Assignment Without Recourse

Description

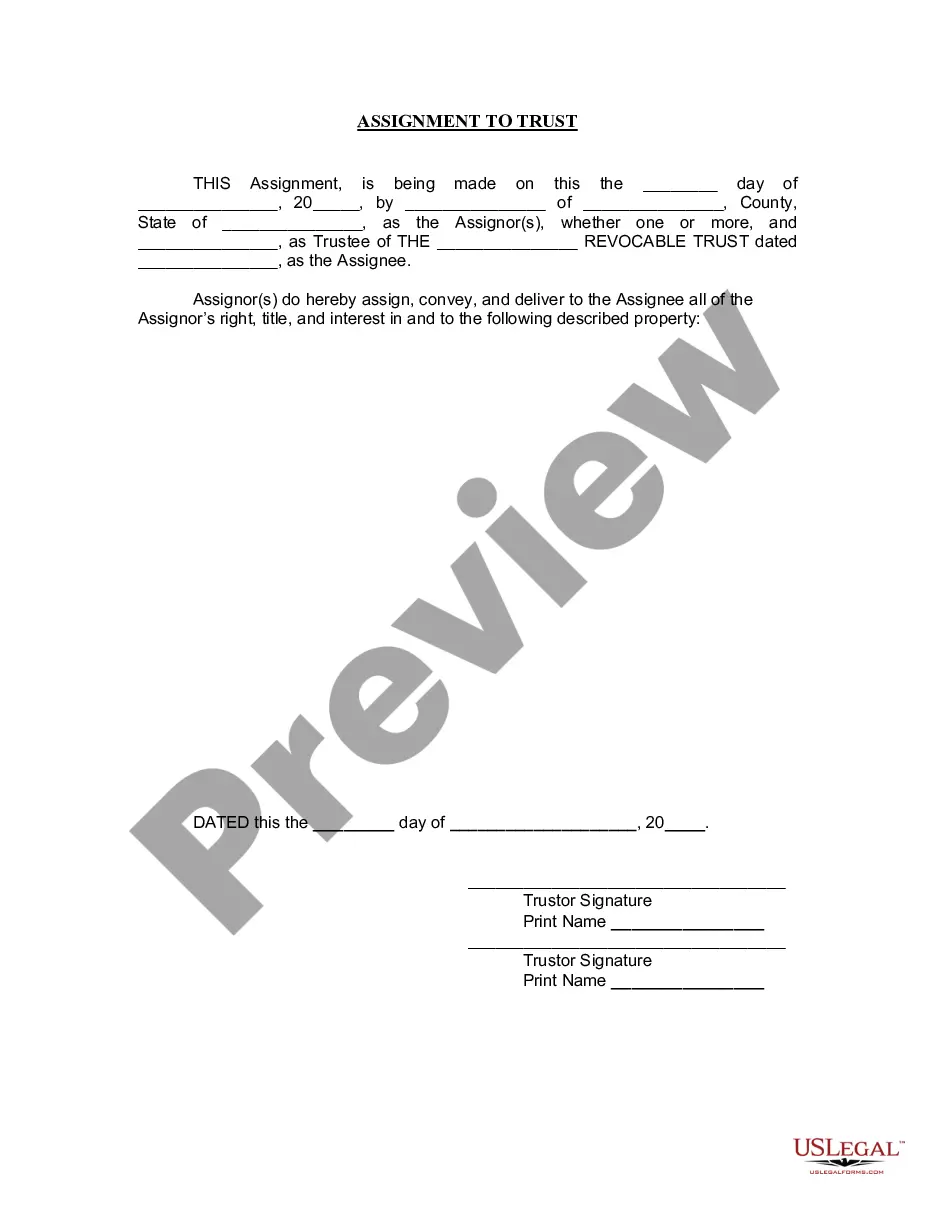

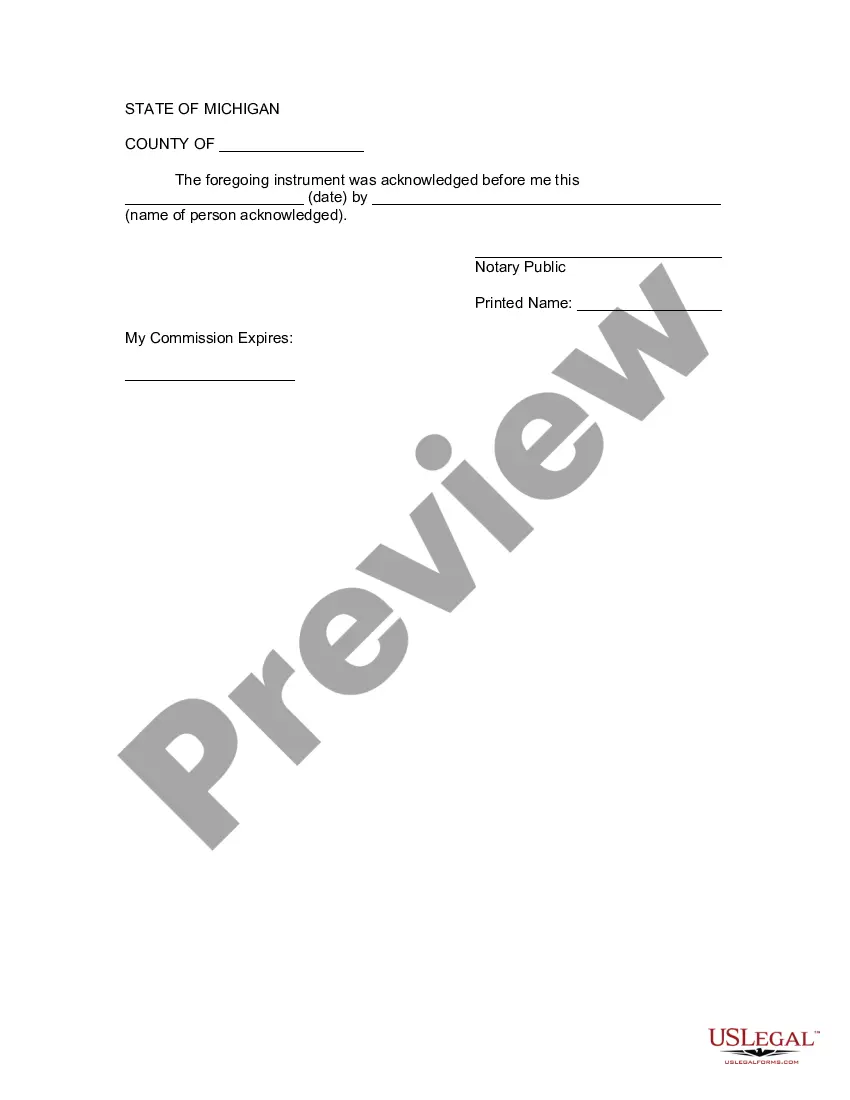

How to fill out Michigan Assignment To Living Trust?

Individuals typically link legal documentation with complexity that only an expert can handle.

In a sense, this is accurate, as composing Assignment Without Recourse necessitates significant understanding of subject parameters, which includes state and county statutes.

Nevertheless, with US Legal Forms, everything is now more straightforward: pre-prepared legal documents for any personal and business circumstance per state regulations are consolidated in a single online repository and are currently accessible to everyone.

Select the format for your document and click Download. Print your file or transfer it to an online editor for quicker completion. All templates in our library are reusable: once obtained, they are stored in your account. You can access them whenever needed through the My documents tab. Explore all the benefits of using the US Legal Forms platform. Subscribe today!

- US Legal Forms provides over 85,000 current forms categorized by state and area of application, making it easy to find Assignment Without Recourse or any specific document in just a few minutes.

- Previously registered members with an active subscription must Log In to their account and select Download to obtain the document.

- New users on the platform will need to create an account and subscribe first before downloading any legal documentation.

- Here is the detailed guide on how to acquire the Assignment Without Recourse.

- Review the page content carefully to confirm it aligns with your requirements.

- Examine the form description or check it through the Preview feature.

- If the initial sample does not meet your expectations, look for another example using the Search field in the header.

- Select Buy Now when you identify the appropriate Assignment Without Recourse.

- Choose a pricing option that fits your needs and financial plan.

- Create an account or Log In to continue to the payment interface.

- Complete your subscription payment via PayPal or with your credit card.

Form popularity

FAQ

Signing your name without recourse indicates that you will not be responsible for the debt in case of a default. This prevents any future claims against you regarding that specific financial transaction. By opting for an Assignment without recourse, you securely transfer the credit risk to another party, allowing you to focus on your operations without financial concerns.

To write without recourse, you need to include specific language in your assignment document. This language indicates that the obligation to repay does not fall back on you if the debtor defaults. Crafting an Assignment without recourse contract ensures clarity and protection, and you can find templates on platforms like US Legal Forms to assist you in this process.

In simple terms, recourse refers to the right to seek compensation or hold someone accountable for a financial obligation. If a contract is structured with recourse, the creditor can pursue the debtor if they fail to meet their payment responsibilities. This can create added pressure on the debtor, as they remain liable in such agreements. Grasping the concept of recourse helps you comprehend various financial arrangements, especially when evaluating options like assignment without recourse.

The primary difference lies in the liability after the assignment. With recourse, the assignor retains responsibility for the performance of the assignee, while in a without recourse arrangement, the assignor is not responsible for any defaults by the assignee. Essentially, assignment without recourse limits the assignor's risk, making it a favorable option for many. Understanding this distinction is vital when navigating financial contracts and agreements.

Assignment with recourse is a type of agreement where the assignor remains liable for the obligations transferred to the assignee. In this scenario, if the assignee does not meet their obligations, the assignor must step in to cover any losses. This approach offers a safety net for the assignee but increases the risks for the assignor. Knowing the difference between assignment with recourse and assignment without recourse is crucial for managing your financial agreements.

Assignment without recourse refers to an agreement where the assignor transfers certain rights or obligations to another party, but retains no liability for any defaults by the assignee. This means that if the assignee fails to fulfill the obligations, the assignor is not responsible for any losses incurred. This type of assignment protects the assignor, allowing them to shift responsibilities while minimizing risk. Understanding assignment without recourse can help you make informed decisions in financial and legal matters.

Saying 'without recourse' means that the individual or party is transferring their interests or assets while abandoning any responsibility for future claims or liabilities. This term assures the receiving party that they are assuming the risk involved. Understanding this phrase is vital for anyone involved in financial transactions, as it influences the structure and obligations of a deal.

To endorse without recourse, one must include specific language on the financial document, clearly stating that the endorsement is made without liability for repayment. This can be achieved by writing 'without recourse' next to the signature. This simple notation communicates to all parties involved that future obligations are no longer the endorser's concern.

When someone signs without recourse, they are indicating that they are not accepting responsibility for any implications of the agreement once it is signed. This means that if the contract does not fulfill or leads to a loss, the signer cannot be held accountable. Such agreements provide clarity and protect the signer from unforeseen financial burdens.

A without recourse clause typically exists in contracts, specifying that the assignor will not be held responsible for the obligations outlined in the agreement if certain conditions are met. For example, if a company sells an account receivable and includes a clause stipulating that they will not be liable for defaults, that defines the nature of the transaction. This clause provides reassurance to the assignee regarding potential risks.