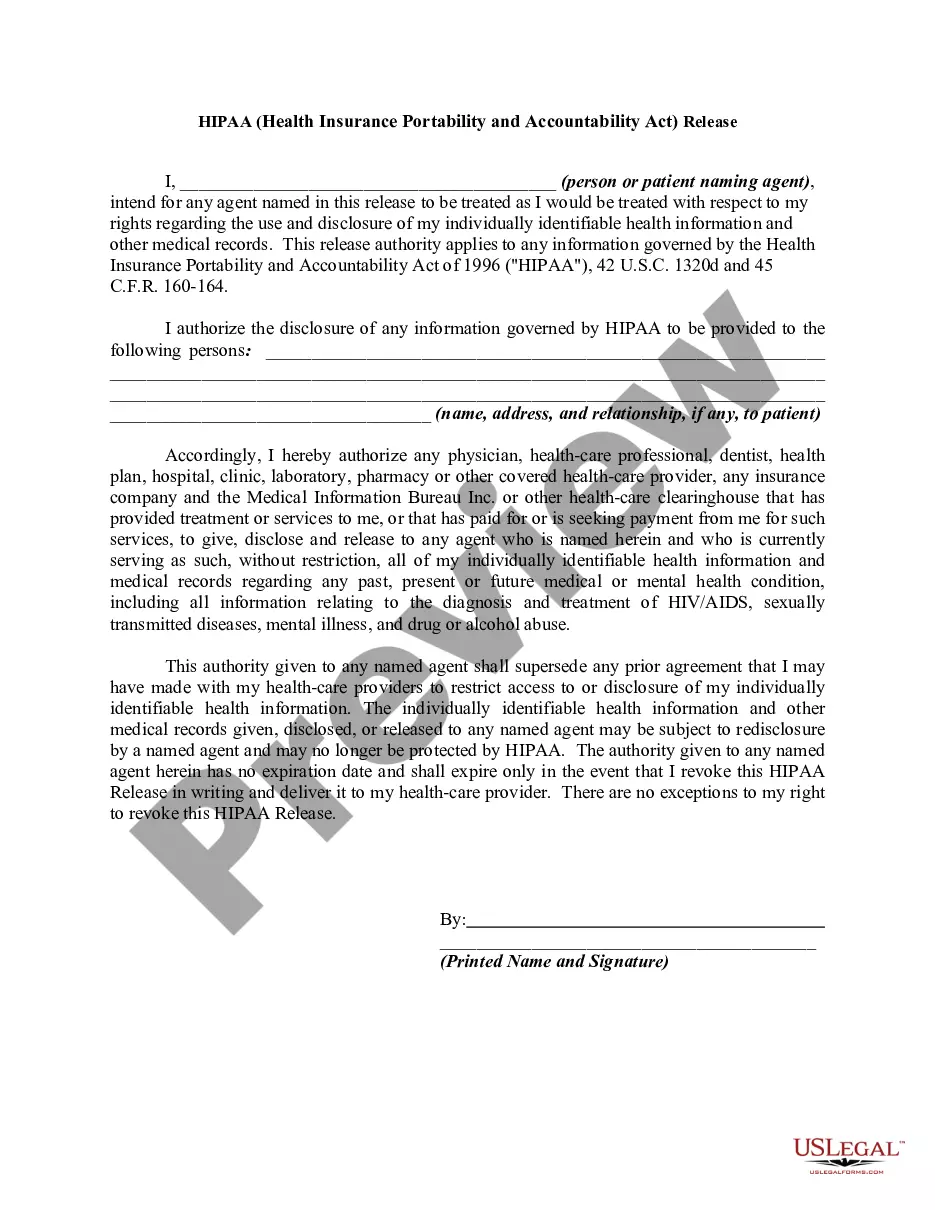

In conclusion, US Legal Forms provides a robust and user-friendly platform for efficiently managing legal paperwork when dealing with a deceased spouse's estate. With over 85,000 forms and expert assistance at your fingertips, you can rest assured that your documents will be accurate and compliant.

Start your journey today and make legal documentation straightforward with US Legal Forms!

Form popularity

FAQ

A surviving spouse has generally nine months from the date of death to elect portability. However, this period can be extended to 15 months if an estate tax return is filed. It’s crucial to stay informed about these timeframes when planning to transfer death individual with deceased spouse. Taking proactive steps can ensure you don’t miss out on valuable tax benefits.

When your spouse dies, it's important to avoid making hasty decisions regarding financial and legal matters. Rushing can lead to mistakes, particularly with the transfer of death individual with deceased spouse. Instead, take the time to grieve and consult with trusted advisors before making any commitments. This careful approach will pave the way for better outcomes.

The portability of a deceased spouse refers to the ability of the surviving spouse to use any unused estate tax exemption of the deceased spouse. This option allows for potentially significant tax savings when planning your estate. Therefore, knowing how to effectively transfer death individual with deceased spouse can be beneficial. It enhances your estate's financial resilience.

Not always. The distribution of assets depends on how they are titled and any existing wills or trusts. In cases where you need to transfer death individual with deceased spouse, it’s vital to review your estate planning documents. This ensures your assets go where you intend, potentially avoiding family disputes.

While portability allows for the transfer of unused estate tax exemptions, it does come with some disadvantages. For instance, it requires timely filing of estate tax returns, which can be complex. Additionally, not everyone is eligible for portability, especially if the deceased spouse did not file an estate tax return. If you're looking to transfer death individual with deceased spouse, it's essential to weigh these factors carefully.

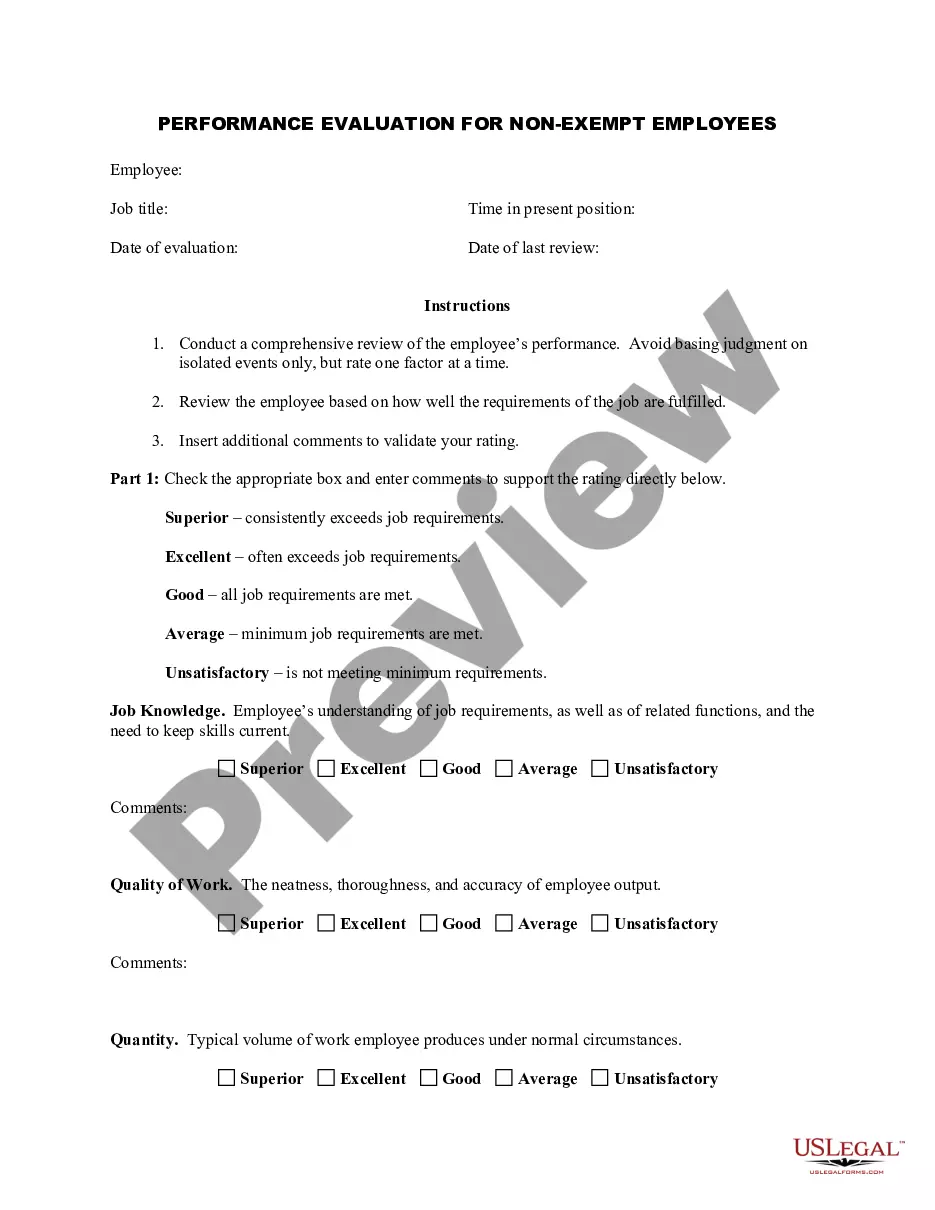

The deceased spouse exclusion refers to a tax benefit that allows the surviving spouse to exclude certain assets from estate taxes. In situations where you want to transfer death individual with deceased spouse, this exclusion can significantly reduce the financial burden. Understanding this provision is crucial for proper estate planning. It ensures you can keep more of what you and your spouse have built together.

Losing a spouse can profoundly alter your perspective and priorities. Many people report a deeper appreciation for life and a renewed focus on personal growth and relationships. This change can also prompt practical decisions, including how to handle shared assets through processes like transfer death individual with deceased spouse. Uslegalforms can assist you in ensuring that these transitions are handled with care and respect.

Getting over the death of a spouse often involves processing a range of emotions, from sadness to relief. Establishing new routines, honoring memories, and focusing on self-care are essential steps in this journey. If you are faced with additional responsibilities, such as managing joint assets, understanding how to transfer death individual with deceased spouse can provide clarity. Uslegalforms is here to support you through practical solutions and guidance.

In general, a house may remain in the deceased spouse's name until the estate is settled, which can take months or even years. However, you can initiate the process of transferring the property to avoid complications, especially if you need to sell or manage it. To navigate this process more smoothly, considering transfer death individual with deceased spouse may be crucial. Uslegalforms provides resources to help you manage this efficiently.

Moving on after losing a spouse involves a mix of emotional healing and practical steps. Connecting with friends, seeking professional help, and participating in support groups can provide necessary encouragement. Additionally, if you are considering transferring ownership of shared assets, understanding the process of transfer death individual with deceased spouse can significantly ease this transition. Uslegalforms offers valuable tools to guide you through these important decisions.