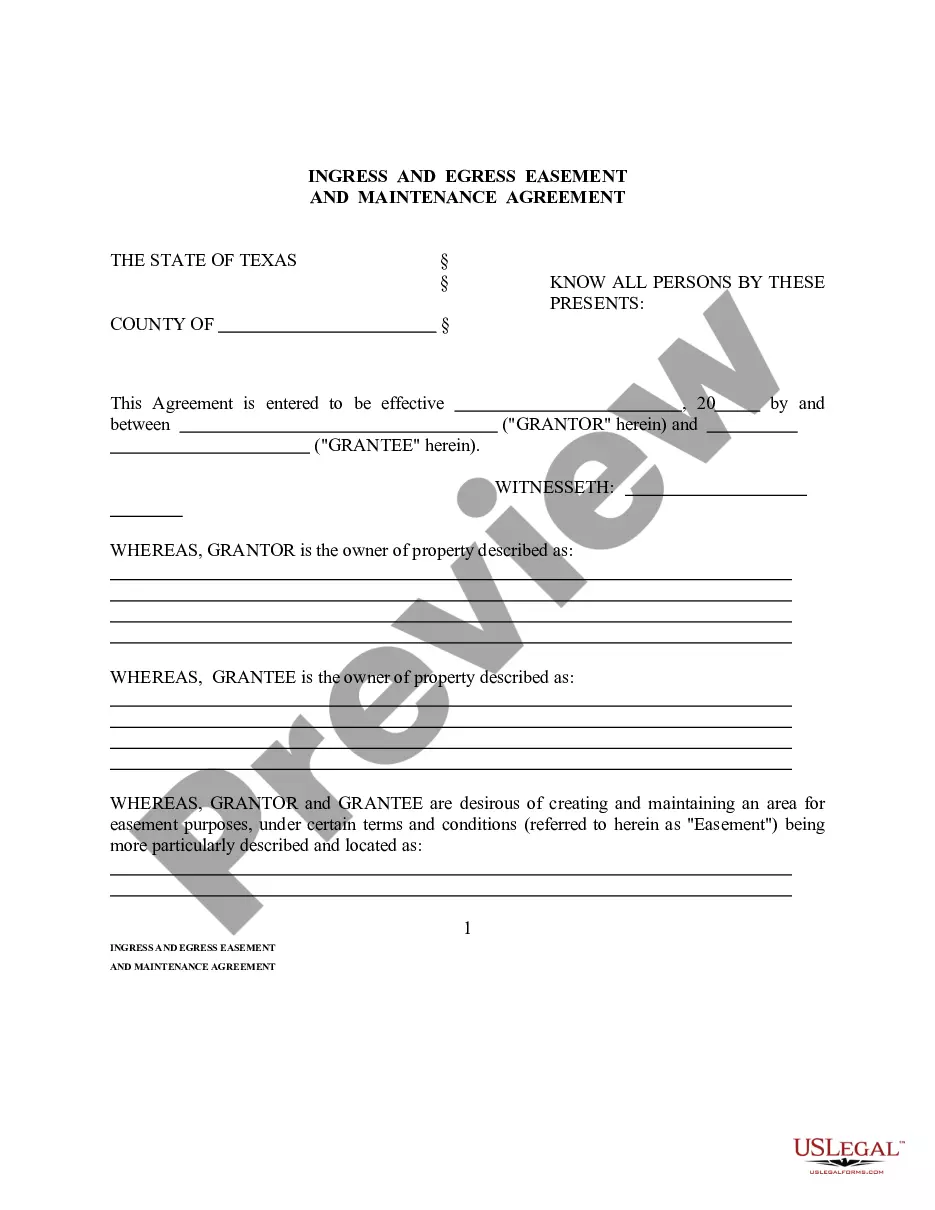

Bird Deed Statement With Multiple Conditions

Description

How to fill out Michigan Enhanced Life Estate Or Lady Bird Deed - Individual To Four Individuals?

It’s obvious that you can’t become a legal professional overnight, nor can you figure out how to quickly draft Bird Deed Statement With Multiple Conditions without having a specialized background. Creating legal documents is a long process requiring a specific training and skills. So why not leave the preparation of the Bird Deed Statement With Multiple Conditions to the pros?

With US Legal Forms, one of the most extensive legal document libraries, you can find anything from court documents to templates for internal corporate communication. We understand how crucial compliance and adherence to federal and local laws and regulations are. That’s why, on our website, all templates are location specific and up to date.

Here’s start off with our website and obtain the form you require in mere minutes:

- Find the document you need with the search bar at the top of the page.

- Preview it (if this option provided) and read the supporting description to figure out whether Bird Deed Statement With Multiple Conditions is what you’re looking for.

- Start your search over if you need any other template.

- Set up a free account and select a subscription option to buy the template.

- Choose Buy now. Once the transaction is through, you can get the Bird Deed Statement With Multiple Conditions, fill it out, print it, and send or mail it to the necessary individuals or organizations.

You can re-access your forms from the My Forms tab at any time. If you’re an existing client, you can simply log in, and find and download the template from the same tab.

No matter the purpose of your documents-whether it’s financial and legal, or personal-our website has you covered. Try US Legal Forms now!

Form popularity

FAQ

Disadvantages of a lady bird deed Available in only five states. Lady bird deeds are currently used only in Florida, Texas, Michigan, Vermont and West Virginia. ... Property taxes may be higher for the beneficiary. States may increase the taxable value of a property when it transfers to your beneficiary when you die.

Some potential problems include: Paying estate debt. ... Accidentally disinheriting someone. ... Jeopardizing your beneficiary's government benefits. ... Conflict with your will. ... No plan for incapacity.

A transfer on death deed can be a useful addition to your estate plan, but it may not address other concerns, like minimizing estate tax or creditor protection, for which you need a trust. In addition to a will or trust, you can also transfer property by making someone else a joint owner, or using a life estate deed.

In Florida, a property owner technically can prepare their own Lady Bird deed (also known as an Enhanced Life Estate Deed).

Tax Consequences of Ladybird Deeds This can allow the beneficiary to sell the property without incurring income taxes on the sale. The deeds also do not trigger Federal gift taxes. They are not completed gifts for gift tax purposes. The property does remain in the decedent's taxable estate for estate tax purposes.