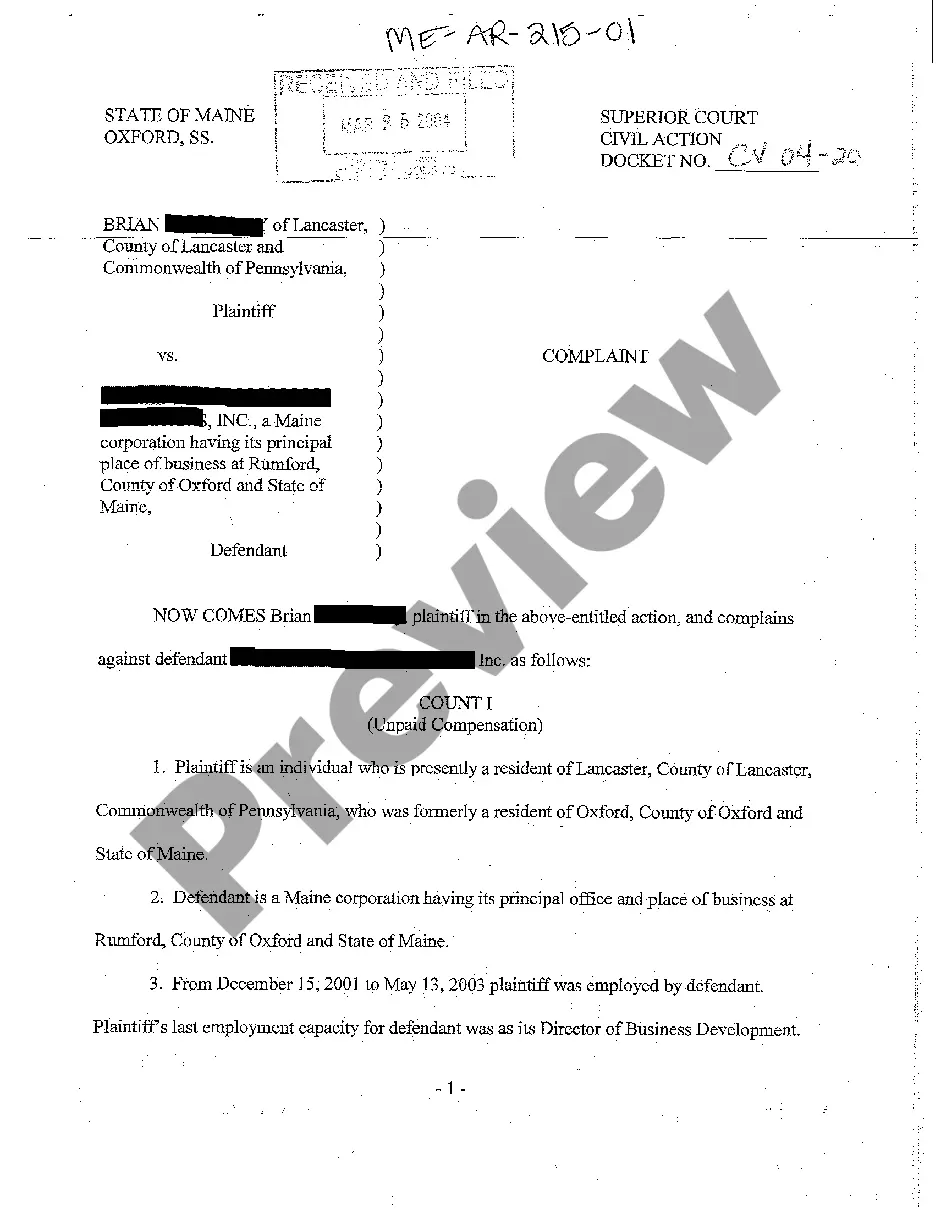

Form Complaint For Unpaid Wages Maine Withholding Tax

Description

How to fill out Maine Complaint - Unpaid Compensation And Breach Of Employment Contract?

No longer is there a necessity to squander time searching for legal documents to adhere to your local state laws. US Legal Forms has assembled all of them in one location and made them easier to access.

Our site offers over 85,000 templates for various business and personal legal situations categorized by state and area of usage. All forms are expertly crafted and validated, ensuring you can confidently acquire an updated Form Complaint For Unpaid Wages Maine Withholding Tax.

If you are acquainted with our service and already possess an account, ensure your subscription is current before retrieving any templates. Log In to your account, select the document, and click Download. You can also revisit all saved documents at any time by accessing the My documents section in your profile.

Print your form to complete it manually or upload the sample if you prefer to do it in an online editor. Organizing official paperwork in compliance with federal and state regulations is quick and easy with our library. Try US Legal Forms today to maintain your documentation systematically!

- If you are a first-time user of our service, the process will require a few additional steps to finalize.

- Examine the content of the page closely to confirm it includes the example you need.

- Utilize the form description and preview options if available.

- Use the Search bar above to look for another template if this one does not meet your needs.

- Click Buy Now next to the template title once you find the correct one.

- Select the most appropriate subscription plan and either create an account or Log In.

- Complete your subscription payment with a card or through PayPal to proceed.

- Pick the file format for your Form Complaint For Unpaid Wages Maine Withholding Tax and download it to your device.

Form popularity

FAQ

To file a complaint online with the Department of Labor, visit their official website and navigate to the appropriate forms section. Fill out the required information, and ensure to include aspects like unpaid wages and your employer’s information. By submitting a form complaint for unpaid wages maine withholding tax, you contribute to a system that holds employers accountable for fair labor practices.

If your employer fails to report your wages, you may face consequences such as tax penalties or reduced benefits from government programs. It is essential to take action by filing a form complaint for unpaid wages maine withholding tax to notify the relevant authorities. This action can help restore your rights and ensure your earnings are properly accounted for.

You can report employee wages to the Internal Revenue Service (IRS) as well as your state tax agency. If you suspect that your employer is not accurately reporting your wages, you may want to file a form complaint for unpaid wages maine withholding tax. This step ensures that your concerns are documented and addressed appropriately.

To report unpaid wages, you should contact the Maine Department of Labor. They have dedicated staff who can assist you in understanding your rights and help you take the necessary steps towards resolution. Moreover, using our platform, you can easily form a complaint for unpaid wages in Maine withholding tax and submit it to the appropriate authority.

The Maine Department of Labor plays a vital role in overseeing employment laws and protecting worker rights in the state. They assist employees in resolving wage disputes, including unpaid wages. If you find yourself needing to form a complaint for unpaid wages in Maine withholding tax, the department can provide guidance and resources to help you navigate the process effectively.

If your employer frequently pays you late, it is important to address this issue promptly. Late payments can create financial stress, impacting your ability to meet your obligations. You may consider discussing the matter with your employer directly to seek a resolution. If the problem continues, you can form a complaint for unpaid wages in Maine withholding tax to protect your rights.