Amendment Living Trust With The Bank

Description

How to fill out Michigan Amendment To Living Trust?

- Log in to your US Legal Forms account if you're a returning user and download the necessary amendment template. Ensure your subscription is active; renew it if necessary.

- For first-time users, browse the extensive library to find the appropriate amendment form. Utilize the Preview mode and check the description to confirm it fits your needs and jurisdiction.

- If the first form doesn’t meet your criteria, use the search bar to explore additional templates that may be a better fit.

- Once you find the right document, click on the Buy Now button to select a subscription plan that suits you. You'll need to register for an account to access all resources.

- Complete your purchase by entering your payment information, either through credit card or PayPal.

- After the transaction, download your amendment form to your device for completion. You can also revisit it later from the My Forms section in your profile.

By using US Legal Forms, you gain access to a vast collection of over 85,000 fillable and editable legal forms, ensuring you get more value compared to many competitors.

In conclusion, amending a living trust with the bank is made easy with the right resources. Don't hesitate to start your journey towards secure financial planning—visit US Legal Forms today for your legal document needs!

Form popularity

FAQ

Amending a trust can be a straightforward process, especially if you have the right tools and guidance. When considering an amendment living trust with the bank, it's crucial to understand the specific requirements set by your bank and state laws. Typically, you will need to draft an amendment document, which clearly outlines the changes you wish to make. Utilizing platforms like US Legal Forms can streamline this process, providing you with templates and resources to help you successfully amend your trust.

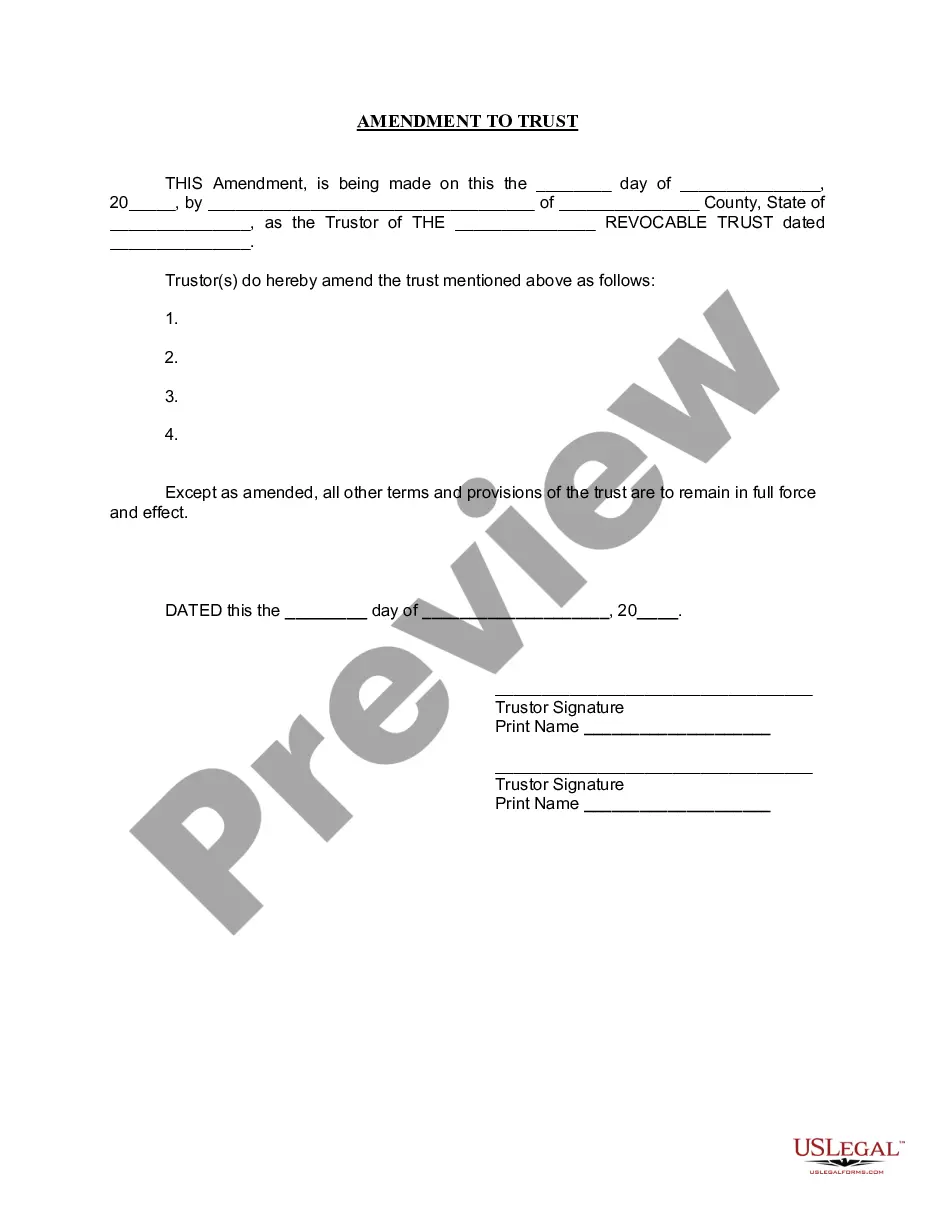

To write an amendment to a living trust, start by clearly stating your intent to modify the trust. Include the name of the trust, the date it was created, and specify the sections you wish to change. Utilize a reliable platform like uslegalforms to access templates and guidance, ensuring your amendment complies with legal standards. Lastly, sign the amendment in accordance with your state’s requirements to make it official.

Placing bank accounts in an amendment living trust with the bank can streamline the management of your assets and ensure smoother transitions after your passing. By doing so, you provide clear instructions on how these funds should be handled. Additionally, this arrangement can help your loved ones avoid probate, making access to the funds more straightforward. It's essential to consult with your bank and legal advisor to fully understand the implications and processes involved.

A significant downside of placing assets in a trust is the potential loss of direct control over those assets. Once assets are transferred, the trust becomes the legal owner, which may raise concerns for some individuals. Furthermore, while a trust can offer tax benefits, it might also entail long-term financial commitments for management and legal fees. Understanding these aspects is crucial when considering the amendment living trust with the bank.

One of the biggest mistakes parents make is not funding the trust properly. It's essential to ensure that assets are transferred into the trust, or else the trust's effectiveness can be compromised. Additionally, failing to update the trust as family circumstances change can lead to outdated instructions. Careful planning around the amendment living trust with the bank can help avoid such pitfalls.

Amending a living trust usually involves drafting a document known as a trust amendment. This document outlines the specific changes your trust requires and must be signed and dated by the trust granter. Additionally, it's wise to inform any involved parties about these amendments to avoid confusion in the future. Utilizing the services of US Legal Forms can simplify this process when amending a living trust with the bank.

Deciding whether to place assets in a trust typically depends on your parents' financial situation and goals. For many, a trust can provide protection from probate and ensure a smoother transfer of assets. However, they should consider the implications, including taxes and management responsibilities. Amending a living trust with the bank may be a good option, especially if they want to maintain control over their assets.

One common downfall of having a trust is the complexity it introduces to estate planning. If not managed correctly, a trust can lead to misunderstandings among family members about asset distribution. Moreover, you may have to deal with legal fees and annual maintenance costs, especially when amending a living trust with the bank. Careful planning and clear communication can help mitigate these issues.

A family trust can sometimes lead to a loss of control over assets. Once you place your assets into a family trust, you may have reduced authority over how those assets are managed. Additionally, while family trusts offer privacy and can avoid probate, they may incur initial setup costs and ongoing maintenance fees. It's important to consider these factors when deciding on an amendment living trust with the bank.