Llc Operating Agreement Michigan With Units

Description

How to fill out Michigan Limited Liability Company LLC Operating Agreement?

Whether for business reasons or personal matters, everyone has to deal with legal issues at some point in their life.

Completing legal documents requires meticulous attention, starting with selecting the appropriate form template.

Complete the profile registration form. Choose your payment method: use a credit card or PayPal account. Select the document format you prefer and download the LLC Operating Agreement Michigan With Units. Once saved, you can either fill in the form using editing software or print it and complete it manually. With the extensive US Legal Forms catalog available, you never have to waste time searching for the correct template online. Leverage the library’s user-friendly navigation to find the right template for any circumstance.

- For instance, if you select an incorrect version of the LLC Operating Agreement Michigan With Units, it will be denied upon submission.

- Thus, it is essential to have a trustworthy source for legal documents like US Legal Forms.

- If you need to obtain an LLC Operating Agreement Michigan With Units template, follow these straightforward steps.

- Acquire the template you require using the search bar or catalog browsing.

- Review the form’s description to confirm it is suitable for your situation, state, and county.

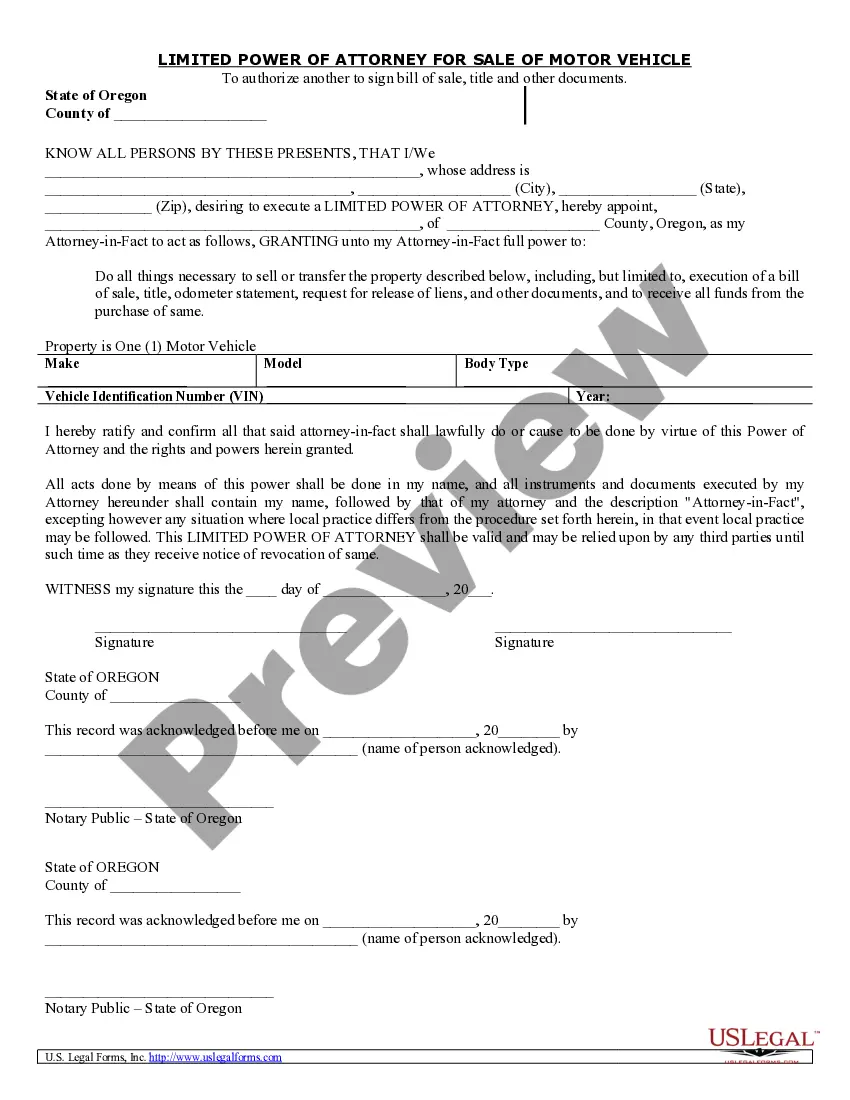

- Click on the form’s preview to inspect it.

- If it is not the correct form, revert to the search function to locate the LLC Operating Agreement Michigan With Units sample you need.

- Download the template if it meets your criteria.

- If you possess a US Legal Forms account, simply click Log in to access previously saved documents in My documents.

- In case you don’t have an account yet, you can download the form by clicking Buy now.

- Select the appropriate pricing option.

Form popularity

FAQ

Estate agents have a legal obligation to be upfront with all of the relevant and necessary information that a buyer will need to know. If they are seen to have deliberately withheld information, they can face fines and even imprisonment. The information that estate agents are obligated to pass on to buyers is varied.

A Hawaii property disclosure statement is used by home sellers to report to buyers any material defects, past and present, that could affect the value of the real estate for sale. The disclosure identifies damages that are actually known to the seller and which can be readily observed.

The most commonly used form for such disclosures is the Transfer Disclosure Statement that the sellers will complete and sign.

Seller's Real Property Disclosure Form (SRPD)

Potential seller disclosures can range from knowledge of drafty windows to any work that has been done without a permit, to information about a major construction or new development project happening nearby. It is the duty of the seller to also disclose any latent defects with the property to any potential buyers.

Pursuant to Hawaii Revised Statutes Section 508D-9, the seller is obligated to prepare the Hawaii Seller's disclosure statement in good faith and with due care. ?In good faith and with due care? includes honesty in fact in the investigation, research and preparation of the Hawaii Seller's disclosure statement.

California Real Estate Disclosure Requirements California Transfer Disclosure Statement. California Natural Hazard Disclosure Statement. California Notice of Supplemental Property Tax Bill Disclosure. California Appraisal Discrimination Addendum Disclosure.

Common issues that require disclosures include anything that may cause major foundation issues to a property or endanger a prospective buyer or the integrity of the house.