Life Lady Bird Deed With A Child

Description

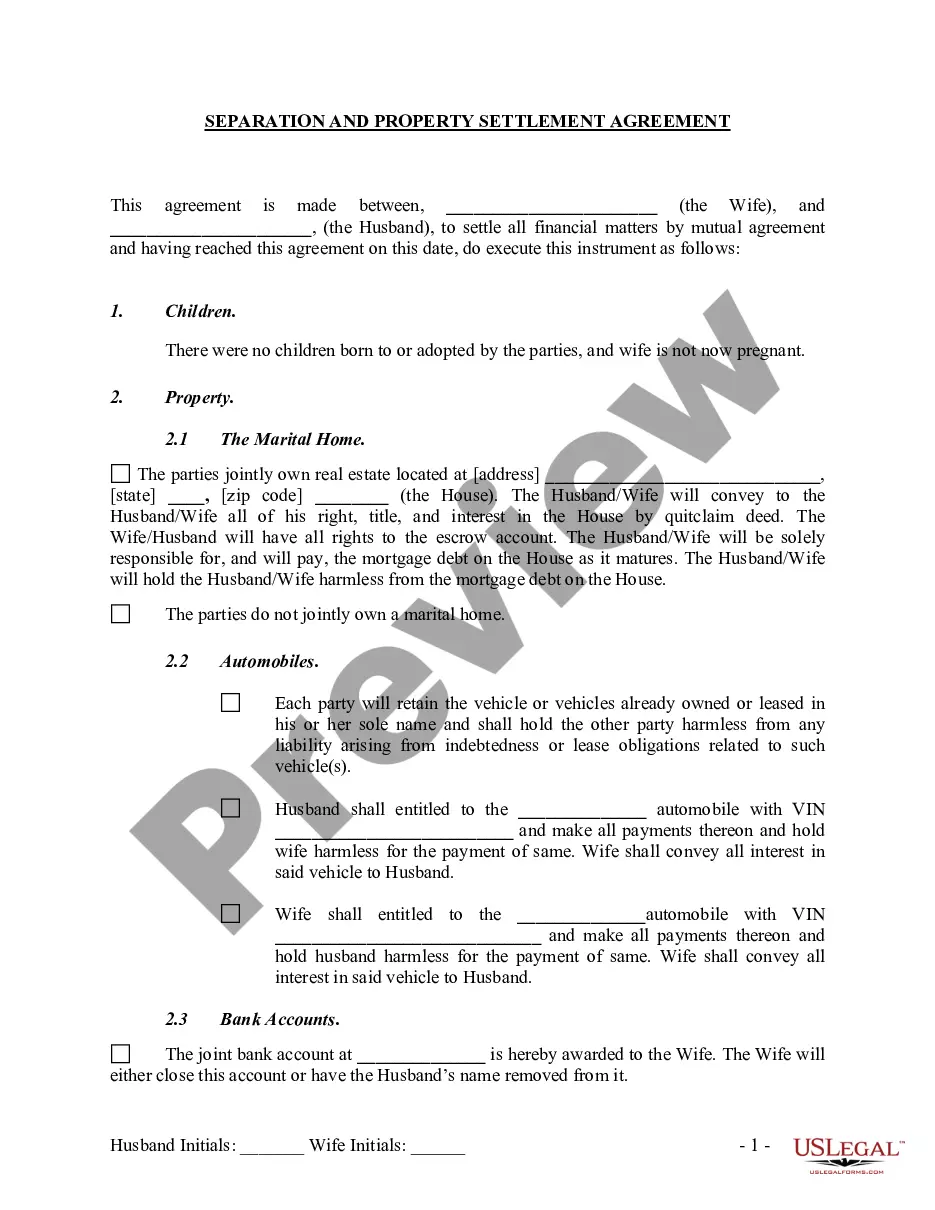

How to fill out Michigan Enhanced Life Estate Or Lady Bird Deed - Individual To Four Individuals?

- Log in to your existing US Legal Forms account. Ensure your subscription is active; renew if necessary.

- Browse the preview mode to find the life lady bird deed template that fits your needs. Confirm its compliance with your local jurisdiction.

- If the selected template doesn't meet your requirements, use the search bar to locate another suitable document.

- Select the 'Buy Now' option and choose a subscription plan that works for you. You will need to create an account to proceed.

- Complete your purchase using a credit card or PayPal to gain access to the library resources.

- Download the form and save it to your device. You can access it later from the 'My Forms' section of your profile.

In conclusion, US Legal Forms simplifies the process of creating essential legal documents like the life lady bird deed with a child. By following these steps, you can efficiently secure your assets while ensuring your loved ones are cared for.

Don't wait—visit US Legal Forms today to get started on your life lady bird deed!

Form popularity

FAQ

While it is not mandatory to have a lawyer to file a life lady bird deed with a child in Florida, having legal guidance can simplify the process. A qualified attorney can help ensure that your deed complies with Florida laws and accurately reflects your wishes. This can help prevent potential disputes down the line. If you are uncertain about any step, consulting with an expert can provide peace of mind.

Yes, you can create a life lady bird deed with a child on your own, but it's crucial to understand the process. Completing the deed requires accurate information about the property and the intended beneficiaries. You must ensure that all documentation is correctly filled out and filed with the appropriate county office. However, while it’s possible to go it alone, seeking assistance can help avoid mistakes that may complicate matters in the future.

The main disadvantage of a Life Lady Bird Deed with a child is potential complications regarding property tax assessments. If the property is reassessed upon transfer, this can lead to higher taxes for your children. Additionally, if the property is sold, it may affect their capital gains taxes. We recommend discussing these implications with a knowledgeable professional for clarity.

Yes, a Life Lady Bird Deed with a child can protect your home from Medicaid claims. This type of deed allows you to retain full control of your property while ensuring it passes directly to your children upon your death, bypassing probate. It’s important to structure the deed correctly, as improper execution could leave your home vulnerable. Consider using US Legal Forms for clear, accessible guidance.

A house can be protected from Medicaid under certain conditions, particularly with a Life Lady Bird Deed with a child. This deed allows you to retain ownership while designating your children as beneficiaries. When structured properly, it helps you avoid Medicaid claims during your lifetime. Always consult with a legal professional to understand your specific situation.

To remove a Medicaid lien from your property, you typically need to demonstrate that the lien is no longer valid. This might involve paying off the debt or establishing an alternative arrangement. A Life Lady Bird Deed with a child can help in some cases by transferring the property outside of Medicaid’s reach. Consulting with a legal expert or using US Legal Forms can guide you through this process.

A downside of a Life Lady Bird Deed with a child is that it may not protect against certain estate taxes. While it helps avoid probate, it does not shield assets from creditors. Additionally, transferring the property may affect your eligibility for certain government benefits. Understanding these factors can help you make an informed decision.

To add your children to your deed, you can create a Life Lady Bird Deed with a child. This deed allows you to retain control of your property while naming your children as beneficiaries. You will need to complete the deed form and file it with your local property records office. Using a legal service like US Legal Forms can simplify this process and ensure you follow all necessary steps.

Yes, more than one person can indeed be on a ladybird deed, which is beneficial in situations involving family, such as a life lady bird deed with a child. This arrangement allows the property to pass smoothly to multiple beneficiaries without the need for probate. Just make sure to clarify each person's rights and shares in the deed to avoid potential conflicts. A legal professional can help outline these details effectively.

Certainly, you can create a life lady bird deed with a child that designates two people as beneficiaries. This method allows both individuals to have rights to the property upon your passing, streamlining the inheritance process. Ensure that the language in the deed reflects your intentions clearly, including any specific conditions or instructions. Engaging with a professional can aid in drafting an effective deed.