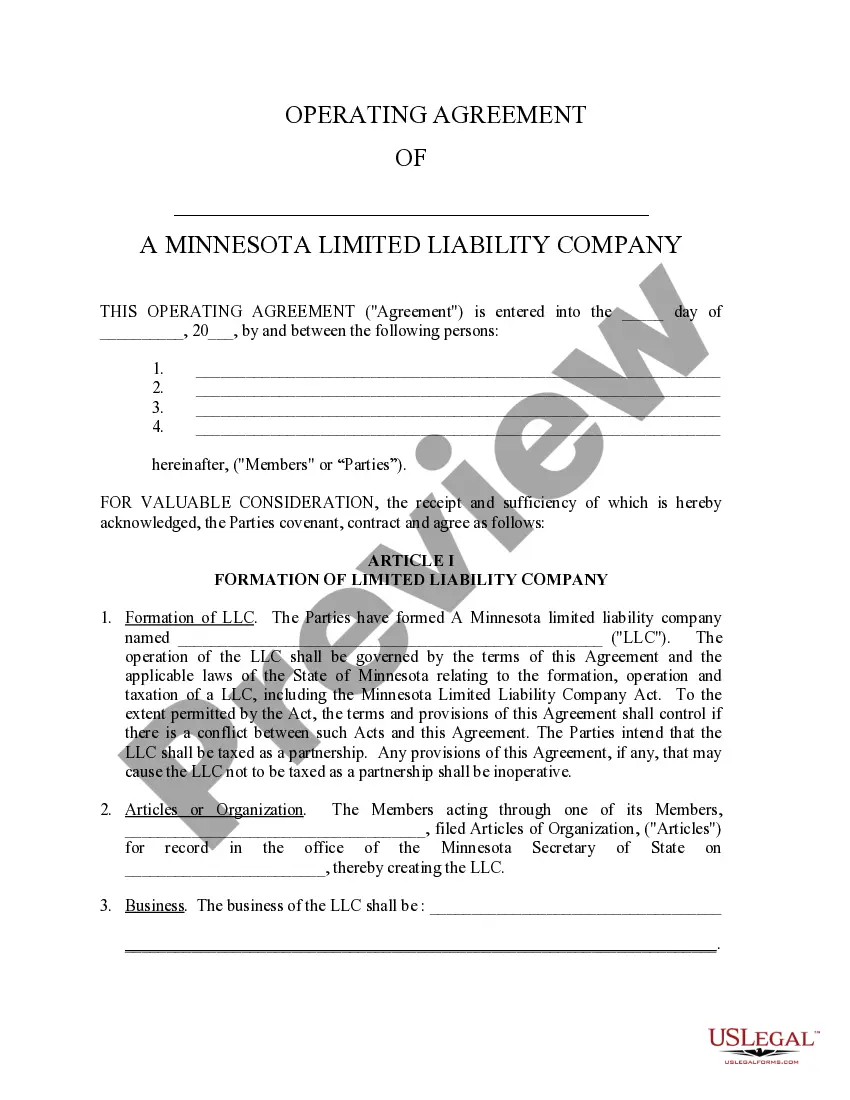

Llc Operating Agreement Minnesota With Multiple Members

Description

How to fill out Minnesota Limited Liability Company LLC Operating Agreement?

Legal document managing might be mind-boggling, even for the most knowledgeable specialists. When you are interested in a Llc Operating Agreement Minnesota With Multiple Members and don’t get the time to spend trying to find the correct and up-to-date version, the procedures may be nerve-racking. A strong web form catalogue could be a gamechanger for anybody who wants to deal with these situations efficiently. US Legal Forms is a industry leader in online legal forms, with over 85,000 state-specific legal forms accessible to you at any moment.

With US Legal Forms, you can:

- Access state- or county-specific legal and organization forms. US Legal Forms handles any requirements you may have, from personal to enterprise documents, all-in-one spot.

- Make use of advanced resources to accomplish and manage your Llc Operating Agreement Minnesota With Multiple Members

- Access a resource base of articles, guides and handbooks and materials related to your situation and needs

Save time and effort trying to find the documents you will need, and use US Legal Forms’ advanced search and Preview tool to find Llc Operating Agreement Minnesota With Multiple Members and download it. For those who have a monthly subscription, log in to your US Legal Forms account, search for the form, and download it. Take a look at My Forms tab to find out the documents you previously saved as well as to manage your folders as you can see fit.

If it is your first time with US Legal Forms, make a free account and have unlimited usage of all benefits of the library. Listed below are the steps to consider after downloading the form you need:

- Verify it is the right form by previewing it and reading its description.

- Be sure that the sample is approved in your state or county.

- Pick Buy Now when you are ready.

- Choose a subscription plan.

- Find the formatting you need, and Download, complete, sign, print and send your document.

Benefit from the US Legal Forms web catalogue, supported with 25 years of expertise and stability. Enhance your daily document administration in a easy and easy-to-use process today.

Form popularity

FAQ

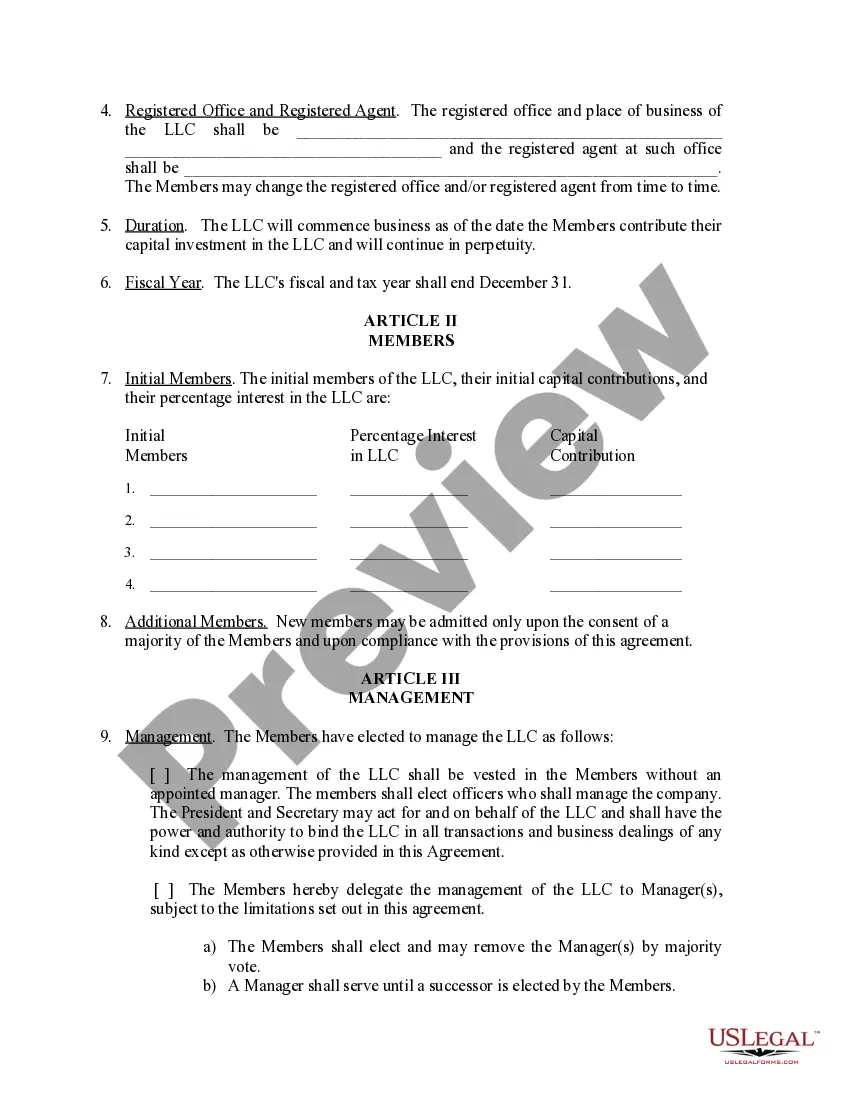

The process of adding a member to a Minnesota LLC may involve amending the company's articles of organization to include the new member. Depending on the terms in the agreement, current LLC members may need to vote on it for the amendment to pass.

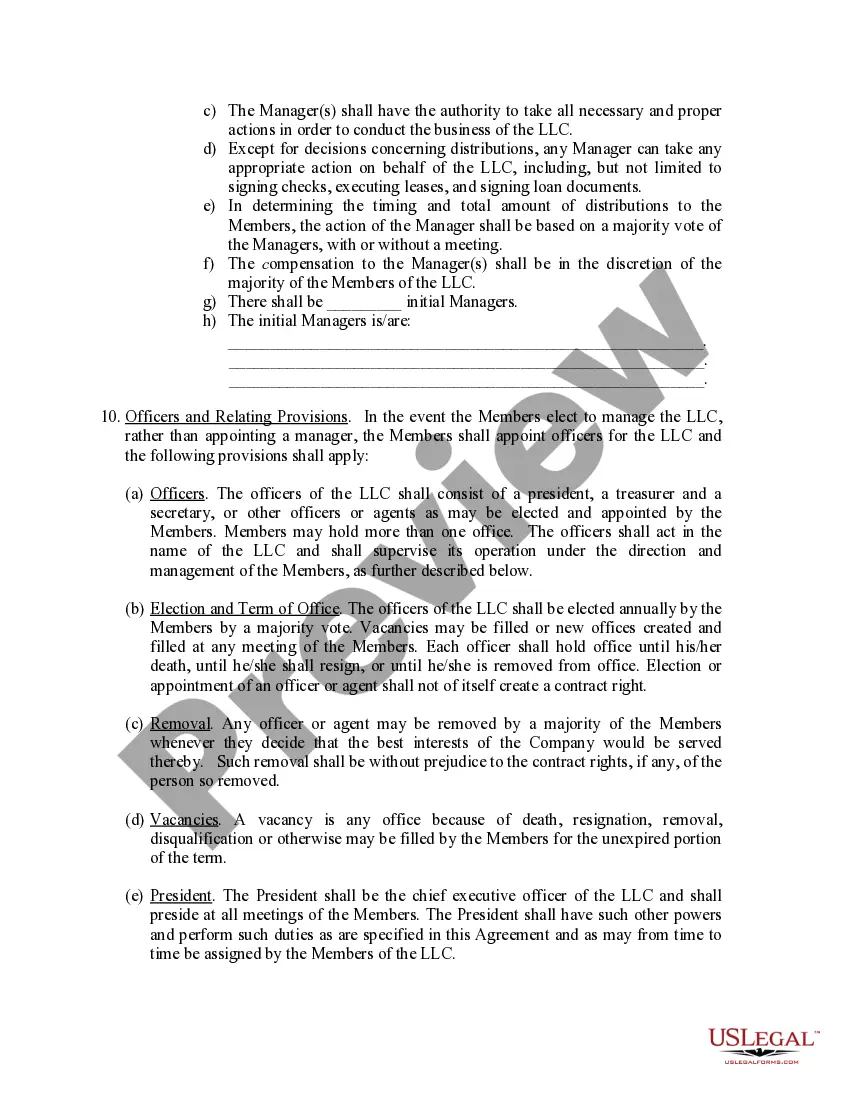

Here, Class A would be business-founding members with complete voting rights. Class B would also be founders, but perhaps they played a minor role and are thus given less voting power. Class C would be investors, which aren't given any voting power.

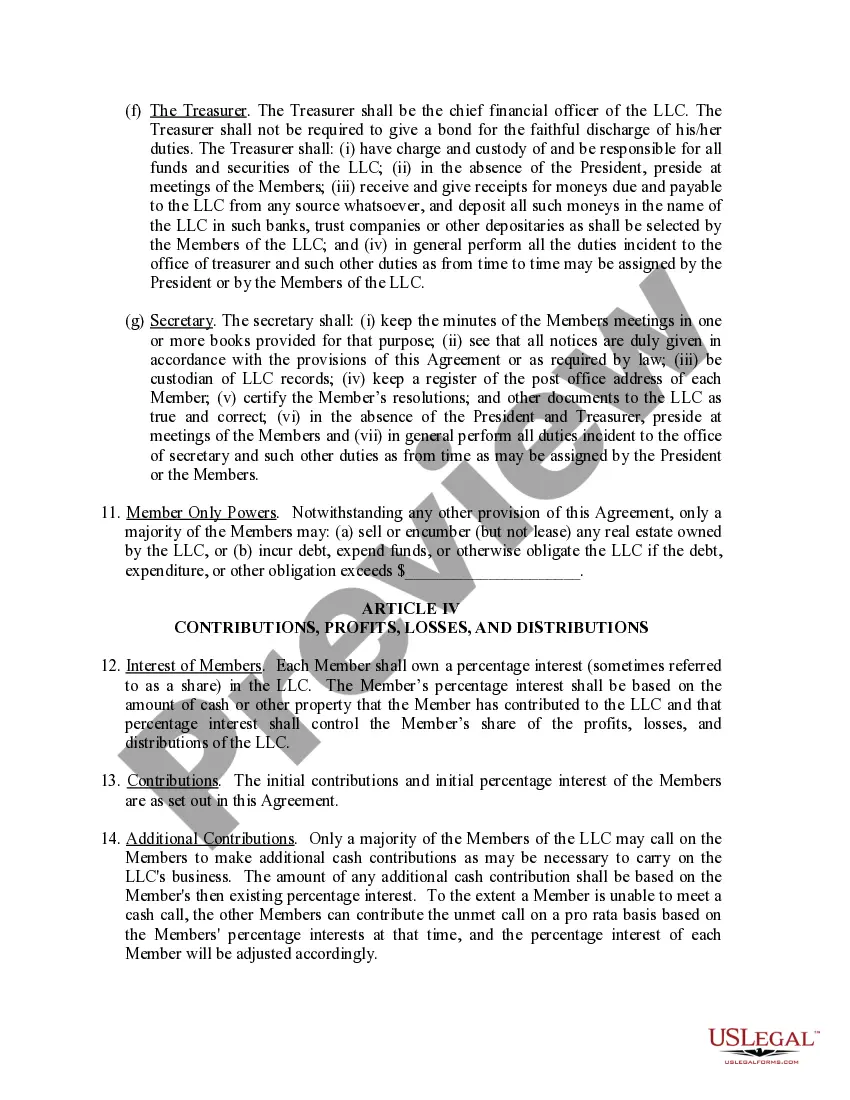

In order to complete your Operating Agreement, you will need some basic information. The formation date of your LLC. The name and address of the Registered Office and Registered Agent. The general business purpose of the LLC. Member(s) percentages of ownership. Names of the Members and their addresses.

An operating agreement isn't mandatory. It also helps show that your LLC is a legitimate business entity that's separate from you, not just some sham that's been created to avoid liability.

Without the operating agreement, your state might not acknowledge you as an LLC, which means someone could sue you without there being any shield to protect your personal assets. You've already put in the time and effort to form your LLC to get liability protection.