Llc Operating Agreement Minnesota For Rental Property

Description

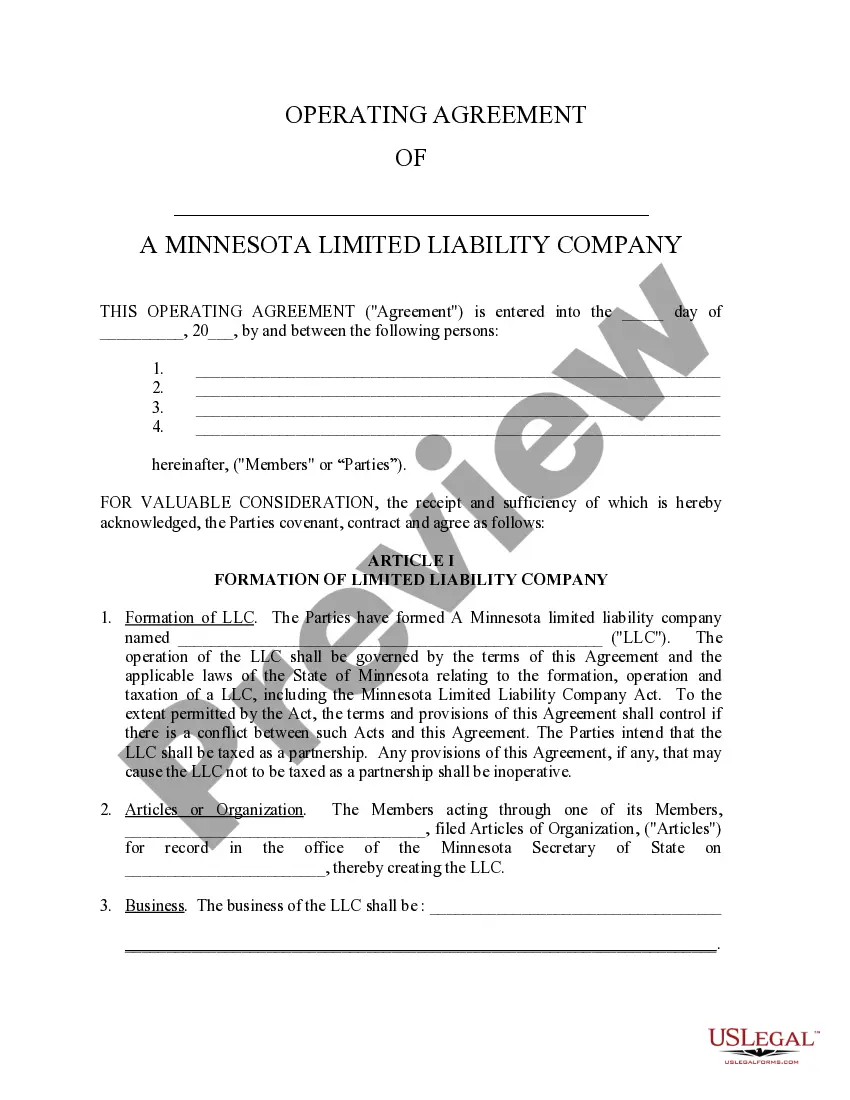

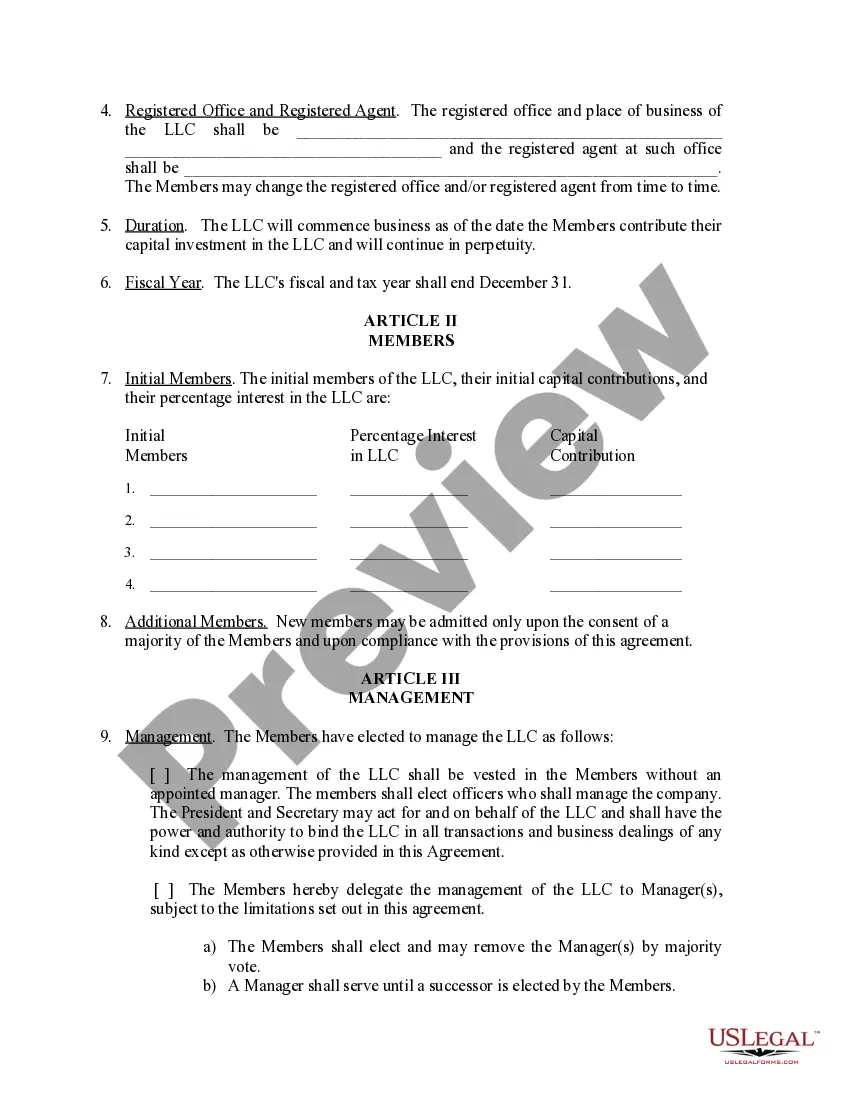

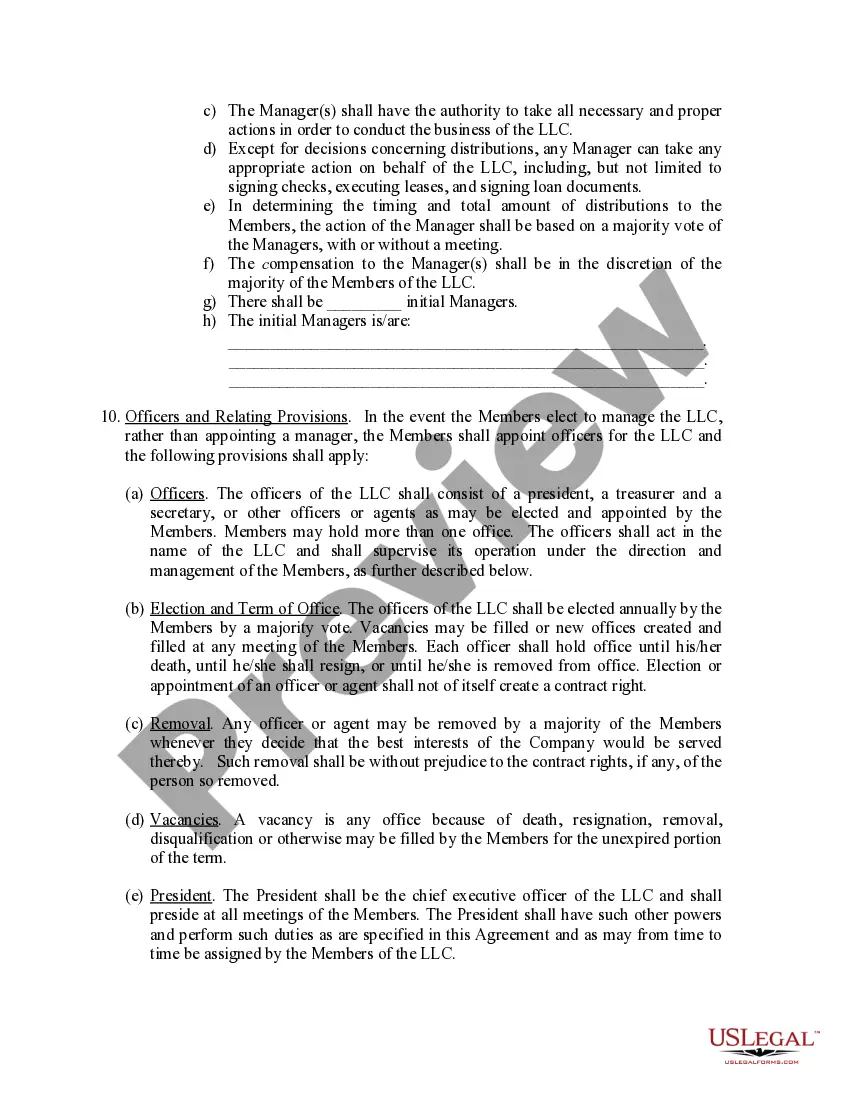

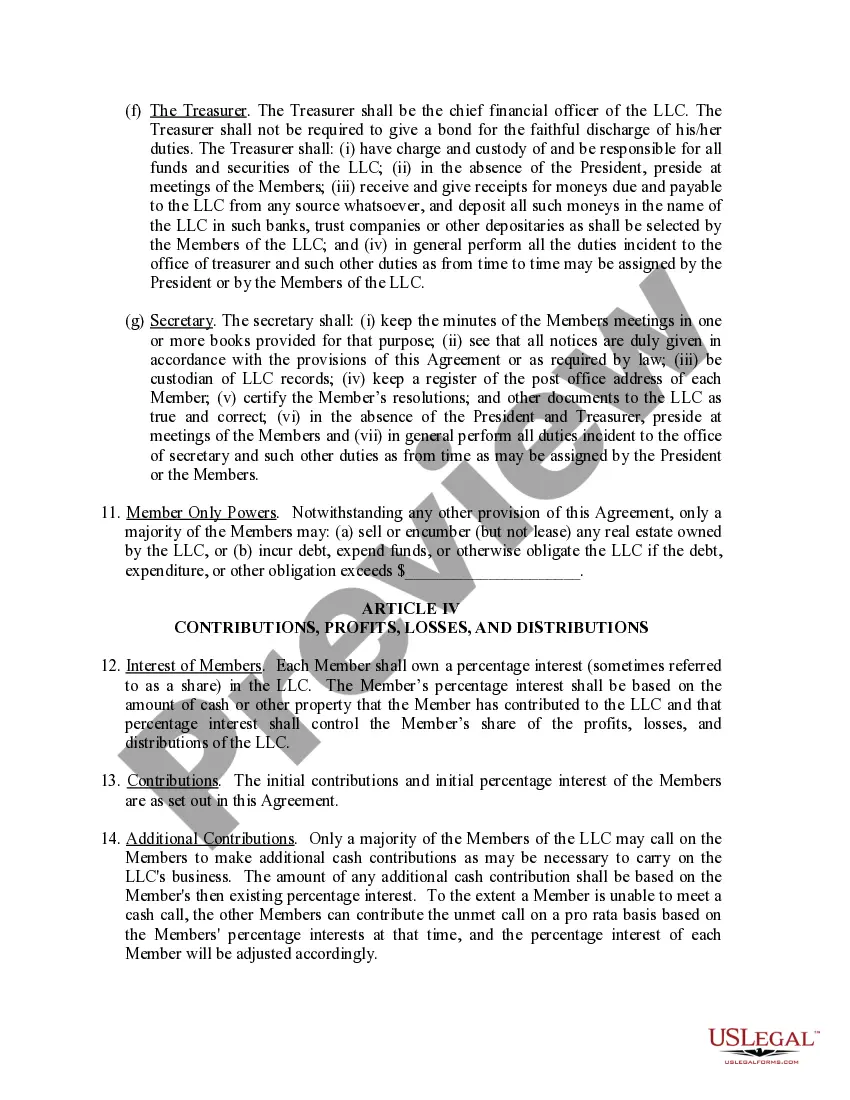

How to fill out Minnesota Limited Liability Company LLC Operating Agreement?

Legal papers management might be overwhelming, even for the most experienced specialists. When you are searching for a Llc Operating Agreement Minnesota For Rental Property and don’t get the time to commit searching for the right and updated version, the procedures could be nerve-racking. A strong web form library might be a gamechanger for everyone who wants to take care of these situations successfully. US Legal Forms is a industry leader in web legal forms, with more than 85,000 state-specific legal forms accessible to you at any time.

With US Legal Forms, you may:

- Gain access to state- or county-specific legal and business forms. US Legal Forms handles any requirements you may have, from individual to business documents, all-in-one location.

- Employ innovative tools to finish and deal with your Llc Operating Agreement Minnesota For Rental Property

- Gain access to a useful resource base of articles, tutorials and handbooks and materials related to your situation and requirements

Help save effort and time searching for the documents you will need, and employ US Legal Forms’ advanced search and Review feature to discover Llc Operating Agreement Minnesota For Rental Property and download it. If you have a membership, log in for your US Legal Forms account, search for the form, and download it. Review your My Forms tab to see the documents you previously downloaded and also to deal with your folders as you can see fit.

If it is your first time with US Legal Forms, create a free account and have limitless use of all benefits of the library. Here are the steps to take after accessing the form you need:

- Confirm this is the correct form by previewing it and reading through its description.

- Be sure that the sample is recognized in your state or county.

- Select Buy Now when you are all set.

- Select a monthly subscription plan.

- Find the file format you need, and Download, complete, eSign, print and send out your document.

Take advantage of the US Legal Forms web library, supported with 25 years of expertise and reliability. Enhance your daily document managing into a easy and intuitive process today.

Form popularity

FAQ

Although not required by Minnesota law, an operating agreement further protects those with an interest in an LLC by pre-determining how the LLC will conduct business. A Bloomington LLC operating agreements lawyer could help you form an operations structure optimized for your business.

It costs $155 to form an LLC in Minnesota. This is a fee paid for the Articles of Organization. You'll file this form with the Minnesota Secretary of State. And once approved, your LLC will go into existence.

In Minnesota, LLCs are taxed as pass-through entities by default. Instead of paying business taxes directly, an LLC passes its revenue onto its members, who then pay individual income tax on the earnings they receive.

Minnesota LLC Approval Times Mail filings: In total, mail filing approvals for Minnesota LLCs take 3-4 weeks. This accounts for the 11-12 business day processing time (a bit more than 2 weeks), plus the time your documents are in the mail. Online filings: Online filings for Minnesota LLCs are approved immediately.

Name your Minnesota LLC. You'll need to choose a name to include in your articles before you can register your LLC. ... Your LLC must establish a registered office. ... Prepare and file articles of organization. ... Receive a certificate from the state. ... Create an operating agreement. ... Get an Employer Identification Number.