Full Ratchet Clause

Description

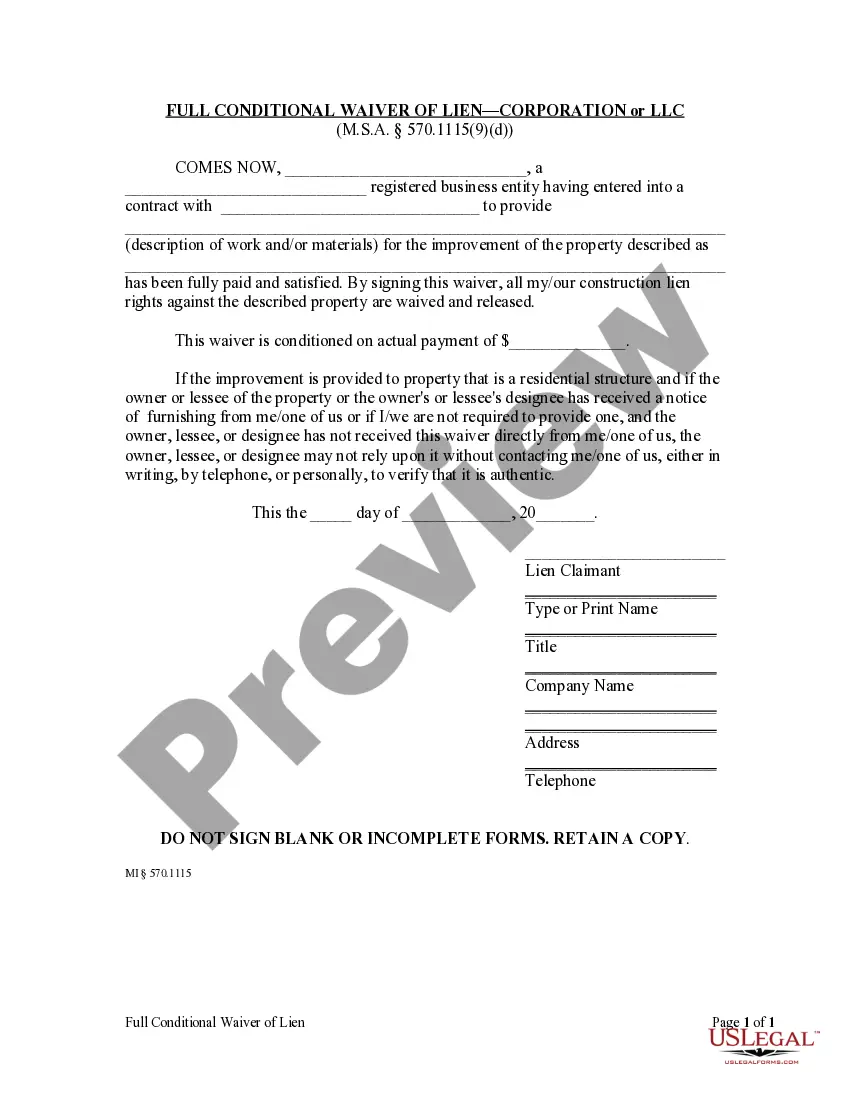

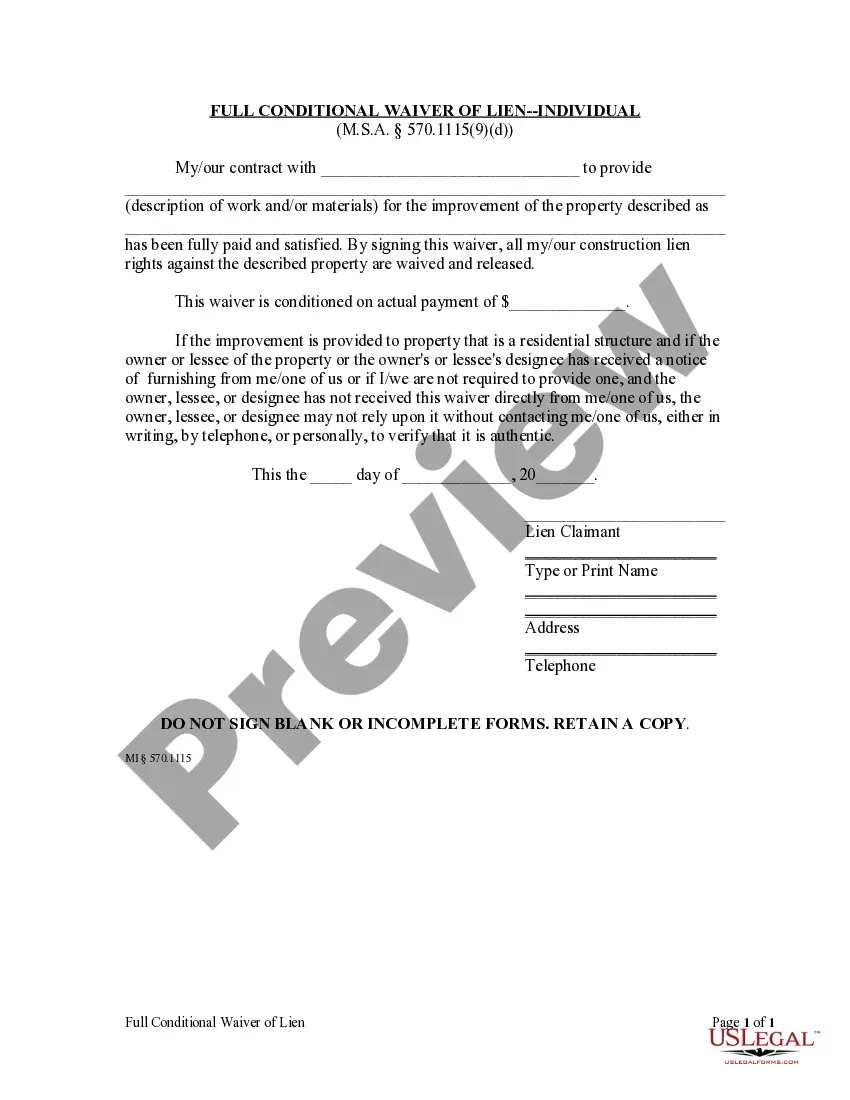

How to fill out Michigan Full Conditional Waiver And Release Of Lien By Contractor - Individual?

- If you're a returning user, log in to your account and select your desired form template. Click the Download button, ensuring your subscription is active. If it's expired, renew it based on your payment plan.

- For first-time users, start by previewing the available forms. Review the form descriptions carefully to select the one that meets your specific jurisdiction requirements.

- If the initial form doesn't meet your needs, utilize the Search tab to find alternative templates. Once you discover the correct document, proceed to the next step.

- Purchase your document by clicking the Buy Now button. Choose the subscription plan that best fits your needs, and be sure to create your account to access the resources.

- Complete your transaction by entering your credit card information or using your PayPal account for payment.

- Download your selected form and save it onto your device. You can access your downloaded documents anytime through the My documents section of your profile.

Utilizing US Legal Forms not only streamlines the process of obtaining legal documents but also grants access to a robust collection that surpasses many competitors, featuring over 85,000 customizable forms and packages.

In conclusion, understanding and securing a full ratchet clause through US Legal Forms can save you valuable time and ensure legal accuracy. Start your journey today and create your customized document with ease!

Form popularity

FAQ

A full ratchet, in simple terms, is a type of anti-dilution protection aimed at early investors. When subsequent funding rounds occur at lower valuations, the full ratchet allows these investors to receive more shares without additional payment. This feature demonstrates the commitment of investors in safeguarding their interests in the company. Utilizing a full ratchet can significantly enhance investor confidence in a startup's potential, making it an important factor in funding discussions.

A ratchet clause in a term sheet outlines the potential adjustments to an investor’s equity stake based on future financing situations. This clause serves as a safeguard, allowing investors to retain a proportionate share of ownership despite valuation changes in later investment rounds. Incorporating the full ratchet clause in the term sheet can enhance investor confidence by securing their financial interests.

In a contract, the ratchet clause is included to offer protection to investors against dilution of their ownership percentage due to future funding rounds. It provides clarity on how shares will be adjusted based on subsequent investment valuations. Knowledge of the full ratchet clause can empower parties negotiating equity stakes to ensure equitable terms and safeguard their interests.

The ratchet clause is a contractual provision that adjusts the equity ownership in a business based on certain triggers, commonly linked to future funding rounds. This clause ensures that early investors maintain their equity percentage regardless of changes in investment conditions. By including the full ratchet clause, stakeholders can protect their investments, making it a vital part of many venture capital agreements.

The ratchet method is a negotiation tool used in financial agreements, particularly involving the full ratchet clause. This clause allows investors to adjust their ownership percentage in a company during subsequent funding rounds, ensuring their investment retains value. By implementing a full ratchet clause, investors protect themselves from dilution if a company's valuation decreases. Understanding this mechanism can be crucial for both startup founders and investors when structuring deals.

The full ratchet approach involves implementing a strong form of protection for early-stage investors against dilution caused by future financing rounds. This method reflects a commitment to safeguarding investor interests by automatically recalibrating share prices when new funding occurs at lower valuations. By using the full ratchet approach, you can instill confidence among your investors, indicating that you value their contributions and commitment to the company’s future. Utilizing platforms like USLegalForms can help you craft appropriate legal documentation to establish this approach.

The full ratchet method is a mechanism used to recalibrate share prices based on subsequent funding rounds. This method ensures that if a company raises funds at a valuation lower than previous rounds, existing investors receive immediate adjustments to their share value to mitigate dilution. The simplicity of the full ratchet method lies in its straightforward approach, providing clarity and reassurance to investors regarding their stakes and returns.

Whether the full ratchet anti-dilution clause is better than the weighted average clause depends on your perspective as an investor or a company. The full ratchet clause offers stronger protection for existing shareholders during down rounds, while weighted average provides a more balanced approach that mitigates extreme adjustments. Therefore, if you seek maximum protection from dilution, the full ratchet clause is often the preferred choice. However, companies may opt for weighted average clauses to foster better relationships with investors.